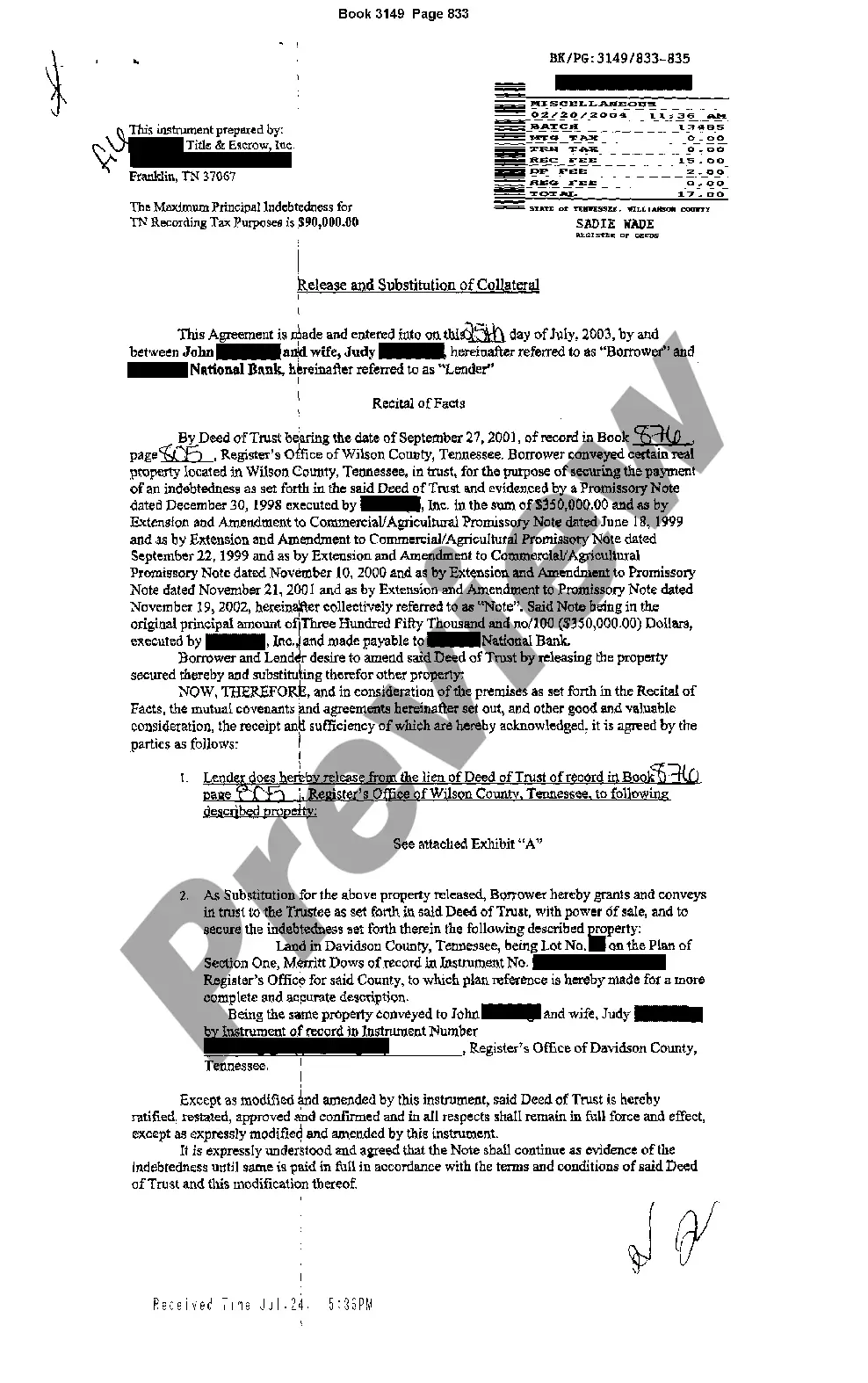

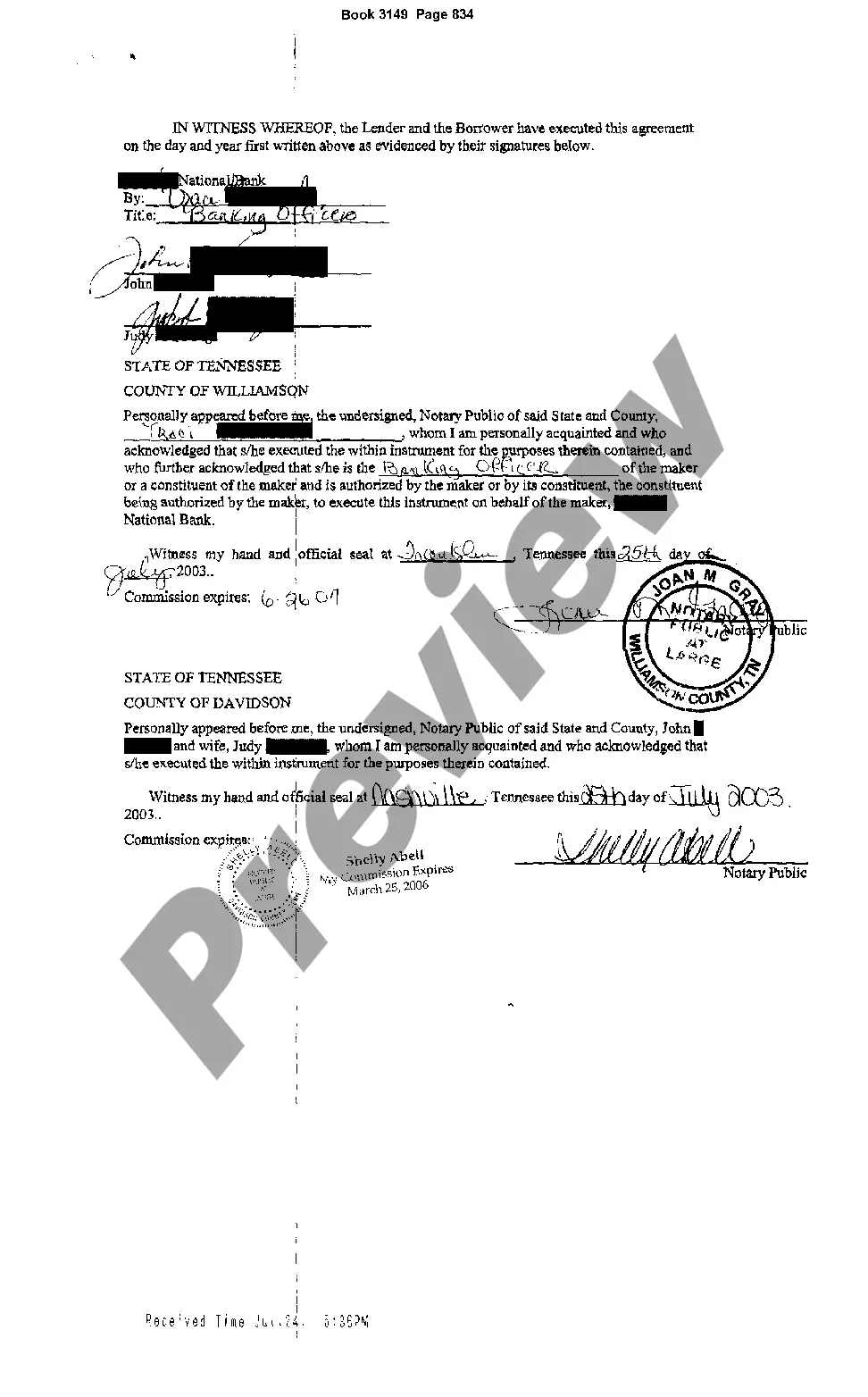

The Memphis Tennessee Release and Substitution of Collateral is a legal process that allows individuals or entities to release and replace collateral in a secured transaction. In this context, collateral refers to assets or property that are pledged as security for a debt or loan. The release and substitution of collateral typically occur when the borrower wants to replace the existing collateral with another asset. This may happen when the original collateral is no longer valuable or does not meet the requirements of the lender. The process starts with the borrower sending a request to the lender, expressing the intention to release and substitute collateral. The request should include comprehensive information about the new collateral proposed for substitution, such as a detailed description, its value, and any lien or encumbrances on the new asset. The lender will carefully review the borrower's request and assess the proposed collateral to determine if it meets the necessary requirements and provides adequate security for the loan. The lender may also evaluate the value and marketability of the new collateral to ensure it aligns with the loan agreement. If the lender approves the request, a release and substitution agreement will be drafted. This agreement outlines the terms and conditions of the collateral release and replacement, including any additional obligations or guarantees that the borrower may need to provide. The agreement will specify the date and time when the original collateral will be released and the new collateral will be substituted. It's important to note that the Memphis Tennessee Release and Substitution of Collateral may have different variations depending on specific circumstances and legal frameworks. For instance, there could be variations in the requirements, documentation, or procedures when dealing with real estate collateral or personal property collateral. Overall, the Memphis Tennessee Release and Substitution of Collateral is a legal process designed to provide flexibility and adaptability in secured transactions. It enables borrowers to replace collateral in situations where the original assets no longer serve their intended purpose, while ensuring that lenders have sufficient security for their loans.

The Memphis Tennessee Release and Substitution of Collateral is a legal process that allows individuals or entities to release and replace collateral in a secured transaction. In this context, collateral refers to assets or property that are pledged as security for a debt or loan. The release and substitution of collateral typically occur when the borrower wants to replace the existing collateral with another asset. This may happen when the original collateral is no longer valuable or does not meet the requirements of the lender. The process starts with the borrower sending a request to the lender, expressing the intention to release and substitute collateral. The request should include comprehensive information about the new collateral proposed for substitution, such as a detailed description, its value, and any lien or encumbrances on the new asset. The lender will carefully review the borrower's request and assess the proposed collateral to determine if it meets the necessary requirements and provides adequate security for the loan. The lender may also evaluate the value and marketability of the new collateral to ensure it aligns with the loan agreement. If the lender approves the request, a release and substitution agreement will be drafted. This agreement outlines the terms and conditions of the collateral release and replacement, including any additional obligations or guarantees that the borrower may need to provide. The agreement will specify the date and time when the original collateral will be released and the new collateral will be substituted. It's important to note that the Memphis Tennessee Release and Substitution of Collateral may have different variations depending on specific circumstances and legal frameworks. For instance, there could be variations in the requirements, documentation, or procedures when dealing with real estate collateral or personal property collateral. Overall, the Memphis Tennessee Release and Substitution of Collateral is a legal process designed to provide flexibility and adaptability in secured transactions. It enables borrowers to replace collateral in situations where the original assets no longer serve their intended purpose, while ensuring that lenders have sufficient security for their loans.