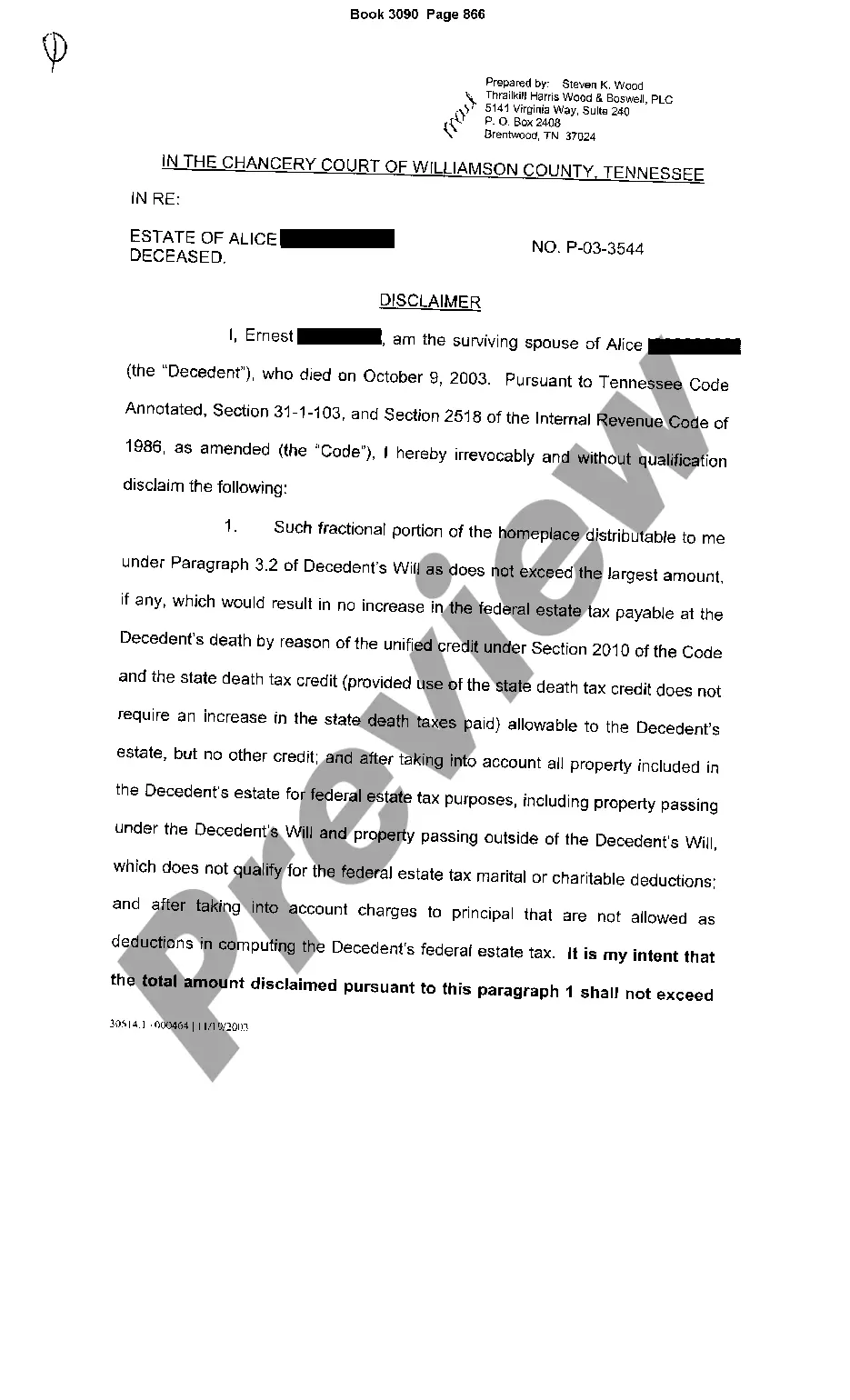

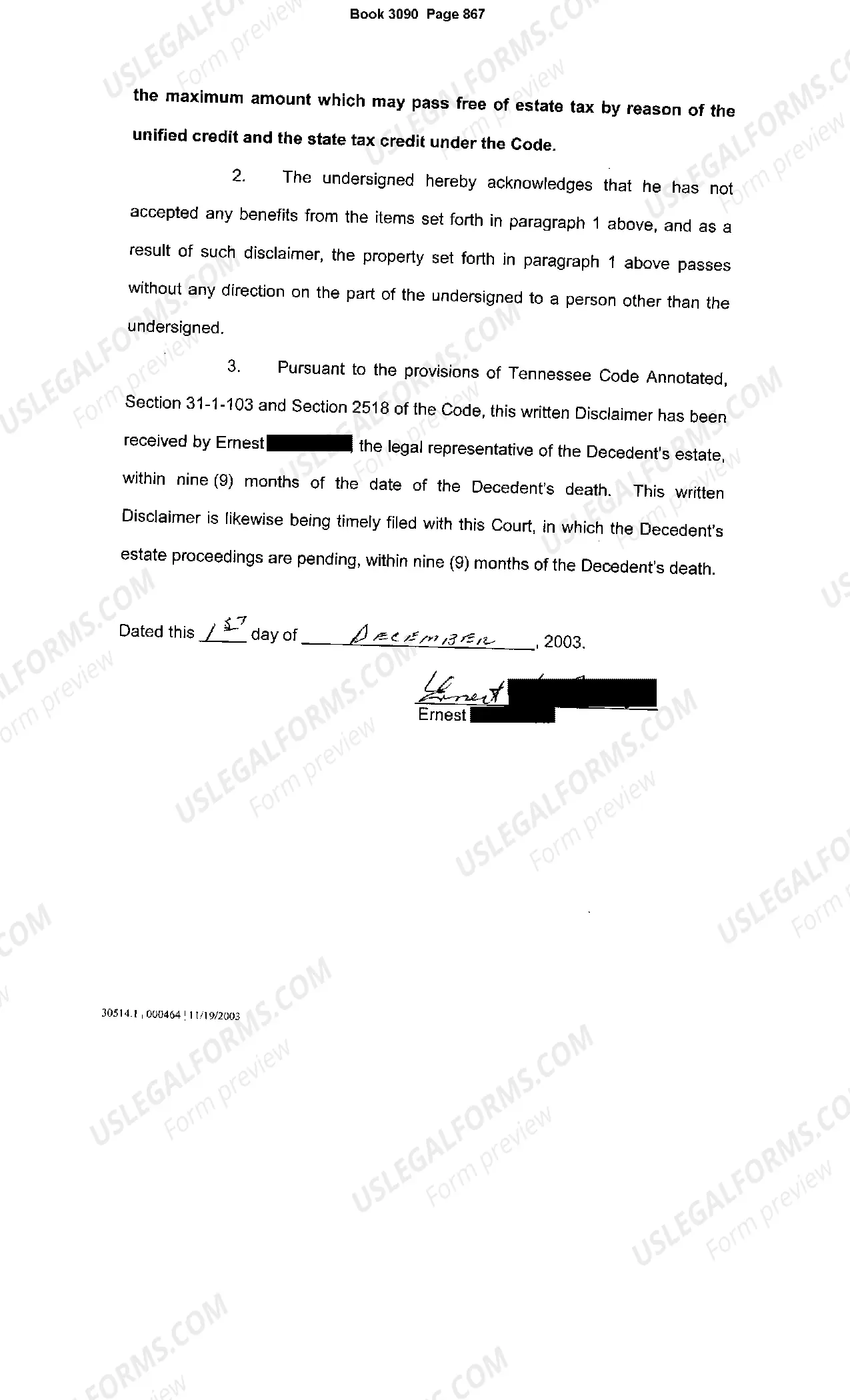

Chattanooga Tennessee Disclaimer by Surviving Spouse to Portion of Decedent's Real Property is a legal document that allows the surviving spouse of a deceased person to disclaim or renounce their right to inherit a portion of the decedent's real property. This disclaimer is an important tool in estate planning and ensures that the surviving spouse has the ability to make decisions regarding their share of the property. There are different types of disclaimers that can be made in Chattanooga Tennessee, each with its own specific circumstances and requirements. One type is a Qualified Disclaimer, which must meet certain criteria set forth by the Internal Revenue Service (IRS) to be eligible for tax benefits. By disclaiming a portion of the property, the surviving spouse may be able to reduce their tax liability. Another type is a Nontaxable Disclaimer, which does not meet the IRS criteria for a Qualified Disclaimer but still allows the surviving spouse to disclaim their portion of the decedent's real property. This type of disclaimer is often used when the surviving spouse does not want or need the inherited property. It is important to note that the decision to make a disclaimer should be made with the guidance of an experienced attorney. They will be able to assess the specific situation and advise on the best course of action. Additionally, the disclaimer must be made within a certain timeframe, typically within nine months of the decedent's passing, so prompt action is necessary. In conclusion, the Chattanooga Tennessee Disclaimer by Surviving Spouse to Portion of Decedent's Real Property provides an avenue for surviving spouses to disclaim their right to inherit a portion of the decedent's real property. This allows the surviving spouse to have control over their inheritance and make decisions based on their individual circumstances. Whether it is a Qualified Disclaimer or a Nontaxable Disclaimer, consulting with an attorney is crucial to ensure compliance with legal requirements and to make informed choices.

Chattanooga Tennessee Disclaimer by Surviving Spouse to Portion of Decedent's Real Property

State:

Tennessee

City:

Chattanooga

Control #:

TN-E275

Format:

PDF

Instant download

This form is available by subscription

Description

Disclaimer by Surviving Spouse to Portion of Decedent's Real Property

Chattanooga Tennessee Disclaimer by Surviving Spouse to Portion of Decedent's Real Property is a legal document that allows the surviving spouse of a deceased person to disclaim or renounce their right to inherit a portion of the decedent's real property. This disclaimer is an important tool in estate planning and ensures that the surviving spouse has the ability to make decisions regarding their share of the property. There are different types of disclaimers that can be made in Chattanooga Tennessee, each with its own specific circumstances and requirements. One type is a Qualified Disclaimer, which must meet certain criteria set forth by the Internal Revenue Service (IRS) to be eligible for tax benefits. By disclaiming a portion of the property, the surviving spouse may be able to reduce their tax liability. Another type is a Nontaxable Disclaimer, which does not meet the IRS criteria for a Qualified Disclaimer but still allows the surviving spouse to disclaim their portion of the decedent's real property. This type of disclaimer is often used when the surviving spouse does not want or need the inherited property. It is important to note that the decision to make a disclaimer should be made with the guidance of an experienced attorney. They will be able to assess the specific situation and advise on the best course of action. Additionally, the disclaimer must be made within a certain timeframe, typically within nine months of the decedent's passing, so prompt action is necessary. In conclusion, the Chattanooga Tennessee Disclaimer by Surviving Spouse to Portion of Decedent's Real Property provides an avenue for surviving spouses to disclaim their right to inherit a portion of the decedent's real property. This allows the surviving spouse to have control over their inheritance and make decisions based on their individual circumstances. Whether it is a Qualified Disclaimer or a Nontaxable Disclaimer, consulting with an attorney is crucial to ensure compliance with legal requirements and to make informed choices.

Free preview

How to fill out Chattanooga Tennessee Disclaimer By Surviving Spouse To Portion Of Decedent's Real Property?

If you’ve already utilized our service before, log in to your account and save the Chattanooga Tennessee Disclaimer by Surviving Spouse to Portion of Decedent's Real Property on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your file:

- Ensure you’ve found the right document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Chattanooga Tennessee Disclaimer by Surviving Spouse to Portion of Decedent's Real Property. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!