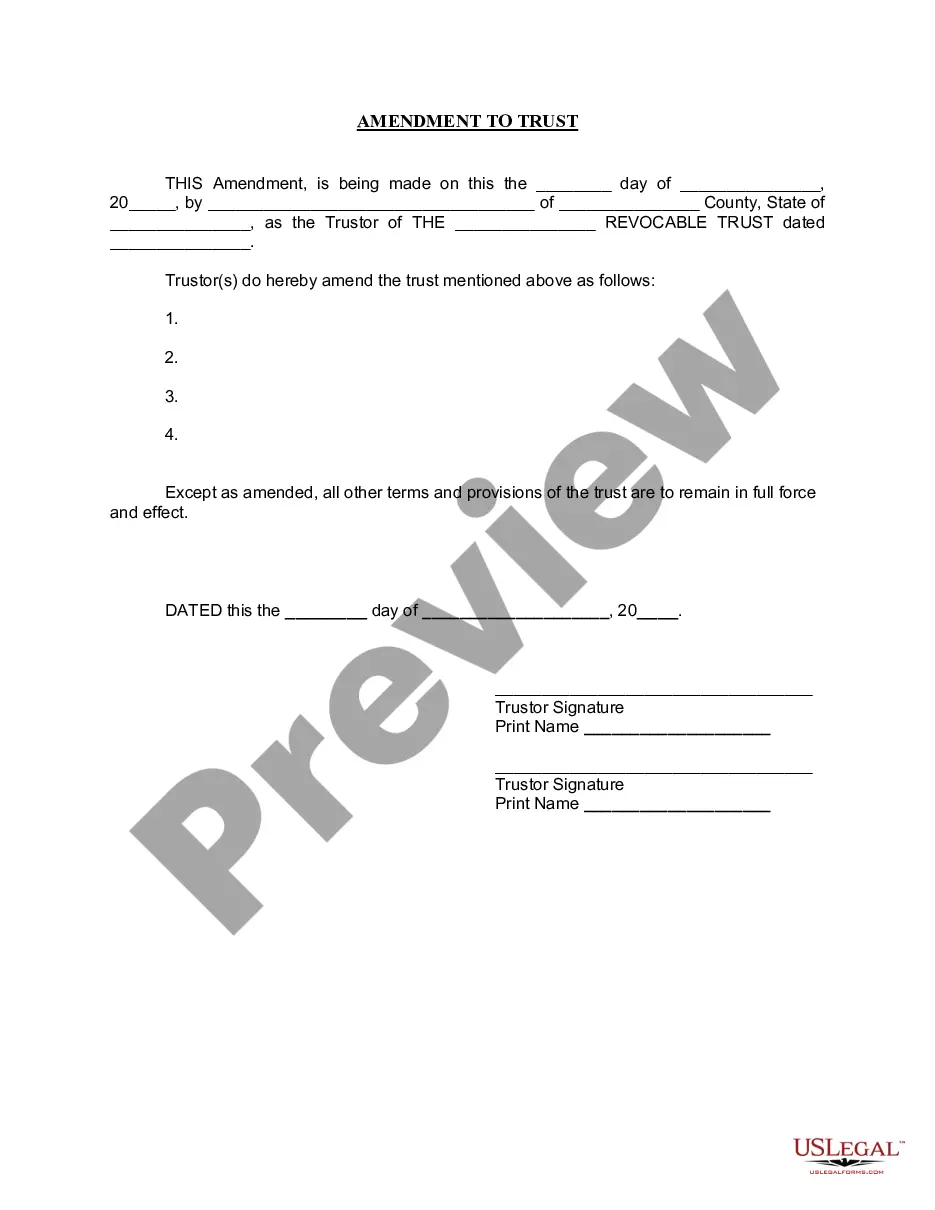

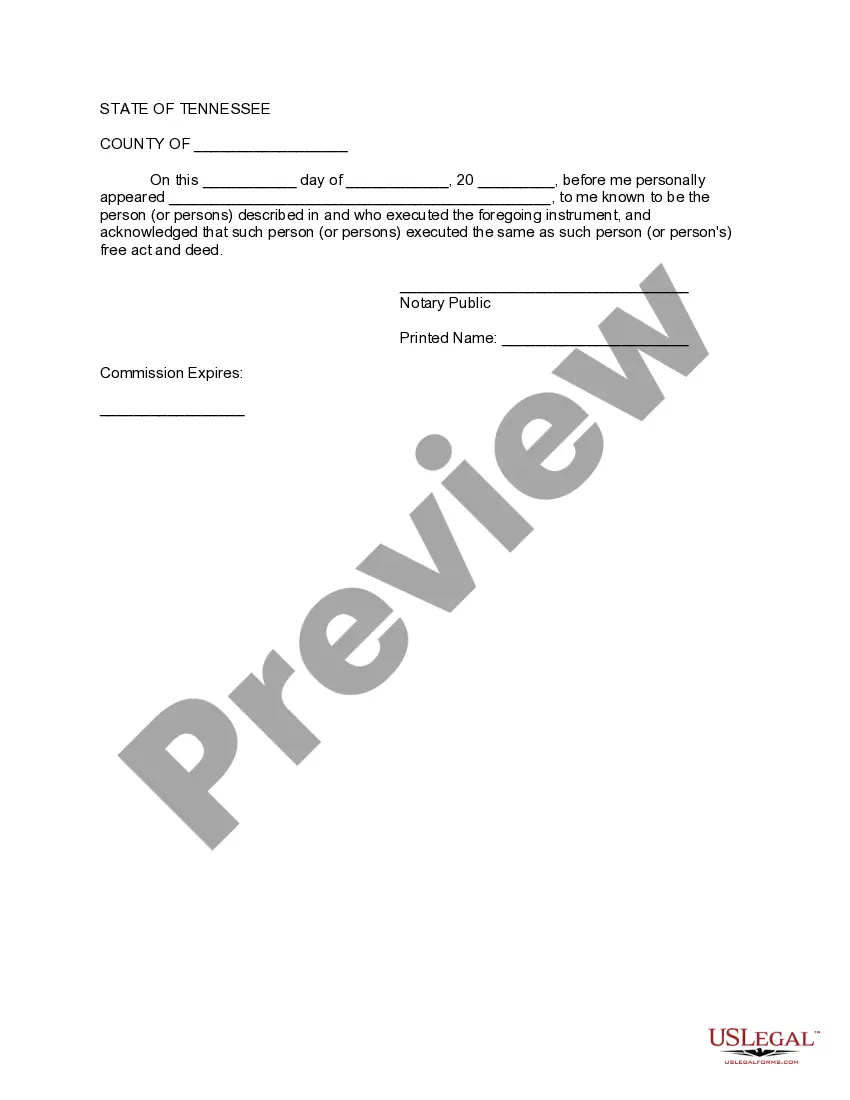

This form is for amending a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form permits the Trustor to amend certain properties of the trust without changing the purpose or nature of the trust. Except for the amended provisions, all other parts of the trust will remain in full force and effect. The Trustor(s) signature(s) is needed, and it must be signed in front of a notary public.

Memphis Tennessee Amendment to Living Trust

Description

How to fill out Tennessee Amendment To Living Trust?

If you have previously used our service, Log In to your account and download the Memphis Tennessee Amendment to Living Trust onto your device by pressing the Download button. Ensure your subscription is active. If it’s not, renew it according to your payment arrangement.

If this is your initial encounter with our service, follow these straightforward steps to acquire your file.

You have perpetual access to every document you have bought: you can find it in your profile under the My documents section whenever you need to use it again. Leverage the US Legal Forms service to effortlessly locate and preserve any template for your personal or business requirements!

- Ensure you’ve found the correct document. Browse through the description and utilize the Preview feature, if available, to verify if it satisfies your requirements. If it doesn’t meet your expectations, use the Search tab above to find the suitable one.

- Purchase the template. Click the Buy Now button and opt for a monthly or yearly subscription plan.

- Create an account and make a payment. Enter your credit card information or use the PayPal option to finalize the purchase.

- Receive your Memphis Tennessee Amendment to Living Trust. Choose the file format for your document and store it on your device.

- Fill out your document. Print it or utilize professional online editors to complete it and sign it electronically.

Form popularity

FAQ

How Much Does a Trust Cost? If you hire an attorney to build your trust, you'll likely pay in the range of $1,500 to $2,500, depending on whether you are single or married, how complex the trust needs to be and what state you are in.

Amending a Living Trust in California Nearly all trust documents can be amended. However, some are easier to amend than others. In the case of a revocable living trust, amendments usually take on the form of additional documents written after the original trust document has been signed and notarized.

Fortunately, California law allows for the amendment, modification or termination of an otherwise irrevocable trust--under the proper circumstances and using the proper procedures.

A revocable trust can be modified while the Grantor is alive. Revising the terms of a trust is known as ?amending? the trust. An amendment is generally appropriate when there are only a few minor changes to make, like rewording a certain paragraph, changing the successor trustee, or modifying beneficiaries.

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

To transfer personal items to a trust, you or your attorney will list them on a property schedule that is referenced by and attached to the trust. However, note that it is more common to keep these assets just in your name and distribute them under your will than place them in a trust.

(Tennessee is one of seven states where an in terrorem clause may be challenged based on both good faith and probable cause.) Under the Tennessee Uniform Trust Act, the rules of construction applying to wills also apply to trusts.

STAND-ALONE DOCUMENTS Revocable Living Trust Amendments & Restatements: Cost starts at $350 for a simple amendment or $1,000 for a full restatement. Special Needs Trust: Cost starts at $3,000 for a stand-alone document or $1,500 when created in conjunction with a revocable living trust-based estate plan.

With the adoption of Probate Code Section 15401, that changed, and the law provided two distinct ways in which to revoke a California Trust: (1) revoke using the manner provided in the Trust instrument, or (2) revoke by any writing (other than a Will) signed by the Settlor and delivered to the trustee during the

Tennessee has not adopted the Uniform Probate Code. So if your property is worth more than $50,000, a living trust will enable your heirs to avoid the state's lengthy probate period ? and legal costs. Living trusts do cost money, though, so you should weigh the benefits with the outlay of $1,000 or more.