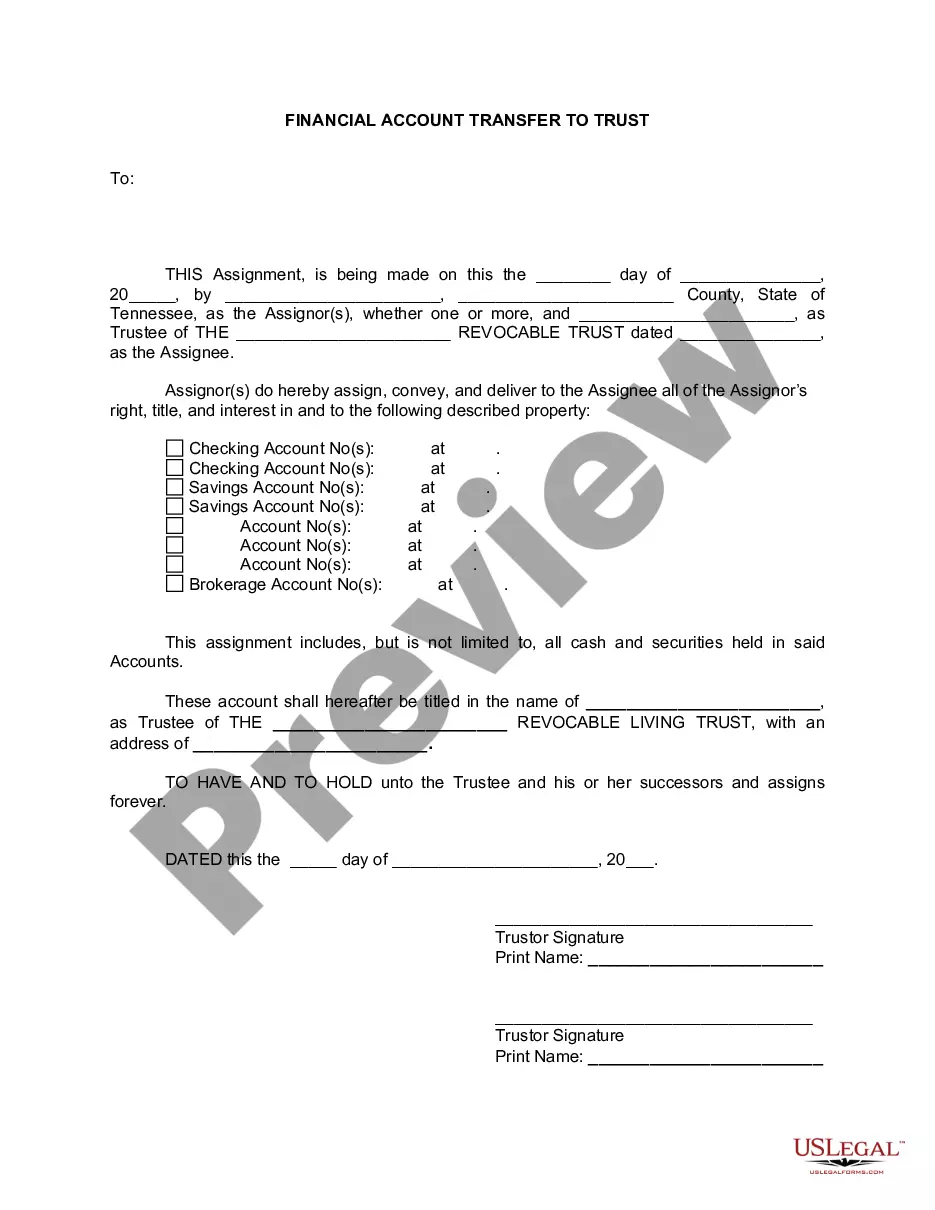

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Title: Knoxville Tennessee Financial Account Transfer to Living Trust: A Detailed Guide Introduction: In Knoxville, Tennessee, individuals have the option to transfer their financial accounts to a living trust as part of their estate planning strategy. This process allows for efficient management, protection, and distribution of assets, ensuring the seamless transfer of wealth to beneficiaries. This article will provide a comprehensive overview of Knoxville Tennessee financial account transfer to living trusts, covering associated benefits, applicable laws, and different types of transfers available. I. Understanding the Basics of Living Trusts: 1. Definition of a Living Trust 2. Benefits of Establishing a Living Trust 3. Key Participants in a Living Trust 4. Legal Framework for Living Trusts in Knoxville, Tennessee II. Financial Account Transfer to Living Trust: 1. Types of Financial Accounts Eligible for Transfer: a. Bank Accounts (Checking, Savings, Money Market) b. Investment Accounts (Stocks, Bonds, Mutual Funds) c. Retirement Accounts (IRA, 401(k), 403(b)) d. Life Insurance Policies with Cash Value e. Real Estate Holdings III. Steps for Financial Account Transfer to Living Trust: 1. Determine the Assets to Transfer 2. Identify Trustworthy Trustees and Successor Trustees 3. Complete Required Documentation for Account Transfer 4. Maintain Consistency with Account Management and Record-Keeping 5. Review and Update Beneficiary Designations IV. Importance of Consultation with Estate Planning Professionals: 1. Seeking Professional Assistance for Creating a Living Trust 2. Benefits of Legal Advice for Financial Account Transfers 3. Selecting a Qualified Estate Planning Attorney in Knoxville, Tennessee V. Potential Challenges and Considerations: 1. Tax Implications of Financial Account Transfers 2. Ensuring Adequate Funding of the Living Trust 3. Potential Pitfalls and Precautions during Account Transfers Conclusion: In conclusion, Knoxville, Tennessee residents have several types of financial accounts that can be transferred to a living trust. By doing so, individuals can protect and efficiently manage their wealth, ensuring its seamless transfer to beneficiaries. Engaging with a qualified estate planning attorney is crucial to navigate the legal complexities associated with financial account transfers to living trusts. By following the recommended steps and considering all relevant factors, individuals can establish a robust and comprehensive estate plan tailored to their specific needs.Title: Knoxville Tennessee Financial Account Transfer to Living Trust: A Detailed Guide Introduction: In Knoxville, Tennessee, individuals have the option to transfer their financial accounts to a living trust as part of their estate planning strategy. This process allows for efficient management, protection, and distribution of assets, ensuring the seamless transfer of wealth to beneficiaries. This article will provide a comprehensive overview of Knoxville Tennessee financial account transfer to living trusts, covering associated benefits, applicable laws, and different types of transfers available. I. Understanding the Basics of Living Trusts: 1. Definition of a Living Trust 2. Benefits of Establishing a Living Trust 3. Key Participants in a Living Trust 4. Legal Framework for Living Trusts in Knoxville, Tennessee II. Financial Account Transfer to Living Trust: 1. Types of Financial Accounts Eligible for Transfer: a. Bank Accounts (Checking, Savings, Money Market) b. Investment Accounts (Stocks, Bonds, Mutual Funds) c. Retirement Accounts (IRA, 401(k), 403(b)) d. Life Insurance Policies with Cash Value e. Real Estate Holdings III. Steps for Financial Account Transfer to Living Trust: 1. Determine the Assets to Transfer 2. Identify Trustworthy Trustees and Successor Trustees 3. Complete Required Documentation for Account Transfer 4. Maintain Consistency with Account Management and Record-Keeping 5. Review and Update Beneficiary Designations IV. Importance of Consultation with Estate Planning Professionals: 1. Seeking Professional Assistance for Creating a Living Trust 2. Benefits of Legal Advice for Financial Account Transfers 3. Selecting a Qualified Estate Planning Attorney in Knoxville, Tennessee V. Potential Challenges and Considerations: 1. Tax Implications of Financial Account Transfers 2. Ensuring Adequate Funding of the Living Trust 3. Potential Pitfalls and Precautions during Account Transfers Conclusion: In conclusion, Knoxville, Tennessee residents have several types of financial accounts that can be transferred to a living trust. By doing so, individuals can protect and efficiently manage their wealth, ensuring its seamless transfer to beneficiaries. Engaging with a qualified estate planning attorney is crucial to navigate the legal complexities associated with financial account transfers to living trusts. By following the recommended steps and considering all relevant factors, individuals can establish a robust and comprehensive estate plan tailored to their specific needs.