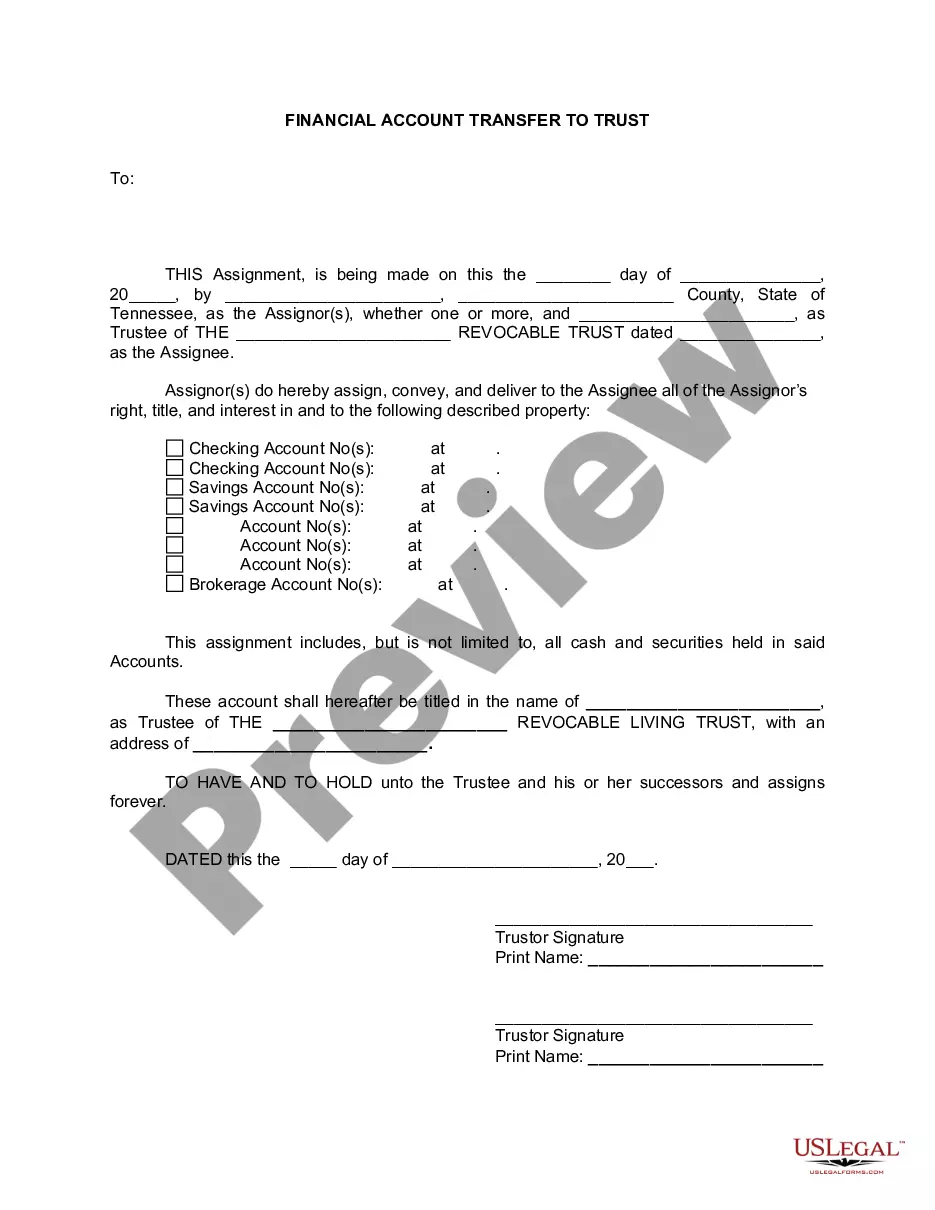

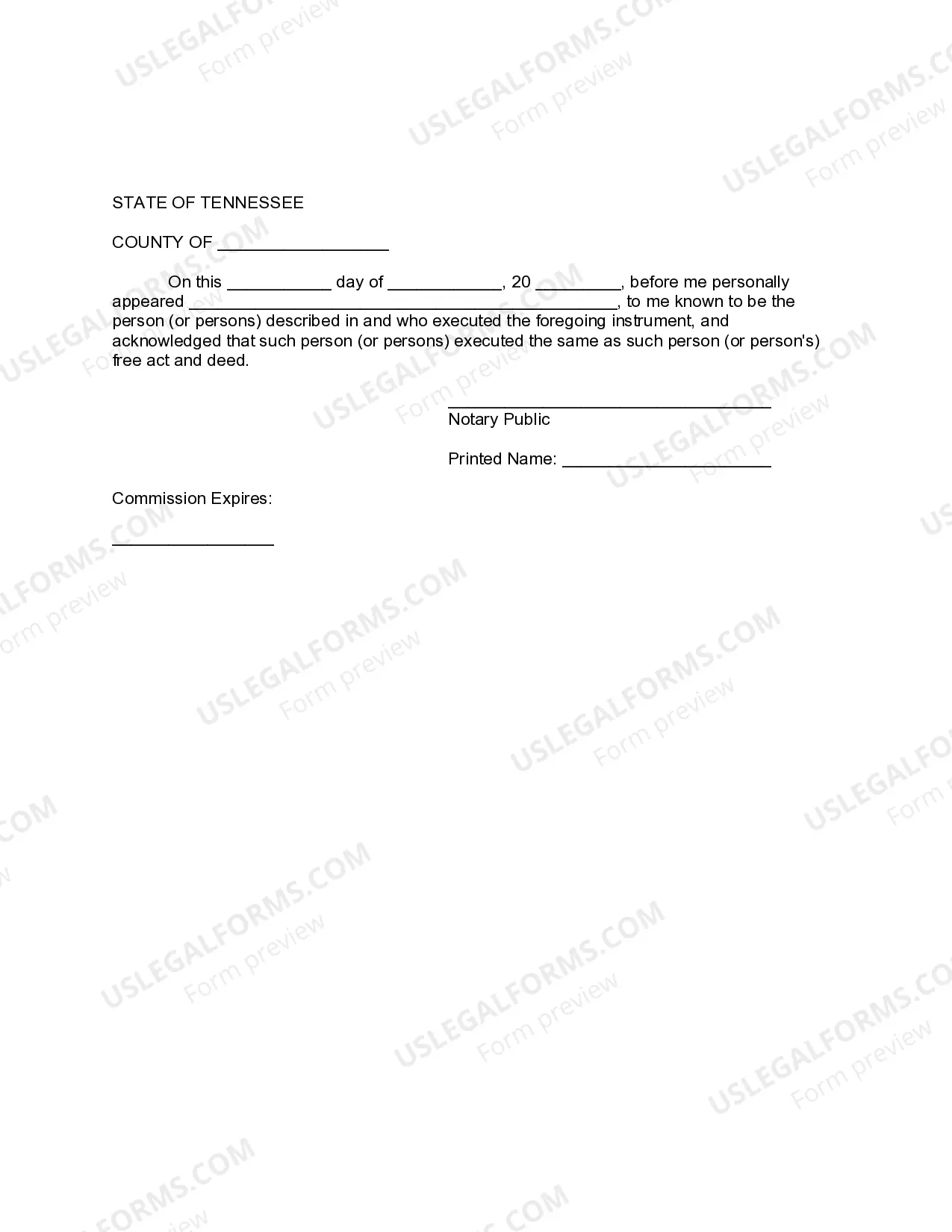

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Title: Murfreesboro Tennessee Financial Account Transfer to Living Trust — A Comprehensive Guide Introduction: In Murfreesboro, Tennessee, transferring financial accounts to a living trust is a significant aspect of estate planning and asset management. This process enables individuals to protect their wealth, ensure efficient distribution after their passing, and potentially reduce estate taxes. This detailed description aims to explain what a Murfreesboro Tennessee financial account transfer to a living trust entails and provide insights into different types of transfers. 1. Understanding Living Trusts: A living trust, also known as a revocable trust, is a legal arrangement allowing individuals (known as granters) to transfer their assets into the trust during their lifetime. The granter retains control over the trust and can make amendments or revoke it if necessary. Upon the granter's passing, the assets held within the trust are distributed to designated beneficiaries according to the trust document. 2. Types of Financial Accounts Transferable to a Living Trust: 2.1. Bank Accounts: Murfreesboro residents can transfer various bank accounts, including checking, savings, money market, and certificates of deposits (CDs), to their living trust. They should work with their financial institution to properly retitle these accounts in the name of the trust. 2.2. Investment Accounts: Individuals with brokerage accounts, stocks, bonds, mutual funds, and other investment assets can transfer these accounts to their living trust. It ensures seamless asset management, especially if the granter becomes incapacitated or upon their passing. 2.3. Retirement Accounts: In certain cases, individuals may choose to transfer individual retirement accounts (IRAs) or 401(k)s to a living trust. However, this decision requires careful consideration due to tax implications and potential loss of favorable beneficiary distribution options. Seeking professional guidance is strongly advised. 2.4. Real Estate: Real estate properties in Murfreesboro, including residential properties, commercial buildings, and vacant land, can be transferred to a living trust. Retitling the property within the trust's name ensures easy transfer to beneficiaries and may help avoid probate. 2.5. Life Insurance Policies: While life insurance policies cannot be directly transferred to a living trust, individuals can designate the trust as the beneficiary. This ensures the trust receives the insurance proceeds upon the policyholder's passing, facilitating efficient and controlled distribution. Conclusion: Transferring financial accounts to a living trust in Murfreesboro, Tennessee, is a vital step in comprehensive estate planning. By utilizing this legal tool, individuals can protect their assets, minimize unnecessary taxes and fees, and provide peace of mind to their loved ones. It is highly recommended consulting with an estate planning attorney or financial advisor experienced in living trusts to navigate the complex legal and financial aspects of the process effectively.Title: Murfreesboro Tennessee Financial Account Transfer to Living Trust — A Comprehensive Guide Introduction: In Murfreesboro, Tennessee, transferring financial accounts to a living trust is a significant aspect of estate planning and asset management. This process enables individuals to protect their wealth, ensure efficient distribution after their passing, and potentially reduce estate taxes. This detailed description aims to explain what a Murfreesboro Tennessee financial account transfer to a living trust entails and provide insights into different types of transfers. 1. Understanding Living Trusts: A living trust, also known as a revocable trust, is a legal arrangement allowing individuals (known as granters) to transfer their assets into the trust during their lifetime. The granter retains control over the trust and can make amendments or revoke it if necessary. Upon the granter's passing, the assets held within the trust are distributed to designated beneficiaries according to the trust document. 2. Types of Financial Accounts Transferable to a Living Trust: 2.1. Bank Accounts: Murfreesboro residents can transfer various bank accounts, including checking, savings, money market, and certificates of deposits (CDs), to their living trust. They should work with their financial institution to properly retitle these accounts in the name of the trust. 2.2. Investment Accounts: Individuals with brokerage accounts, stocks, bonds, mutual funds, and other investment assets can transfer these accounts to their living trust. It ensures seamless asset management, especially if the granter becomes incapacitated or upon their passing. 2.3. Retirement Accounts: In certain cases, individuals may choose to transfer individual retirement accounts (IRAs) or 401(k)s to a living trust. However, this decision requires careful consideration due to tax implications and potential loss of favorable beneficiary distribution options. Seeking professional guidance is strongly advised. 2.4. Real Estate: Real estate properties in Murfreesboro, including residential properties, commercial buildings, and vacant land, can be transferred to a living trust. Retitling the property within the trust's name ensures easy transfer to beneficiaries and may help avoid probate. 2.5. Life Insurance Policies: While life insurance policies cannot be directly transferred to a living trust, individuals can designate the trust as the beneficiary. This ensures the trust receives the insurance proceeds upon the policyholder's passing, facilitating efficient and controlled distribution. Conclusion: Transferring financial accounts to a living trust in Murfreesboro, Tennessee, is a vital step in comprehensive estate planning. By utilizing this legal tool, individuals can protect their assets, minimize unnecessary taxes and fees, and provide peace of mind to their loved ones. It is highly recommended consulting with an estate planning attorney or financial advisor experienced in living trusts to navigate the complex legal and financial aspects of the process effectively.