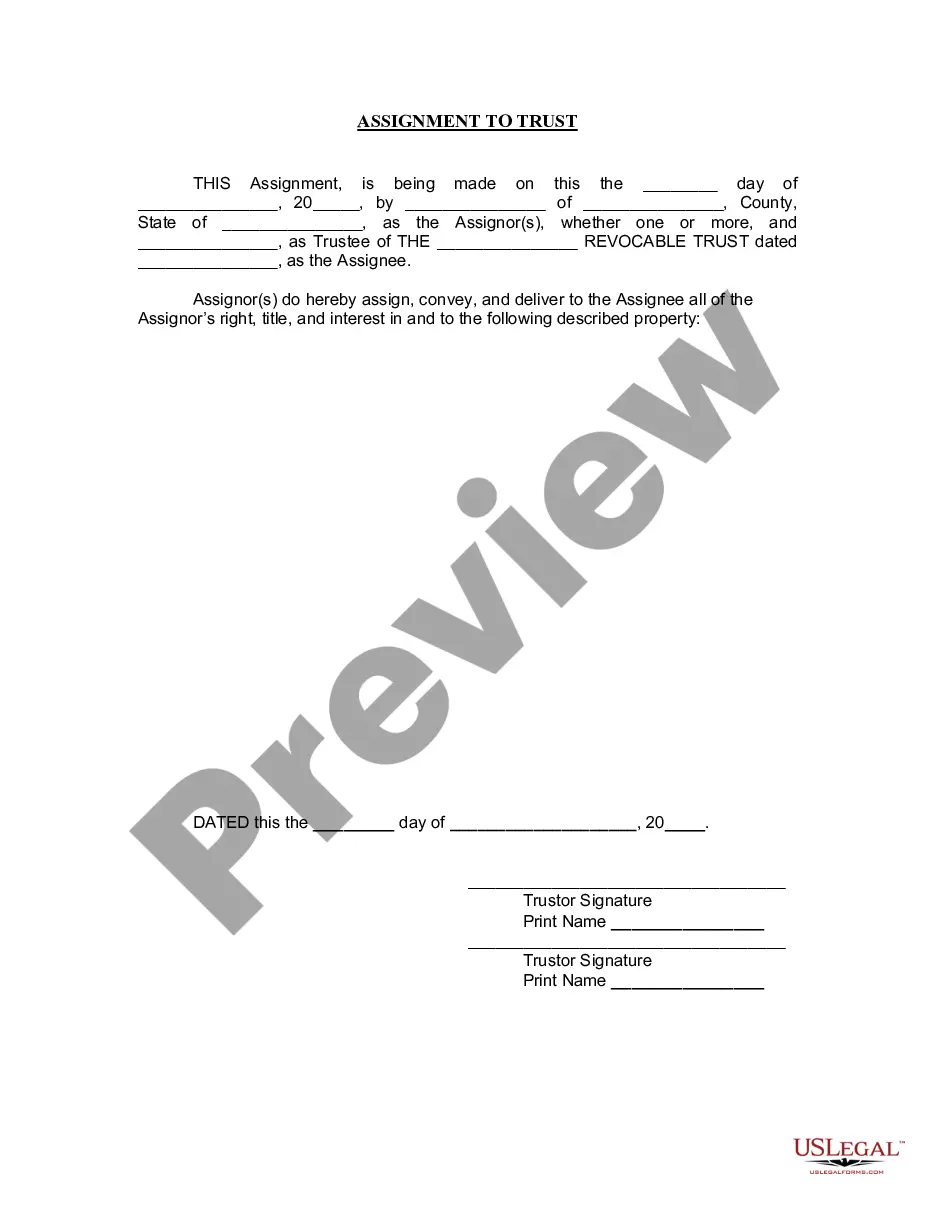

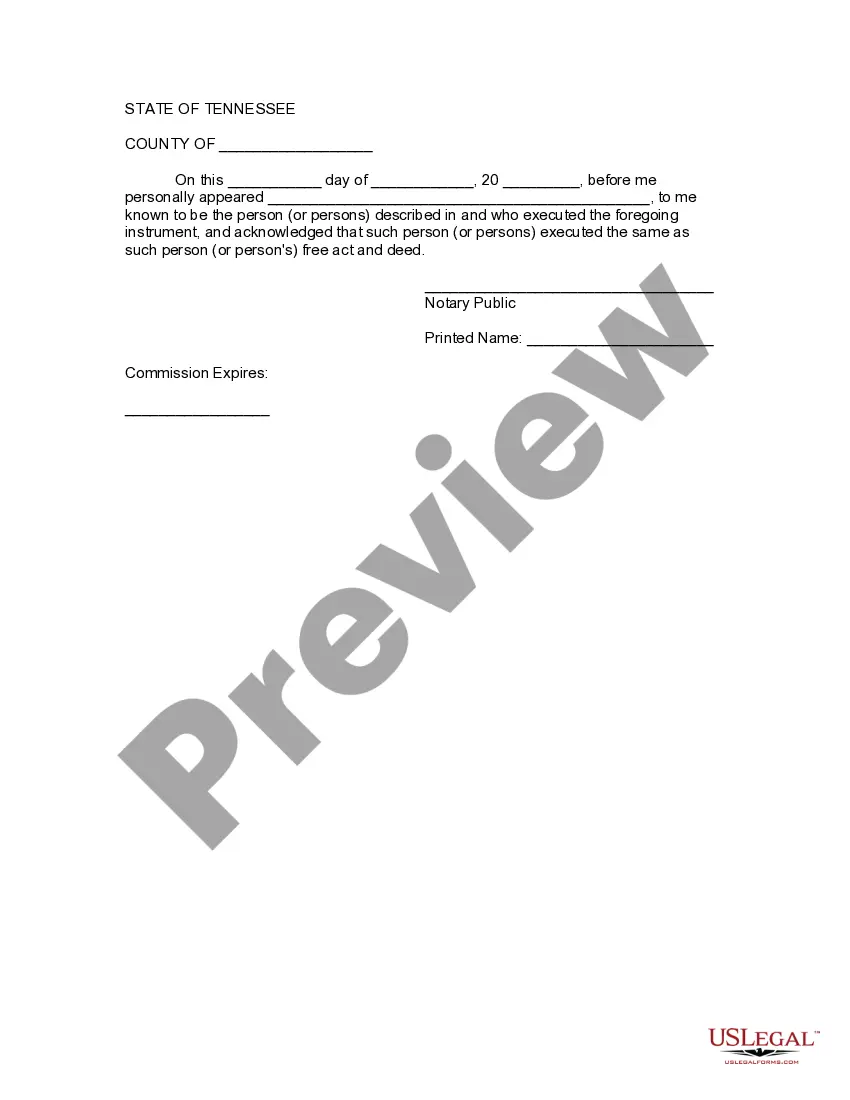

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Memphis Tennessee Assignment to Living Trust is a legal process whereby an individual transfers their assets, property, and financial holdings into a living trust based in Memphis, Tennessee. This assignment is governed by specific state laws and regulations to ensure the proper transfer of ownership and management of these assets. A living trust is a legal document created by an individual, also known as the granter or trust or, during their lifetime to hold and administer their assets. By establishing a living trust, the granter designates a trustee to manage and distribute the assets held within the trust upon their incapacitation or death. The primary objective of this Assignment to Living Trust is to avoid probate, a lengthy court process, and ensure a smooth and efficient transfer of assets to beneficiaries. There are different types of Memphis Tennessee Assignment to Living Trust, and they can vary based on specific circumstances and goals of the granter. Some common types include revocable living trusts, irrevocable living trusts, testamentary living trusts, and special needs living trusts. A revocable living trust is the most common type and allows the granter to retain control over the assets placed in the trust. The granter can amend, modify, or revoke the trust at any time during their lifetime. This type of trust provides flexibility and avoids probate upon the granter's death. In contrast, an irrevocable living trust cannot be changed after it is established. Once assets are transferred into this trust, the granter relinquishes control, and the trustee manages the assets for the beneficiaries. This type of trust is often used for estate planning purposes to minimize estate taxes and protect assets from creditors. A testamentary living trust is created through a will and only takes effect upon the granter's death. It allows for the distribution of assets according to the granter's wishes, but it must go through probate before the trust can be implemented. Lastly, a special needs living trust is designed to provide financial support for individuals with special needs or disabilities. This trust ensures that the beneficiary can receive financial assistance without jeopardizing their eligibility for government benefits. In summary, Memphis Tennessee Assignment to Living Trust is a legal process for transferring assets into a trust based in Memphis, Tennessee. The trust can be categorized into different types, such as revocable, irrevocable, testamentary, and special needs trusts, depending on the granter's objectives. This assignment aims to streamline the transfer of assets, avoid probate, and facilitate the proper management and distribution of assets to beneficiaries.