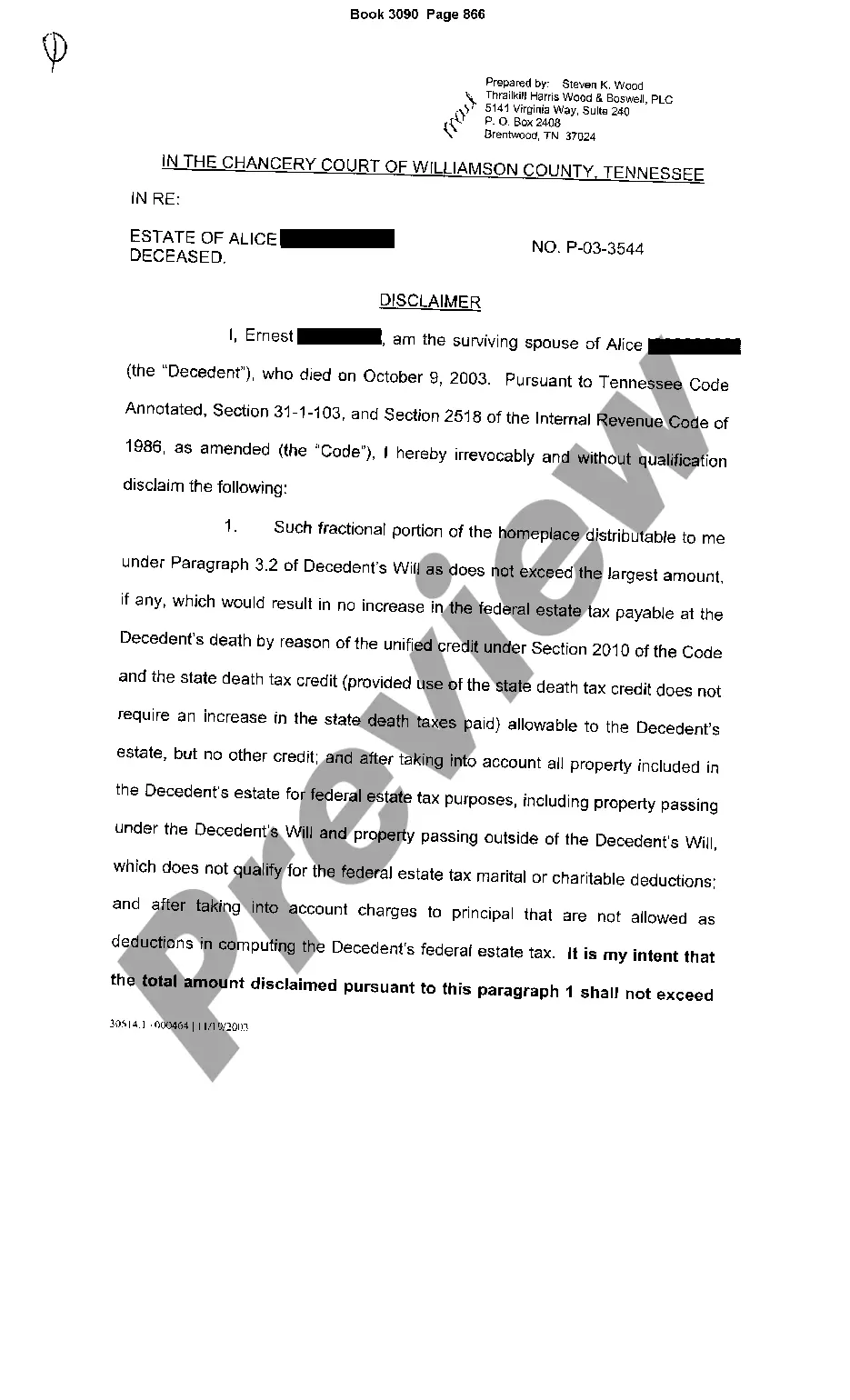

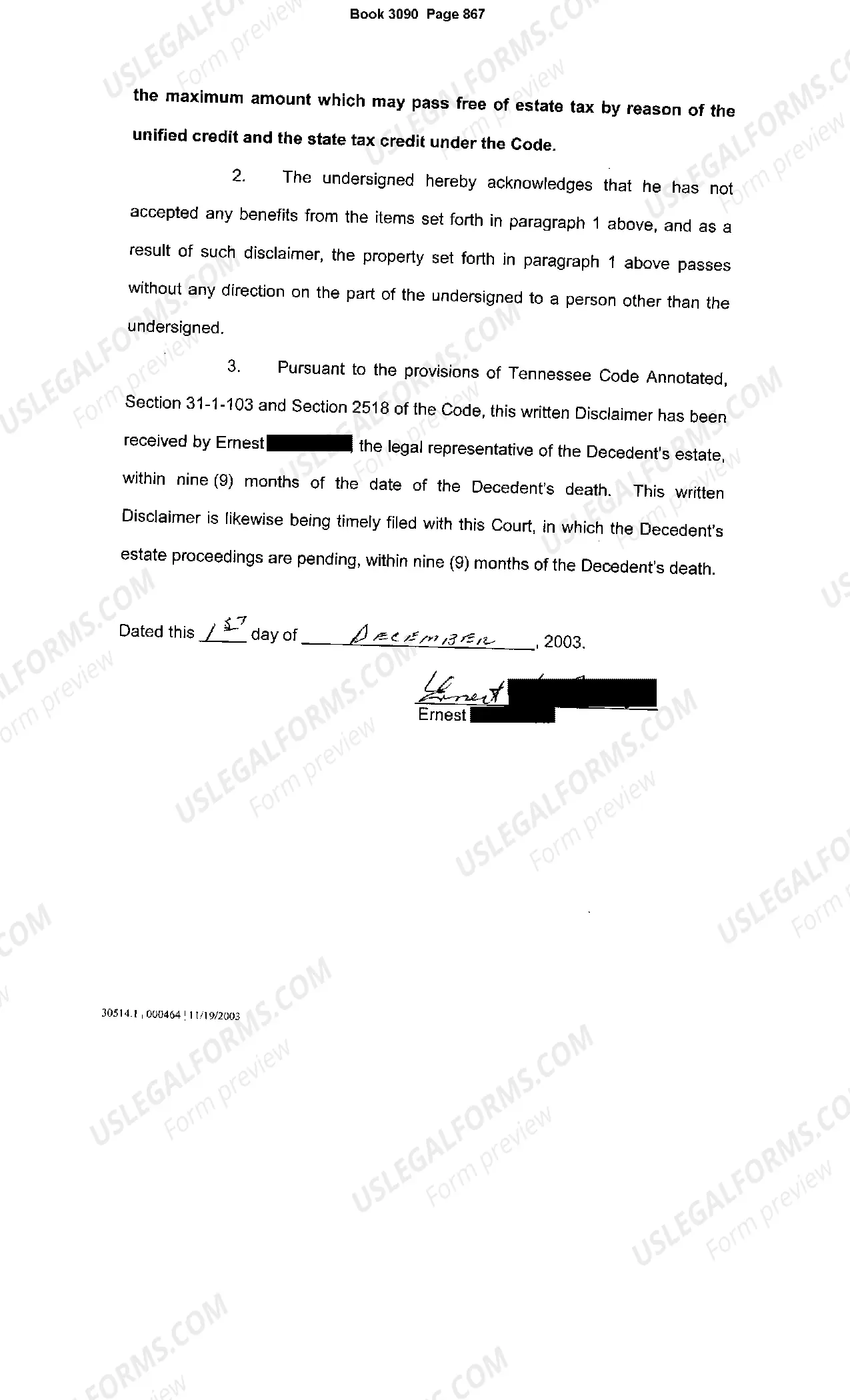

Title: Understanding Clarksville Tennessee Disclaimer by Surviving Spouse to Portion of Decedent's Real Property: Types and Key Considerations Introduction: In Clarksville, Tennessee, a surviving spouse may choose to disclaim or renounce their interest in a portion of the deceased spouse's real property. This legal process is known as the "Clarksville Tennessee Disclaimer by Surviving Spouse to Portion of Decedent's Real Property." This article aims to provide a comprehensive overview of this disclaimer, its various types, and important considerations for surviving spouses in Clarksville. Types of Clarksville Tennessee Disclaimer by Surviving Spouse to Portion of Decedent's Real Property: 1. Full Disclaimer: A surviving spouse can choose to completely disclaim their interest in the deceased spouse's real property, relinquishing any rights or claims they may have had. This type of disclaimer allows for the transfer of the spouse's interest to other beneficiaries or in accordance with the decedent's will or the state's intestacy laws. 2. Partial Disclaimer: In certain cases, a surviving spouse may only wish to disclaim a specific portion or fraction of the decedent's real property. This type of disclaimer allows the spouse to retain their interest in the remaining portion while disclaiming a particular share, which may be transferred to other beneficiaries as specified by the decedent's will or the state's intestacy laws. Key Considerations for Surviving Spouses: 1. Timely Filing: In order to make a valid disclaimer, the surviving spouse must file the disclaimer within a specific timeframe, typically within nine months of the decedent's passing or within nine months of the spouse turning 21 years old (if the spouse is a minor). 2. Irrevocable Decision: It is crucial for surviving spouses to understand that once a disclaimer is filed, it is considered an irrevocable decision. Hence, careful consideration is necessary before opting for a disclaimer to avoid potential complications in the future. 3. Impact on Estate Planning: Surviving spouses need to be aware of the potential impact of disclaimers on their personal estate planning. By disclaiming their interest in the decedent's real property, the surviving spouse must consider how this decision will affect their own estate plan, particularly if they intend to leave the disclaimed assets to specific beneficiaries. 4. Legal Consultation: Given the intricacies involved in the disclaimer process, it is highly recommended for surviving spouses to seek professional legal advice. An attorney experienced in estate planning and probate law can provide the necessary guidance to ensure a seamless and legally compliant disclaimer process. Conclusion: The Clarksville Tennessee Disclaimer by Surviving Spouse to Portion of Decedent's Real Property is a legal tool that allows surviving spouses to disclaim their interest in a deceased spouse's real property. Understanding the types of disclaimers and important considerations associated with this process is crucial for making well-informed decisions. Surviving spouses should consult with an attorney to ensure compliance with the legal requirements and protect their own estate planning goals.

Clarksville Tennessee Disclaimer by Surviving Spouse to Portion of Decedent's Real Property

Description

How to fill out Clarksville Tennessee Disclaimer By Surviving Spouse To Portion Of Decedent's Real Property?

No matter the social or professional status, filling out legal forms is an unfortunate necessity in today’s professional environment. Very often, it’s practically impossible for someone with no legal education to create such papers from scratch, mainly because of the convoluted terminology and legal subtleties they involve. This is where US Legal Forms can save the day. Our platform provides a huge collection with more than 85,000 ready-to-use state-specific forms that work for practically any legal situation. US Legal Forms also serves as a great resource for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

No matter if you need the Clarksville Tennessee Disclaimer by Surviving Spouse to Portion of Decedent's Real Property or any other document that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Clarksville Tennessee Disclaimer by Surviving Spouse to Portion of Decedent's Real Property quickly using our reliable platform. If you are already a subscriber, you can go on and log in to your account to download the appropriate form.

However, if you are a novice to our library, make sure to follow these steps before downloading the Clarksville Tennessee Disclaimer by Surviving Spouse to Portion of Decedent's Real Property:

- Be sure the template you have found is good for your location since the rules of one state or area do not work for another state or area.

- Preview the document and go through a quick description (if available) of scenarios the paper can be used for.

- If the form you picked doesn’t meet your needs, you can start again and look for the necessary document.

- Click Buy now and pick the subscription plan you prefer the best.

- Access an account {using your credentials or register for one from scratch.

- Select the payment gateway and proceed to download the Clarksville Tennessee Disclaimer by Surviving Spouse to Portion of Decedent's Real Property as soon as the payment is through.

You’re all set! Now you can go on and print out the document or fill it out online. If you have any issues getting your purchased forms, you can easily find them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.