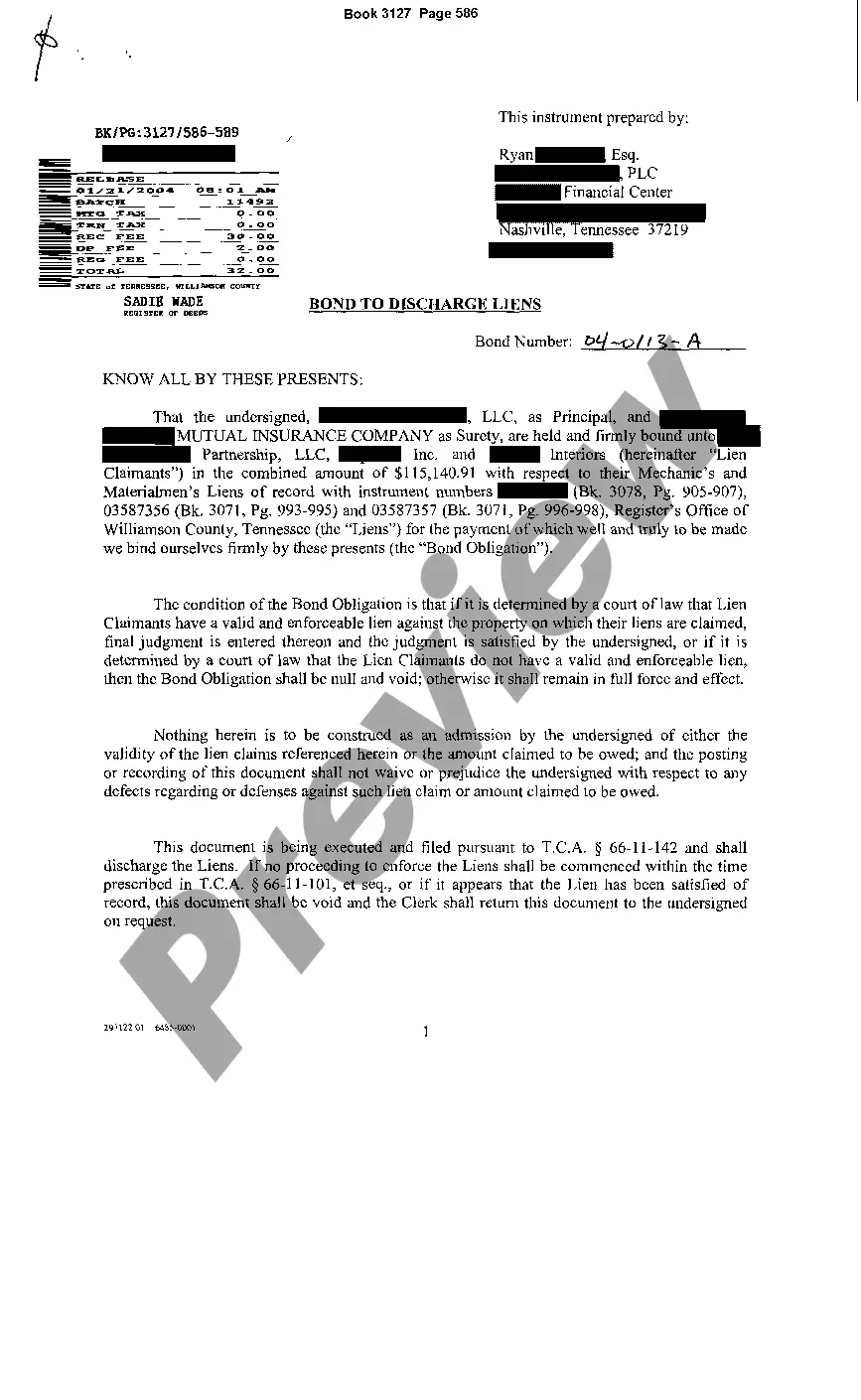

Chattanooga Tennessee Bond To Discharge Liens is a legal document that plays a crucial role in releasing property liens placed on real estate or personal property in Chattanooga, Tennessee. Liens are typically filed by creditors or contractors who claim payment for debts owed by the property owner. The bond provides an alternative method for the property owner to discharge these liens, ensuring that they have a clean title and legal ownership of their property. When a lien is placed on a property, it can hinder the owner's ability to sell or refinance it until the debt is paid off. However, the Chattanooga Tennessee Bond To Discharge Liens allows the property owner to essentially substitute a bond for the unpaid debt, thus releasing the lien that was initially filed. This bond serves as a guarantee to the lien holder that if the debt remains unpaid, they can seek financial restitution from the bond. There are several types of Chattanooga Tennessee Bond To Discharge Liens, each catering to specific circumstances: 1. Mechanics Lien Discharge Bond: This type of bond helps homeowners or property owners discharge liens placed by contractors or construction-related entities related to unpaid bills for labor or materials. 2. Tax Lien Discharge Bond: When a property owner falls behind on their property taxes and accrues a tax lien, they can utilize this bond to remove the lien, allowing them to sell or refinance the property. 3. Judgment Lien Discharge Bond: A judgment lien can be placed on a property when the owner loses a lawsuit. Using this bond, the property owner can discharge the lien while navigating through the legal process. 4. Municipal Lien Discharge Bond: Property owners who owe outstanding fines, fees, or other municipal debts can utilize this bond to discharge liens typically placed by local government agencies. 5. Subcontractor Lien Discharge Bond: When a subcontractor files a lien against a property due to non-payment from the general contractor, the property owner can employ this bond to discharge the lien and resolve the dispute. In summary, the Chattanooga Tennessee Bond To Discharge Liens provides a valuable solution for property owners facing liens on their real estate or personal property. It offers a legal means to release these liens, ensuring the owner's ability to sell, refinance, or maintain clear title on their asset. Whether it's a mechanics lien, tax lien, judgment lien, municipal lien, or subcontractor lien, this bond serves as a financial safeguard for both the lien holder and the property owner.

Chattanooga Tennessee Bond To Discharge Liens

Category:

State:

Tennessee

City:

Chattanooga

Control #:

TN-E033

Format:

PDF

Instant download

This form is available by subscription

Description

Bond To Discharge Liens

Chattanooga Tennessee Bond To Discharge Liens is a legal document that plays a crucial role in releasing property liens placed on real estate or personal property in Chattanooga, Tennessee. Liens are typically filed by creditors or contractors who claim payment for debts owed by the property owner. The bond provides an alternative method for the property owner to discharge these liens, ensuring that they have a clean title and legal ownership of their property. When a lien is placed on a property, it can hinder the owner's ability to sell or refinance it until the debt is paid off. However, the Chattanooga Tennessee Bond To Discharge Liens allows the property owner to essentially substitute a bond for the unpaid debt, thus releasing the lien that was initially filed. This bond serves as a guarantee to the lien holder that if the debt remains unpaid, they can seek financial restitution from the bond. There are several types of Chattanooga Tennessee Bond To Discharge Liens, each catering to specific circumstances: 1. Mechanics Lien Discharge Bond: This type of bond helps homeowners or property owners discharge liens placed by contractors or construction-related entities related to unpaid bills for labor or materials. 2. Tax Lien Discharge Bond: When a property owner falls behind on their property taxes and accrues a tax lien, they can utilize this bond to remove the lien, allowing them to sell or refinance the property. 3. Judgment Lien Discharge Bond: A judgment lien can be placed on a property when the owner loses a lawsuit. Using this bond, the property owner can discharge the lien while navigating through the legal process. 4. Municipal Lien Discharge Bond: Property owners who owe outstanding fines, fees, or other municipal debts can utilize this bond to discharge liens typically placed by local government agencies. 5. Subcontractor Lien Discharge Bond: When a subcontractor files a lien against a property due to non-payment from the general contractor, the property owner can employ this bond to discharge the lien and resolve the dispute. In summary, the Chattanooga Tennessee Bond To Discharge Liens provides a valuable solution for property owners facing liens on their real estate or personal property. It offers a legal means to release these liens, ensuring the owner's ability to sell, refinance, or maintain clear title on their asset. Whether it's a mechanics lien, tax lien, judgment lien, municipal lien, or subcontractor lien, this bond serves as a financial safeguard for both the lien holder and the property owner.

How to fill out Chattanooga Tennessee Bond To Discharge Liens?

If you’ve already utilized our service before, log in to your account and save the Chattanooga Tennessee Bond To Discharge Liens on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your file:

- Make sure you’ve located a suitable document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Chattanooga Tennessee Bond To Discharge Liens. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your individual or professional needs!