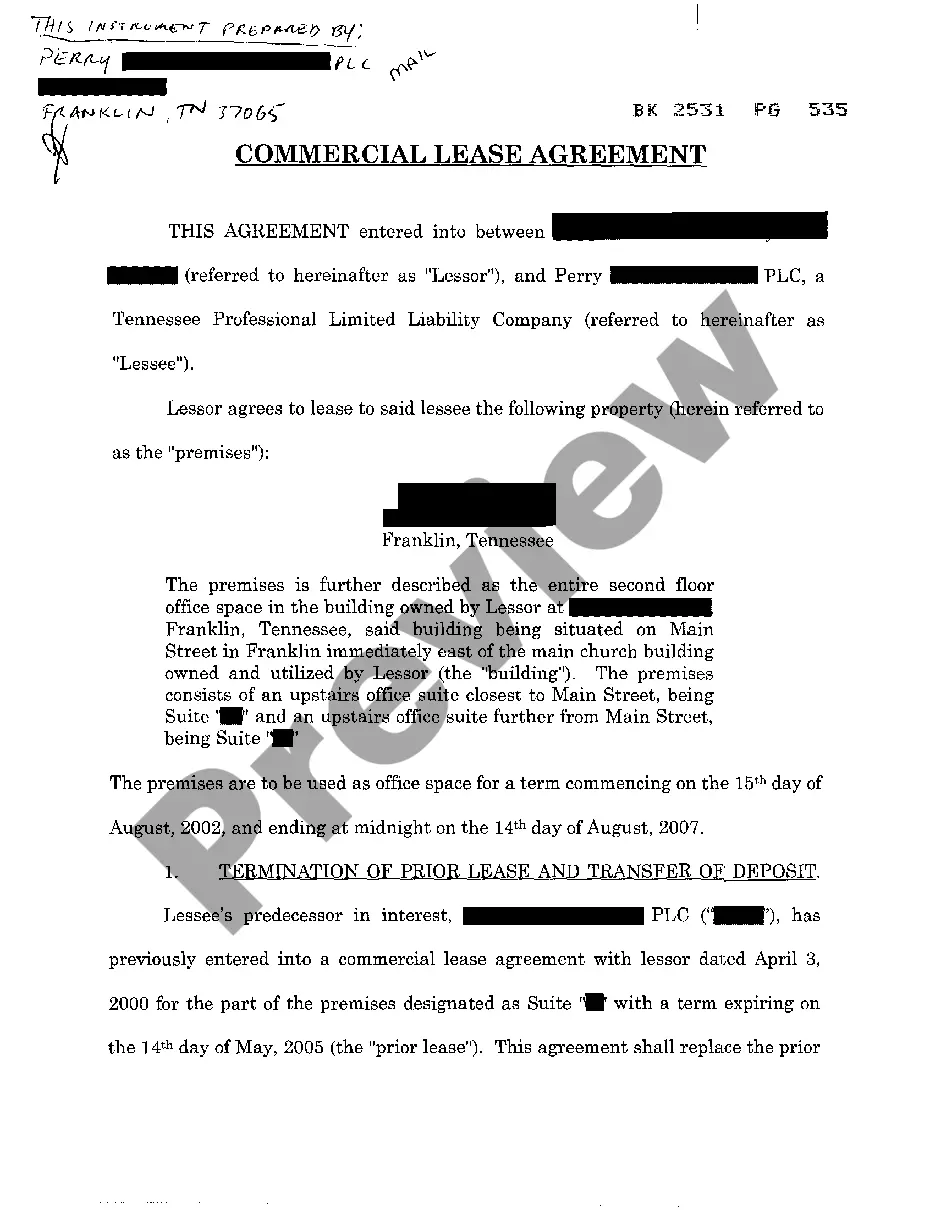

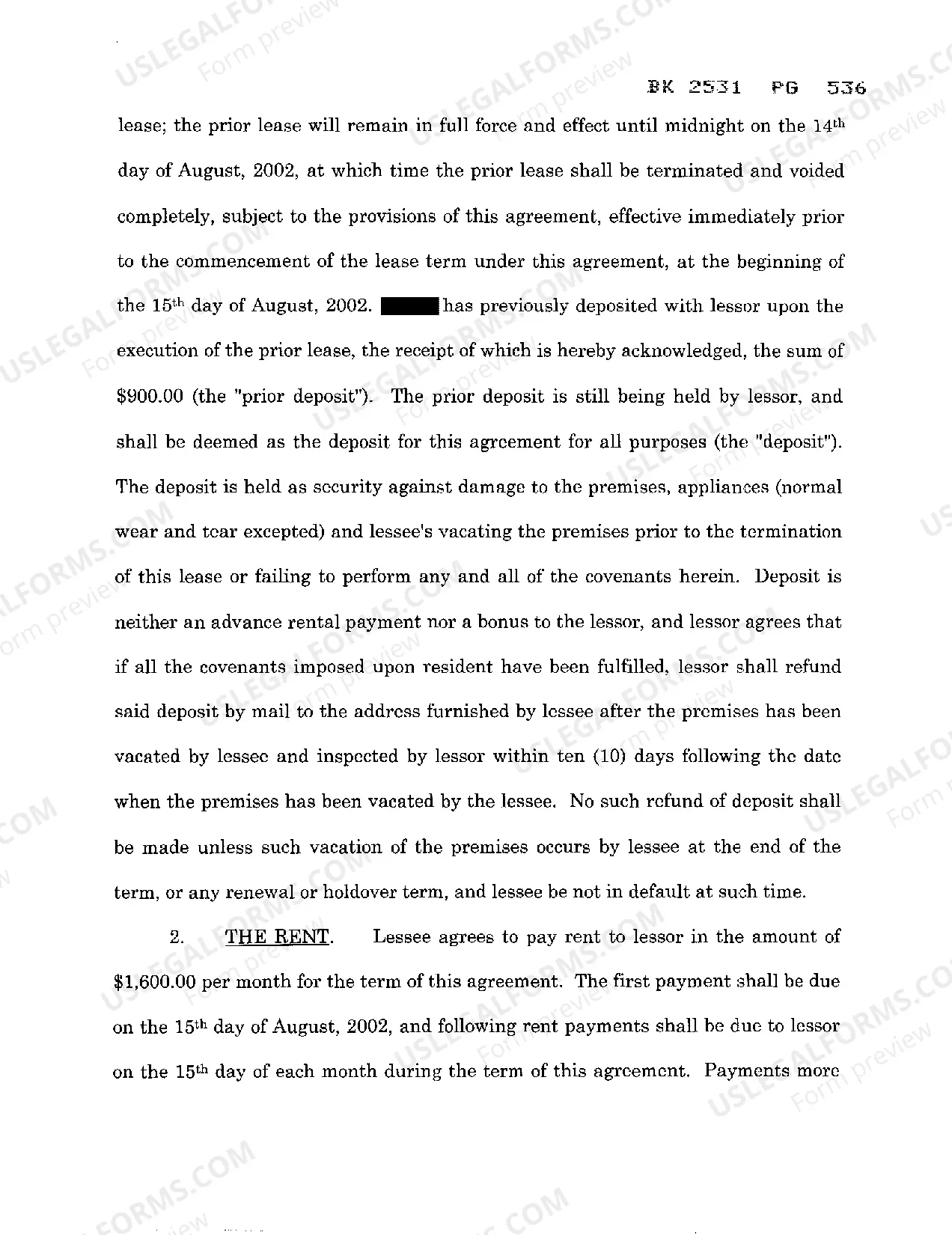

A Memphis Tennessee Commercial Lease Agreement is a legal contract that establishes the terms and conditions under which a landlord rents a commercial property to a tenant in Memphis, Tennessee. It outlines the rights and obligations of both parties involved and serves as a binding document that governs the relationship between the landlord and the tenant throughout the lease period. Keywords: Memphis, Tennessee, commercial lease, agreement, legal contract, terms and conditions, landlord, tenant, rights, obligations, relationship, lease period. In Memphis, there are several types of Commercial Lease Agreements tailored to meet the specific needs of various businesses. These include: 1. Gross Lease Agreement: This type of lease agreement sets a fixed rental amount, and the landlord is responsible for bearing all operating expenses such as property taxes, insurance, utilities, and maintenance costs. 2. Triple Net Lease Agreement (NNN): In a triple net lease, the tenant assumes responsibility for a majority of the property's expenses, including property taxes, insurance, and maintenance, in addition to paying the rent. 3. Percentage Lease Agreement: This lease arrangement is commonly used in retail businesses. The tenant pays a base rent plus a percentage of their sales revenue as additional rent, ensuring that the landlord shares in the tenant's success. 4. Modified Gross Lease Agreement: This lease agreement combines elements of both the gross lease and the triple net lease. The tenant pays a base rent, and the expenses are shared between the landlord and tenant, often negotiated to suit their respective needs. 5. Full-Service Lease Agreement: In a full-service lease, the tenant pays a fixed rental amount that includes all expenses associated with the property, such as maintenance, property taxes, insurance, and utilities. When entering into a Memphis Tennessee Commercial Lease Agreement, it is crucial for both parties to carefully review and understand the terms and conditions outlined in the document. The agreement typically covers essential aspects such as the duration of the lease, rent payment details, security deposit requirements, permitted use of the property, maintenance and repair responsibilities, insurance requirements, potential renewal options, and any special clauses or provisions specific to the property or business type. It is advisable for both the landlord and tenant to seek legal counsel to ensure that the Commercial Lease Agreement accurately reflects their interests and protects their rights throughout the lease term. Clarity and transparency in understanding the lease terms are vital to avoid legal disputes or misunderstandings between the parties involved.

Memphis Tennessee Commercial Lease Agreement

Description

How to fill out Memphis Tennessee Commercial Lease Agreement?

Getting verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Memphis Tennessee Commercial Lease Agreement gets as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, getting the Memphis Tennessee Commercial Lease Agreement takes just a few clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. The process will take just a few more actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Look at the Preview mode and form description. Make sure you’ve chosen the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to find the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Memphis Tennessee Commercial Lease Agreement. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!