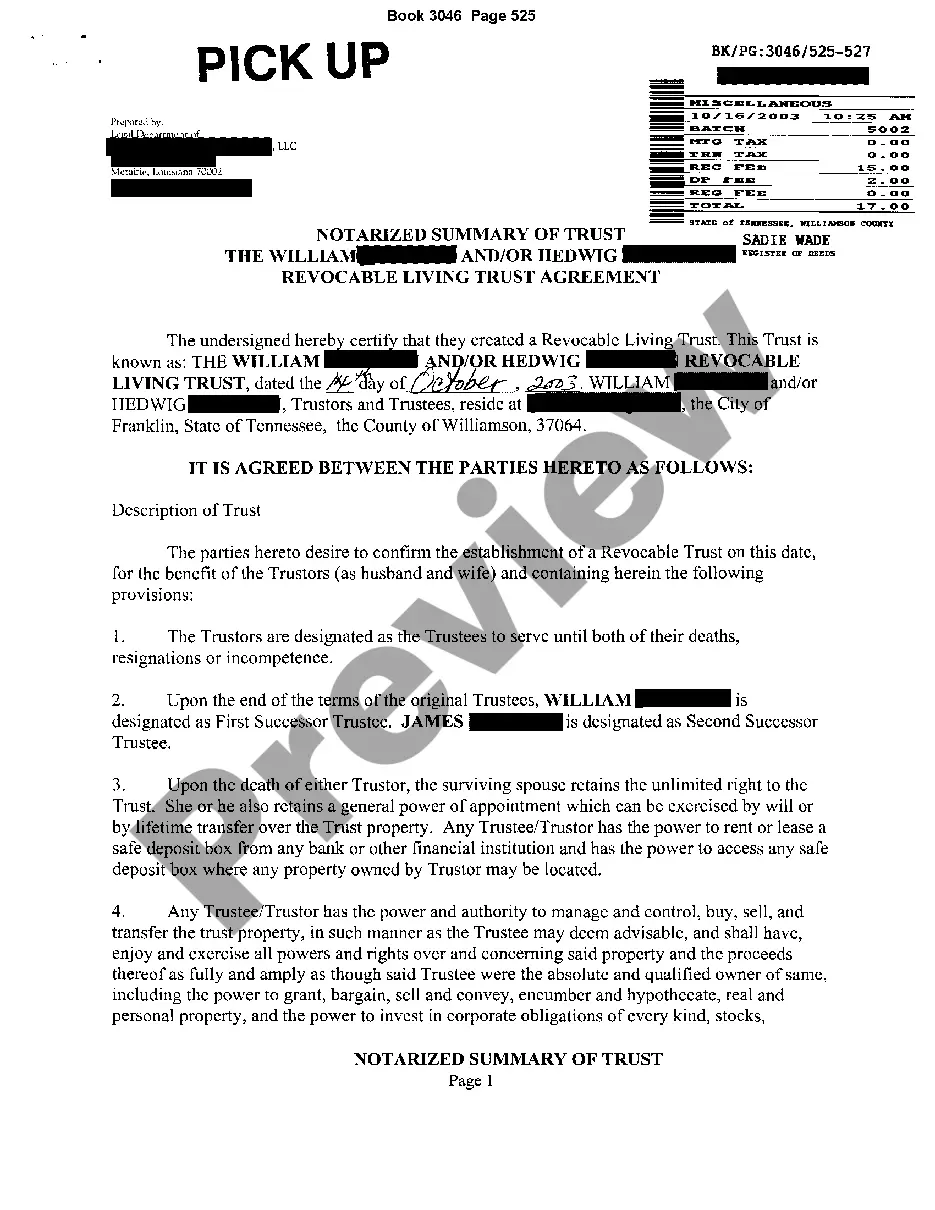

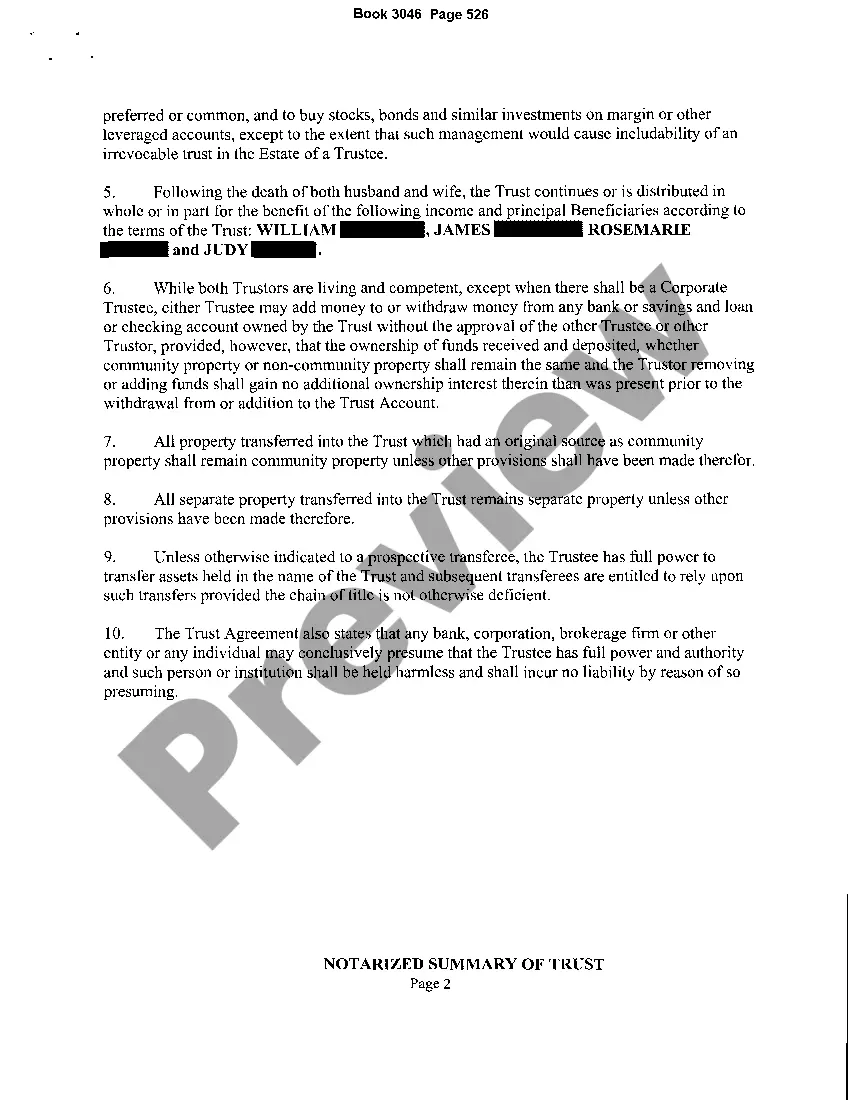

A Knoxville Tennessee Notarized Summary of Trust is a legally binding document that provides an overview of the terms and provisions of a trust in the context of Knoxville, Tennessee. This summary is notarized for validation and serves as a conclusive evidence of the trust's existence and key details. When drafting a Notarized Summary of Trust in Knoxville, several important elements should be included. Keywords such as "Knoxville," "Tennessee," "notarized," "summary of trust," "trust document," and "legal validity" are essential for search engine optimization. By incorporating these terms, individuals seeking information about this document in Knoxville will easily find the content they need. The purpose of a Notarized Summary of Trust in Knoxville is to provide a concise yet comprehensive overview of the main aspects of a trust agreement. While there may be different types of trusts, each with nuanced provisions specific to individual circumstances, the Notarized Summary of Trust generally covers the following: 1. Granter: This section outlines the identity of the person who established the trust, known as the granter or settler. It includes their full legal name, contact information, and any relevant identification details. 2. Trustee: The trustee is the individual or entity responsible for managing and distributing the assets within the trust. The Notarized Summary of Trust should mention the trustee's name, address, and contact details, underscoring their designated role. 3. Beneficiaries: The individuals or organizations benefiting from the trust are referred to as beneficiaries. Their names and identification information are included in this section, ensuring their rights and interests are safeguarded. 4. Trust Assets: A summary of the assets held within the trust is vital. Whether it includes real estate properties, financial instruments, heirlooms, or any other valuable possessions, this section serves to give an overall idea of the assets held in the trust. 5. Terms and Provisions: This part outlines the specific terms, conditions, and provisions governing the trust. It may include details such as the distribution of assets, conditions for disbursements, how the trust should be managed, and any restrictions or guidelines imposed on the beneficiaries. 6. Revocability or Irrevocability: Indicating whether the trust is revocable or irrevocable is crucial. A revocable trust can be altered or terminated during the granter's lifetime, while an irrevocable trust is typically unmodifiable without the consent of all involved parties. 7. Notarization: To enhance the document's legal validity, the Notarized Summary of Trust must be signed and notarized by a duly authorized and impartial notary public. This adds a layer of authenticity and integrity to the document. It is worth noting that while different types of trusts exist, such as living trusts, testamentary trusts, special needs trusts, and charitable trusts, the Notarized Summary of Trust primarily summarizes the key elements common to all trust agreements.

Knoxville Tennessee Notarized Summary of Trust

Description

How to fill out Knoxville Tennessee Notarized Summary Of Trust?

Benefit from the US Legal Forms and have immediate access to any form template you require. Our helpful platform with a large number of document templates makes it easy to find and get virtually any document sample you will need. You are able to download, fill, and certify the Knoxville Tennessee Notarized Summary of Trust in just a couple of minutes instead of browsing the web for several hours searching for a proper template.

Utilizing our library is a superb way to raise the safety of your document submissions. Our experienced lawyers regularly check all the documents to make certain that the templates are relevant for a particular state and compliant with new acts and polices.

How do you get the Knoxville Tennessee Notarized Summary of Trust? If you have a profile, just log in to the account. The Download option will be enabled on all the documents you view. Moreover, you can get all the earlier saved records in the My Forms menu.

If you don’t have an account yet, stick to the instructions below:

- Find the template you need. Ensure that it is the template you were hoping to find: check its title and description, and utilize the Preview feature when it is available. Otherwise, utilize the Search field to look for the appropriate one.

- Launch the downloading procedure. Select Buy Now and choose the pricing plan you prefer. Then, create an account and process your order with a credit card or PayPal.

- Export the document. Choose the format to obtain the Knoxville Tennessee Notarized Summary of Trust and change and fill, or sign it for your needs.

US Legal Forms is one of the most extensive and reliable document libraries on the internet. We are always ready to help you in any legal process, even if it is just downloading the Knoxville Tennessee Notarized Summary of Trust.

Feel free to take advantage of our platform and make your document experience as straightforward as possible!