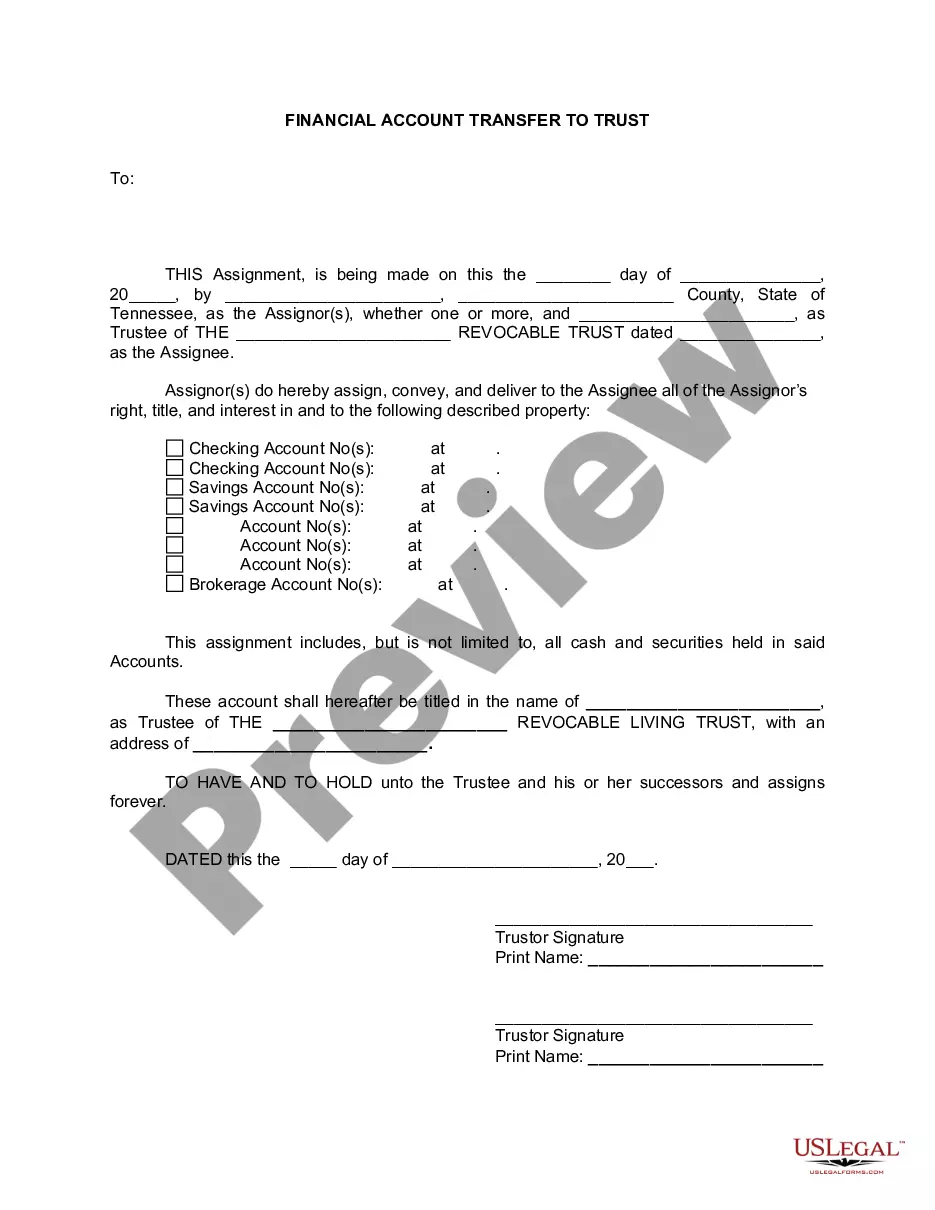

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Title: Clarksville Tennessee Financial Account Transfer to Living Trust: A Comprehensive Guide Introduction: When planning your financial future, it is important to consider the benefits of a living trust. A living trust allows you to transfer your financial accounts seamlessly and efficiently, ensuring the protection and management of your assets during your lifetime and beyond. This article explores the various types of Clarksville Tennessee Financial Account Transfer to Living Trust and provides detailed insights to help you make informed decisions. 1. Revocable Living Trust: A revocable living trust is a popular option as it allows you to maintain control over your financial accounts during your lifetime. By transferring your accounts to this trust, you can still make changes, add or remove assets, or even revoke the trust if circumstances change. Clarksville Tennessee residents often opt for revocable living trusts due to their flexibility and ease of administration. 2. Irrevocable Living Trust: Unlike revocable trusts, an irrevocable living trust cannot be changed or terminated without the consent of named beneficiaries. This type of trust offers enhanced asset protection as the transferred financial accounts are no longer considered part of your estate, which may have potential tax advantages. Consider consulting with an experienced estate planning attorney in Clarksville Tennessee to determine if an irrevocable living trust aligns with your long-term goals. 3. Testamentary Trust: While not technically a living trust, a testamentary trust is created and funded upon your passing. It allows you to transfer your financial accounts to beneficiaries in a more controlled manner. By designating specific conditions or timing for asset distribution, you can ensure your intended beneficiaries receive their inheritance according to your wishes. Clarksville Tennessee residents can utilize testamentary trusts as part of a comprehensive estate plan. Key Considerations for Clarksville Tennessee Financial Account Transfer to Living Trust: 1. Consult an Estate Planning Attorney: To navigate the complex legal requirements and ensure compliance with Tennessee laws, consult an experienced estate planning attorney in Clarksville. They will guide you through the process of transferring your financial accounts to a living trust effectively. 2. Asset Evaluation and Inventory: Before initiating any account transfers, it is crucial to identify and evaluate all your financial assets. Make an inventory of bank accounts, investment portfolios, retirement accounts, real estate holdings, and other assets to determine the scope of the transfer. 3. Beneficiary and Successor Trustee Designation: Clearly identify beneficiaries who will receive the assets upon your passing. Additionally, designate trustworthy individuals as successor trustees who will manage and distribute the trust assets in accordance with your wishes. 4. Updating Account Documentation: Work closely with your estate planning attorney to ensure all necessary documentation, such as beneficiary designation forms, account transfer forms, and property deeds, are accurately completed for each financial account you intend to transfer. Conclusion: Transferring financial accounts to a living trust in Clarksville Tennessee is an effective method to secure your assets and ease the transfer of wealth to your loved ones. By understanding the different types of living trusts, consulting with legal professionals, and documenting account transfers meticulously, you can ensure a smooth and seamless transition while protecting your financial interests.Title: Clarksville Tennessee Financial Account Transfer to Living Trust: A Comprehensive Guide Introduction: When planning your financial future, it is important to consider the benefits of a living trust. A living trust allows you to transfer your financial accounts seamlessly and efficiently, ensuring the protection and management of your assets during your lifetime and beyond. This article explores the various types of Clarksville Tennessee Financial Account Transfer to Living Trust and provides detailed insights to help you make informed decisions. 1. Revocable Living Trust: A revocable living trust is a popular option as it allows you to maintain control over your financial accounts during your lifetime. By transferring your accounts to this trust, you can still make changes, add or remove assets, or even revoke the trust if circumstances change. Clarksville Tennessee residents often opt for revocable living trusts due to their flexibility and ease of administration. 2. Irrevocable Living Trust: Unlike revocable trusts, an irrevocable living trust cannot be changed or terminated without the consent of named beneficiaries. This type of trust offers enhanced asset protection as the transferred financial accounts are no longer considered part of your estate, which may have potential tax advantages. Consider consulting with an experienced estate planning attorney in Clarksville Tennessee to determine if an irrevocable living trust aligns with your long-term goals. 3. Testamentary Trust: While not technically a living trust, a testamentary trust is created and funded upon your passing. It allows you to transfer your financial accounts to beneficiaries in a more controlled manner. By designating specific conditions or timing for asset distribution, you can ensure your intended beneficiaries receive their inheritance according to your wishes. Clarksville Tennessee residents can utilize testamentary trusts as part of a comprehensive estate plan. Key Considerations for Clarksville Tennessee Financial Account Transfer to Living Trust: 1. Consult an Estate Planning Attorney: To navigate the complex legal requirements and ensure compliance with Tennessee laws, consult an experienced estate planning attorney in Clarksville. They will guide you through the process of transferring your financial accounts to a living trust effectively. 2. Asset Evaluation and Inventory: Before initiating any account transfers, it is crucial to identify and evaluate all your financial assets. Make an inventory of bank accounts, investment portfolios, retirement accounts, real estate holdings, and other assets to determine the scope of the transfer. 3. Beneficiary and Successor Trustee Designation: Clearly identify beneficiaries who will receive the assets upon your passing. Additionally, designate trustworthy individuals as successor trustees who will manage and distribute the trust assets in accordance with your wishes. 4. Updating Account Documentation: Work closely with your estate planning attorney to ensure all necessary documentation, such as beneficiary designation forms, account transfer forms, and property deeds, are accurately completed for each financial account you intend to transfer. Conclusion: Transferring financial accounts to a living trust in Clarksville Tennessee is an effective method to secure your assets and ease the transfer of wealth to your loved ones. By understanding the different types of living trusts, consulting with legal professionals, and documenting account transfers meticulously, you can ensure a smooth and seamless transition while protecting your financial interests.