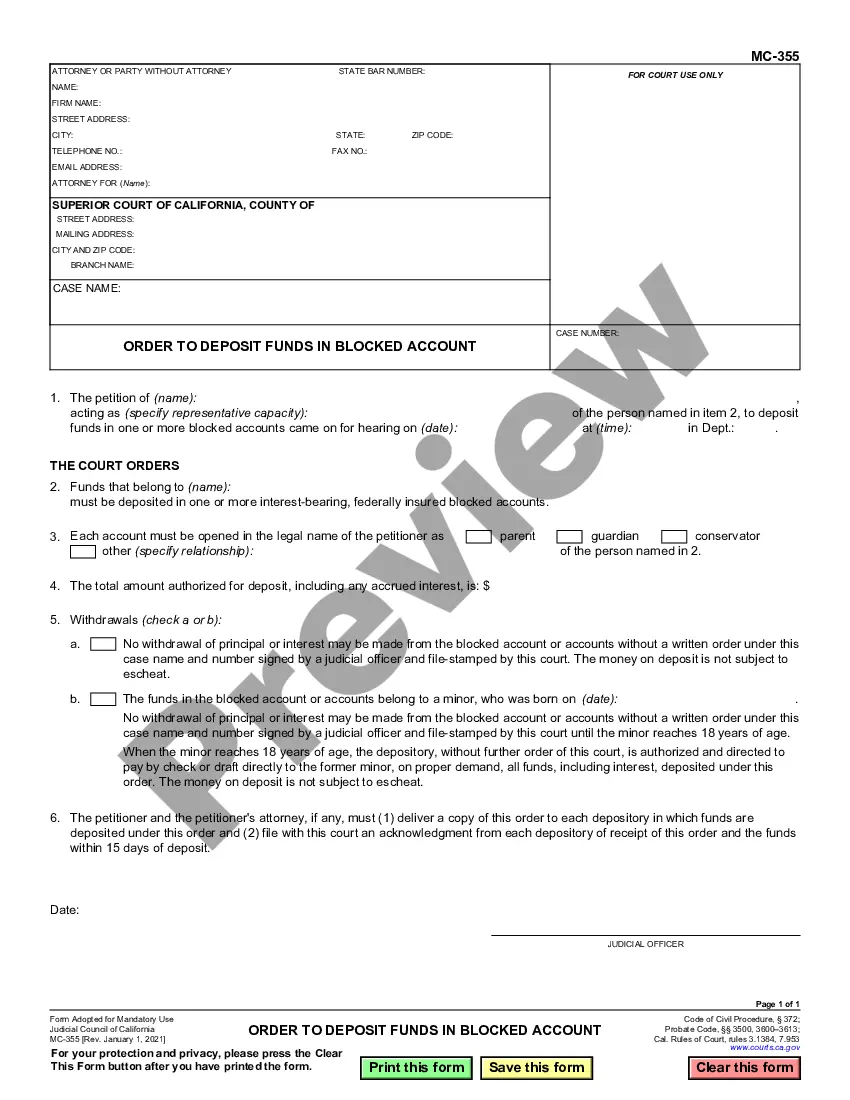

This Living Trust form is a living trust prepared for your state. It is for a husband and wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

A Murfreesboro Tennessee Living Trust for Husband and Wife with No Children is a legal document that allows a married couple to protect and distribute their assets in a way that aligns with their wishes while avoiding the probate process. This type of trust provides several benefits, including privacy, asset protection, and flexibility for the couple. One key advantage of a Living Trust is privacy. Unlike a will, which becomes a public record once it goes through the probate process, a Living Trust is kept private. This means that the details of the couple's assets, beneficiaries, and distribution plans remain confidential. Asset protection is another significant advantage of establishing a Living Trust. By transferring their assets into the trust, the couple effectively shields them from potential creditors, lawsuits, or any other legal claims. This can be particularly beneficial for protecting real estate, investments, and other valuable assets. A Living Trust also provides flexibility for the couple. They can make changes to the trust at any time, adding or removing assets, adjusting the beneficiaries, or modifying the distribution plan. Additionally, if one spouse passes away, the surviving spouse retains full control over the trust and can make any necessary changes or amendments to match their current situation. Different types of Murfreesboro Tennessee Living Trust for Husband and Wife with No Children may include: 1. Revocable Living Trust: This is the most common type of living trust and allows the couple to retain full control over their assets during their lifetime. They can change, amend, or revoke the trust if needed. 2. Irrevocable Living Trust: In contrast to a revocable trust, an irrevocable trust cannot be modified or revoked once established. It provides additional asset protection and may have tax benefits, but the couple sacrifices control over the assets once they are placed in the trust. 3. Testamentary Trust: This trust is formed through a will and comes into effect only upon the death of the surviving spouse. It allows the couple to specify how their assets will be distributed and managed after both spouses pass away. Establishing a Murfreesboro Tennessee Living Trust for Husband and Wife with No Children requires the couple to create a comprehensive trust agreement that outlines their intentions, designates a successor trustee (who will manage the trust if both spouses become incapacitated), names beneficiaries, and provides specific instructions for asset distribution. Consulting with an experienced estate planning attorney familiar with Murfreesboro, Tennessee laws and regulations is highly recommended ensuring that a Living Trust is correctly established and tailored to meet the unique needs and goals of the couple.