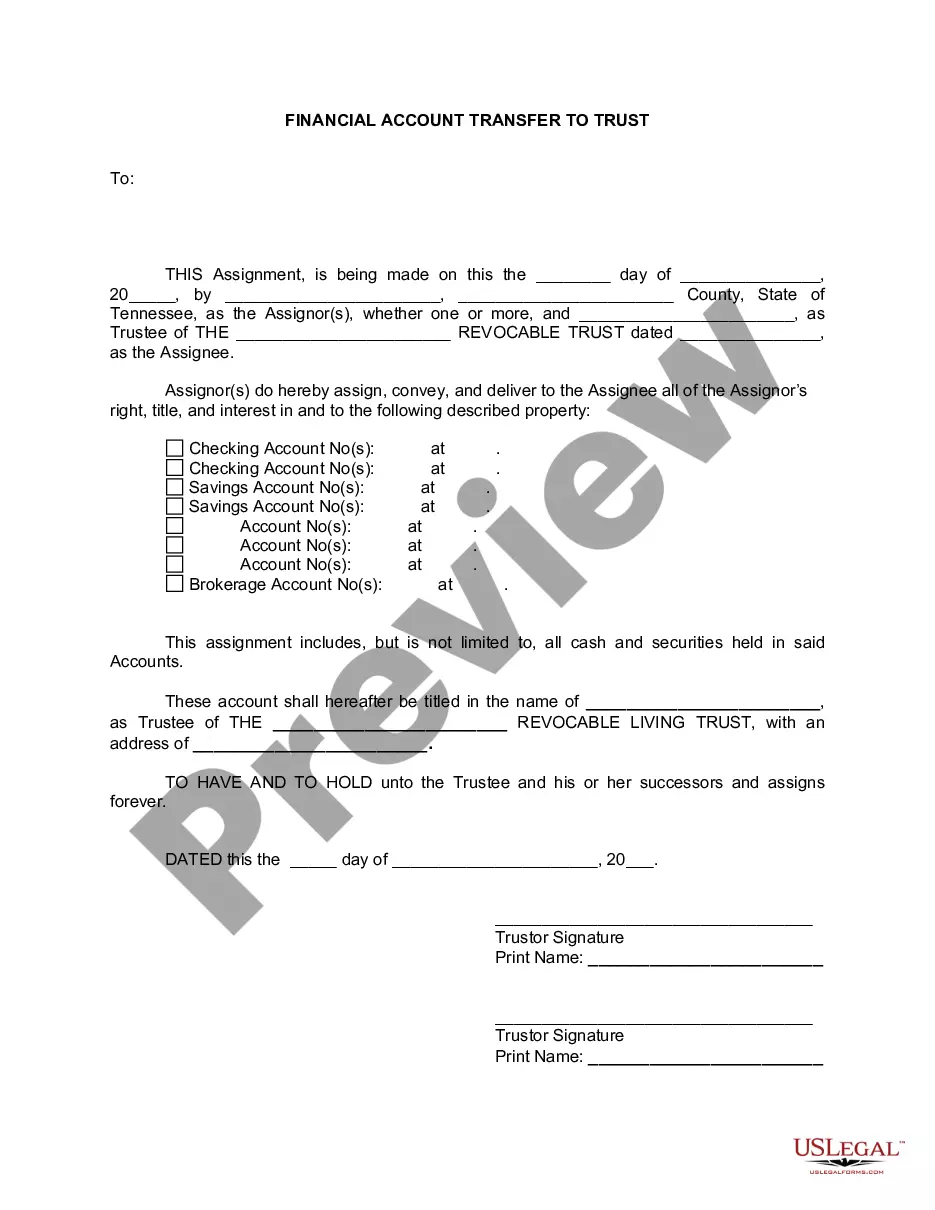

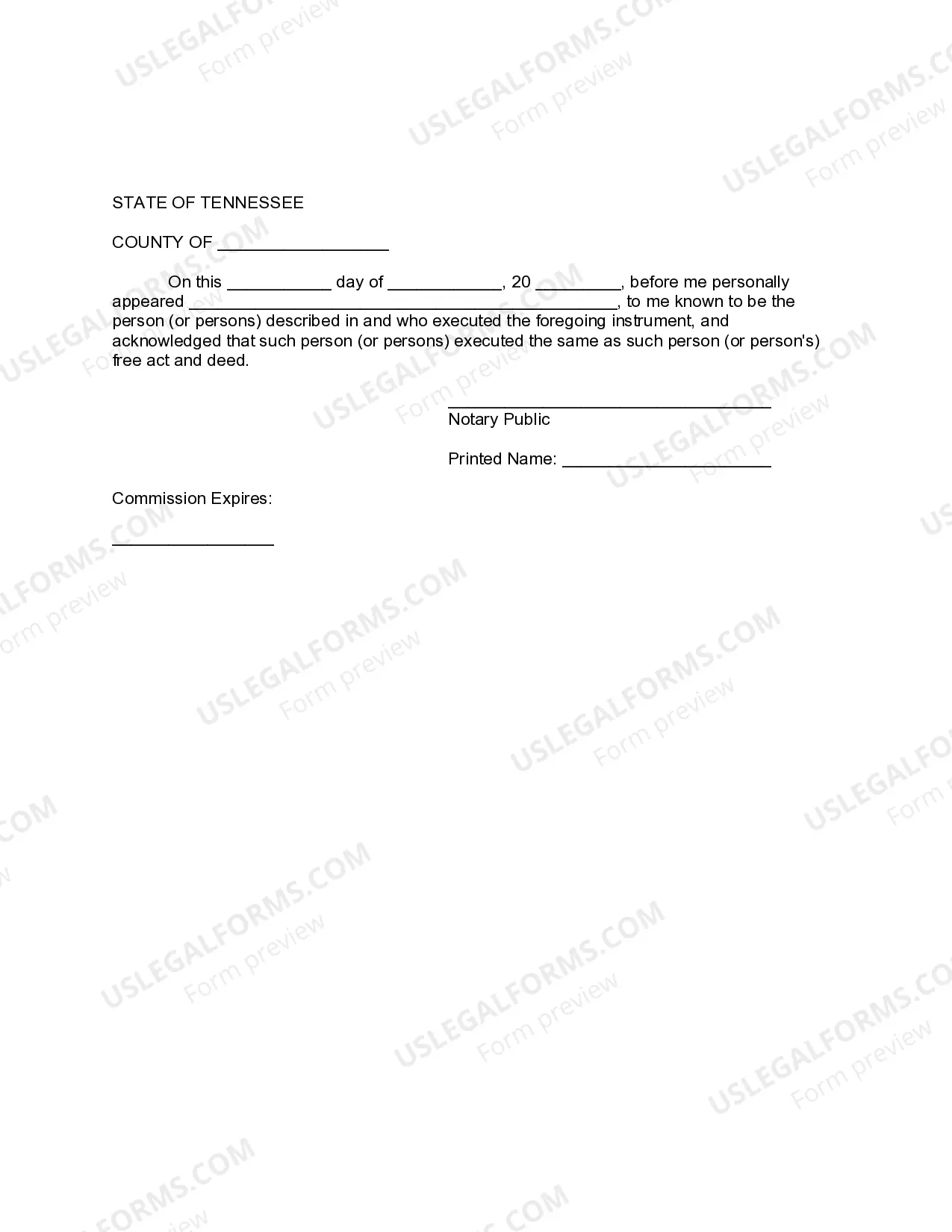

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Chattanooga, Tennessee Financial Account Transfer to Living Trust: A Comprehensive Guide In Chattanooga, Tennessee, a financial account transfer to a living trust is a crucial step in estate planning and ensuring your assets are managed according to your wishes. By transferring your financial accounts to a living trust, you can gain increased control, flexibility, and privacy over the distribution of your assets. Types of Chattanooga Tennessee Financial Account Transfer to Living Trust: 1. Bank Accounts Transfer: This involves transferring various types of financial accounts, such as checking accounts, savings accounts, money market accounts, and certificates of deposit (CDs), to your living trust. By designating your trust as the account's owner, you effectively place these funds under the trust's control. 2. Investment Accounts Transfer: This type of transfer encompasses a wide range of investment vehicles, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), and retirement accounts such as IRAs and 401(k)s. By re-titling these accounts in the name of your living trust, you enable the trust to manage and distribute the assets without the need for probate. 3. Real Estate Transfer: Besides financial accounts, a living trust can also hold ownership of real estate properties you own in Chattanooga or other locations. By transferring the property's title to your trust, its management and disposition can be streamlined, and potential probate costs and delays can be avoided. 4. Business Accounts Transfer: If you own a business, you can transfer ownership and control of your business accounts, including partnerships, corporations, or sole proprietorship, to your living trust. By doing so, your trust becomes the legal owner and manager of these assets, ensuring a smooth transition and continued operation in case of incapacity or death. Benefits of Chattanooga Tennessee Financial Account Transfer to Living Trust: 1. Avoidance of Probate: By transferring your financial accounts to a living trust, you can bypass the long and costly probate process. Probate can lead to delays, increased expenses, and reduced privacy, all of which can be mitigated through the use of a living trust. 2. Incapacity Planning: A living trust allows for continued management of your financial accounts in the event of incapacity. With a successor trustee named in the trust, the management and control of your assets seamlessly transition, preventing any disruption or uncertainty. 3. Privacy and Confidentiality: Probate proceedings are a matter of public record. By utilizing a living trust, your financial affairs and asset distribution plans remain confidential, providing a higher level of privacy for you and your beneficiaries. 4. Flexibility in Asset Distribution: A living trust enables you to determine how and when your assets are distributed to your beneficiaries. You have the freedom to specify detailed instructions, including limitations, conditions, and timing, ensuring your wishes are followed precisely. In conclusion, a Chattanooga Tennessee Financial Account Transfer to Living Trust is an essential component of a well-rounded estate plan. By exploring the different types of financial accounts that can be transferred to a living trust, you can effectively protect and manage your assets, avoid probate, ensure privacy, and provide your loved ones with clear instructions for asset distribution.Chattanooga, Tennessee Financial Account Transfer to Living Trust: A Comprehensive Guide In Chattanooga, Tennessee, a financial account transfer to a living trust is a crucial step in estate planning and ensuring your assets are managed according to your wishes. By transferring your financial accounts to a living trust, you can gain increased control, flexibility, and privacy over the distribution of your assets. Types of Chattanooga Tennessee Financial Account Transfer to Living Trust: 1. Bank Accounts Transfer: This involves transferring various types of financial accounts, such as checking accounts, savings accounts, money market accounts, and certificates of deposit (CDs), to your living trust. By designating your trust as the account's owner, you effectively place these funds under the trust's control. 2. Investment Accounts Transfer: This type of transfer encompasses a wide range of investment vehicles, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), and retirement accounts such as IRAs and 401(k)s. By re-titling these accounts in the name of your living trust, you enable the trust to manage and distribute the assets without the need for probate. 3. Real Estate Transfer: Besides financial accounts, a living trust can also hold ownership of real estate properties you own in Chattanooga or other locations. By transferring the property's title to your trust, its management and disposition can be streamlined, and potential probate costs and delays can be avoided. 4. Business Accounts Transfer: If you own a business, you can transfer ownership and control of your business accounts, including partnerships, corporations, or sole proprietorship, to your living trust. By doing so, your trust becomes the legal owner and manager of these assets, ensuring a smooth transition and continued operation in case of incapacity or death. Benefits of Chattanooga Tennessee Financial Account Transfer to Living Trust: 1. Avoidance of Probate: By transferring your financial accounts to a living trust, you can bypass the long and costly probate process. Probate can lead to delays, increased expenses, and reduced privacy, all of which can be mitigated through the use of a living trust. 2. Incapacity Planning: A living trust allows for continued management of your financial accounts in the event of incapacity. With a successor trustee named in the trust, the management and control of your assets seamlessly transition, preventing any disruption or uncertainty. 3. Privacy and Confidentiality: Probate proceedings are a matter of public record. By utilizing a living trust, your financial affairs and asset distribution plans remain confidential, providing a higher level of privacy for you and your beneficiaries. 4. Flexibility in Asset Distribution: A living trust enables you to determine how and when your assets are distributed to your beneficiaries. You have the freedom to specify detailed instructions, including limitations, conditions, and timing, ensuring your wishes are followed precisely. In conclusion, a Chattanooga Tennessee Financial Account Transfer to Living Trust is an essential component of a well-rounded estate plan. By exploring the different types of financial accounts that can be transferred to a living trust, you can effectively protect and manage your assets, avoid probate, ensure privacy, and provide your loved ones with clear instructions for asset distribution.