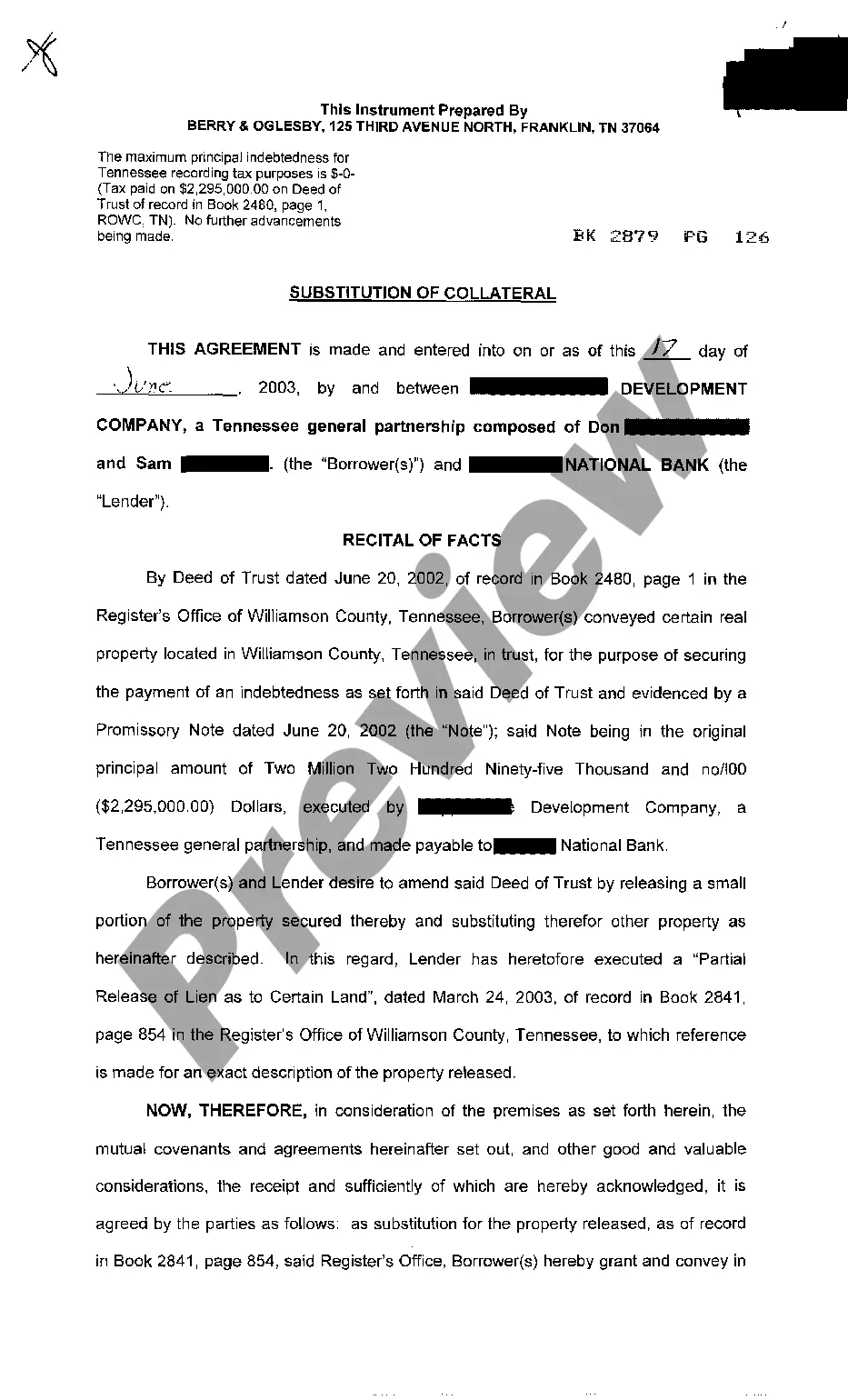

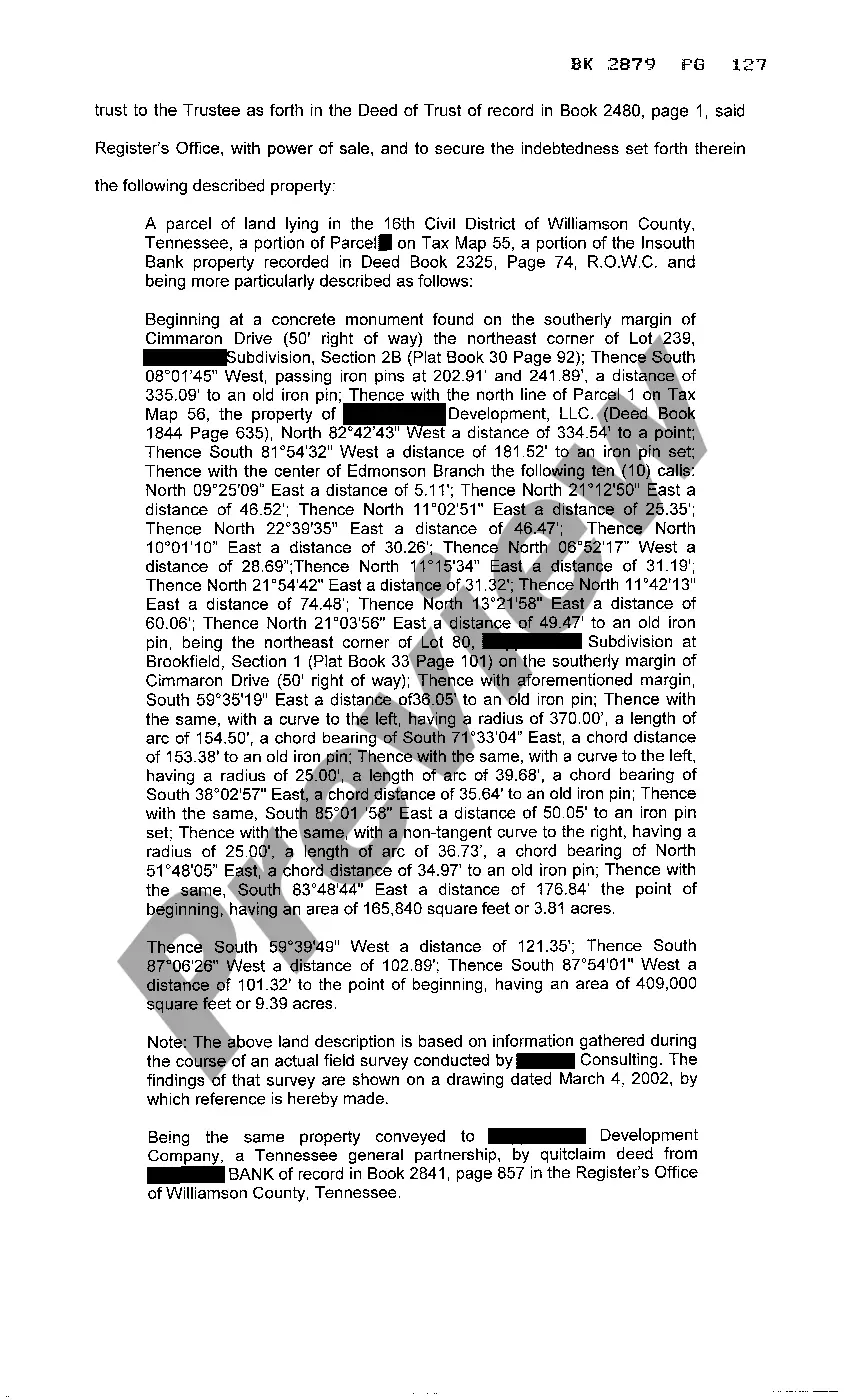

Memphis Tennessee Substitution of Collateral refers to a legal process that allows a borrower to replace the original collateral pledged for a loan with a new asset of equal or greater value. This process often occurs when the borrower no longer wishes to use the original collateral to secure the loan or when a more valuable asset becomes available. In the context of Memphis, Tennessee, substitution of collateral typically applies to various types of secured loans, such as mortgages, car loans, or business loans. It is important to note that the specific requirements and procedures for substitution of collateral may vary depending on the type of loan and the lender's policies. One common type of Memphis Tennessee Substitution of Collateral is in the real estate industry, known as a loan collateral substitution. This occurs when a borrower wants to replace the originally pledged property (such as a house or land) with a new property that will act as the collateral for the loan. The borrower must negotiate and obtain the lender's approval for the substitution of collateral, ensuring that the new property fulfills the lender's requirements in terms of value, marketability, and title. Another type of substitution of collateral that can occur in Memphis, Tennessee is related to vehicle loans. If a borrower has an existing car loan and wishes to exchange the current vehicle for a different one, they may need to go through a substitution of collateral process. This allows them to replace the original vehicle pledged as collateral for the loan with the new vehicle. The borrower must communicate with the lender, provide necessary documentation, and comply with any fees or charges associated with the process. Overall, Memphis Tennessee Substitution of Collateral enables borrowers to update or modify the collateral securing their loans, subject to certain conditions and lender approval. This process can be complex and involves negotiations, documentation, and adherence to legal requirements. It is crucial for borrowers to consult with their lenders and seek professional legal advice to ensure a smooth and successful substitution of collateral.

Memphis Tennessee Substitution of Collateral

Description

How to fill out Memphis Tennessee Substitution Of Collateral?

No matter the social or professional status, filling out law-related documents is an unfortunate necessity in today’s world. Very often, it’s practically impossible for a person with no law education to draft such paperwork cfrom the ground up, mainly because of the convoluted terminology and legal nuances they entail. This is where US Legal Forms comes to the rescue. Our platform provides a huge collection with over 85,000 ready-to-use state-specific documents that work for almost any legal case. US Legal Forms also is an excellent resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

No matter if you want the Memphis Tennessee Substitution of Collateral or any other paperwork that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Memphis Tennessee Substitution of Collateral in minutes employing our trusted platform. If you are already an existing customer, you can go ahead and log in to your account to download the appropriate form.

However, if you are new to our library, ensure that you follow these steps before downloading the Memphis Tennessee Substitution of Collateral:

- Be sure the template you have chosen is suitable for your location considering that the regulations of one state or county do not work for another state or county.

- Review the form and go through a brief outline (if provided) of scenarios the document can be used for.

- If the one you selected doesn’t meet your needs, you can start over and look for the needed document.

- Click Buy now and pick the subscription plan you prefer the best.

- utilizing your credentials or create one from scratch.

- Pick the payment method and proceed to download the Memphis Tennessee Substitution of Collateral as soon as the payment is through.

You’re all set! Now you can go ahead and print out the form or complete it online. If you have any issues getting your purchased documents, you can easily access them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.