Memphis Tennessee Lease with Option to Purchase Real Estate is a specific arrangement wherein a potential buyer leases a property for a certain period of time with an option to buy it at a later date. This unique type of agreement provides an opportunity for individuals who may not have sufficient funds or creditworthiness to purchase a property outright but want the flexibility to secure a future purchase. Key features of a Memphis Tennessee Lease with Option to Purchase Real Estate include the lease period, the purchase price, and the option fee. The lease period is typically set for a specific duration, usually ranging from one to three years, during which the lessee resides in the property as a tenant. The lease payment is agreed upon between the lessor and lessee, and it often includes a portion that goes towards the eventual down payment of the property. The purchase price is predetermined at the beginning of the lease agreement and is based on the current market value of the property. This price is typically higher than the original listing price to account for any potential appreciation during the lease period. It is essential for both parties to agree on the purchase price to avoid disputes later on. Additionally, the option fee is a non-refundable amount paid by the lessee to the lessor in exchange for the option to purchase the property at a later date. This fee is typically a percentage of the purchase price and is credited towards the down payment if the lessee decides to exercise the option. Depending on the specific terms outlined in the lease agreement, there may be variations or types of Memphis Tennessee Lease with Option to Purchase Real Estate. These could include: 1. Lease-Purchase Option: This type of lease agreement requires the lessee to purchase the property at the end of the lease period. It is often ideal for individuals who have a clear intention to buy the property but need time to improve their credit or save for a down payment. 2. Lease-Option: In this type, the lessee has the option to purchase the property at the end of the lease period but is not obligated to do so. They can choose to walk away from the agreement without any further obligations if they decide not to exercise the option. 3. Seller-Financed Lease Option: This variation involves the seller providing financing for the purchase of the property, eliminating the need for a traditional mortgage. This can be attractive to individuals who may not qualify for a bank loan but still have the ability to make regular lease payments. In conclusion, Memphis Tennessee Lease with Option to Purchase Real Estate provides a unique opportunity for individuals to lease a property with a potential future purchase. It allows them to enjoy the benefits of living in a home while preparing financially to become homeowners. By understanding the terms and variations of this arrangement, potential buyers can make informed decisions and find a suitable path to homeownership.

Non Qualifying Lease Option To Purchase

State:

Tennessee

City:

Memphis

Control #:

TN-E196

Format:

PDF

Instant download

This form is available by subscription

Description non qualifying homes in memphis tn

Lease with Option to Purchase Real Estate

Memphis Tennessee Lease with Option to Purchase Real Estate is a specific arrangement wherein a potential buyer leases a property for a certain period of time with an option to buy it at a later date. This unique type of agreement provides an opportunity for individuals who may not have sufficient funds or creditworthiness to purchase a property outright but want the flexibility to secure a future purchase. Key features of a Memphis Tennessee Lease with Option to Purchase Real Estate include the lease period, the purchase price, and the option fee. The lease period is typically set for a specific duration, usually ranging from one to three years, during which the lessee resides in the property as a tenant. The lease payment is agreed upon between the lessor and lessee, and it often includes a portion that goes towards the eventual down payment of the property. The purchase price is predetermined at the beginning of the lease agreement and is based on the current market value of the property. This price is typically higher than the original listing price to account for any potential appreciation during the lease period. It is essential for both parties to agree on the purchase price to avoid disputes later on. Additionally, the option fee is a non-refundable amount paid by the lessee to the lessor in exchange for the option to purchase the property at a later date. This fee is typically a percentage of the purchase price and is credited towards the down payment if the lessee decides to exercise the option. Depending on the specific terms outlined in the lease agreement, there may be variations or types of Memphis Tennessee Lease with Option to Purchase Real Estate. These could include: 1. Lease-Purchase Option: This type of lease agreement requires the lessee to purchase the property at the end of the lease period. It is often ideal for individuals who have a clear intention to buy the property but need time to improve their credit or save for a down payment. 2. Lease-Option: In this type, the lessee has the option to purchase the property at the end of the lease period but is not obligated to do so. They can choose to walk away from the agreement without any further obligations if they decide not to exercise the option. 3. Seller-Financed Lease Option: This variation involves the seller providing financing for the purchase of the property, eliminating the need for a traditional mortgage. This can be attractive to individuals who may not qualify for a bank loan but still have the ability to make regular lease payments. In conclusion, Memphis Tennessee Lease with Option to Purchase Real Estate provides a unique opportunity for individuals to lease a property with a potential future purchase. It allows them to enjoy the benefits of living in a home while preparing financially to become homeowners. By understanding the terms and variations of this arrangement, potential buyers can make informed decisions and find a suitable path to homeownership.

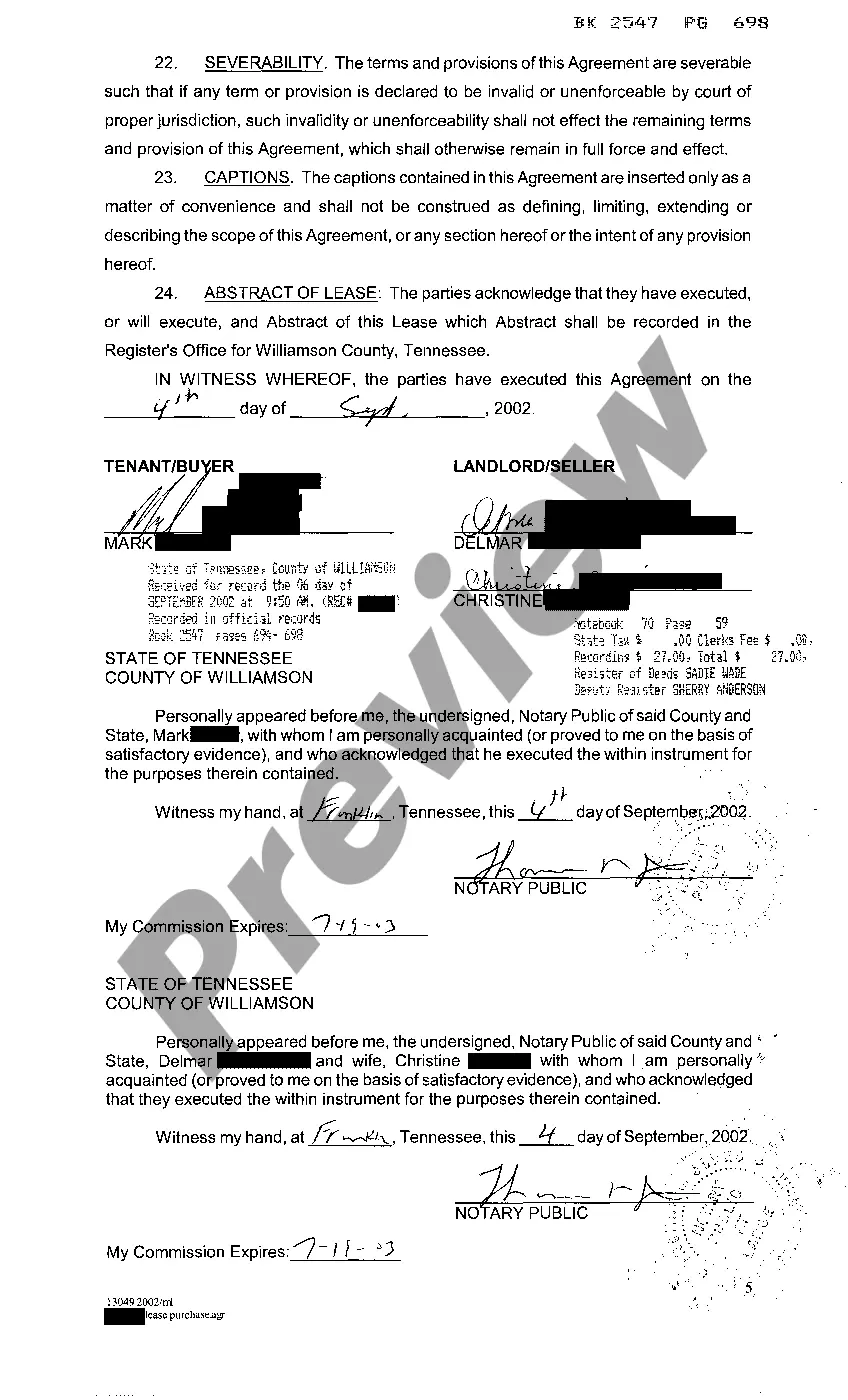

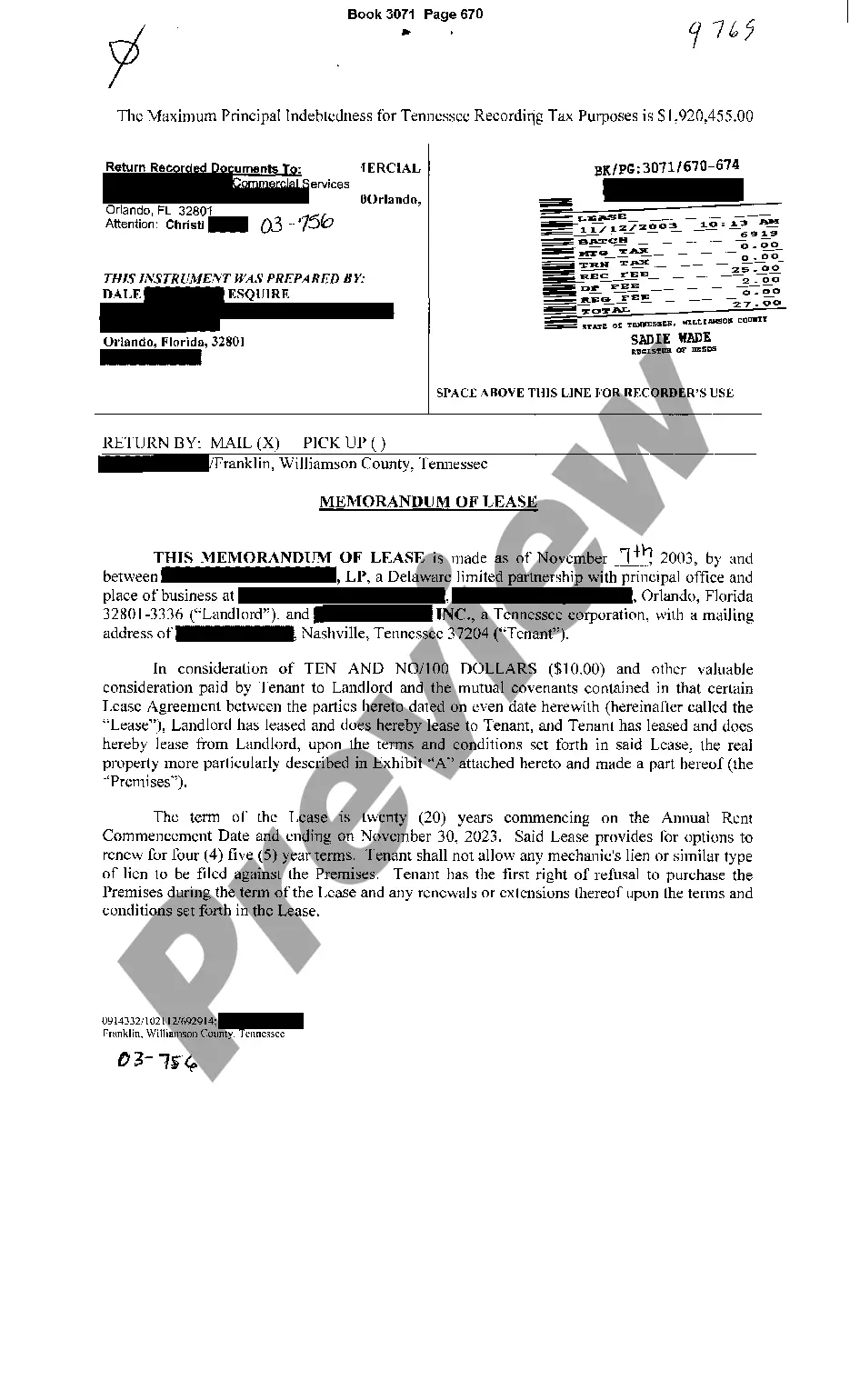

Free preview lease purchase homes memphis tn

How to fill out Memphis Tennessee Lease With Option To Purchase Real Estate?

If you’ve already used our service before, log in to your account and save the Memphis Tennessee Lease with Option to Purchase Real Estate on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to get your file:

- Ensure you’ve located the right document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Memphis Tennessee Lease with Option to Purchase Real Estate. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!