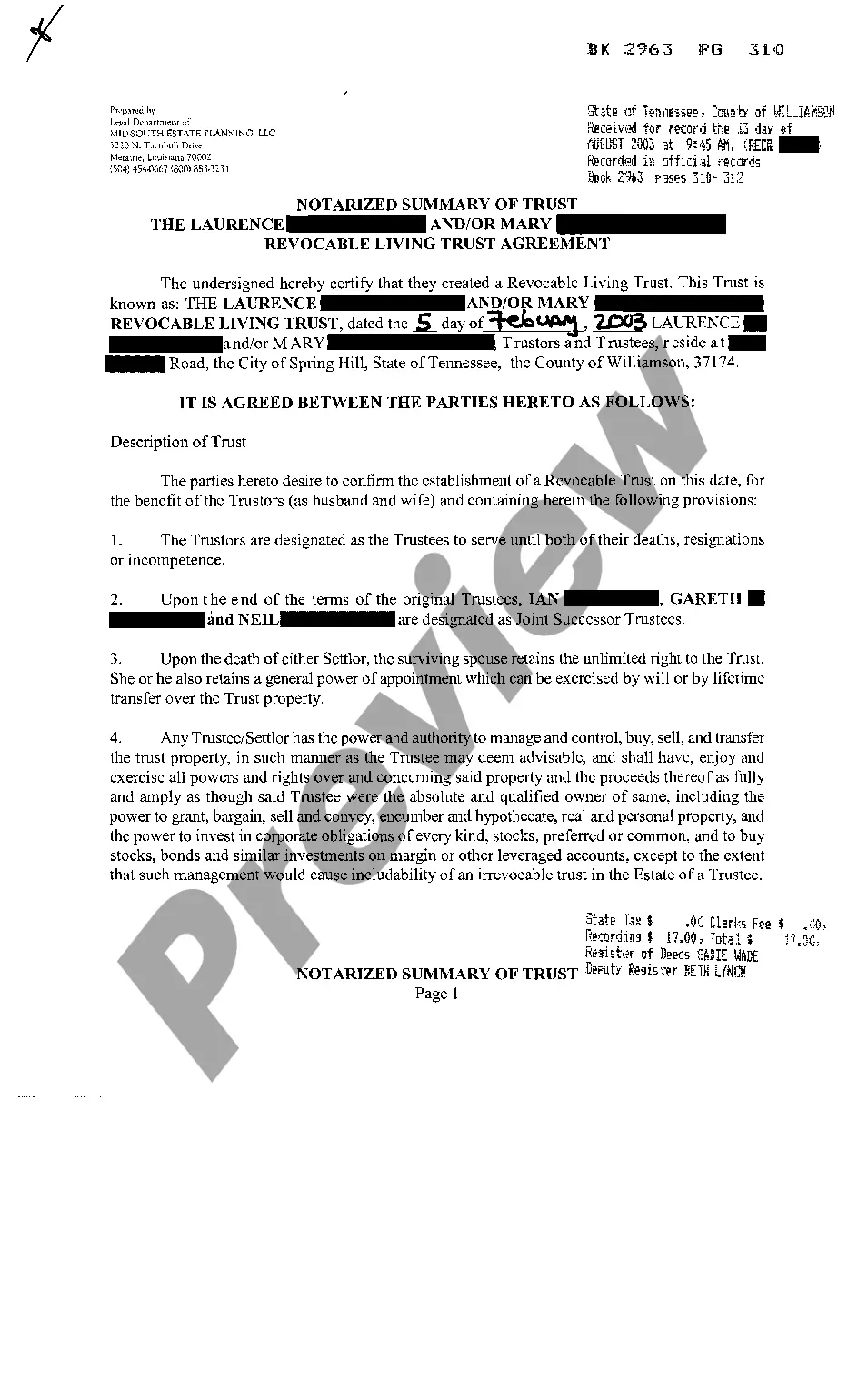

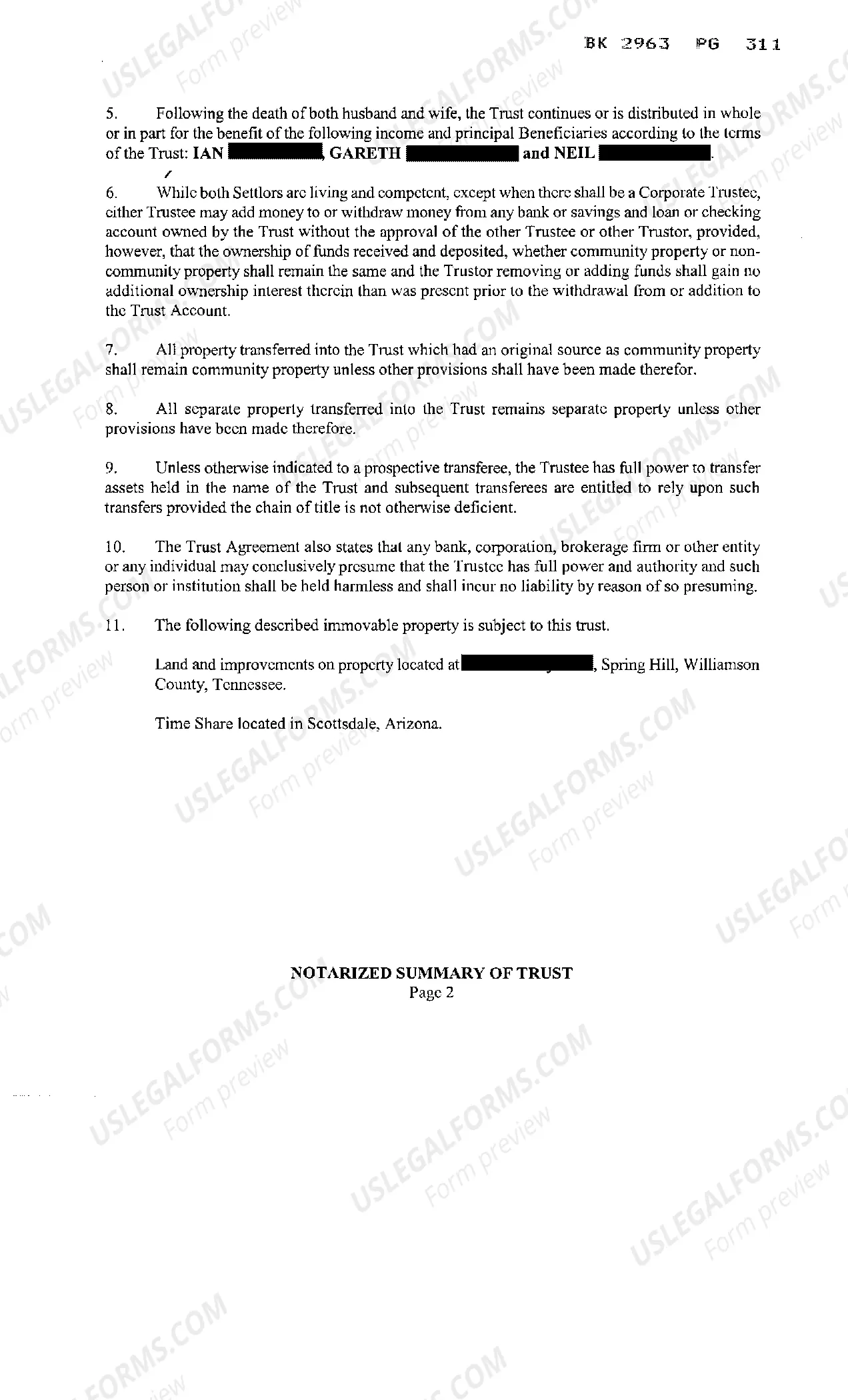

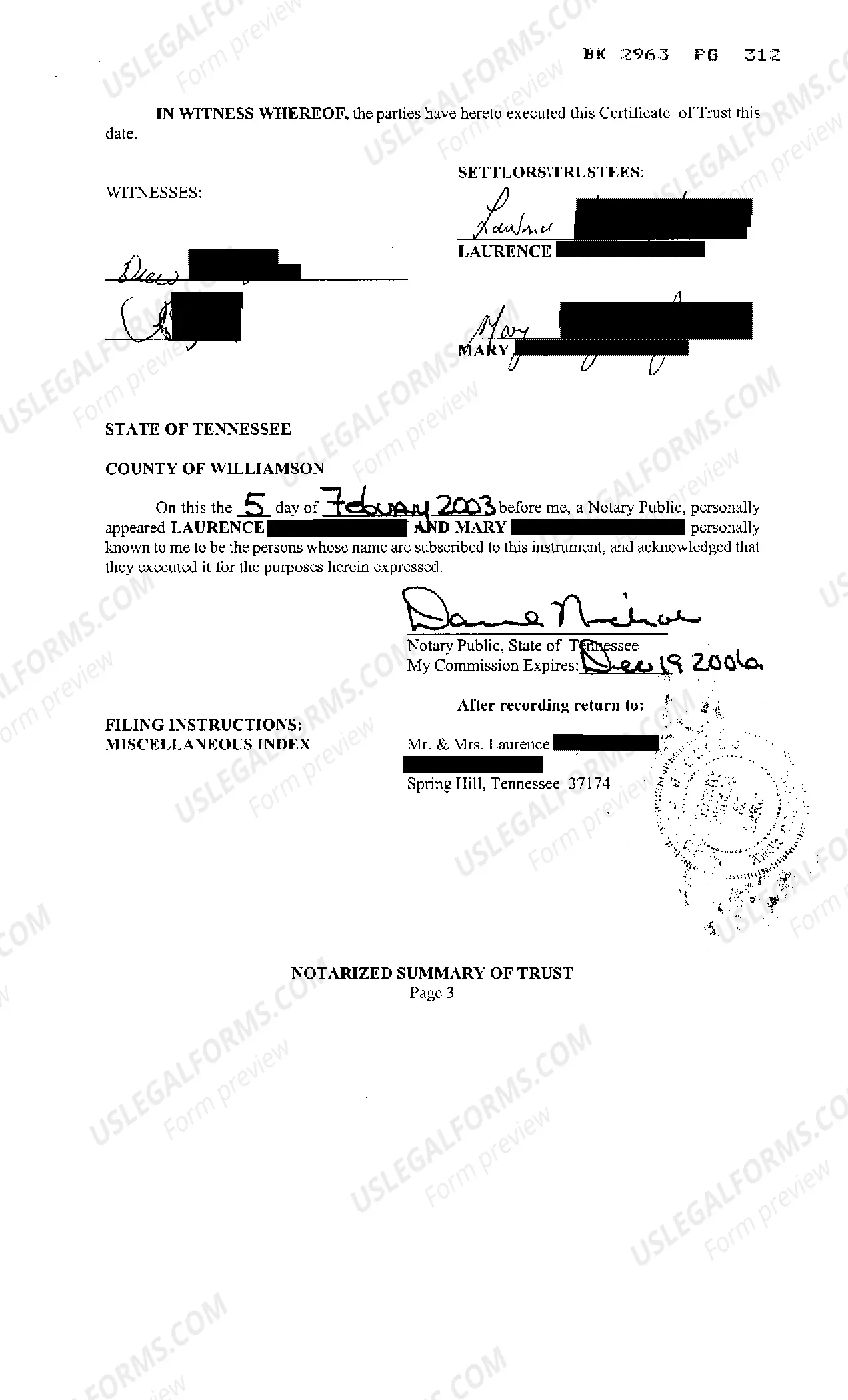

A Memphis Tennessee Revocable Living Trust is a legally binding document that allows individuals to control the distribution of their assets during their lifetime and after their death. This type of trust is established during the granter's lifetime and can be modified or revoked at any time by the granter. The primary purpose of a revocable living trust is to avoid probate, the court-supervised process of distributing assets after an individual's death. By placing assets in a trust, they are no longer considered part of the individual's probate estate, thus allowing for a faster and more private distribution of assets to beneficiaries. Some key features of a Memphis Tennessee Revocable Living Trust include: 1. Granter: The individual who creates the trust and transfers assets into it is referred to as the granter or settler. The granter can also act as the trustee during their lifetime and retain control over the trust assets. 2. Trustee: The trustee is responsible for managing the trust assets according to the granter's instructions. In a revocable living trust, the granter often serves as the trustee, retaining full control over the assets and the ability to make changes to the trust provisions. 3. Beneficiaries: These are the individuals or entities designated by the granter to receive the trust assets upon their death. Beneficiaries can include family members, friends, charities, or any other designated recipients. 4. Asset Protection: While a revocable living trust does not provide direct asset protection from creditors or lawsuits, it can offer some level of protection by avoiding probate, which can reduce the likelihood of assets being subject to legal claims. 5. Privacy: One significant advantage of a revocable living trust is the ability to keep the distribution of assets private. Probate proceedings are a matter of public record, while the terms of a trust can remain confidential. Different types of Memphis Tennessee Revocable Living Trust can include: 1. Individual Living Trust: This is the most common type of trust and is established by a single individual. 2. Joint Living Trust: Created by married or committed couples, a joint living trust allows both partners to combine their assets in a single trust and establish provisions for their distribution. 3. Testamentary Trust: Although not a revocable living trust per se, a testamentary trust is established through a will and comes into effect upon the granter's death. It can specify the distribution of assets to beneficiaries and provide for asset protection or management. In summary, a Memphis Tennessee Revocable Living Trust is a versatile estate planning tool that allows individuals in Memphis, Tennessee, to determine the distribution of their assets during their lifetime and after their death. It can help avoid probate, provide privacy, and offer flexibility in managing and distributing assets.

Memphis Tennessee Revocable Living Trust

Description

How to fill out Memphis Tennessee Revocable Living Trust?

If you are looking for a valid form template, it’s extremely hard to choose a more convenient service than the US Legal Forms website – probably the most extensive libraries on the web. With this library, you can find thousands of form samples for business and individual purposes by types and regions, or key phrases. With our high-quality search feature, getting the most up-to-date Memphis Tennessee Revocable Living Trust is as elementary as 1-2-3. Furthermore, the relevance of each document is verified by a group of professional lawyers that on a regular basis review the templates on our website and revise them based on the newest state and county demands.

If you already know about our system and have an account, all you need to get the Memphis Tennessee Revocable Living Trust is to log in to your user profile and click the Download button.

If you use US Legal Forms for the first time, just follow the instructions listed below:

- Make sure you have chosen the form you need. Read its description and utilize the Preview option (if available) to check its content. If it doesn’t meet your needs, use the Search field at the top of the screen to discover the proper record.

- Affirm your decision. Choose the Buy now button. Next, select your preferred pricing plan and provide credentials to register an account.

- Process the financial transaction. Make use of your credit card or PayPal account to complete the registration procedure.

- Receive the form. Indicate the format and save it on your device.

- Make changes. Fill out, edit, print, and sign the received Memphis Tennessee Revocable Living Trust.

Each form you add to your user profile has no expiration date and is yours forever. You always have the ability to access them using the My Forms menu, so if you want to have an additional copy for enhancing or creating a hard copy, you may come back and export it again at any moment.

Take advantage of the US Legal Forms professional catalogue to get access to the Memphis Tennessee Revocable Living Trust you were seeking and thousands of other professional and state-specific templates on a single platform!