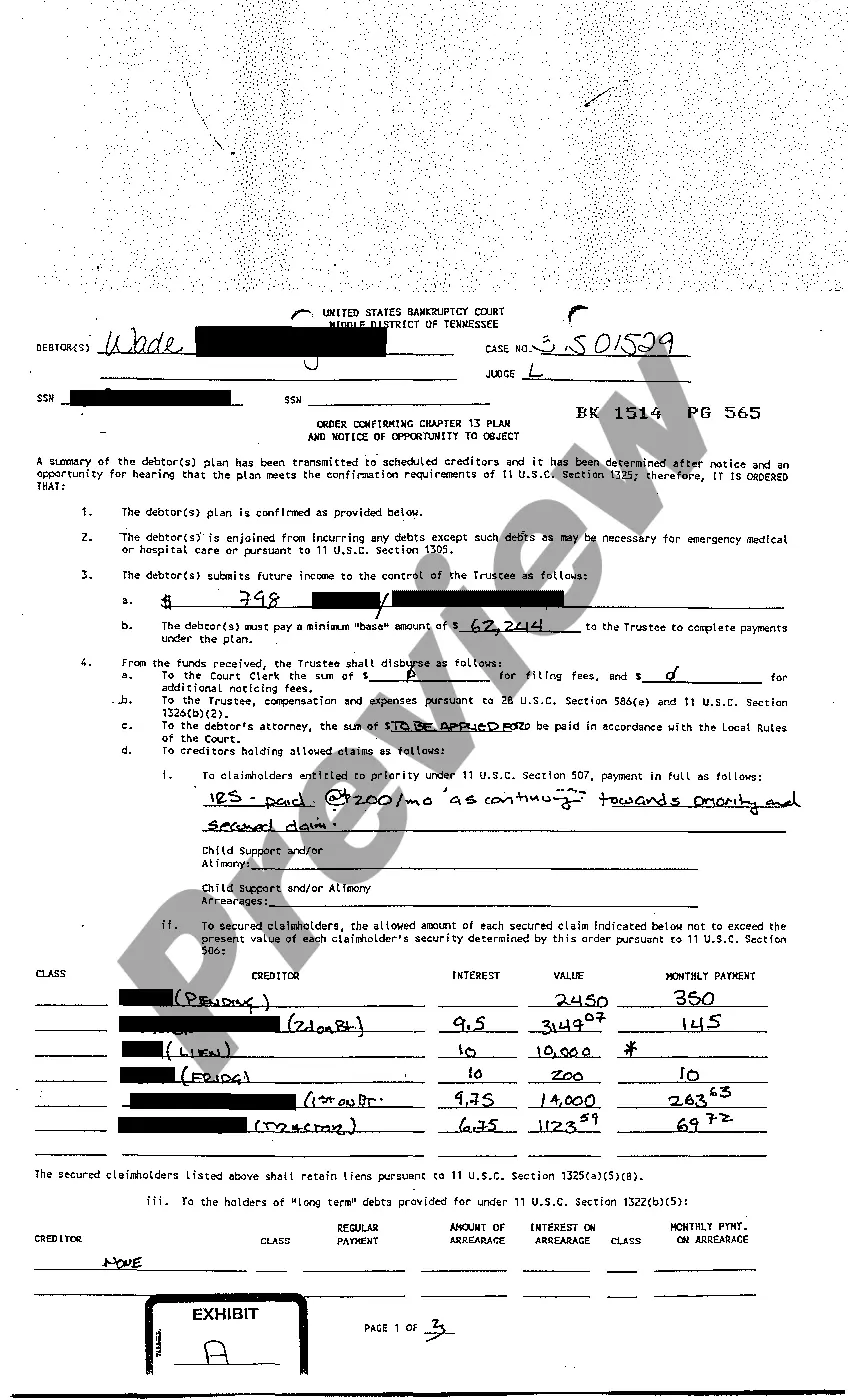

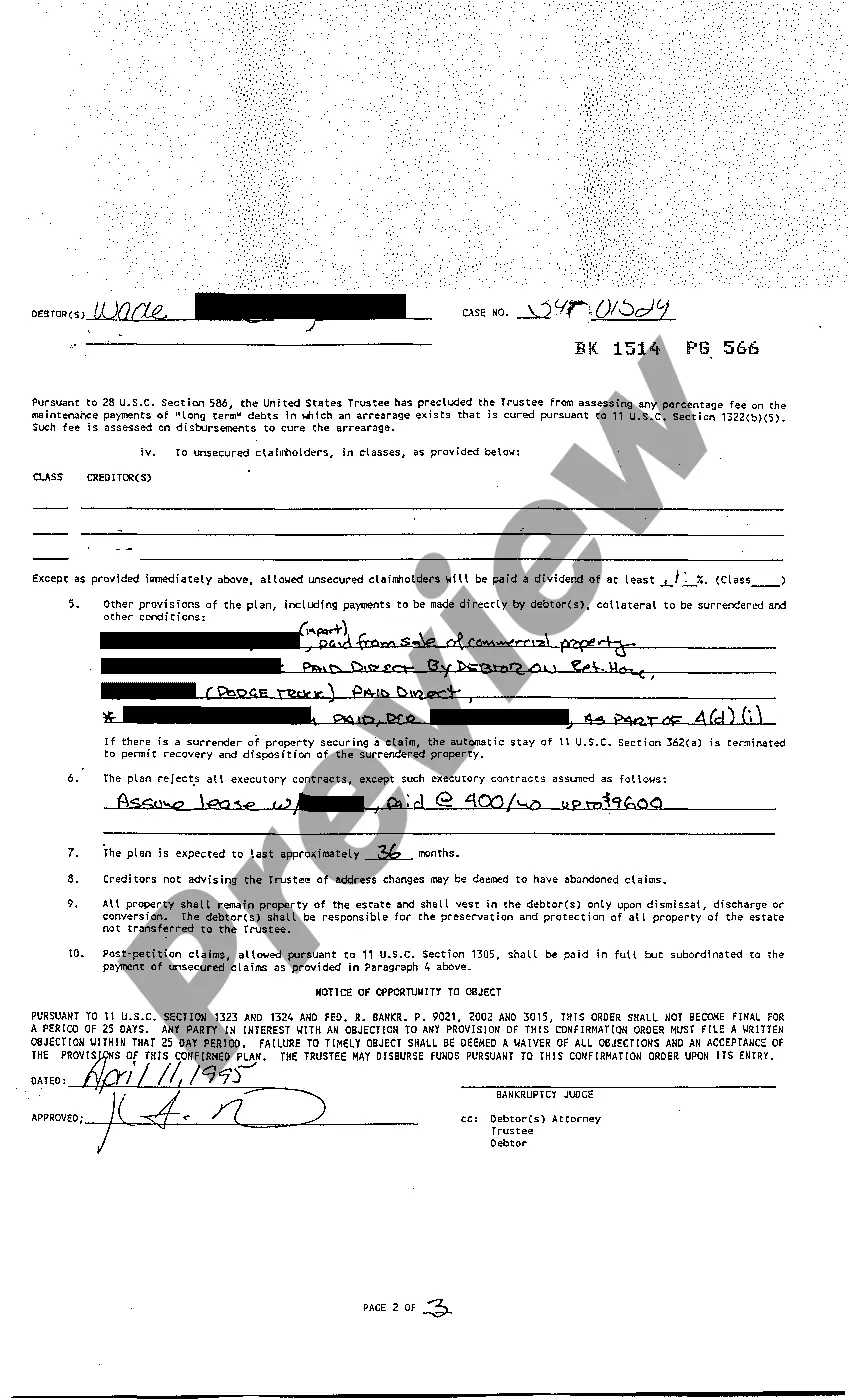

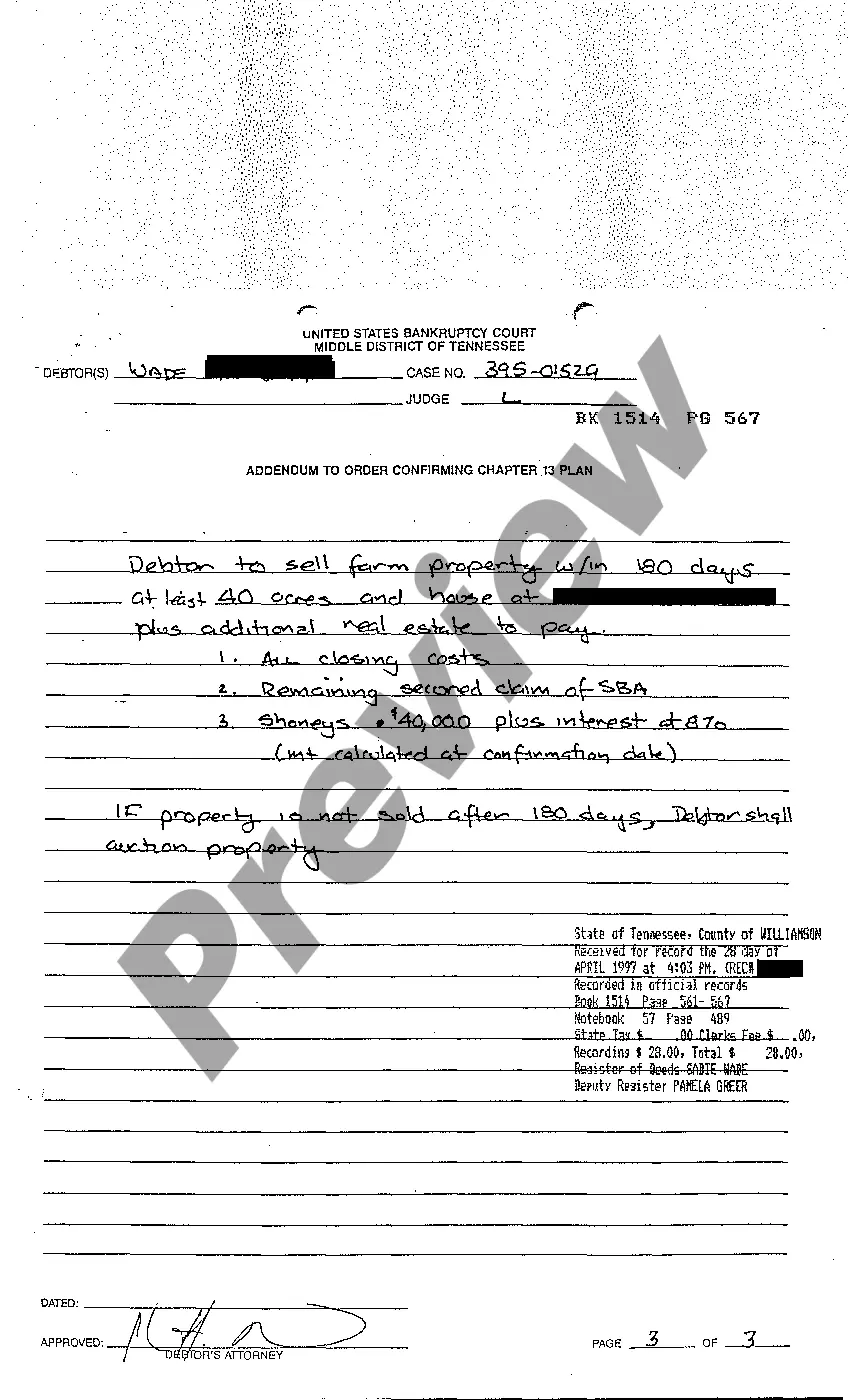

Murfreesboro Tennessee Order Resolving Objections to Confirmation is a legal process carried out in Murfreesboro, Tennessee, to address objections and concerns related to confirmation. This order is commonly associated with bankruptcy cases, specifically Chapter 13 bankruptcies. When an individual or business entity files for bankruptcy under Chapter 13, they propose a repayment plan to repay their debts over a specific period of time, usually three to five years. During the bankruptcy process, creditors have the right to object to the proposed repayment plan. They may raise objections if they believe the plan does not adequately address their claims or if they have concerns about the debtor's ability to fulfill their obligations. In such cases, a Murfreesboro Tennessee Order Resolving Objections to Confirmation is issued by the bankruptcy court to resolve these objections and ensure a fair and equitable outcome for all parties involved. This order serves as a detailed legal document that outlines the court's decision on each objection raised by creditors. It may address various aspects, such as the feasibility of the proposed plan, the valuation of assets, disputes over the classification of debts, or any other relevant issues. The order carefully evaluates each objection and provides a resolution that aligns with bankruptcy laws and regulations. It is important to note that there can be different types of Murfreesboro Tennessee Orders Resolving Objections to Confirmation based on the specific objections raised in a particular bankruptcy case. Some common types include: 1. Valuation Objections: These objections challenge the estimated value of the debtor's assets as stated in the proposed repayment plan. Creditors may argue that the values are either overestimated or underestimated, affecting their potential recovery. 2. Feasibility Objections: Creditors may object to the feasibility of the proposed plan, questioning whether the debtor will be able to follow through with the payments outlined in the repayment plan. These objections are typically based on the debtor's income, expenses, and any potential changes to their financial situation. 3. Classification Objections: Certain creditors may dispute the classification of their debts within the repayment plan. They might believe their claims deserve a higher priority or different treatment than what is initially proposed. 4. Unfair Treatment Objections: Creditors may argue that the proposed repayment plan unfairly benefits certain debtors or fails to treat all creditors similarly. They may seek adjustments or modifications to ensure equitable treatment for all involved parties. In any Murfreesboro Tennessee Order Resolving Objections to Confirmation, the bankruptcy court assesses each objection individually, considering the facts, evidence, and applicable bankruptcy laws. The court then issues an order outlining its decisions and reasoning, providing a resolution for all objections raised. This order becomes a crucial part of the bankruptcy process, guiding the subsequent steps towards debt repayment and financial recovery for the debtor.

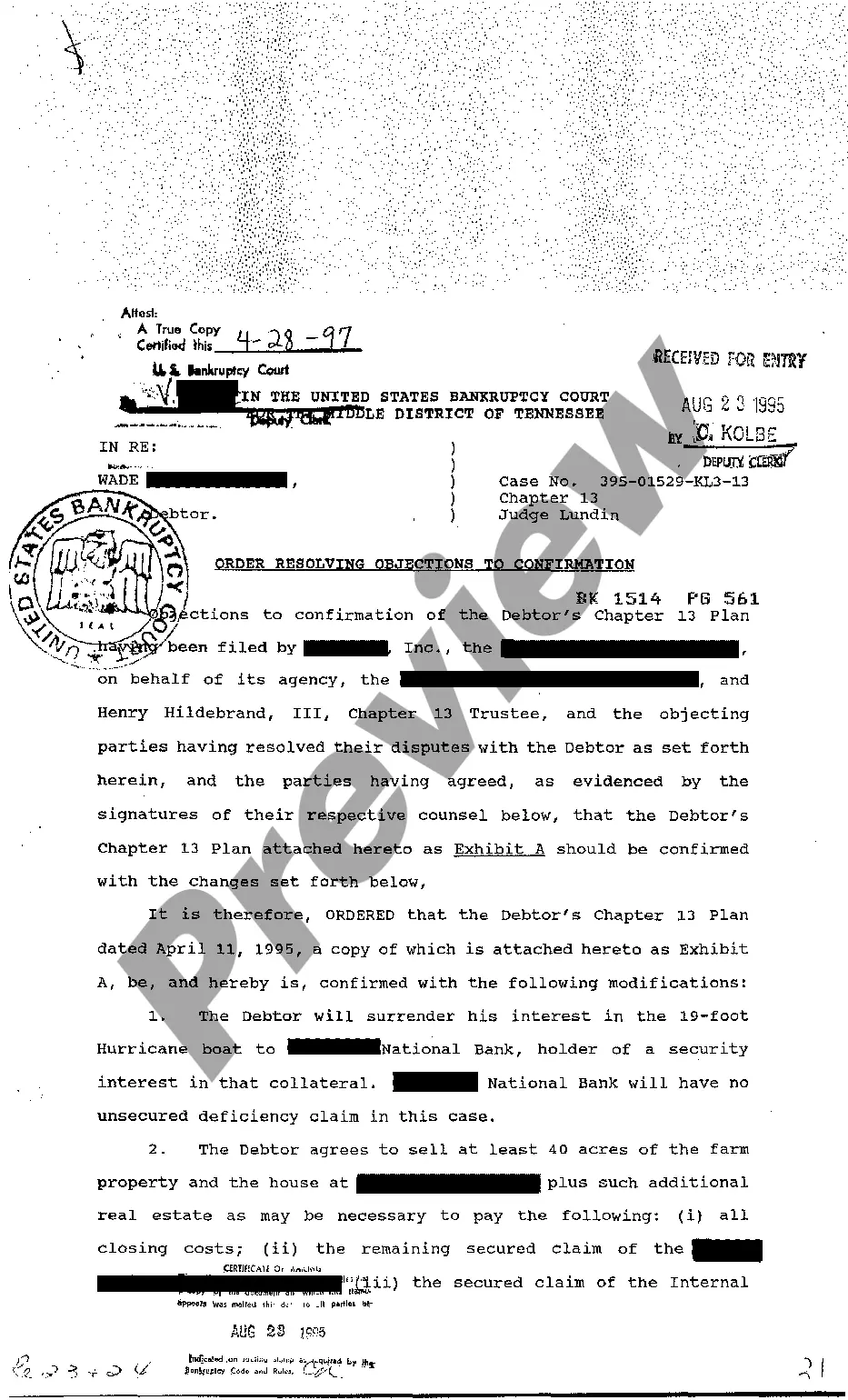

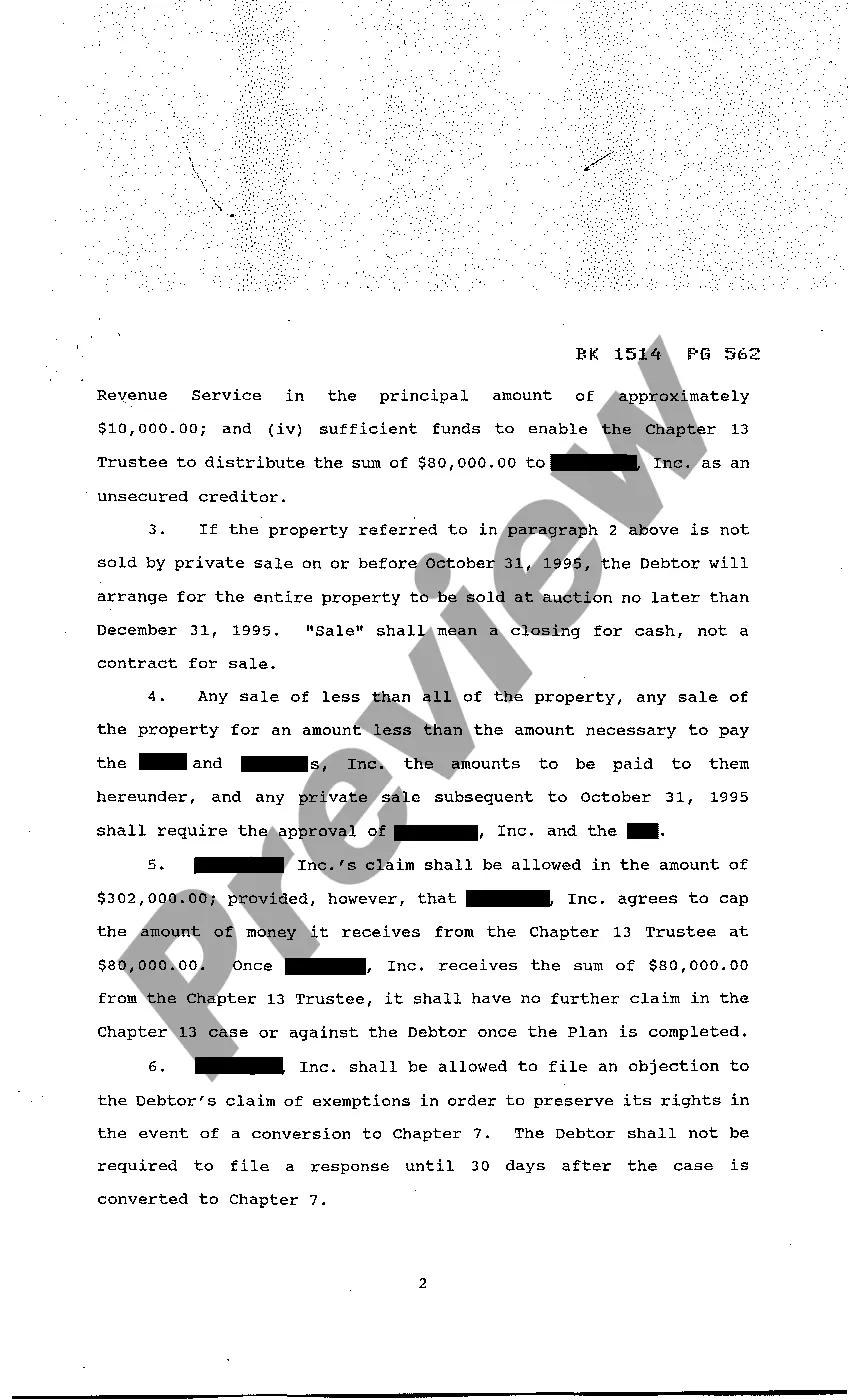

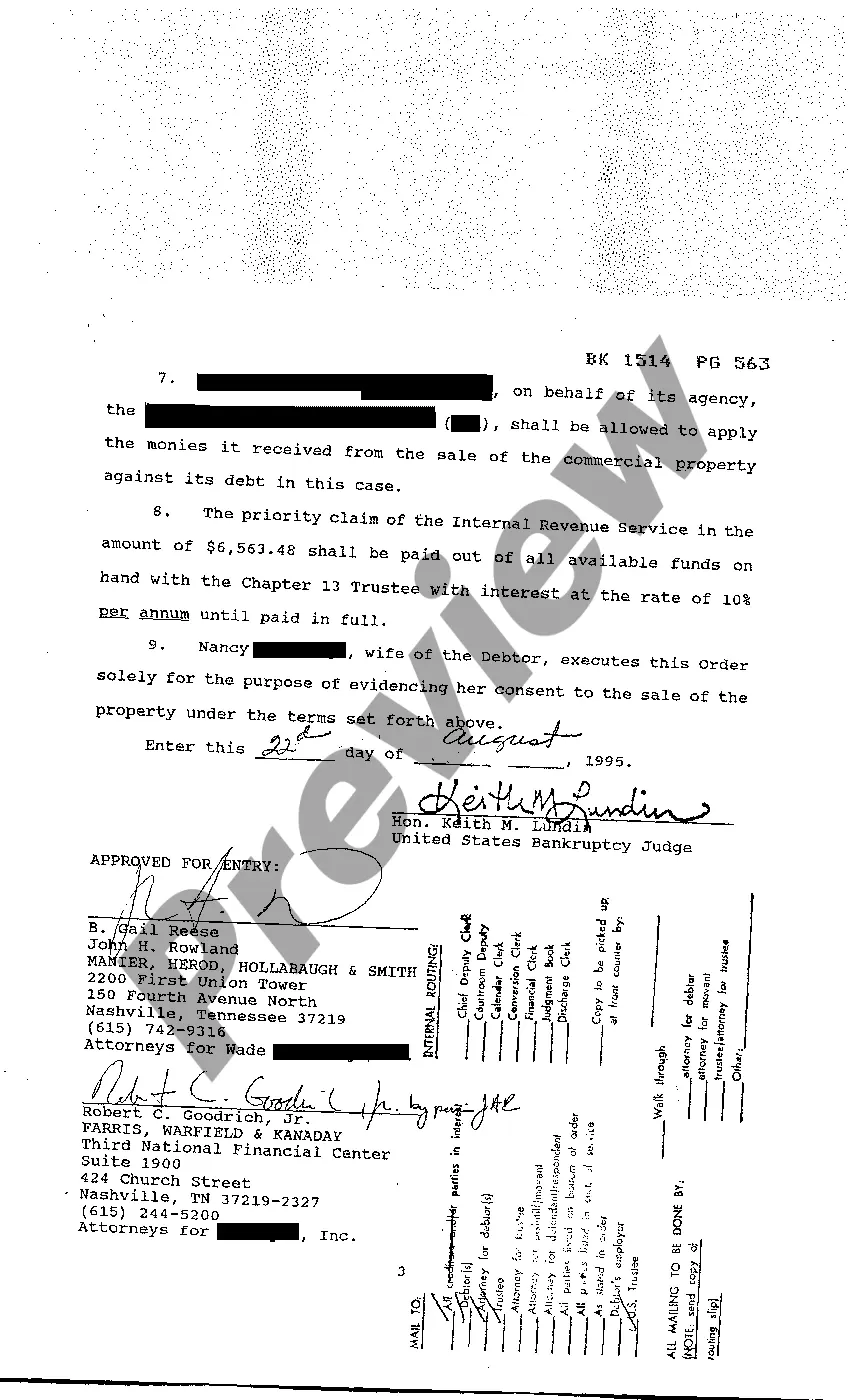

Murfreesboro Tennessee Order Resolving Objections to Confirmation

Description

How to fill out Murfreesboro Tennessee Order Resolving Objections To Confirmation?

Are you looking for a reliable and inexpensive legal forms supplier to buy the Murfreesboro Tennessee Order Resolving Objections to Confirmation? US Legal Forms is your go-to solution.

Whether you require a basic agreement to set rules for cohabitating with your partner or a set of forms to move your separation or divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and framed based on the requirements of separate state and county.

To download the form, you need to log in account, locate the required template, and click the Download button next to it. Please take into account that you can download your previously purchased form templates at any time in the My Forms tab.

Is the first time you visit our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Murfreesboro Tennessee Order Resolving Objections to Confirmation conforms to the laws of your state and local area.

- Read the form’s description (if provided) to find out who and what the form is good for.

- Restart the search if the template isn’t suitable for your specific situation.

Now you can create your account. Then select the subscription option and proceed to payment. As soon as the payment is done, download the Murfreesboro Tennessee Order Resolving Objections to Confirmation in any provided file format. You can return to the website at any time and redownload the form without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about wasting hours learning about legal papers online for good.