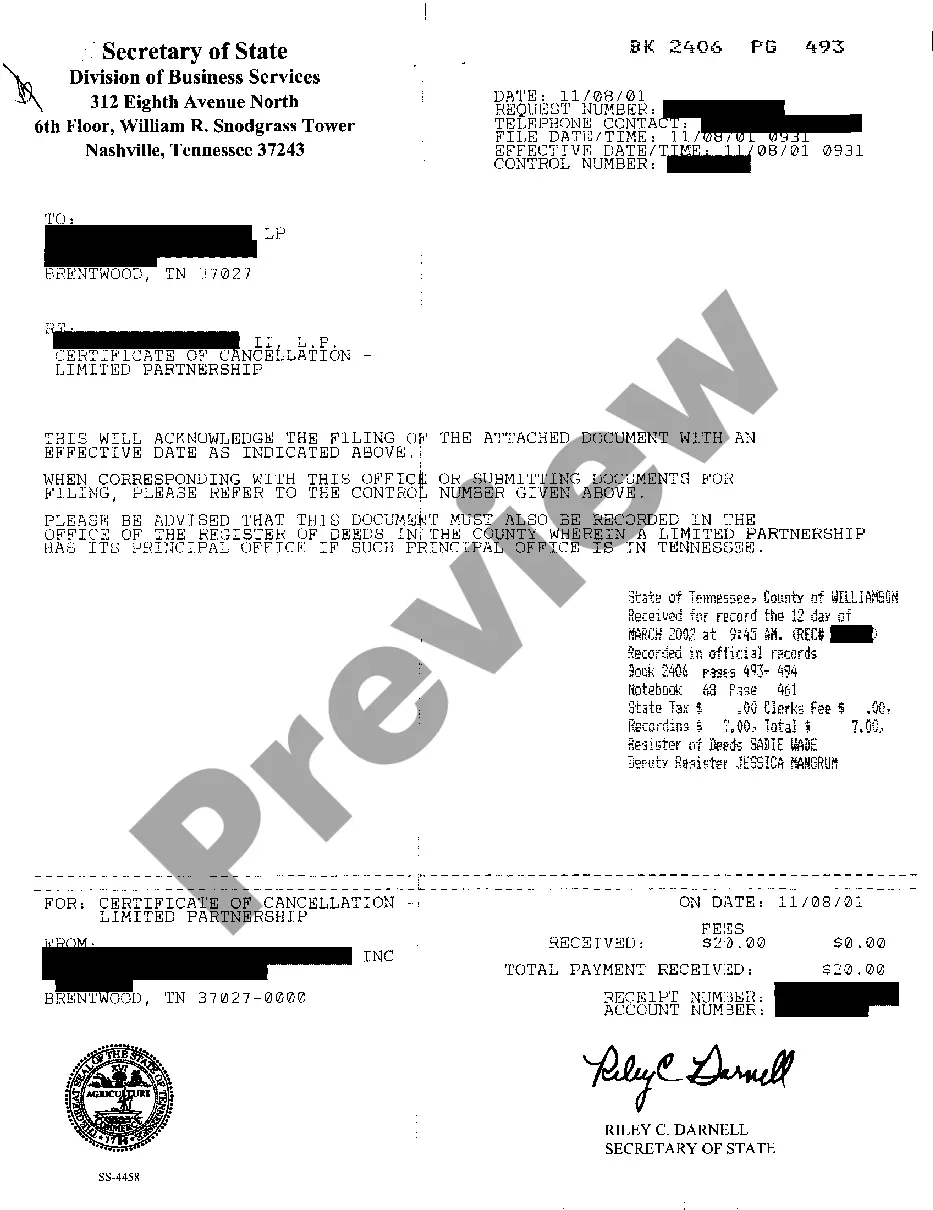

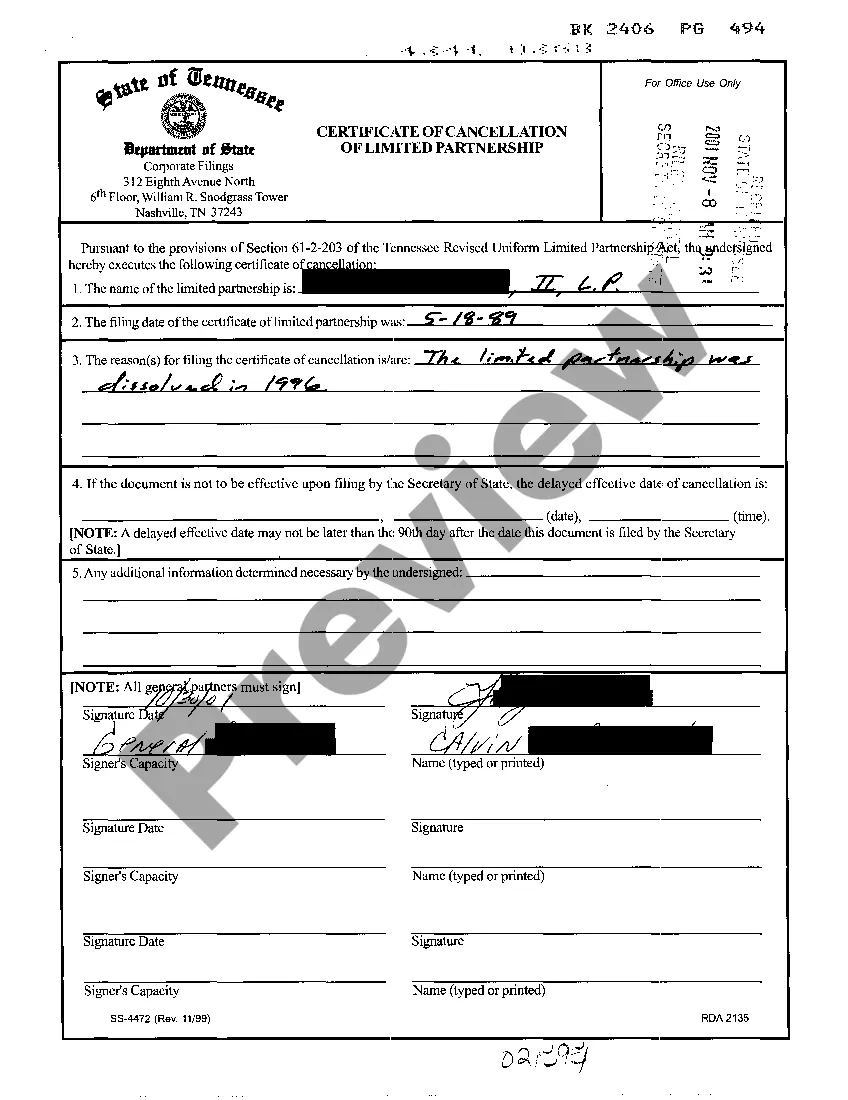

The Memphis Tennessee Certificate of Cancellation is a legal document that signifies the termination or dissolution of a business entity registered in Memphis, Tennessee. It is often needed when a business entity decides to close its operations, merge with another business, or undergo a change in ownership. The Certificate of Cancellation serves as official proof that the business entity no longer exists and has ceased all operations in Memphis. This document is typically submitted to the Tennessee Secretary of State's office, specifically the Business Services Division, which is responsible for processing and filing such requests. There are several types of Memphis Tennessee Certificate of Cancellation, based on the specific circumstances of the termination of the business entity: 1. Voluntary Dissolution: This type of Certificate of Cancellation is used when the owners of the business entity voluntarily decide to cease operations. It may be a result of various reasons such as retirement, financial difficulties, or strategic decisions. 2. Involuntary Dissolution: This type of Certificate of Cancellation is issued when a business entity is forced to close by external factors, such as court orders, bankruptcy, or failure to comply with legal and regulatory requirements. 3. Merger or Acquisition: In cases where a business entity merges with another or is acquired by another entity, a Certificate of Cancellation is needed to legally dissolve the original entity. The specific information required in a Memphis Tennessee Certificate of Cancellation typically includes the legal name of the business entity, the date of its formation, the reason for termination, the effective date of cancellation, and the signature of authorized individuals, such as the officers or members of the entity. It is crucial to ensure that all outstanding taxes, debts, and contractual obligations are fulfilled before filing the Certificate of Cancellation. In some cases, additional documentation may be required, such as a tax clearance certificate or a final financial statement. Once the Certificate of Cancellation is filed and accepted by the Tennessee Secretary of State's office, the business entity is officially dissolved, and its legal obligations and liabilities typically cease. However, it is advisable to consult with a legal professional or a certified public accountant before initiating the process, as it may involve complex legal and financial considerations.

Memphis Tennessee Certificate of Cancellation

Description

How to fill out Memphis Tennessee Certificate Of Cancellation?

We consistently aim to reduce or avert legal complications when navigating intricate legal or financial issues.

To achieve this, we seek legal counsel that is often quite expensive.

Nonetheless, not all legal challenges are equally intricate; many can be managed independently.

US Legal Forms is a digital repository of current DIY legal documents covering a range from wills and powers of attorney to incorporation articles and dissolution petitions.

Just Log In to your account and hit the Get button next to it. If you misplace the document, you can always redownload it from the My documents tab.

- Our repository empowers you to manage your affairs without relying on a lawyer.

- We offer access to legal document templates that are not always readily available.

- Our templates are tailored to specific states and regions, which significantly eases your search.

- Leverage US Legal Forms whenever you require the Memphis Tennessee Certificate of Cancellation or any other document promptly and securely.

Form popularity

FAQ

The first step in terminating a Tennessee LLC is to file Form SS-4246, Notice of Dissolution (Limited Liability Company) with the Department of State, Division of Business Services (DBS). After you file notice of dissolution and wind up your business, you will have to file the appropriate Articles of Termination.

There is a $20 fee to file the notice. Your filing usually will be processed within 3-5 business days. You may also receive same-day processing if you deliver the notice in person. The SOS has a notice of dissolution form available for download.

How long is my Tennessee sales tax exemption certificate good for? All blanket exemption certificates are infinitely valid, so long as there is recurring purchases by the owner of the certificate, where no more than one year passes between sales, or until the buyer cancels the certificate.

Tennessee requires LLCs to file an annual report and pay a franchise tax. The annual report is due on or before the first day of the fourth month following the close of the LLC's fiscal year. The filing fee is $50 per member, with a minimum fee of $300 and a maximum fee of $3000.

To obtain a Certificate of Tax Clearance, contact the Tennessee Department of Revenue at (615) 741-8999.

How to request your Tax Compliance Status via eFiling Selecting the Tax Compliance Status Request option and the type of TCS for which you would like to apply. You will have the following options: Good standing. Tender.Complete the Tax Compliance Status Request and submit it to SARS.

To be active and in good standing you must have filed formation or registration documents with the Secretary of State and have filed all required annual reports and paid all fees.

Most account changes and closures can be handled through TNTAP, or by calling us at (615) 253-0600.

The mailer makes it appear that the 2021 Certificate of Existence Request is part of the business entity's registration process: ?A Certificate of Existence certifies that your Tennessee business is in existence, is authorized to transact business in the state and complies with all state requirements.?