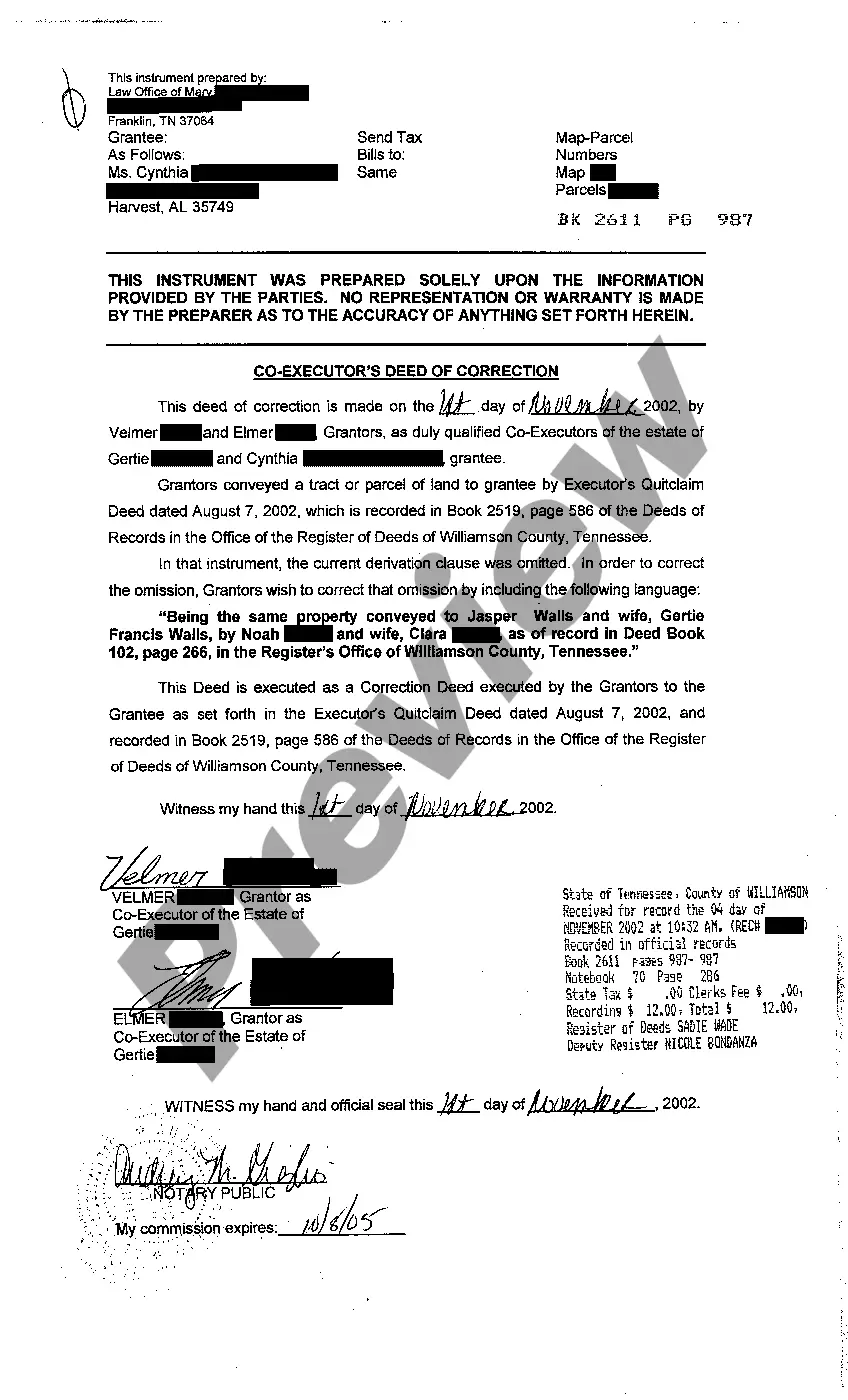

A Murfreesboro Tennessee Co-Executor's Deed of Correction is a legal document that allows co-executors of an estate in Murfreesboro, Tennessee, to make amendments or corrections to a previously filed deed. This type of deed is typically used when errors or omissions are discovered in the original deed or if changes need to be made to accurately reflect the intentions of the deceased. The Co-Executor's Deed of Correction is important in cases where multiple individuals have been appointed as co-executors of an estate, as it ensures that all co-executors are involved in the correction process and have their consent documented. Common types of Murfreesboro Tennessee Co-Executor's Deed of Correction include: 1. Name Correction: This type of correction is necessary when the names of one or more individuals mentioned in the original deed are misspelled or incorrectly stated. It ensures that the correct names of the co-executors are recorded in the legal documents. 2. Tax Assessment Correction: In some cases, errors may occur in the tax assessment details mentioned in the original deed. The Co-Executor's Deed of Correction can be used to rectify any mistakes in property taxes, ensuring accurate information is provided for taxation purposes. 3. Estate Distribution Correction: If the estate's distribution plan outlined in the original deed needs to be modified due to unforeseen circumstances or changes in the beneficiaries' circumstances, a Co-Executor's Deed of Correction can be used to make the necessary amendments. This may include adding or removing beneficiaries or adjusting the distribution percentages. 4. Boundary Description Correction: In situations where the metes and bounds descriptions or the legal description of a property in the original deed are inaccurate or incomplete, a Co-Executor's Deed of Correction can be used to correct these errors. This ensures that the property boundaries are accurately represented in the legal documents. The Murfreesboro Tennessee Co-Executor's Deed of Correction is crucial in maintaining the integrity of the estate administration process. It provides a legal mechanism for co-executors to rectify any mistakes, update relevant information, and ensure that the intentions of the deceased are properly reflected in the property deeds. Consulting with an experienced attorney who specializes in estate planning and real estate law is highly recommended navigating the complexities of this process effectively.

A Murfreesboro Tennessee Co-Executor's Deed of Correction is a legal document that allows co-executors of an estate in Murfreesboro, Tennessee, to make amendments or corrections to a previously filed deed. This type of deed is typically used when errors or omissions are discovered in the original deed or if changes need to be made to accurately reflect the intentions of the deceased. The Co-Executor's Deed of Correction is important in cases where multiple individuals have been appointed as co-executors of an estate, as it ensures that all co-executors are involved in the correction process and have their consent documented. Common types of Murfreesboro Tennessee Co-Executor's Deed of Correction include: 1. Name Correction: This type of correction is necessary when the names of one or more individuals mentioned in the original deed are misspelled or incorrectly stated. It ensures that the correct names of the co-executors are recorded in the legal documents. 2. Tax Assessment Correction: In some cases, errors may occur in the tax assessment details mentioned in the original deed. The Co-Executor's Deed of Correction can be used to rectify any mistakes in property taxes, ensuring accurate information is provided for taxation purposes. 3. Estate Distribution Correction: If the estate's distribution plan outlined in the original deed needs to be modified due to unforeseen circumstances or changes in the beneficiaries' circumstances, a Co-Executor's Deed of Correction can be used to make the necessary amendments. This may include adding or removing beneficiaries or adjusting the distribution percentages. 4. Boundary Description Correction: In situations where the metes and bounds descriptions or the legal description of a property in the original deed are inaccurate or incomplete, a Co-Executor's Deed of Correction can be used to correct these errors. This ensures that the property boundaries are accurately represented in the legal documents. The Murfreesboro Tennessee Co-Executor's Deed of Correction is crucial in maintaining the integrity of the estate administration process. It provides a legal mechanism for co-executors to rectify any mistakes, update relevant information, and ensure that the intentions of the deceased are properly reflected in the property deeds. Consulting with an experienced attorney who specializes in estate planning and real estate law is highly recommended navigating the complexities of this process effectively.