In Memphis, Tennessee, community property classification refers to the legal framework used to determine the ownership and division of assets and debts accrued during a marriage or partnership. Under community property laws, any property acquired during the marriage is considered joint property, belonging equally to both spouses. This classification applies to both real estate and personal property, including income, investments, bank accounts, vehicles, and other assets. There are two main types of community property classifications recognized in Memphis, Tennessee: equitable distribution and community property. 1. Equitable Distribution: In Memphis, Tennessee, the majority of states follow the principles of equitable distribution. Under this classification, assets and debts acquired during the marriage are divided fairly, but not necessarily equally. The courts consider various factors such as the financial situation of each spouse, contributions made to the marriage, and the length of the marriage to determine an equitable distribution. 2. Community Property: Although not as prevalent in Tennessee as it is in other states, some situations may warrant the application of community property classification. Under this classification, all assets and debts acquired during the marriage are equally owned by both spouses, regardless of individual contributions. In the event of divorce or separation, community property is typically divided equally between the spouses. It is essential to note that Tennessee is an "equitable distribution" state. This means that the courts in Memphis have the authority to divide property and debts acquired during the marriage in a manner they consider fair and just, even if it doesn't result in an equal split. The courts take into account various factors, including the length of the marriage, each spouse's financial situation, earning capacity, and contributions to the marriage, among others, to determine the division of property. In summary, Memphis, Tennessee, recognizes two main types of community property classification: equitable distribution and community property. While equitable distribution is the more commonly used framework in the state, the courts have the discretion to divide assets and debts acquired during a marriage based on what they consider to be fair and just for both parties involved.

Memphis Tennessee Community Property Classification

State:

Tennessee

City:

Memphis

Control #:

TN-E276

Format:

PDF

Instant download

This form is available by subscription

Description

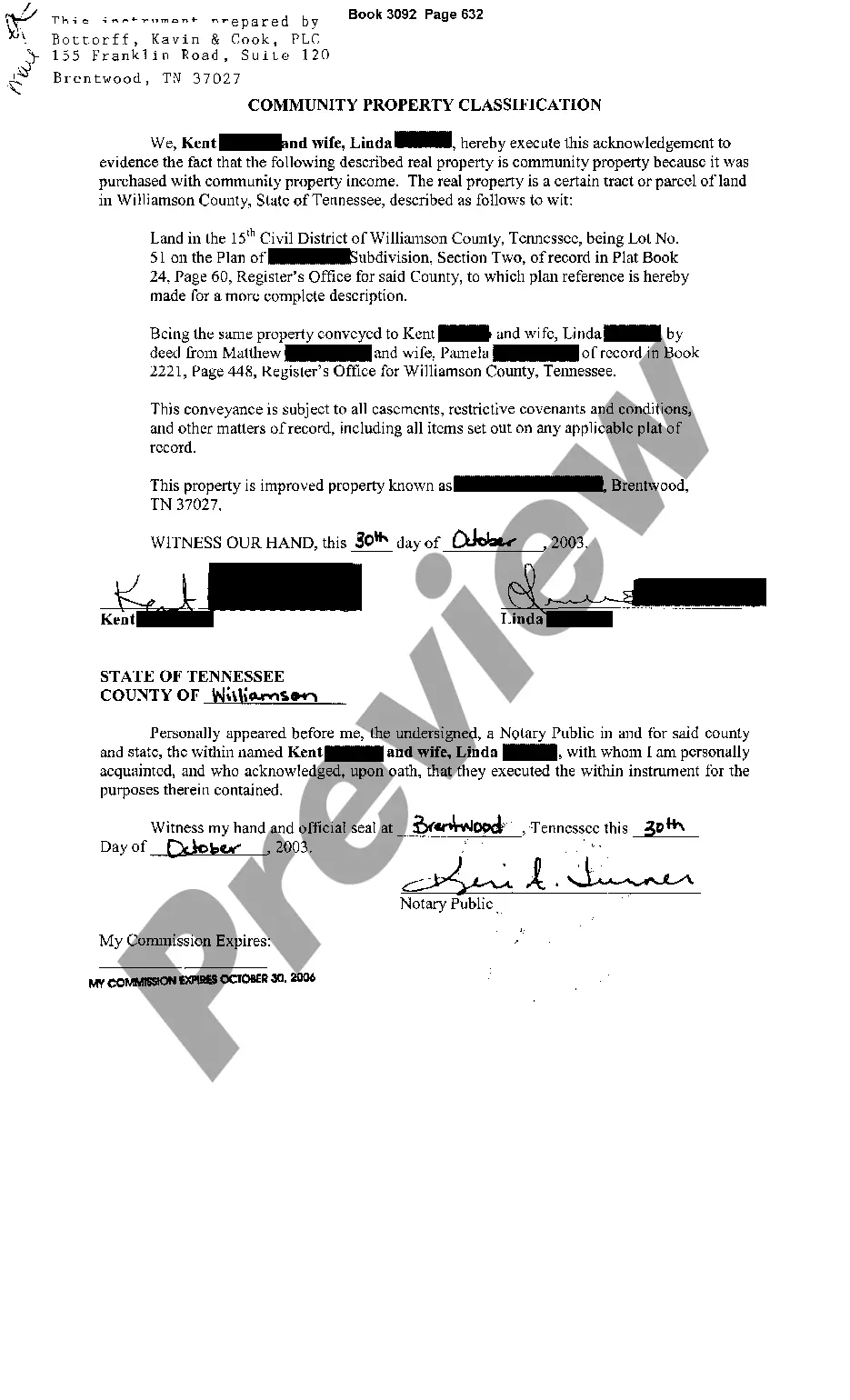

Community Property Classification

In Memphis, Tennessee, community property classification refers to the legal framework used to determine the ownership and division of assets and debts accrued during a marriage or partnership. Under community property laws, any property acquired during the marriage is considered joint property, belonging equally to both spouses. This classification applies to both real estate and personal property, including income, investments, bank accounts, vehicles, and other assets. There are two main types of community property classifications recognized in Memphis, Tennessee: equitable distribution and community property. 1. Equitable Distribution: In Memphis, Tennessee, the majority of states follow the principles of equitable distribution. Under this classification, assets and debts acquired during the marriage are divided fairly, but not necessarily equally. The courts consider various factors such as the financial situation of each spouse, contributions made to the marriage, and the length of the marriage to determine an equitable distribution. 2. Community Property: Although not as prevalent in Tennessee as it is in other states, some situations may warrant the application of community property classification. Under this classification, all assets and debts acquired during the marriage are equally owned by both spouses, regardless of individual contributions. In the event of divorce or separation, community property is typically divided equally between the spouses. It is essential to note that Tennessee is an "equitable distribution" state. This means that the courts in Memphis have the authority to divide property and debts acquired during the marriage in a manner they consider fair and just, even if it doesn't result in an equal split. The courts take into account various factors, including the length of the marriage, each spouse's financial situation, earning capacity, and contributions to the marriage, among others, to determine the division of property. In summary, Memphis, Tennessee, recognizes two main types of community property classification: equitable distribution and community property. While equitable distribution is the more commonly used framework in the state, the courts have the discretion to divide assets and debts acquired during a marriage based on what they consider to be fair and just for both parties involved.

Free preview

How to fill out Memphis Tennessee Community Property Classification?

If you’ve already utilized our service before, log in to your account and save the Memphis Tennessee Community Property Classification on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your file:

- Make sure you’ve located a suitable document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Memphis Tennessee Community Property Classification. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your personal or professional needs!