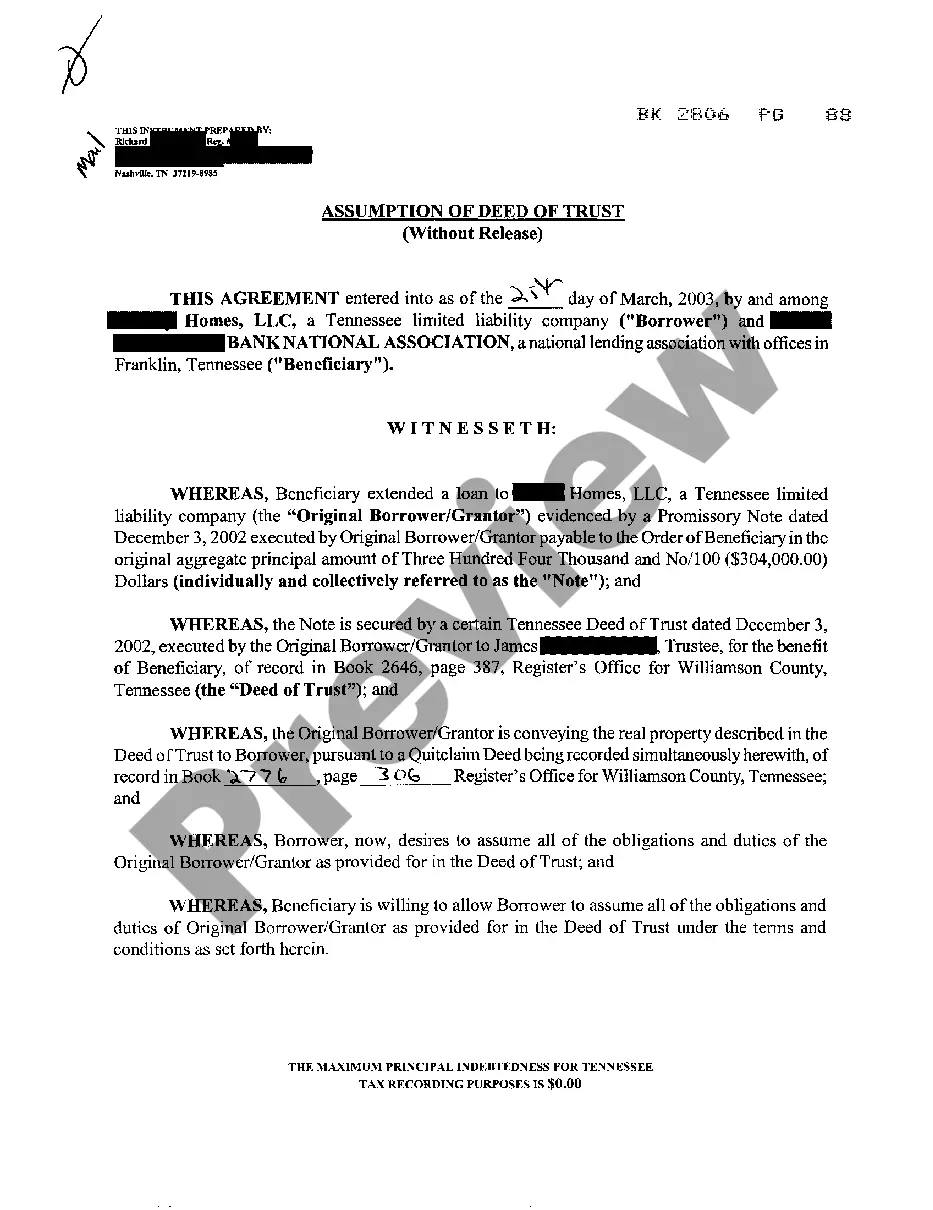

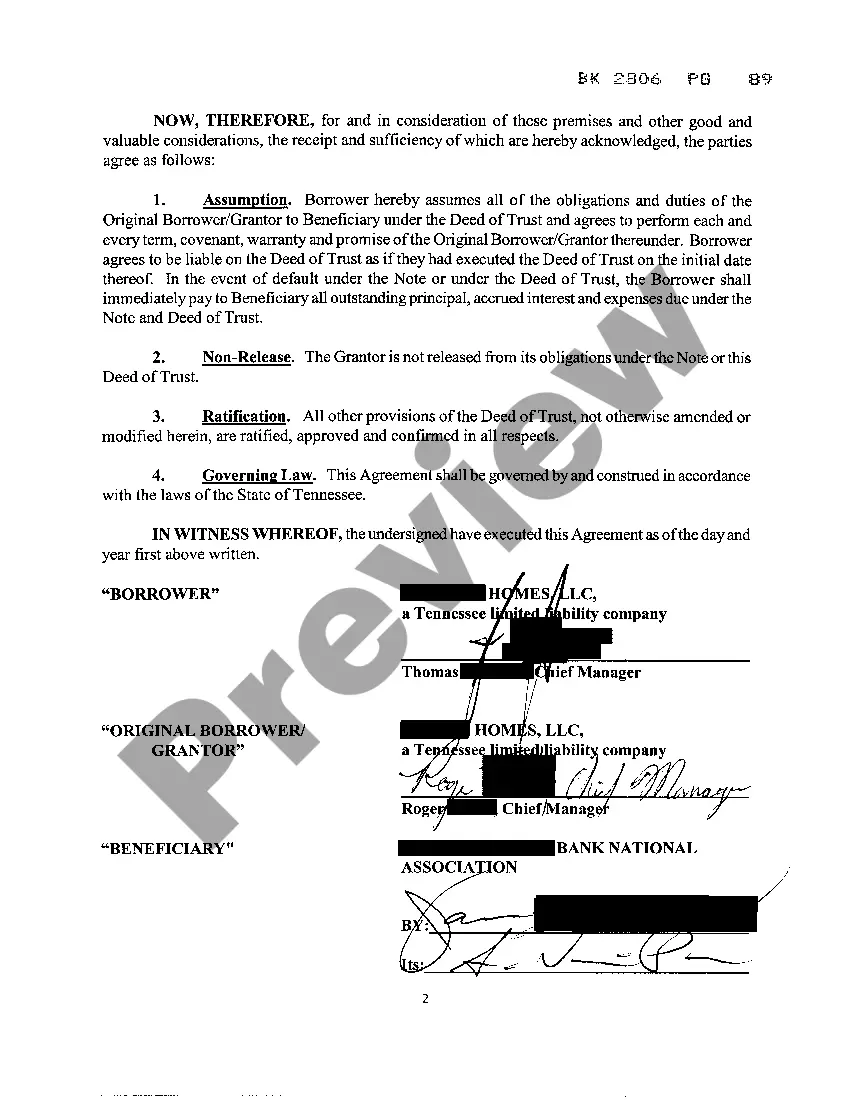

Title: Knoxville Tennessee Assumption of Deed of Trust: Understanding the Process and Types Introduction: The Knoxville Tennessee Assumption of Deed of Trust refers to a legal process in which a new party agrees to take on the responsibilities and obligations of an existing mortgage loan. This arrangement enables the original borrower to transfer their loan to a new individual or entity, allowing them to assume the rights and liabilities associated with the deed of trust. In Knoxville, Tennessee, the assumption of deed of trust has various types, each applicable to different circumstances and parties involved. 1. Voluntary Assumption of Deed of Trust: The voluntary assumption of deed of trust occurs when a willing party voluntarily takes over the mortgage loan. Typically, this involves the original borrower, also known as the granter, finding a qualified person or entity to assume the loan and become the new borrower or grantee. The process requires the approval of the lender and may involve additional documentation and formalities. 2. Divorce Assumption of Deed of Trust: In cases of divorce, one spouse may assume the deed of trust as part of the property division process. This occurs when one partner agrees to retain the property and take over the mortgage loan while releasing the other partner's obligations. It is crucial to involve legal professionals during divorce proceedings to ensure compliance with local laws and protect the interests of all parties involved. 3. Investment Property Assumption of Deed of Trust: Investors or real estate professionals may assume the deed of trust when purchasing an investment property. This allows them to take over the loan and continue making payments while benefiting from income generated by the property. Since investment properties often involve complex transactions, it is advisable to seek guidance from knowledgeable professionals, such as real estate attorneys or financial advisors. 4. Assumption of Deed of Trust due to Foreclosure: In unfortunate instances where a borrower faces foreclosure, an assumption of deed of trust may be an alternative to prevent the loss of the property. This occurs when a qualified third party assumes the existing loan to prevent the foreclosure process. The new grantee must meet the lender's criteria and demonstrate the ability to fulfill the financial obligations associated with the deed of trust. Conclusion: The Knoxville Tennessee Assumption of Deed of Trust encompasses various types suitable for different circumstances. Whether voluntarily transferring a loan, navigating divorce proceedings, investing in real estate, or avoiding foreclosure, these types offer opportunities for borrowers and other parties involved to maintain ownership and responsibility for the mortgage loan. Seeking legal advice and coordinating with lenders ensures a smooth transition while safeguarding the rights and interests of all parties.

Knoxville Tennessee Assumption of Deed of Trust

Description

How to fill out Knoxville Tennessee Assumption Of Deed Of Trust?

No matter the social or professional status, completing legal forms is an unfortunate necessity in today’s professional environment. Too often, it’s virtually impossible for someone without any legal education to create this sort of papers cfrom the ground up, mainly due to the convoluted terminology and legal subtleties they entail. This is where US Legal Forms comes to the rescue. Our platform offers a massive library with more than 85,000 ready-to-use state-specific forms that work for almost any legal situation. US Legal Forms also serves as a great resource for associates or legal counsels who want to save time utilizing our DYI tpapers.

No matter if you want the Knoxville Tennessee Assumption of Deed of Trust or any other paperwork that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Knoxville Tennessee Assumption of Deed of Trust quickly using our trusted platform. In case you are already a subscriber, you can proceed to log in to your account to get the needed form.

However, in case you are a novice to our library, make sure to follow these steps prior to downloading the Knoxville Tennessee Assumption of Deed of Trust:

- Ensure the template you have found is suitable for your location considering that the rules of one state or area do not work for another state or area.

- Preview the form and read a quick description (if available) of scenarios the paper can be used for.

- In case the one you picked doesn’t meet your needs, you can start again and search for the needed form.

- Click Buy now and pick the subscription plan that suits you the best.

- with your credentials or register for one from scratch.

- Pick the payment gateway and proceed to download the Knoxville Tennessee Assumption of Deed of Trust as soon as the payment is done.

You’re all set! Now you can proceed to print the form or complete it online. If you have any problems locating your purchased forms, you can quickly find them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.