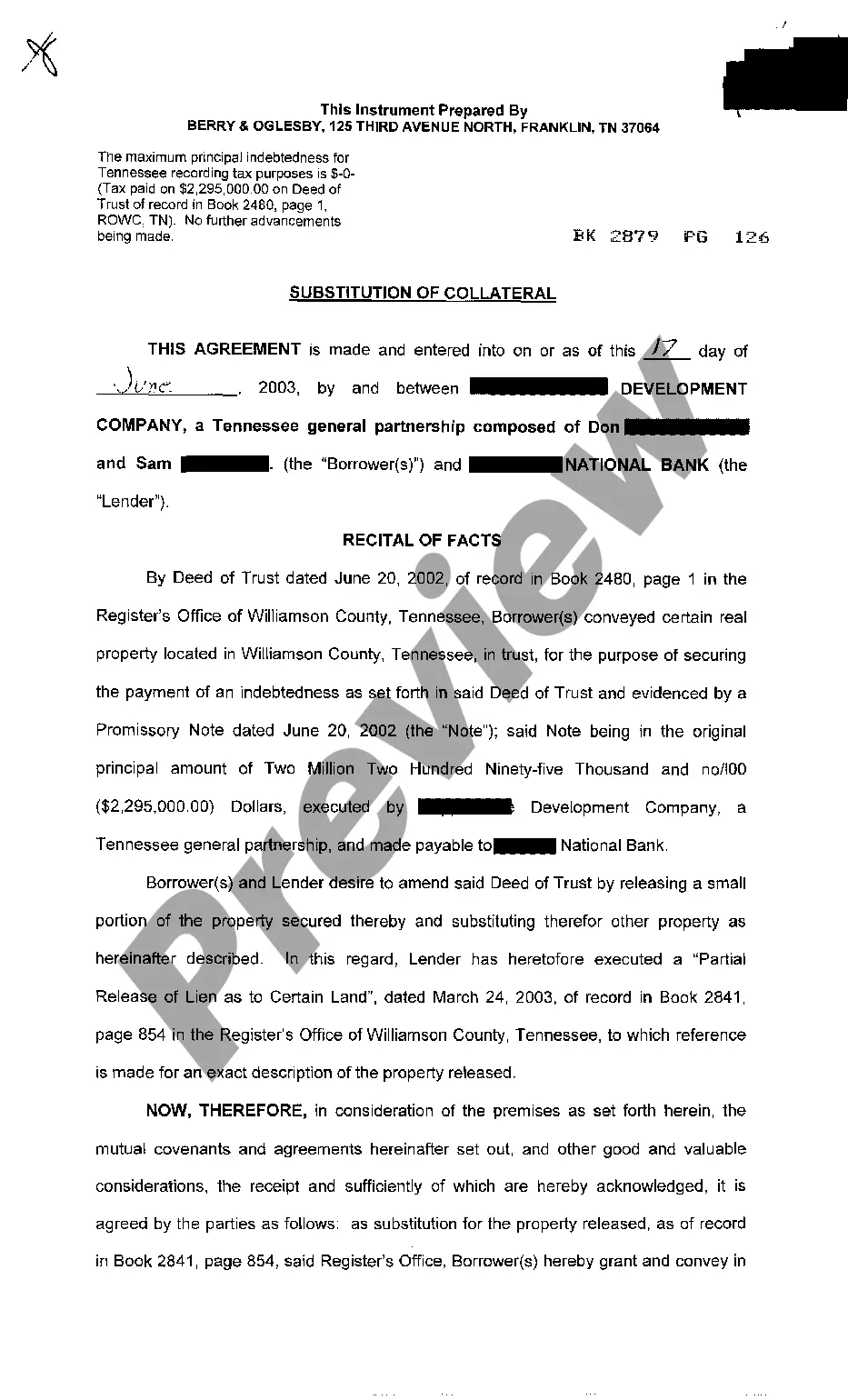

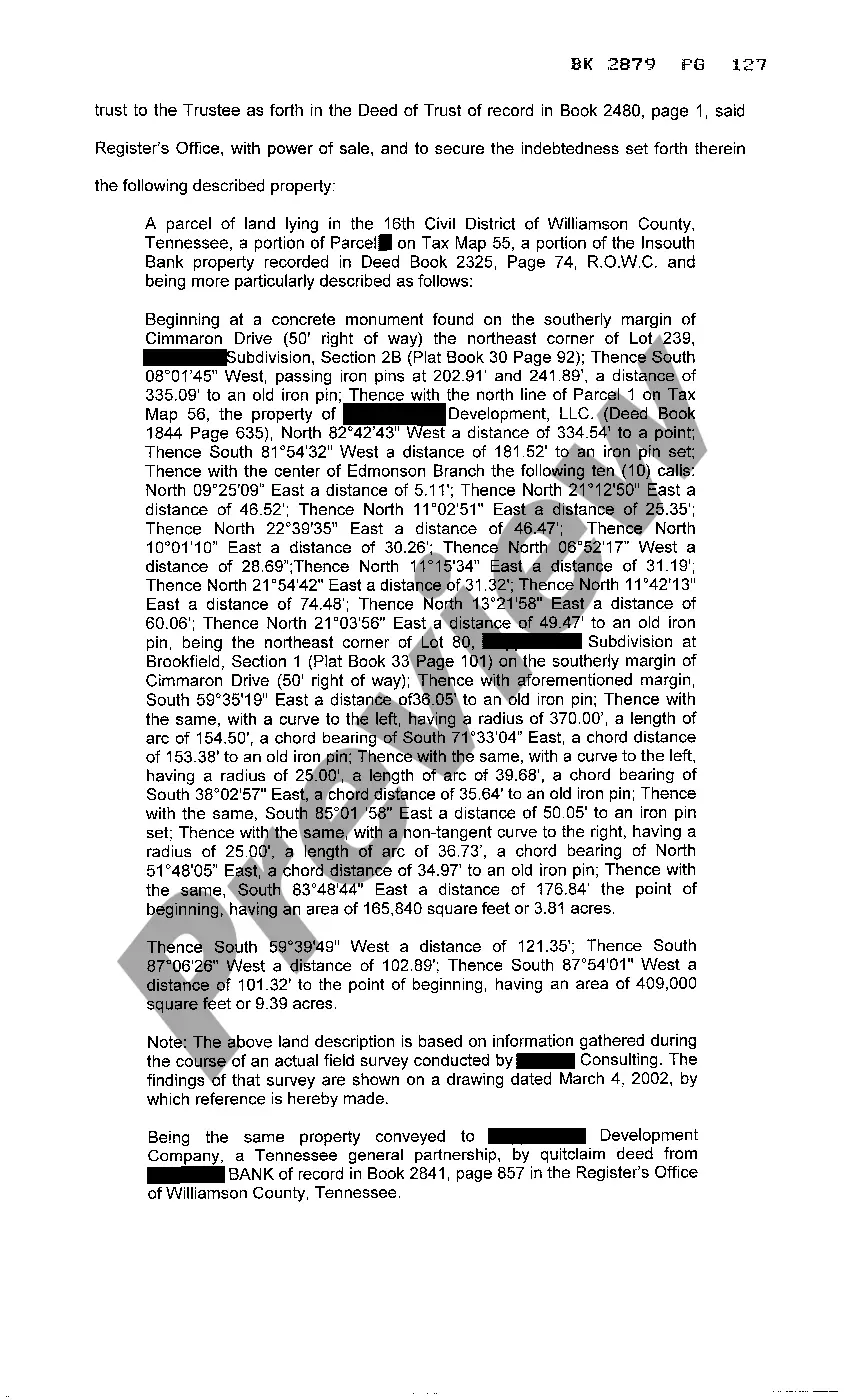

Murfreesboro Tennessee Substitution of Collateral is a legal process through which a party replaces the current collateral used to secure a loan or a debt obligation with a new asset or property. This typically occurs when the original collateral has become insufficient, damaged, or needs to be replaced due to certain circumstances. By substituting collateral, the party involved aims to ensure that the loan or debt obligation remains properly secured. In Murfreesboro, Tennessee, the Substitution of Collateral is governed by specific laws and regulations outlined in the state statutes. It is crucial to fully understand the requirements and procedures involved in this process to ensure compliance and a smooth transition. Different types of Murfreesboro Tennessee Substitution of Collateral include: 1. Real Estate Substitution: This type of collateral substitution involves replacing the property used as collateral with another piece of real estate property. It may be necessary when the original property depreciates significantly or becomes unavailable, or if the lender agrees to accept a different property as sufficient collateral. 2. Vehicle Substitution: In some cases, borrowers may need to substitute the vehicle used as collateral for an auto loan with another vehicle. This can occur due to reasons such as the depreciation of the original vehicle, major damages, or a need for a different type of vehicle for various reasons. 3. Asset Substitution: This involves substituting non-real estate assets, such as equipment, machinery, inventory, or valuable personal items, as collateral for a loan or debt obligation. The substitution may occur when the original assets lose value, are no longer available, or when the lender agrees to accept alternative assets as collateral. Before proceeding with a Murfreesboro Tennessee Substitution of Collateral, it is essential to consult with legal professionals experienced in the field. They can guide you through the process, ensure compliance with state laws and regulations, and help protect your interests. Adequate documentation and clear communication between all parties involved are crucial to facilitating a successful substitution, minimizing potential legal risks, and maintaining the integrity of the original loan or debt obligation.

Substitution Of Collateral Auto

Description

How to fill out Murfreesboro Tennessee Substitution Of Collateral?

Obtaining validated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms repository.

It’s an online assortment of over 85,000 legal documents catering to both individual and business necessities and various real-world situations.

All the forms are aptly categorized by field of application and jurisdictional areas, so finding the Murfreesboro Tennessee Substitution of Collateral becomes as straightforward as one, two, three.

Maintaining paperwork organized and compliant with legal stipulations is extremely important. Utilize the US Legal Forms repository to always have essential document templates readily available for any requirement at your fingertips!

- Examine the Preview mode and form details.

- Ensure you’ve chosen the correct one that satisfies your requirements and fully aligns with your local jurisdiction regulations.

- Look for another template, if necessary.

- If you notice any discrepancies, make use of the Search tab above to find the appropriate one.

- If it meets your needs, move on to the subsequent step.

Form popularity

FAQ

A quit claim deed in Rutherford County Tennessee typically includes the names of the grantor (the person transferring the property) and the grantee (the person receiving the property), as well as a legal description of the property. This instrument is often used in situations such as property transfers between family members or in conjunction with the Murfreesboro Tennessee Substitution of Collateral. By understanding the quit claim process, you can effectively manage property transfers and ensure compliance with local regulations.

In the context of repurchase agreements or repos, a collateral substitution occurs when one type of collateral is replaced with another during the agreement's term. This is important for participants in Murfreesboro Tennessee Substitution of Collateral, as it helps maintain compliance with lending terms and mitigates risks associated with fluctuating asset values. Effective management of collateral substitutions can enhance liquidity and financial stability.

Collateral substitutes refer to assets that can replace traditional forms of collateral in a financial transaction. In the context of Murfreesboro Tennessee Substitution of Collateral, these substitutes can provide flexibility and help parties meet their obligations without liquidating important assets. This approach is particularly beneficial for businesses that seek to maintain operational stability while securing financing.

In Tennessee, grounds for a restraining order include harassment, domestic violence, stalking, or any credible threats that create fear for an individual's safety. You'll need to present clear evidence to support these claims in court. If your situation involves complexities such as Murfreesboro Tennessee Substitution of Collateral, ensuring your case is tailored to address these issues can strengthen your position.

Yes, Tennessee adheres to a collateral source rule, which prevents a defendant from reducing their liability based on compensation victims receive from other sources. This rule exists to ensure that victims can recover damages fully. When navigating legal matters that involve the concept of Murfreesboro Tennessee Substitution of Collateral, understanding this rule can be crucial for proper case management.

To obtain a restraining order in Rutherford County, Tennessee, you need to file a petition in the appropriate court. It's important to provide sufficient evidence to support your request. Consulting with a legal professional can enhance your understanding of the process and help ensure your petition is well-prepared. If the case involves concerns related to the Murfreesboro Tennessee Substitution of Collateral, addressing this issue early can aid your legal standing.

Filling out a quitclaim deed in Tennessee involves collecting the required information, including the current owner's details and the new owner's information. Clearly describe the property being transferred to complete the document accurately. Utilizing tools from uslegalforms may streamline the process, ensuring that users in Murfreesboro Tennessee meet the legal criteria for the substitution of collateral.

To fill out a quit claim deed in Tennessee, start by obtaining a blank deed form that complies with state laws. Fill in the necessary details such as the granter’s and grantee’s names, property description, and any relevant terms. Ensuring your deed meets all legal standards can be simplified with templates available on uslegalforms, which cater to the specific needs in your Murfreesboro Tennessee substitution of collateral situation.

Yes, you can fill out a quit claim deed yourself in Tennessee, but it's essential to understand the legal implications involved. A quit claim deed transfers ownership rights from one party to another, which can have lasting effects on property ownership. If you are unfamiliar with the process or the terms involved, consider using resources available on uslegalforms to ensure accuracy and compliance with the Murfreesboro Tennessee substitution of collateral requirements.

The common fund doctrine in Tennessee allows an attorney to collect fees from a common fund created for the benefit of a group, often seen in class action lawsuits. This legal principle ensures fair compensation for attorneys while protecting the interests of those who benefit from the fund. For issues regarding the Murfreesboro Tennessee Substitution of Collateral, understanding this doctrine may be vital in navigating potential collective claims.