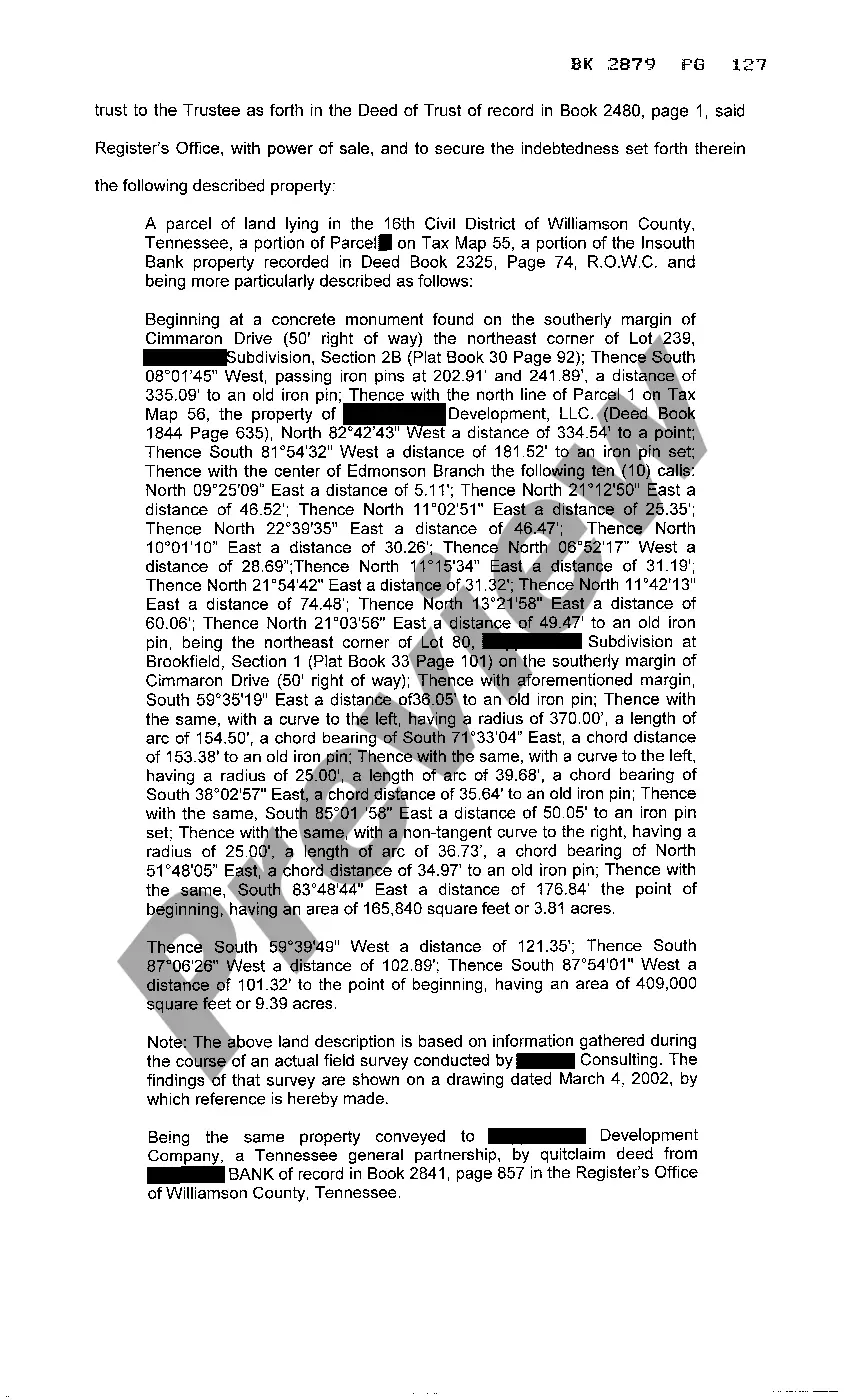

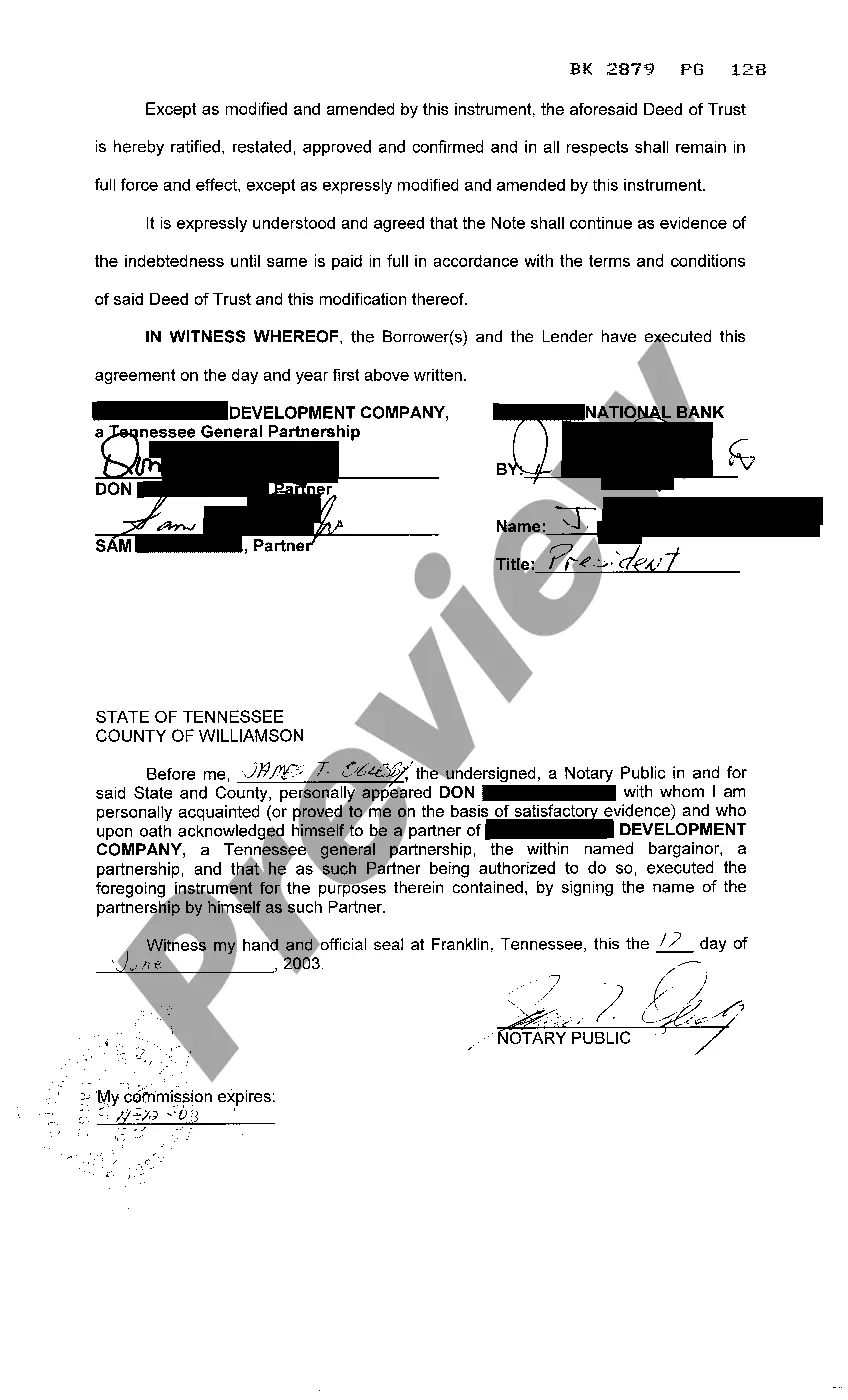

Knoxville Tennessee Substitution of Collateral refers to the legal process of replacing one asset or property with another as security for a loan or debt. This is done to offer an alternative form of collateral to the lender, which maintains the borrower's obligation in case of default or non-payment. Substitution of collateral is a common practice in various financial transactions and typically occurs when the original collateral is no longer sufficient or desirable. In Knoxville, Tennessee, there are different types of Substitution of Collateral based on the nature of the transaction and the parties involved. Here are some key variations: 1. Mortgage Substitution of Collateral: This type of substitution commonly occurs in real estate transactions in Knoxville. When a borrower seeks to replace the originally pledged property with another asset, such as a different property, the lender agrees to the substitution and ensures that the new collateral meets the same or higher value and creditworthiness standards. 2. Vehicle Substitution of Collateral: Knoxville residents who have used their vehicles as collateral for loans or leases may opt for substitution when they wish to switch to a different vehicle during the loan term. This allows the borrower to transfer the loan or lease to the new vehicle effectively, updating the lender about the updated collateral. 3. Business Substitution of Collateral: In the corporate world, businesses in Knoxville may engage in substitution of collateral to improve their financing terms. For instance, a company may replace certain assets, such as equipment, machinery, or inventory, with newer or more valuable assets to obtain better loan terms or negotiate with lenders. 4. Personal Loan Substitution of Collateral: Individuals in Knoxville who have taken out personal loans, such as for education or debt consolidation, may choose to substitute collateral. This could involve replacing the original pledged assets, such as jewelry, stocks, or personal property, with new collateral that better suits their current financial situation. In summary, Knoxville Tennessee Substitution of Collateral is a legal process in which the collateral securing a loan or debt is replaced with another asset. This occurs when the initial collateral becomes insufficient or needs to be updated. Different types of substitution exist, depending on the nature of the transaction, including mortgage, vehicle, business, and personal loan substitutions.

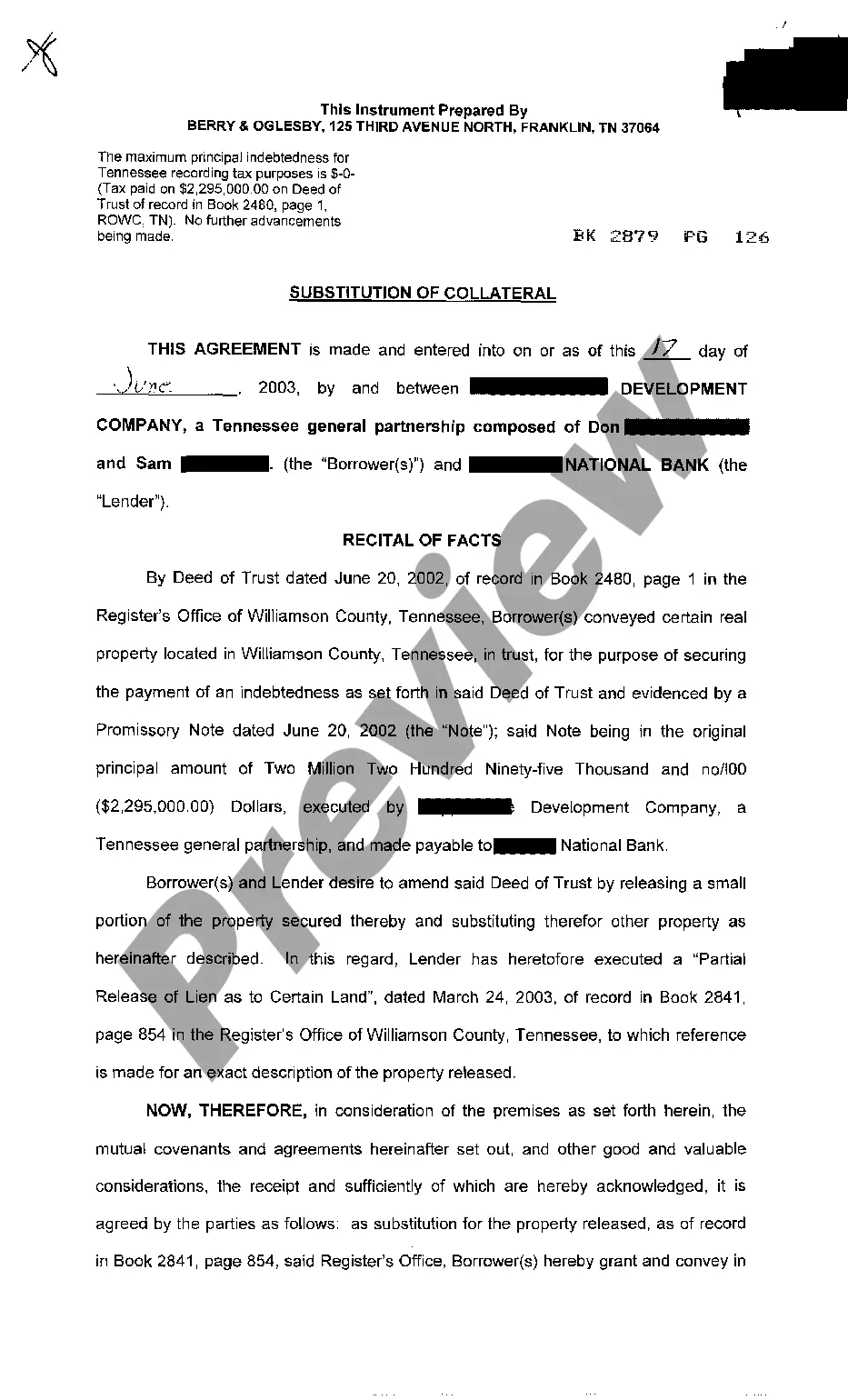

Knoxville Tennessee Substitution of Collateral

Description

How to fill out Knoxville Tennessee Substitution Of Collateral?

Benefit from the US Legal Forms and obtain instant access to any form template you want. Our helpful website with a large number of document templates allows you to find and get virtually any document sample you require. You can download, complete, and certify the Knoxville Tennessee Substitution of Collateral in a few minutes instead of browsing the web for several hours looking for a proper template.

Using our collection is a wonderful strategy to improve the safety of your record submissions. Our experienced attorneys regularly check all the records to ensure that the forms are relevant for a particular state and compliant with new acts and polices.

How can you get the Knoxville Tennessee Substitution of Collateral? If you already have a subscription, just log in to the account. The Download button will appear on all the documents you look at. In addition, you can find all the previously saved files in the My Forms menu.

If you don’t have an account yet, stick to the instruction listed below:

- Find the template you need. Make certain that it is the template you were looking for: check its name and description, and use the Preview function if it is available. Otherwise, utilize the Search field to find the needed one.

- Start the downloading procedure. Select Buy Now and choose the pricing plan that suits you best. Then, create an account and pay for your order with a credit card or PayPal.

- Save the document. Pick the format to obtain the Knoxville Tennessee Substitution of Collateral and modify and complete, or sign it according to your requirements.

US Legal Forms is among the most extensive and trustworthy document libraries on the internet. We are always ready to help you in virtually any legal procedure, even if it is just downloading the Knoxville Tennessee Substitution of Collateral.

Feel free to benefit from our form catalog and make your document experience as efficient as possible!