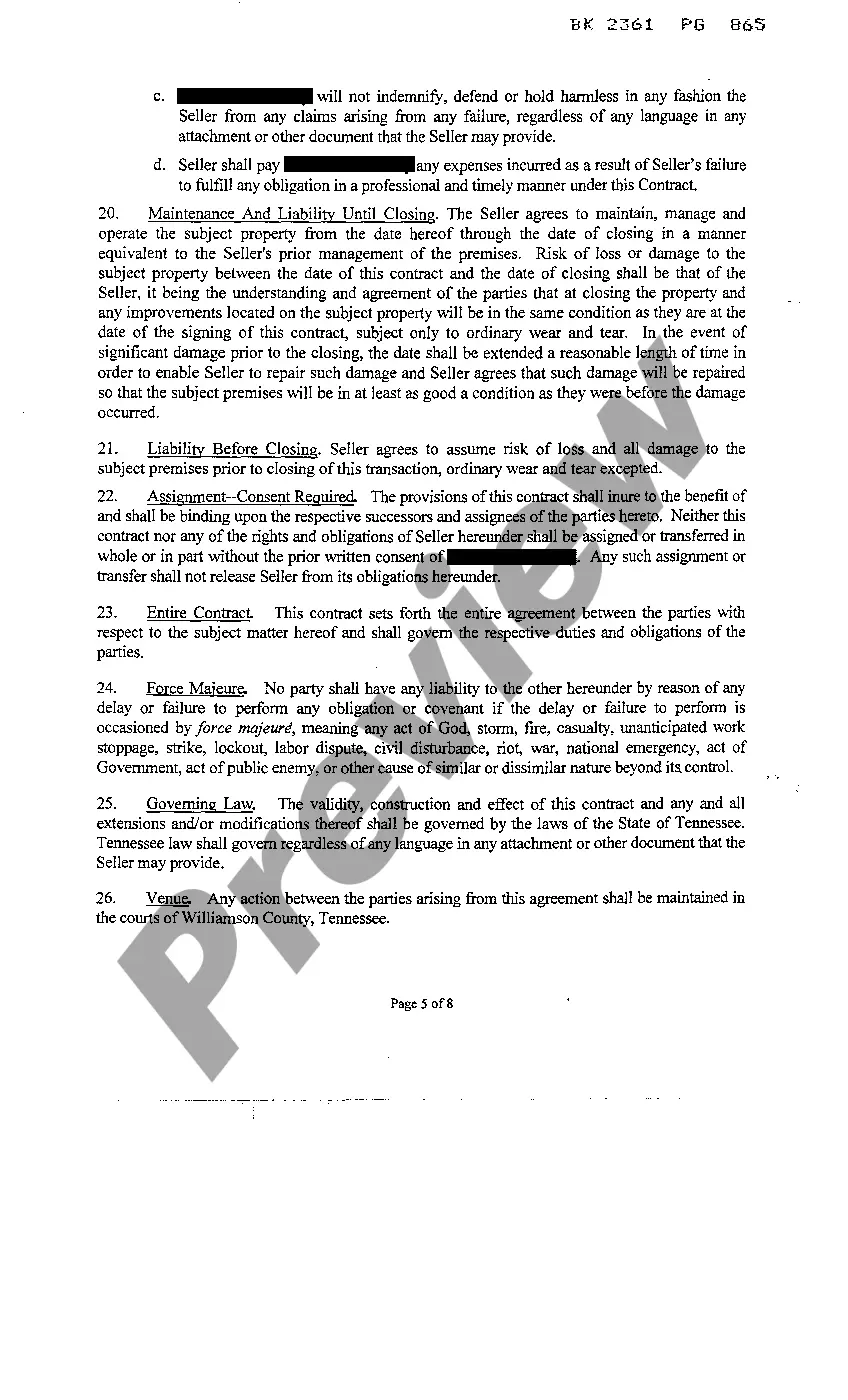

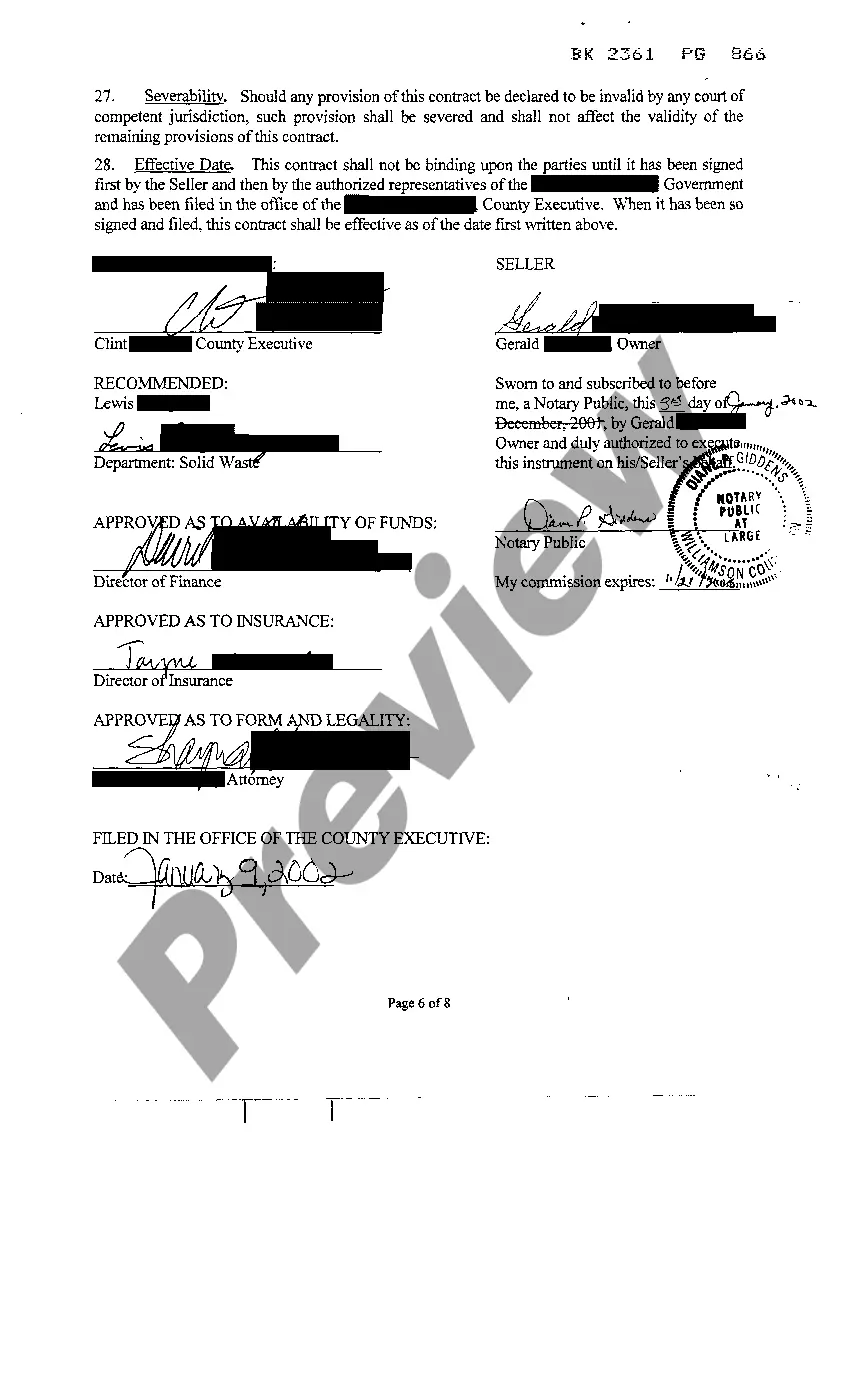

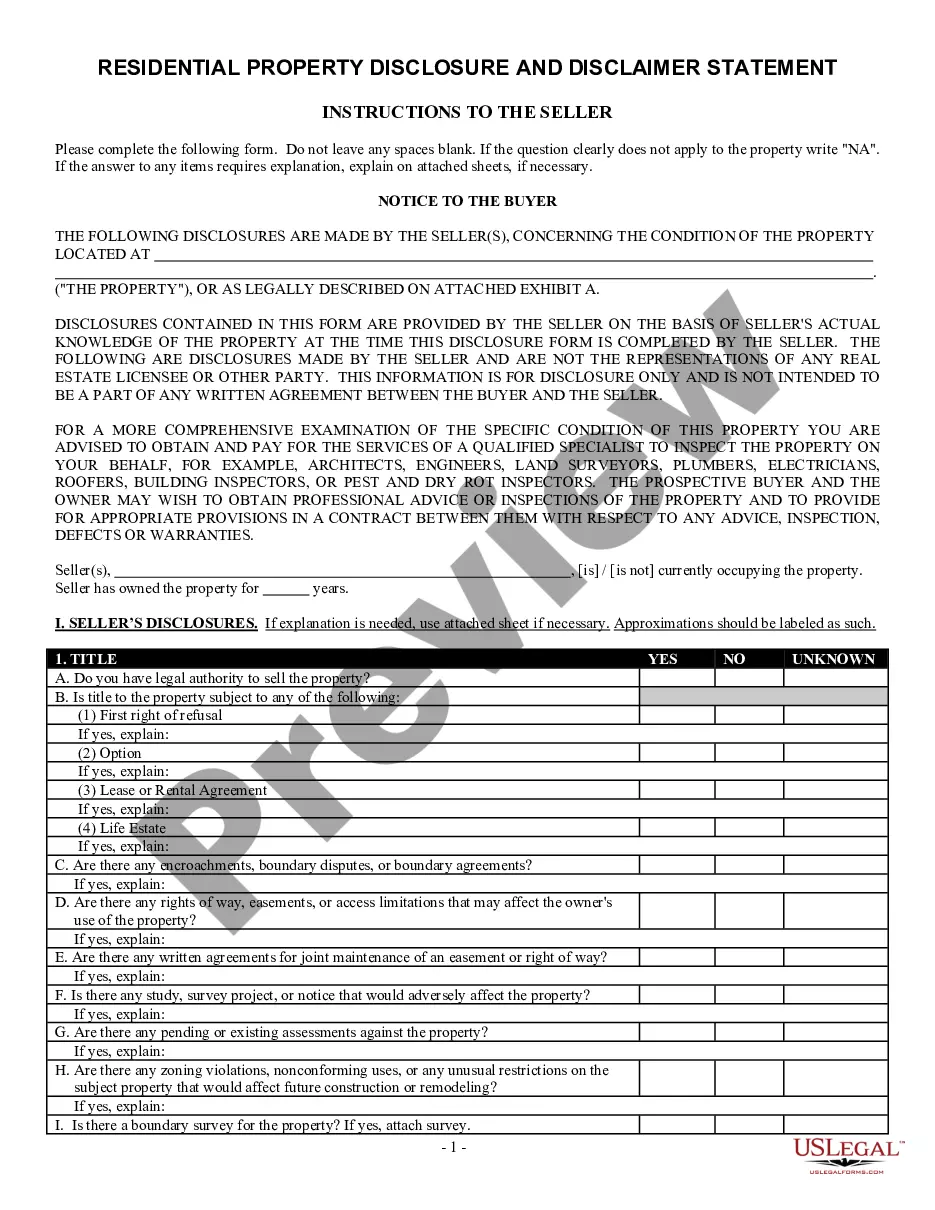

The Nashville Tennessee Contract for the Purchase of Real Property is a legally binding agreement used in the city of Nashville, Tennessee, which outlines the terms and conditions for buying and selling real estate. It serves as a crucial document to protect both the buyer and the seller during a property transaction. This contract covers a wide range of important details, ensuring transparency and clarity between the parties involved. The contract typically includes keywords such as: 1. Purchase Price: The contract will specify the agreed-upon purchase price for the property, which includes the consideration for the real estate being sold. 2. Property Description: A detailed description of the property being purchased, including its address, legal description, boundaries, and any other pertinent information that uniquely identifies it. 3. Earnest Money: This refers to the initial deposit made by the buyer to the seller, demonstrating their good faith and commitment to proceed with the purchase. The contract will outline the amount of earnest money and the conditions under which it may be refunded or forfeited. 4. Contingencies: The contract may include various contingencies that protect the buyer's interests, such as financing, inspections, or the sale of the buyer's existing property. These contingencies must be met within specific timelines outlined in the contract. 5. Closing Date: The contract will specify the date by which the transaction is expected to be completed, also known as the closing date. This includes the transfer of the property ownership and the financial settlement. 6. Apportionment: This section details any prorated expenses, such as property taxes, homeowner association fees, or rent reimbursements. It ensures that both the buyer and the seller are responsible for their respective shares of these expenses. 7. Representation and Warranties: Each party involved in the transaction may provide various representations and warranties. The seller may provide guarantees about the property's condition, while the buyer may warrant that they have the necessary funds for the purchase. 8. Default and Remedies: The contract will outline the consequences if either party fails to fulfill their obligations, including the potential remedies available to the non-defaulting party. 9. Disclosures: Both the buyer and the seller are typically required to provide any necessary disclosures, such as known defects or environmental hazards associated with the property. Different types of Nashville Tennessee Contracts for the Purchase of Real Property can include specialized agreements based on the type of property or unique circumstances. This could encompass contracts for residential properties, commercial properties, vacant land, or even contracts that involve lease-options or seller financing arrangements. It is important to consult with a qualified real estate attorney or professional to ensure that the specific contract being used is appropriate for the type of property transaction and complies with the laws and regulations of Tennessee and Nashville.

Nashville Tennessee Contract For The Purchase of Real Property

Description

How to fill out Nashville Tennessee Contract For The Purchase Of Real Property?

We always strive to minimize or avoid legal damage when dealing with nuanced law-related or financial affairs. To do so, we sign up for legal services that, usually, are very expensive. Nevertheless, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based catalog of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without using services of an attorney. We provide access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Nashville Tennessee Contract For The Purchase of Real Property or any other form easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again in the My Forms tab.

The process is equally effortless if you’re unfamiliar with the website! You can create your account in a matter of minutes.

- Make sure to check if the Nashville Tennessee Contract For The Purchase of Real Property adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Nashville Tennessee Contract For The Purchase of Real Property is proper for your case, you can pick the subscription plan and make a payment.

- Then you can download the form in any suitable format.

For more than 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!