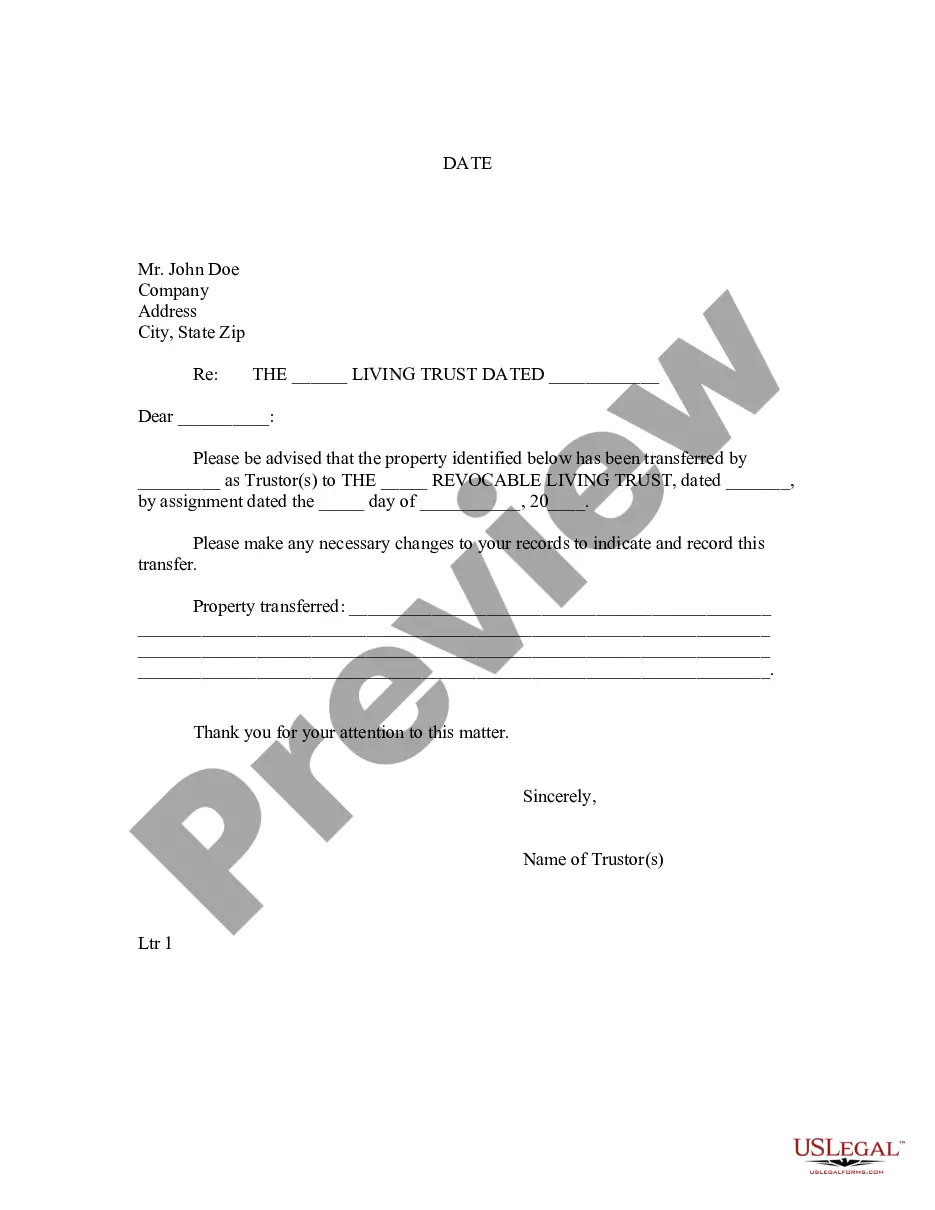

This Letter to Lienholder to Notify of Trust form is a letter notice to a lienholder to notify the lienholder that property has been transferred to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trustor would use this form to specify what specific property was being held by the trust.

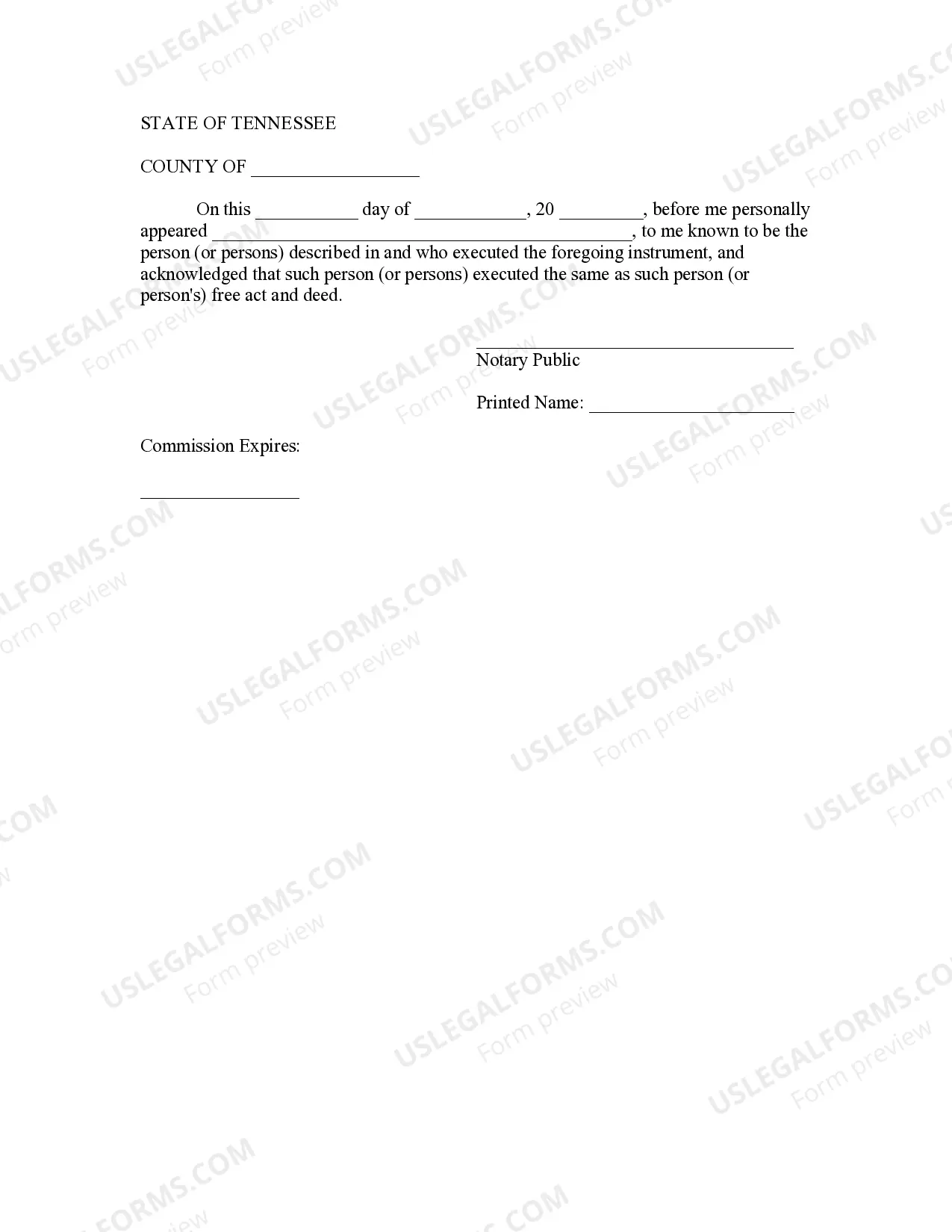

A Chattanooga Tennessee Letter to Lien holder to Notify of Trust is a formal document that serves to inform the lien holder about the creation of a trust in relation to a certain property or asset. This letter is an essential step in ensuring that all parties involved are aware of the trust's existence and their respective roles and responsibilities. Keywords: Chattanooga Tennessee, letter, lien holder, notify, trust. When drafting a Chattanooga Tennessee Letter to Lien holder to Notify of Trust, it is crucial to include key information to accurately convey the trust's details and its impact on the lien holder's interests. Here's a detailed description of what should be covered: 1. Heading: Begin the letter with a professional heading that includes the current date and addresses both the lien holder and any relevant financial institution or legal entity involved. 2. Introduction: Introduce yourself and state your role within the trust. Clearly identify the lien holder's name, address, and any relevant account numbers or reference numbers for easy identification. 3. Opening Paragraph: State the purpose of the letter, which is to officially notify the lien holder about the creation of a trust that involves the asset or property specified in the lien. Emphasize the importance of this notification to ensure proper handling and management of the asset in question. 4. Trust Details: Provide a comprehensive description of the trust, including the trust name, date of creation, and any relevant legal or financial documents associated with it. Mention the names of the granter(s) and beneficiary(IES) involved. Additionally, include the specific asset or property subject to the lien, clearly highlighting its importance. 5. Trustee Information: Provide detailed information about the appointed trustee(s), including their name(s), contact information, and professional credentials. Clarify their obligations and duties towards the trust and its beneficiaries, emphasizing their role in managing the asset while ensuring the lien holder's interests are protected. 6. Collaboration and Communication: Express the desire for open and regular communication between the lien holder and the trustee(s). Encourage the lien holder to reach out with any concerns, questions, or requests related to the trust or the asset in question. 7. Next Steps: Outline any specific actions that the lien holder may need to take to ensure a smooth transition of the asset into the trust. If required, provide the necessary instructions for updating account information and ensuring the trust is properly reflected in any relevant documentation or legal agreements. 8. Closing: End the letter with a polite and professional closing, providing contact information for the trustee(s) or any other relevant party who can assist the lien holder in case further clarification is needed. Different types of Chattanooga Tennessee Letters to Lien holders to Notify of Trust may vary based on the nature of the trust or asset involved. Some possible variations may include Chattanooga Tennessee Letter to Lien holder to Notify of Real Estate Trust, Chattanooga Tennessee Letter to Lien holder to Notify of Investment Trust, or Chattanooga Tennessee Letter to Lien holder to Notify of Business Trust. The content of these letters would be similar, with slight variations to address the specific type of trust.A Chattanooga Tennessee Letter to Lien holder to Notify of Trust is a formal document that serves to inform the lien holder about the creation of a trust in relation to a certain property or asset. This letter is an essential step in ensuring that all parties involved are aware of the trust's existence and their respective roles and responsibilities. Keywords: Chattanooga Tennessee, letter, lien holder, notify, trust. When drafting a Chattanooga Tennessee Letter to Lien holder to Notify of Trust, it is crucial to include key information to accurately convey the trust's details and its impact on the lien holder's interests. Here's a detailed description of what should be covered: 1. Heading: Begin the letter with a professional heading that includes the current date and addresses both the lien holder and any relevant financial institution or legal entity involved. 2. Introduction: Introduce yourself and state your role within the trust. Clearly identify the lien holder's name, address, and any relevant account numbers or reference numbers for easy identification. 3. Opening Paragraph: State the purpose of the letter, which is to officially notify the lien holder about the creation of a trust that involves the asset or property specified in the lien. Emphasize the importance of this notification to ensure proper handling and management of the asset in question. 4. Trust Details: Provide a comprehensive description of the trust, including the trust name, date of creation, and any relevant legal or financial documents associated with it. Mention the names of the granter(s) and beneficiary(IES) involved. Additionally, include the specific asset or property subject to the lien, clearly highlighting its importance. 5. Trustee Information: Provide detailed information about the appointed trustee(s), including their name(s), contact information, and professional credentials. Clarify their obligations and duties towards the trust and its beneficiaries, emphasizing their role in managing the asset while ensuring the lien holder's interests are protected. 6. Collaboration and Communication: Express the desire for open and regular communication between the lien holder and the trustee(s). Encourage the lien holder to reach out with any concerns, questions, or requests related to the trust or the asset in question. 7. Next Steps: Outline any specific actions that the lien holder may need to take to ensure a smooth transition of the asset into the trust. If required, provide the necessary instructions for updating account information and ensuring the trust is properly reflected in any relevant documentation or legal agreements. 8. Closing: End the letter with a polite and professional closing, providing contact information for the trustee(s) or any other relevant party who can assist the lien holder in case further clarification is needed. Different types of Chattanooga Tennessee Letters to Lien holders to Notify of Trust may vary based on the nature of the trust or asset involved. Some possible variations may include Chattanooga Tennessee Letter to Lien holder to Notify of Real Estate Trust, Chattanooga Tennessee Letter to Lien holder to Notify of Investment Trust, or Chattanooga Tennessee Letter to Lien holder to Notify of Business Trust. The content of these letters would be similar, with slight variations to address the specific type of trust.