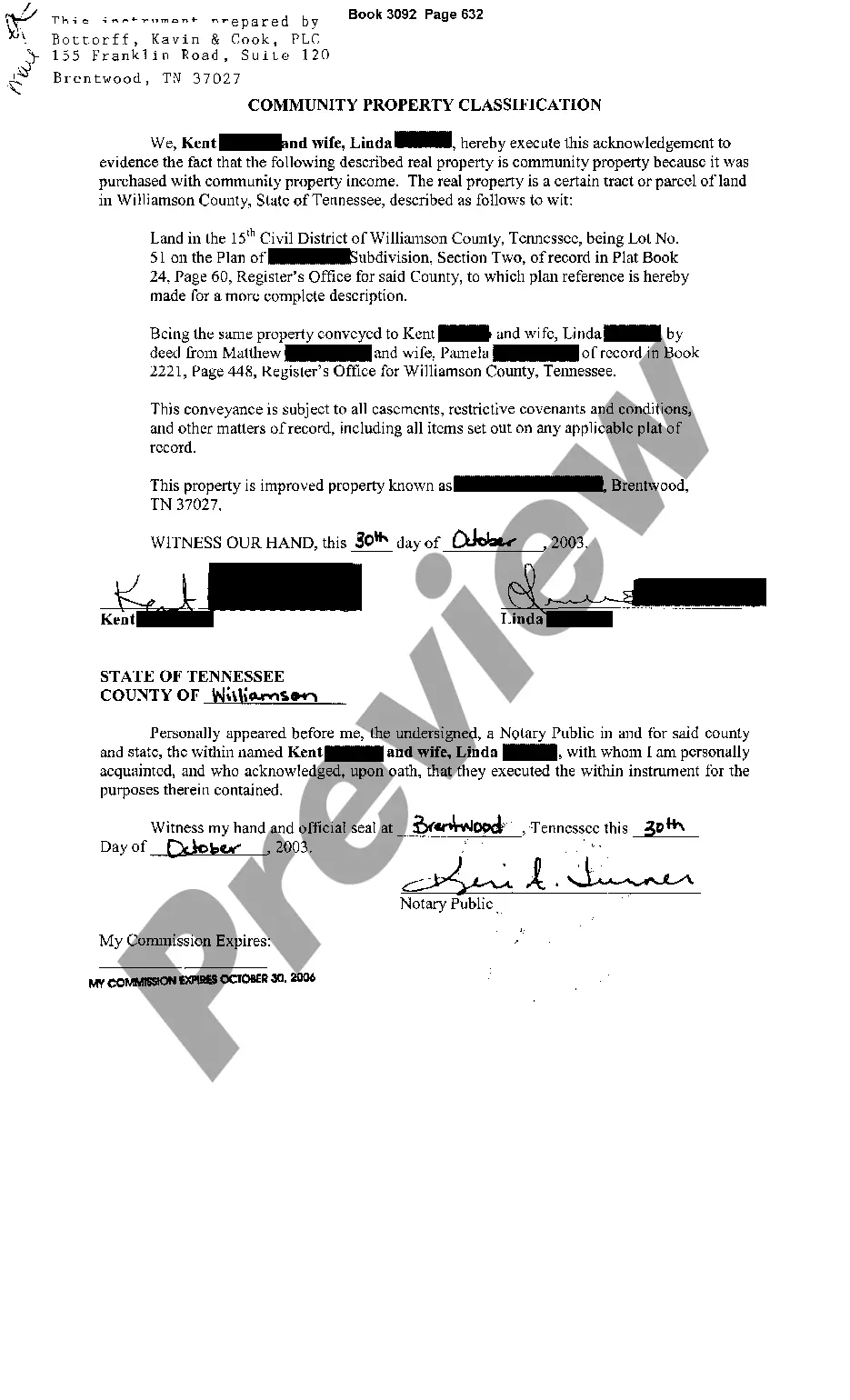

Nashville, Tennessee: Understanding the Community Property Classification In Nashville, Tennessee, community property classification refers to a legal framework that governs the ownership and distribution of assets obtained during a marriage or civil partnership. It is crucial for residents to comprehend the different types of property classifications to ensure fair and just division during divorce or separation processes. This article aims to provide a detailed description of Nashville Tennessee community property classification, including relevant keywords. 1. Tennessee Marital Property Laws: Under Tennessee law, marital property follows the principle of equitable distribution, where courts strive to divide assets and debts fairly based on various factors, rather than enforcing a strict 50/50 split. Such factors can include the duration of the marriage, the economic circumstances of each spouse, their contributions to the acquisition and preservation of the marital property, and the value of separate property owned by each spouse. 2. Community Property vs. Separate Property: Community property typically refers to property acquired during the marriage or civil partnership that is equally owned by both spouses, regardless of individual contribution or ownership status. Separate property, on the other hand, includes assets acquired prior to the marriage, during the marriage through gift or inheritance, or explicitly designated as separate property through a legal agreement. 3. Tennessee's Definition of Separate Property: According to Tennessee law, separate property remains with the owner spouse during a divorce or separation and is not subject to division. This can include assets such as premarital savings, inherited properties, or gifts solely received by one spouse. However, it's important to note that commingling separate property with marital property can potentially convert it into marital property subject to division. 4. Marital Property Classification in Nashville: In Nashville, the majority of assets acquired by couples during their marriage are likely to be considered marital property. This includes real estate, vehicles, financial accounts, investments, retirement savings, businesses, and even debts incurred during the marriage. Understanding the classification of these assets is crucial for a fair division during divorce or separation proceedings. 5. Common Types of Marital Property: — Real Estate: Houses, land, vacation homes, rental properties, etc. — Vehicles: Cars, motorcycles, boats, recreational vehicles, etc. — Financial Accounts: Checking accounts, savings accounts, certificates of deposit, etc. — Investments: Stocks, bonds, mutual funds, annuities, etc. — Retirement Savings: 401(k) plans, IRAs, pension plans, etc. — Businesses: Solproprietorshipps, partnerships, corporations, etc. — Debts: Mortgages, credit card debts, personal loans, student loans, etc. In conclusion, Nashville, Tennessee follows the principle of equitable distribution when it comes to classifying and dividing marital property during a divorce or separation. Understanding the community property classification helps individuals comprehend their rights and responsibilities, ensuring a fair and just outcome. By knowing the various types of assets that fall under marital property, residents can make informed decisions while seeking legal guidance and settlement.

Nashville Tennessee Community Property Classification

Description

How to fill out Nashville Tennessee Community Property Classification?

No matter what social or professional status, completing legal documents is an unfortunate necessity in today’s world. Very often, it’s practically impossible for someone with no law education to draft this sort of papers from scratch, mainly because of the convoluted jargon and legal subtleties they entail. This is where US Legal Forms comes in handy. Our service offers a huge library with over 85,000 ready-to-use state-specific documents that work for almost any legal scenario. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to save time utilizing our DYI tpapers.

Whether you need the Nashville Tennessee Community Property Classification or any other paperwork that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how to get the Nashville Tennessee Community Property Classification in minutes employing our trustworthy service. In case you are already an existing customer, you can go ahead and log in to your account to download the appropriate form.

However, if you are unfamiliar with our platform, ensure that you follow these steps before obtaining the Nashville Tennessee Community Property Classification:

- Ensure the form you have found is good for your location considering that the rules of one state or area do not work for another state or area.

- Preview the document and go through a brief description (if provided) of cases the paper can be used for.

- In case the form you picked doesn’t meet your needs, you can start over and look for the necessary document.

- Click Buy now and pick the subscription plan that suits you the best.

- Log in to your account credentials or register for one from scratch.

- Choose the payment method and proceed to download the Nashville Tennessee Community Property Classification as soon as the payment is through.

You’re all set! Now you can go ahead and print the document or complete it online. Should you have any problems locating your purchased documents, you can easily access them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.