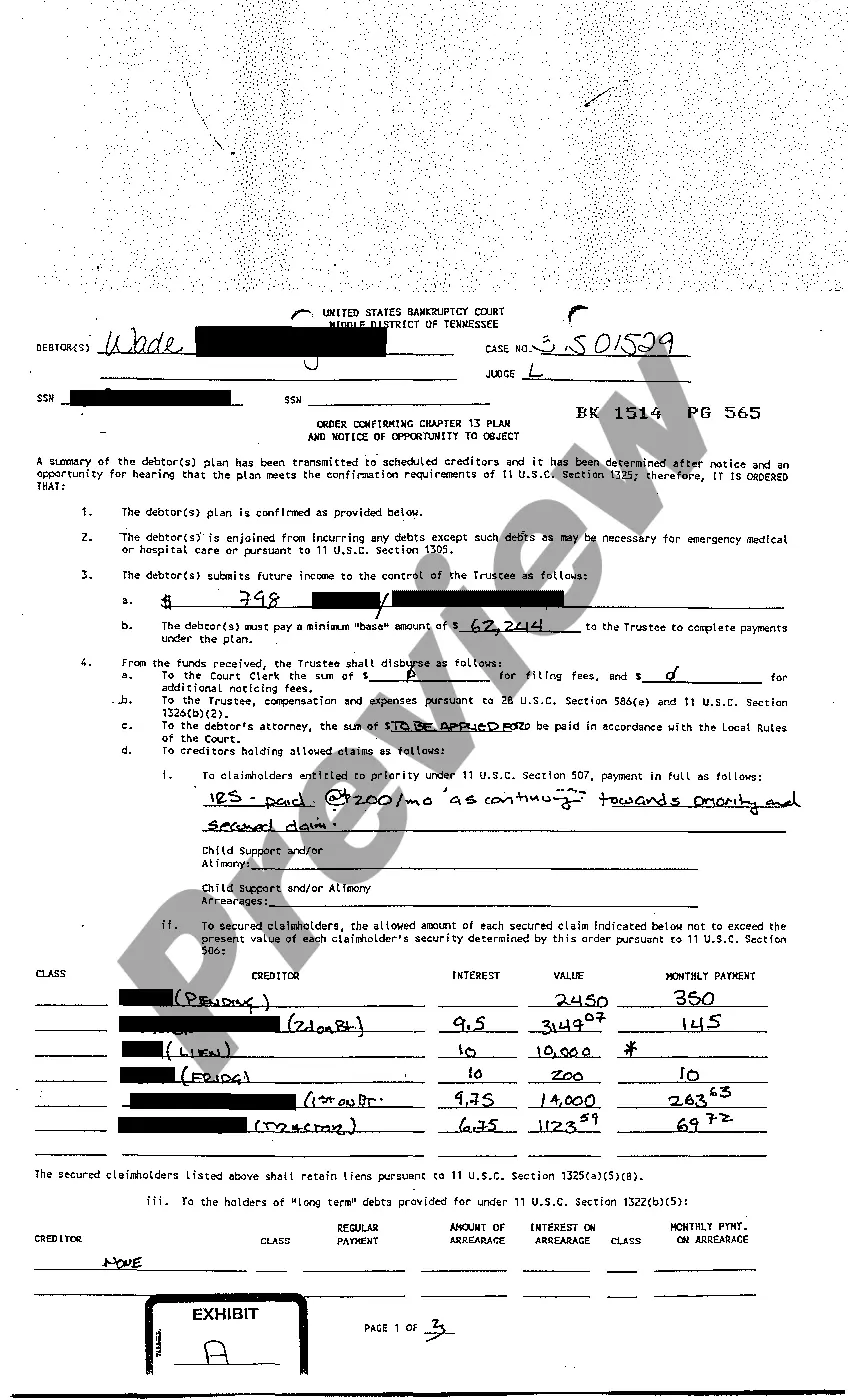

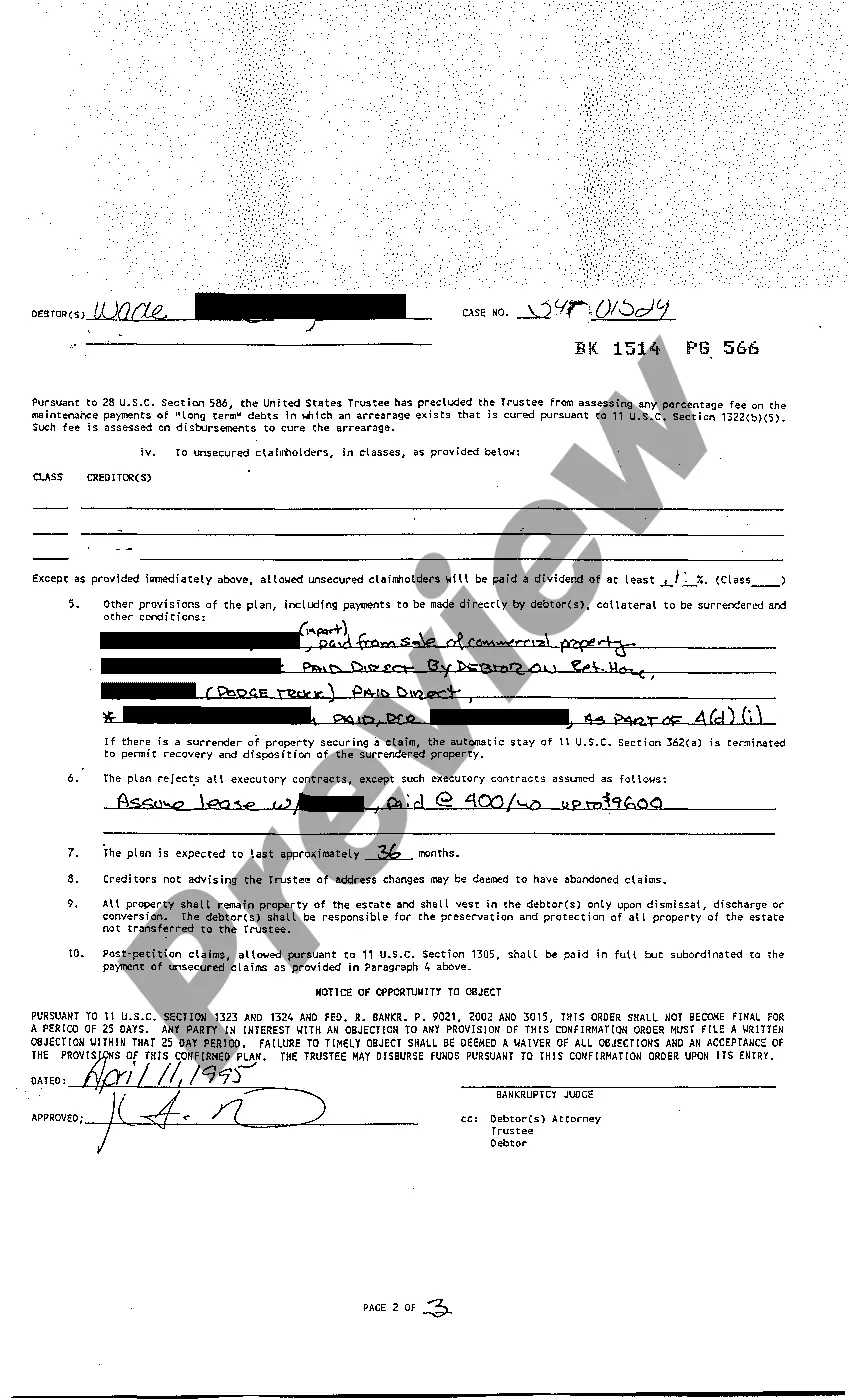

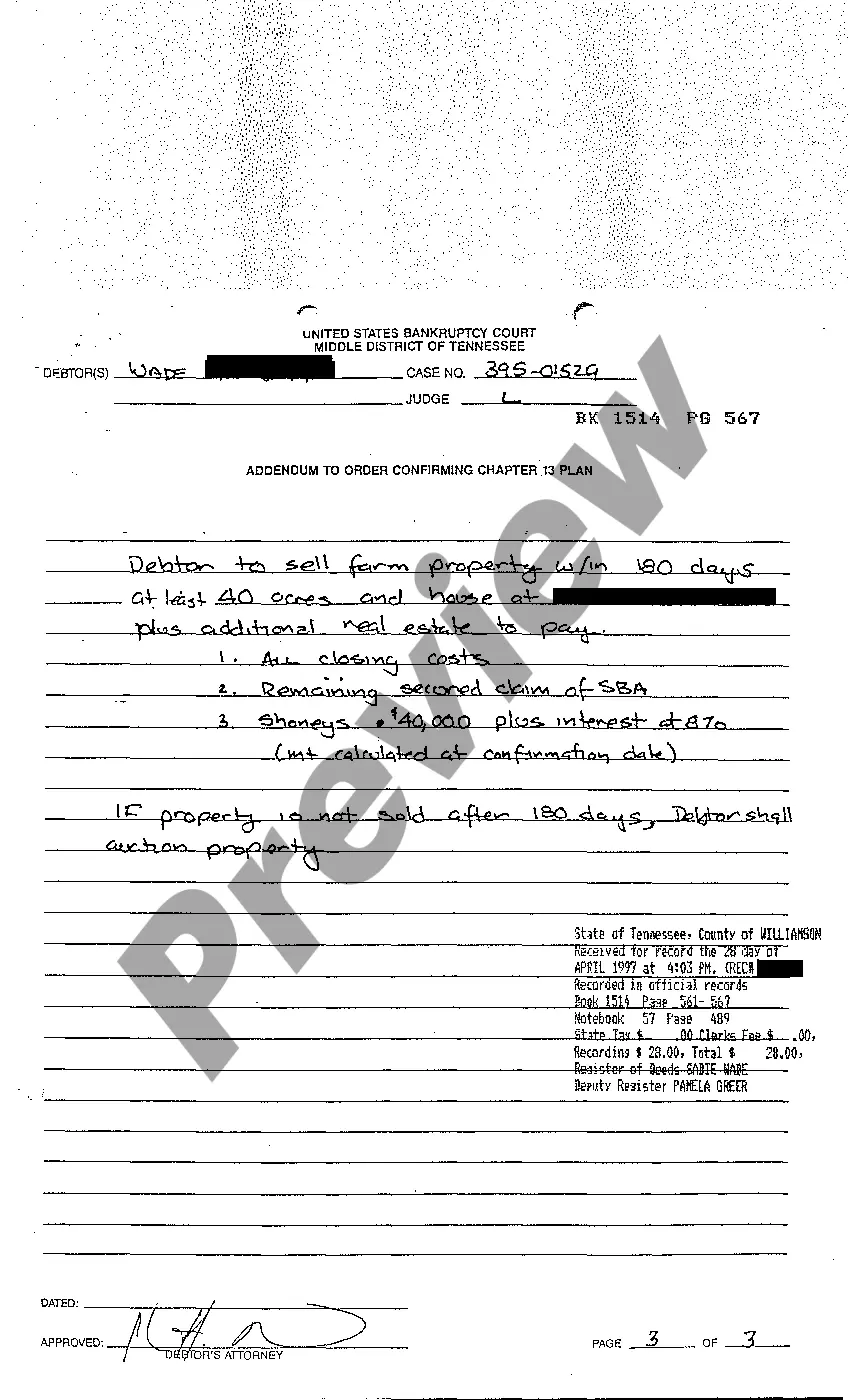

In Memphis, Tennessee, the Order Resolving Objections to Confirmation is a legal proceeding that occurs in the context of a bankruptcy case. It is a crucial step towards finalizing the confirmation process for a debtor's proposed repayment plan, ensuring fairness and resolving objections raised by interested parties. The Order Resolving Objections to Confirmation encompasses carefully articulated decisions made by the court that address the objections raised by creditors, the trustee, or other parties involved in the bankruptcy case. These objections typically revolve around elements of the debtor's proposed plan, such as valuation of assets, treatment of certain debts, or feasibility of repayment. The court's primary goal in this process is to ensure that the proposed plan satisfies the requirements outlined in the Bankruptcy Code and adheres to the principles of fairness and equity. It lays the foundation for the successful implementation of the debtor's repayment plan while attending to the interests of all parties involved. Various types of Orders Resolving Objections to Confirmation may exist, depending on the specific objections raised and the unique circumstances of the case. Some common examples include: 1. Order Resolving Objections to Confirmation — Asset Valuation: This type of order focuses on objections related to the valuation of assets, which may impact the overall feasibility of the debtor's plan. It typically ensures that the valuations are accurate, reasonable, and consistent with applicable legal standards. 2. Order Resolving Objections to Confirmation — Priority of Claims: In some cases, creditors may object to the proposed order due to concern about the priority classification of their claims. The court addresses such objections by clarifying the hierarchy of claims, ensuring the repayment order is lawful and appropriate. 3. Order Resolving Objections to Confirmation — Treatment of Secured Creditors: This type of order addresses objections raised by secured creditors who may dispute the proposed treatment of their claims in the debtor's repayment plan. The court's decision ensures that the treatment is fair and compliant with the Bankruptcy Code. 4. Order Resolving Objections to Confirmation — Feasibility: This order focuses on objections regarding the feasibility of the debtor's proposed repayment plan. The court assesses the debtor's ability to fulfill the plan's requirements and make payments, ensuring it is realistic and achievable. Each type of order requires a thorough analysis of the facts and applicable bankruptcy laws. The court examines the objections, reviews supporting evidence, and may hold hearings to allow parties to present their arguments. Upon careful deliberation, the court issues an order that lays out its decision, resolving the specific objections raised and moving the confirmation process forward. Overall, the Memphis Tennessee Order Resolving Objections to Confirmation plays a crucial role in the bankruptcy process. It ensures that all parties' interests are considered, objections are addressed, and a fair and feasible repayment plan can be implemented to guide the debtor towards financial stability.

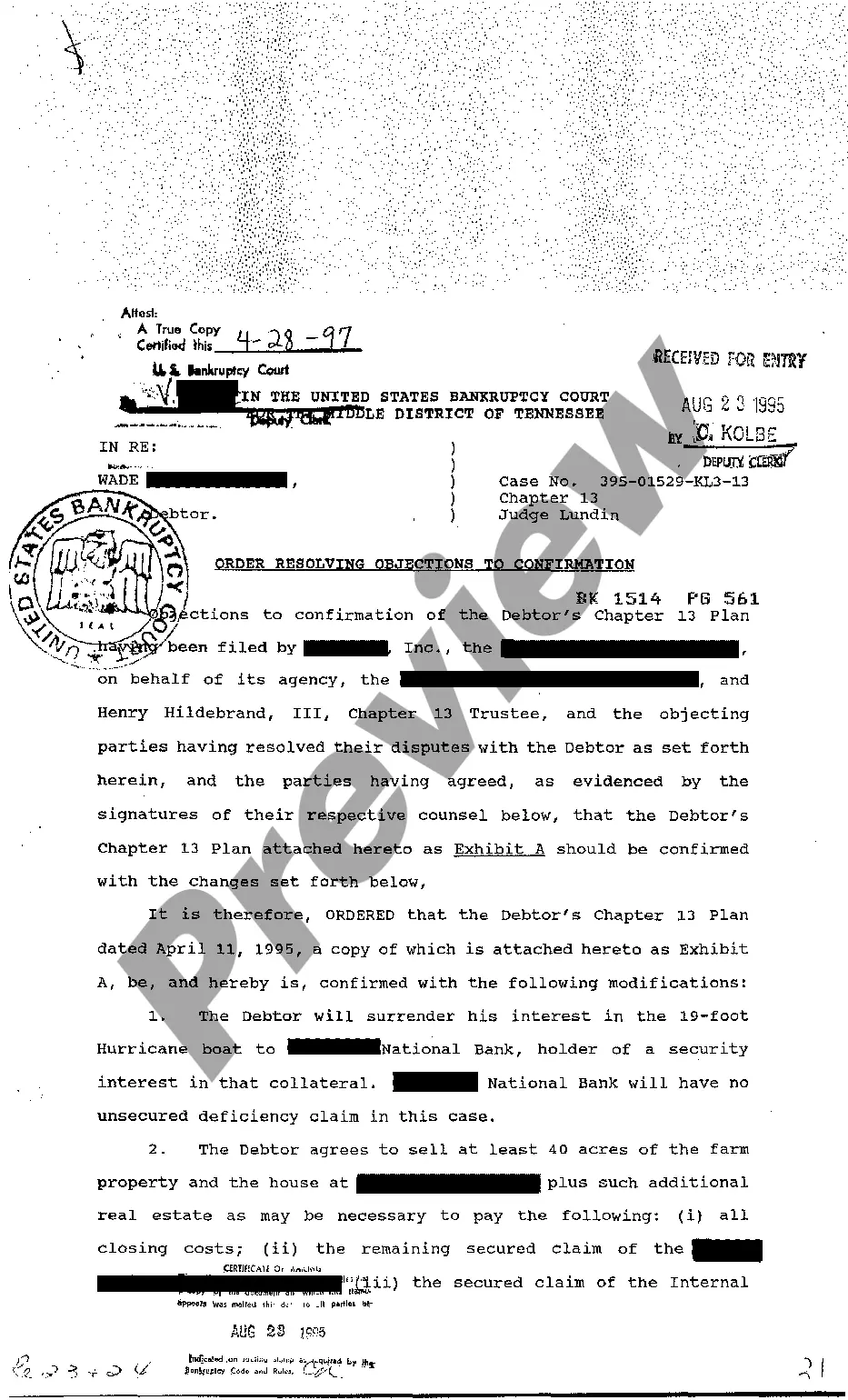

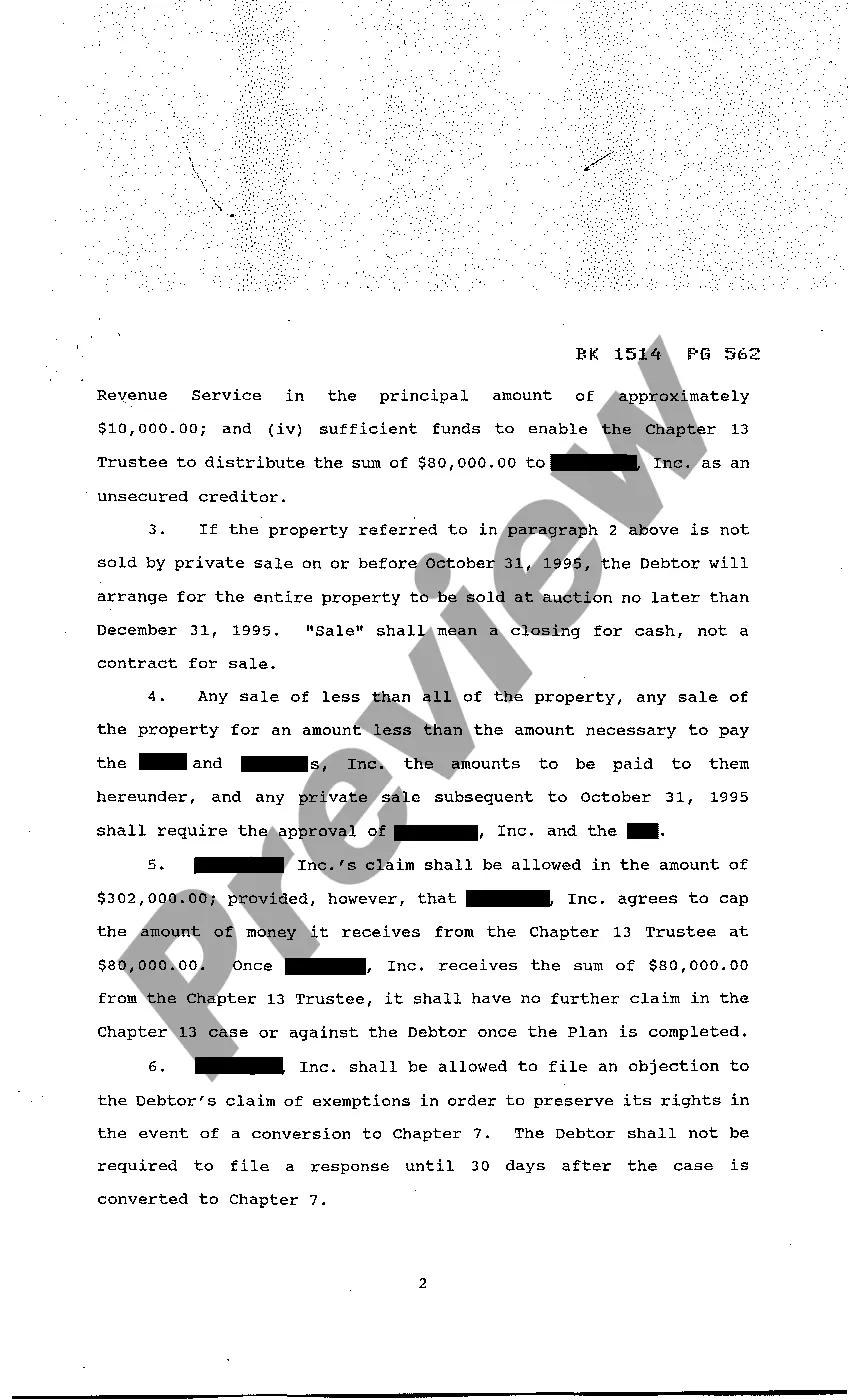

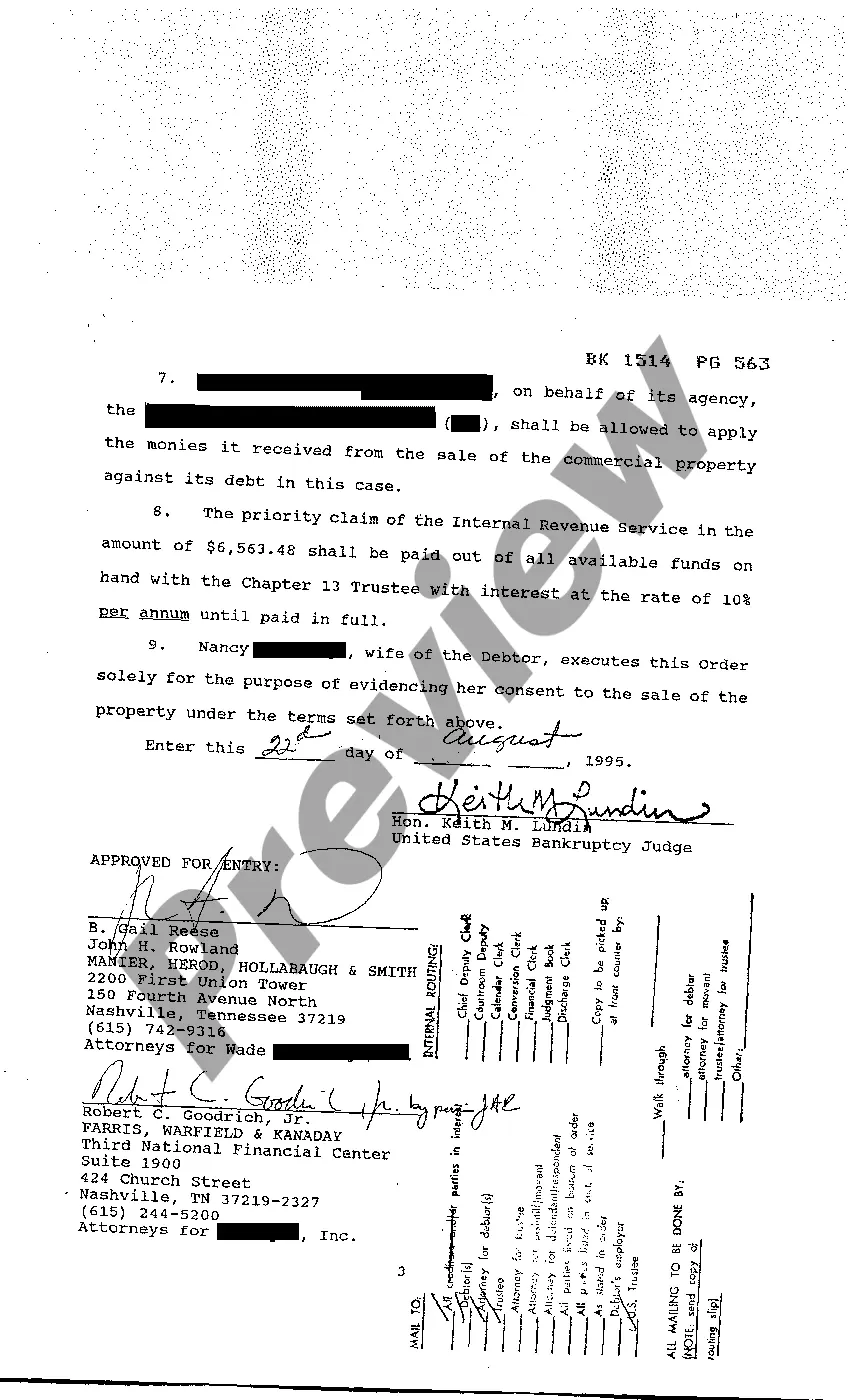

Memphis Tennessee Order Resolving Objections to Confirmation

Description

How to fill out Memphis Tennessee Order Resolving Objections To Confirmation?

Do you need a trustworthy and inexpensive legal forms provider to get the Memphis Tennessee Order Resolving Objections to Confirmation? US Legal Forms is your go-to solution.

No matter if you need a basic arrangement to set regulations for cohabitating with your partner or a package of forms to advance your separation or divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and framed based on the requirements of particular state and area.

To download the form, you need to log in account, locate the needed template, and hit the Download button next to it. Please remember that you can download your previously purchased form templates anytime from the My Forms tab.

Are you new to our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Check if the Memphis Tennessee Order Resolving Objections to Confirmation conforms to the laws of your state and local area.

- Go through the form’s description (if provided) to find out who and what the form is intended for.

- Restart the search in case the template isn’t good for your specific scenario.

Now you can create your account. Then choose the subscription option and proceed to payment. Once the payment is done, download the Memphis Tennessee Order Resolving Objections to Confirmation in any provided file format. You can return to the website when you need and redownload the form free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about spending your valuable time learning about legal papers online for good.