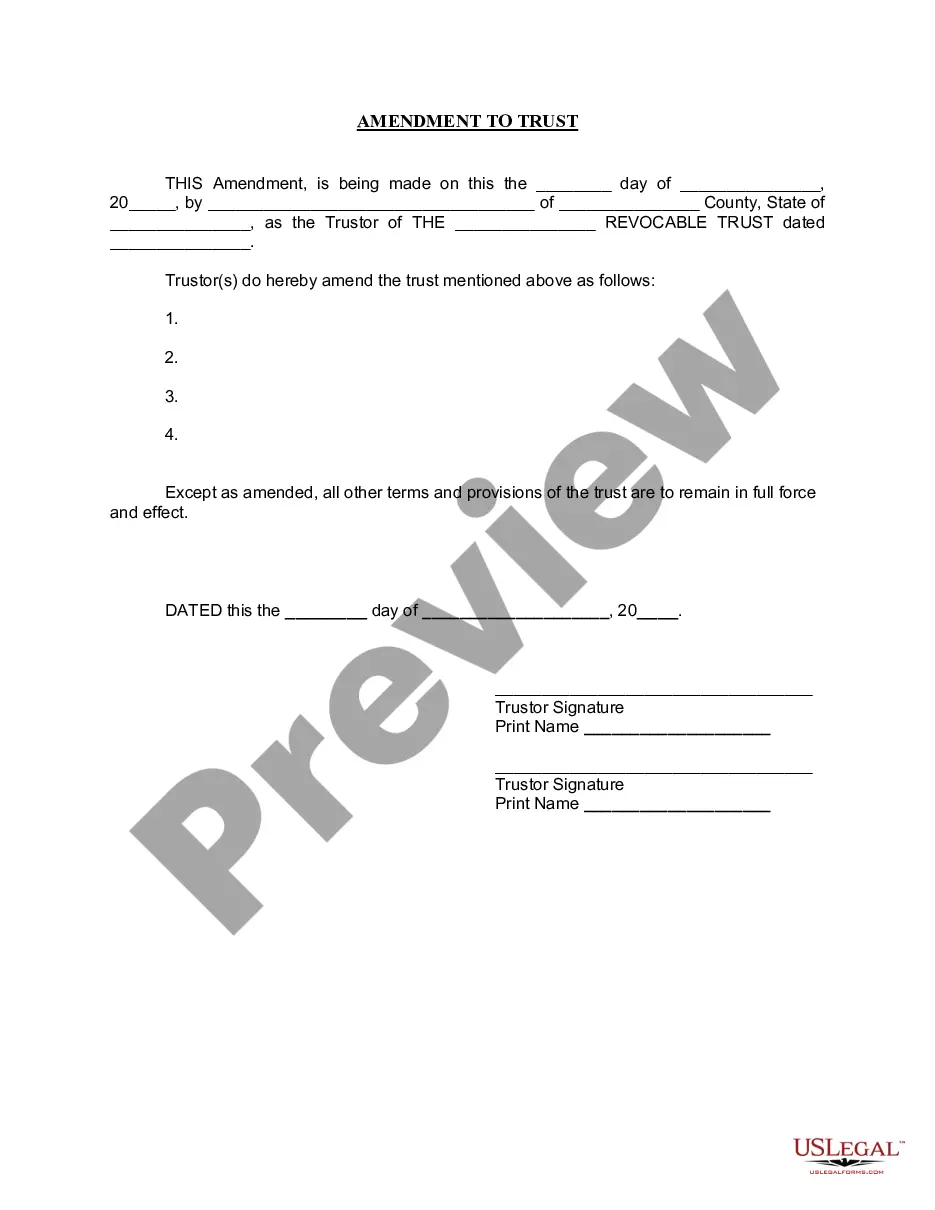

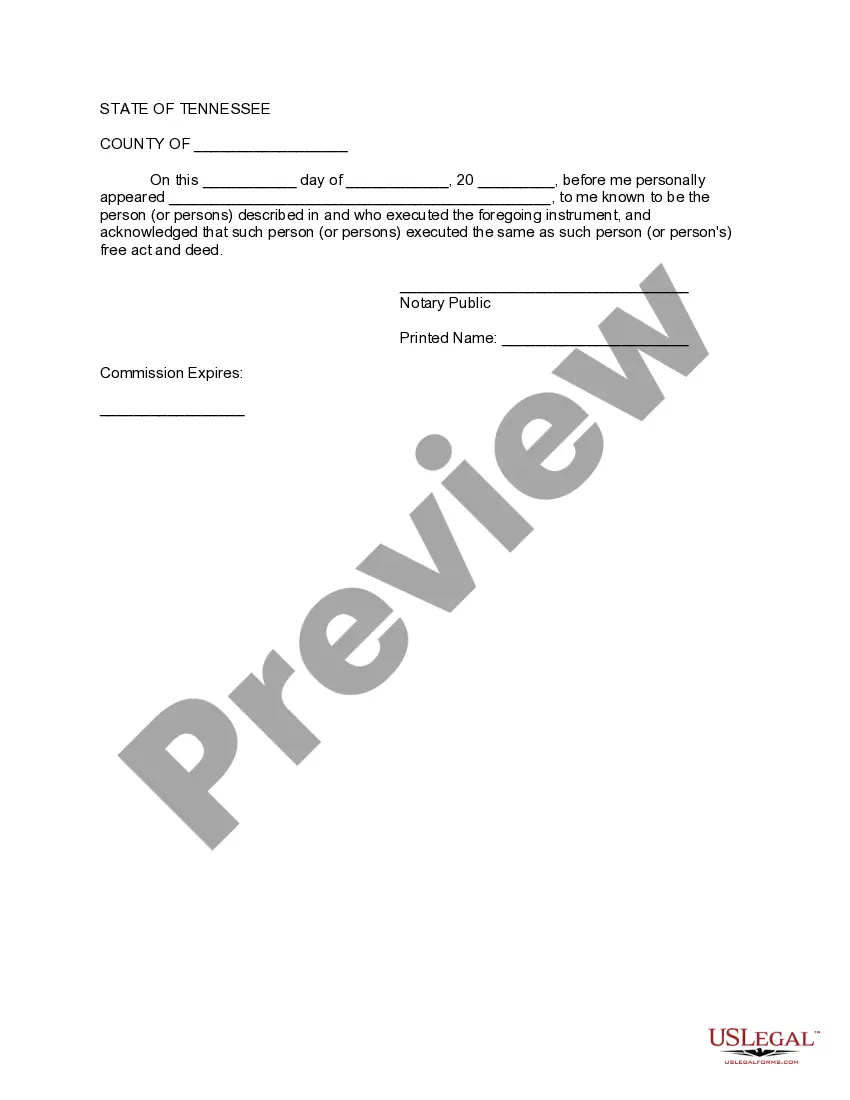

This form is for amending a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form permits the Trustor to amend certain properties of the trust without changing the purpose or nature of the trust. Except for the amended provisions, all other parts of the trust will remain in full force and effect. The Trustor(s) signature(s) is needed, and it must be signed in front of a notary public.

The Murfreesboro Tennessee Amendment to Living Trust refers to a legal document that allows individuals in Murfreesboro, Tennessee, to make changes or modifications to their existing living trust. This amendment is designed to ensure that the trust accurately reflects the wishes and goals of the granter, even if circumstances or preferences change over time. By creating a Murfreesboro Tennessee Amendment to Living Trust, individuals can maintain control over their assets, outline specific instructions for asset distribution, and make provisions for their loved ones in the event of incapacitation or death. This legal instrument is particularly popular among Murfreesboro residents who prioritize asset protection, estate planning, and generational wealth management. There are various types of Murfreesboro Tennessee Amendments to Living Trust, each tailored to meet specific needs. Here are some common variations: 1. Revocable Amendment to Living Trust: This type of amendment allows the granter to modify or revoke the trust entirely, while still retaining control over the assets during their lifetime. The granter can add or remove beneficiaries, change asset allocations, or update instructions, ensuring that the trust aligns with their current wishes. 2. Irrevocable Amendment to Living Trust: In contrast to the revocable amendment, an irrevocable amendment cannot be changed or revoked without the consent of all named beneficiaries. This type of amendment is often used when the granter seeks to protect assets from creditors, minimize estate taxes, or ensure Medicaid eligibility. Once in place, an irrevocable amendment offers greater asset protection and can have significant tax implications. 3. Testamentary Amendment to Living Trust: This type of amendment is utilized when the granter wishes to alter their living trust through their will. The amendment takes effect only upon the granter's death, ensuring that the trust's provisions reflect their most recent intentions. Testamentary amendments can be especially useful when significant life events, such as the birth of a child or the acquisition of new assets, occur after the creation of the original trust. 4. Administrative Amendment to Living Trust: This type of amendment is applied when minor changes or updates are required for administrative purposes. It typically involves modifying non-substantive aspects of the trust, such as trustee contact information or administrative procedures, without altering the primary provisions or intent of the trust. The Murfreesboro Tennessee Amendment to Living Trust ensures that individuals in the region have a legally binding means to modify their living trust as needed, providing greater flexibility and control. Seeking legal advice from a qualified professional is advisable to ensure compliance with state laws and to make informed decisions regarding trust amendments.The Murfreesboro Tennessee Amendment to Living Trust refers to a legal document that allows individuals in Murfreesboro, Tennessee, to make changes or modifications to their existing living trust. This amendment is designed to ensure that the trust accurately reflects the wishes and goals of the granter, even if circumstances or preferences change over time. By creating a Murfreesboro Tennessee Amendment to Living Trust, individuals can maintain control over their assets, outline specific instructions for asset distribution, and make provisions for their loved ones in the event of incapacitation or death. This legal instrument is particularly popular among Murfreesboro residents who prioritize asset protection, estate planning, and generational wealth management. There are various types of Murfreesboro Tennessee Amendments to Living Trust, each tailored to meet specific needs. Here are some common variations: 1. Revocable Amendment to Living Trust: This type of amendment allows the granter to modify or revoke the trust entirely, while still retaining control over the assets during their lifetime. The granter can add or remove beneficiaries, change asset allocations, or update instructions, ensuring that the trust aligns with their current wishes. 2. Irrevocable Amendment to Living Trust: In contrast to the revocable amendment, an irrevocable amendment cannot be changed or revoked without the consent of all named beneficiaries. This type of amendment is often used when the granter seeks to protect assets from creditors, minimize estate taxes, or ensure Medicaid eligibility. Once in place, an irrevocable amendment offers greater asset protection and can have significant tax implications. 3. Testamentary Amendment to Living Trust: This type of amendment is utilized when the granter wishes to alter their living trust through their will. The amendment takes effect only upon the granter's death, ensuring that the trust's provisions reflect their most recent intentions. Testamentary amendments can be especially useful when significant life events, such as the birth of a child or the acquisition of new assets, occur after the creation of the original trust. 4. Administrative Amendment to Living Trust: This type of amendment is applied when minor changes or updates are required for administrative purposes. It typically involves modifying non-substantive aspects of the trust, such as trustee contact information or administrative procedures, without altering the primary provisions or intent of the trust. The Murfreesboro Tennessee Amendment to Living Trust ensures that individuals in the region have a legally binding means to modify their living trust as needed, providing greater flexibility and control. Seeking legal advice from a qualified professional is advisable to ensure compliance with state laws and to make informed decisions regarding trust amendments.