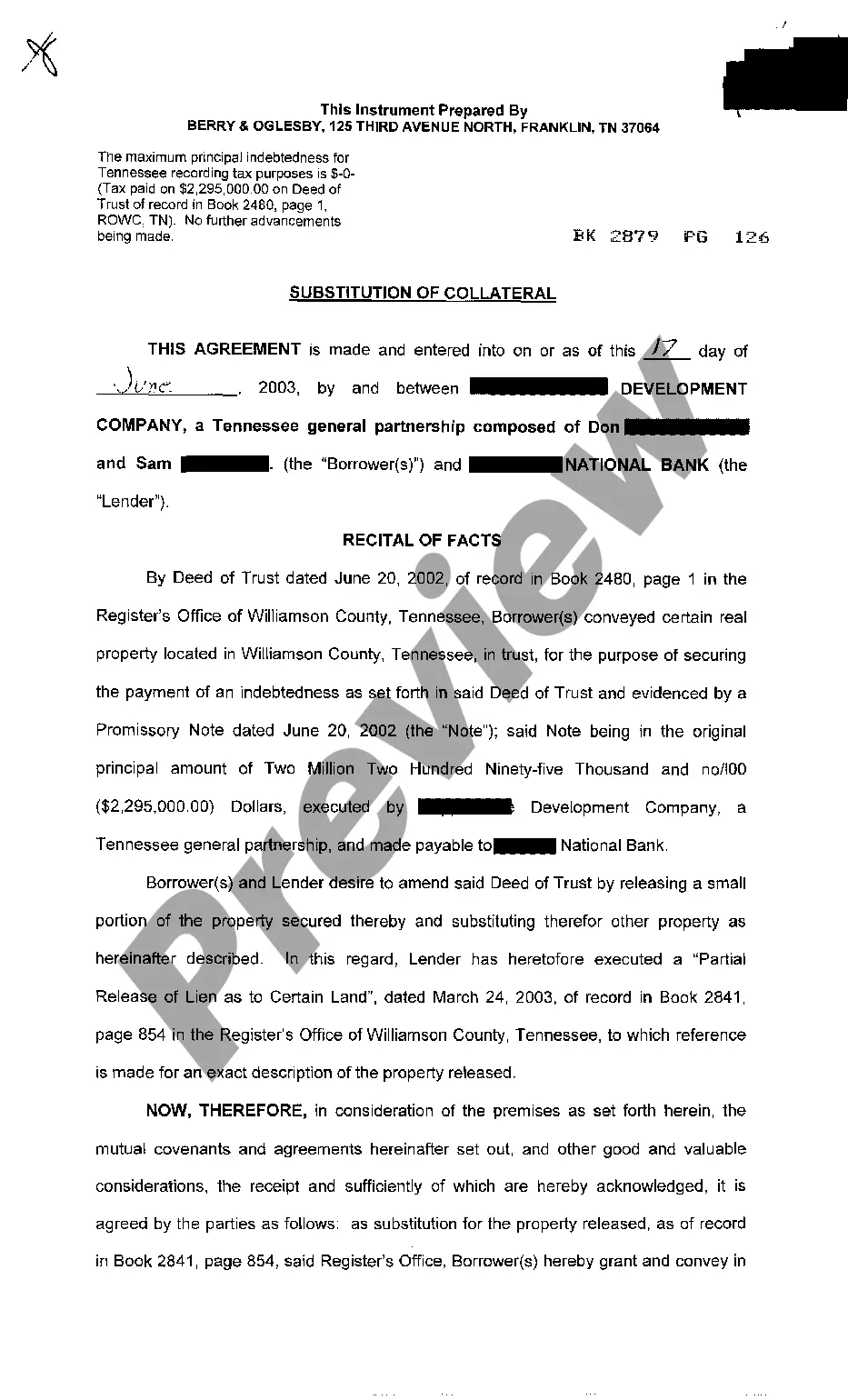

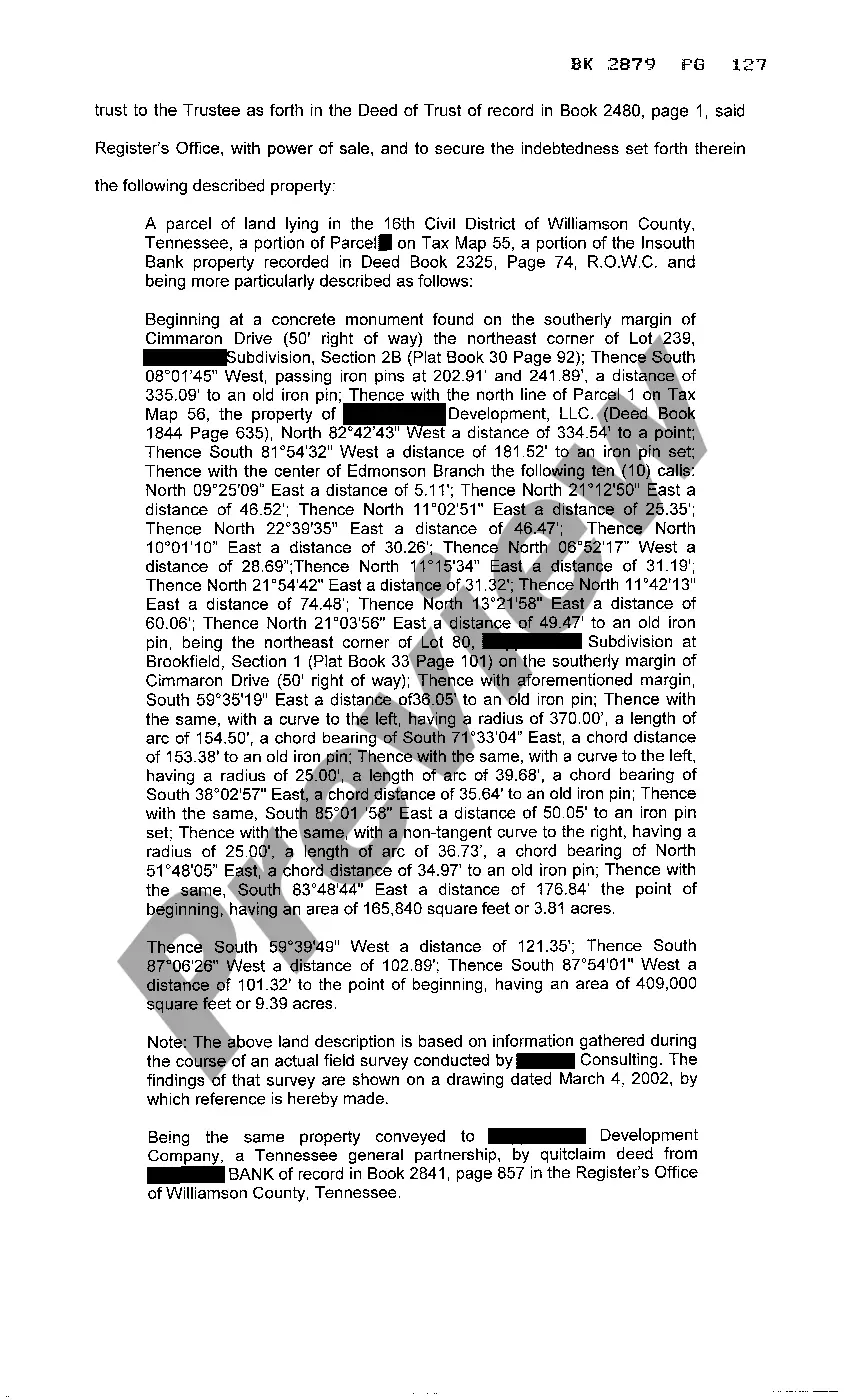

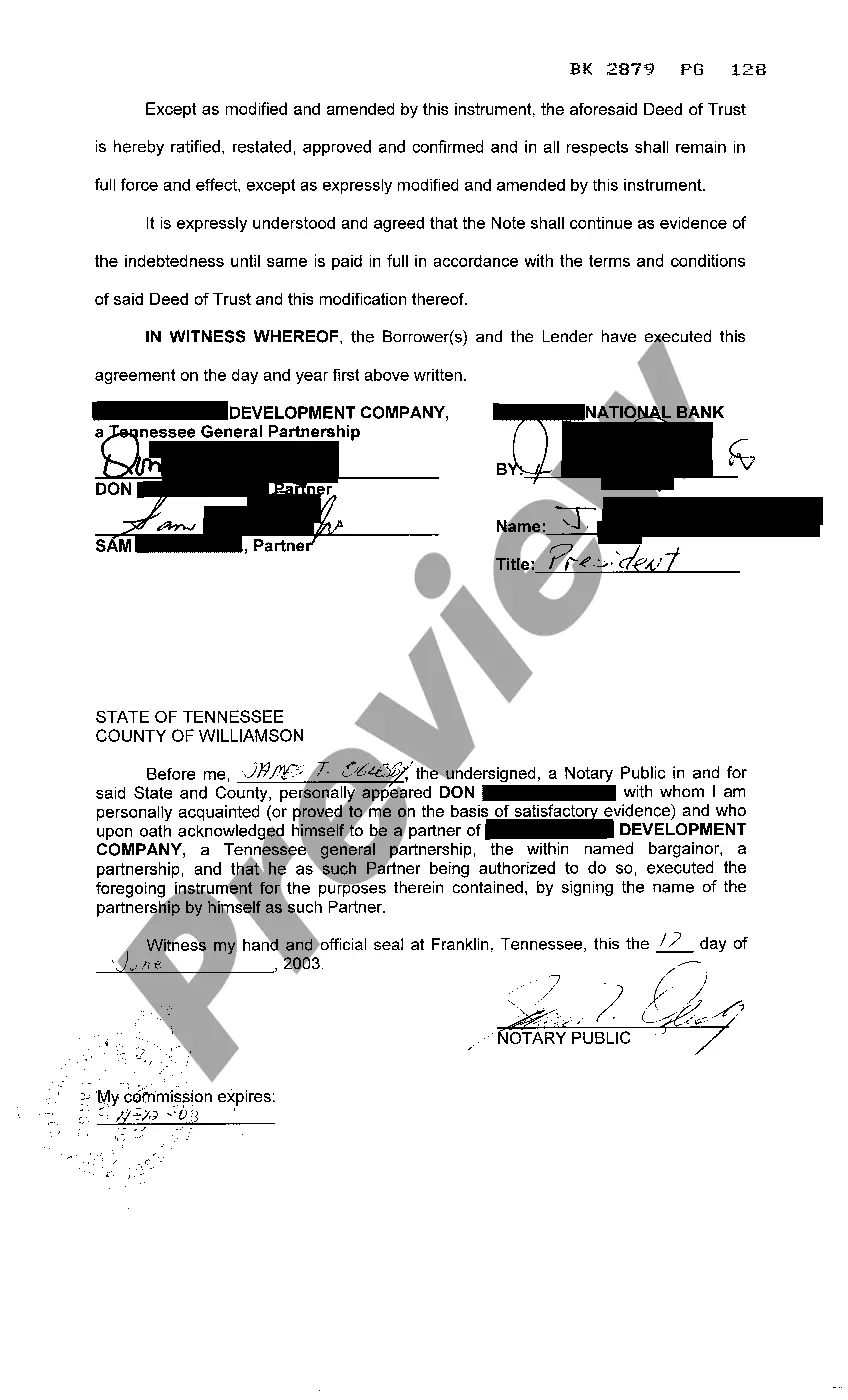

Nashville Tennessee Substitution of Collateral refers to the legal process of replacing one form of collateral with another in a financial agreement. This typically occurs when a borrower wants to substitute the asset that secures a loan or debt with a different asset of equal or higher value. Substitution of collateral is commonly employed in various financial transactions in Nashville, Tennessee, such as mortgages, bank loans, and commercial financing. It is important to note that this process requires the approval of all parties involved and must adhere to the terms and conditions outlined in the original agreement. In the context of Nashville, Tennessee, there are several types of substitution of collateral that may be encountered, including: 1. Real Estate Substitution: This type of collateral substitution involves replacing the existing property used to secure a loan or mortgage with a different property. For example, if a borrower intends to sell their current property and purchase a new one, they may opt for a substitution of collateral to transfer the loan security from the old property to the new one. 2. Vehicle Substitution: In cases where a borrower has pledged a vehicle as collateral for a loan or financing, they may request a substitution of collateral if they wish to replace the current vehicle with another. The new vehicle should meet the lender's criteria for value and ownership. 3. Asset Substitution: Beyond real estate and vehicles, other valuable assets can also be used as collateral in Nashville. These assets may include valuable artwork, jewelry, or even business assets. If a borrower desires to substitute one valuable asset with another, they may need to undergo a substitution of collateral process and meet the lender's requirements. 4. Commercial Collateral Substitution: In commercial financing scenarios, businesses in Nashville may seek a substitution of collateral when they want to replace the collateral securing a loan. This commonly happens when a business undergoes significant changes, such as acquiring new assets or restructuring its operations. The substitution allows the business to continue using the loan while offering alternative security to the lender. In summary, Nashville Tennessee Substitution of Collateral is a legal process that allows borrowers to replace the collateral securing a loan or debt with another asset. This process is used in various financial agreements, including mortgages, bank loans, and commercial financing. The different types of substitution of collateral encountered in Nashville may include real estate, vehicles, valuable assets, and commercial collateral. However, it is important to remember that all parties involved must agree to the substitution, and the terms of the original agreement must be followed.

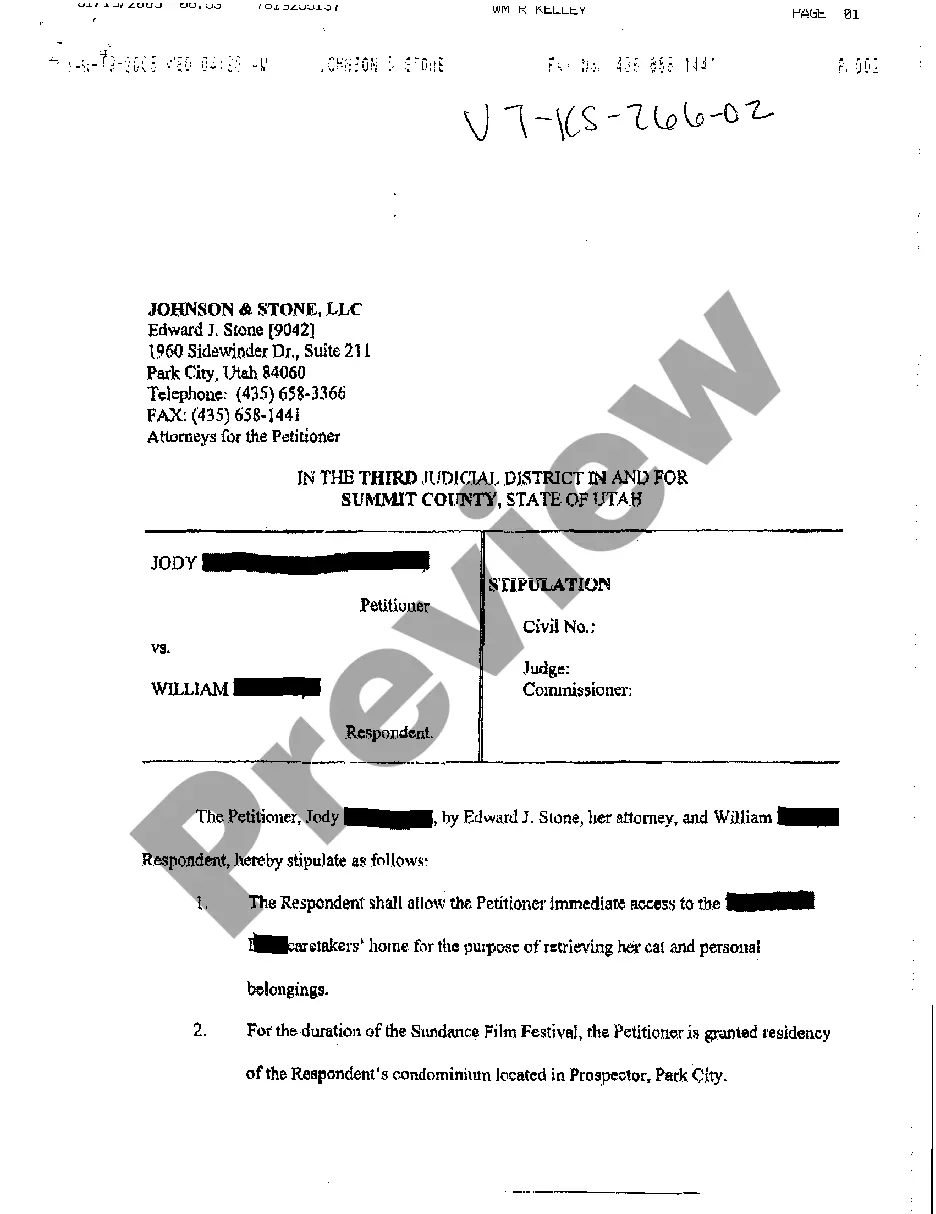

Nashville Tennessee Substitution of Collateral

Description

How to fill out Nashville Tennessee Substitution Of Collateral?

We always want to reduce or prevent legal damage when dealing with nuanced legal or financial affairs. To accomplish this, we apply for legal solutions that, as a rule, are very expensive. Nevertheless, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without turning to a lawyer. We offer access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Nashville Tennessee Substitution of Collateral or any other form quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again in the My Forms tab.

The process is equally effortless if you’re unfamiliar with the website! You can create your account within minutes.

- Make sure to check if the Nashville Tennessee Substitution of Collateral adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Nashville Tennessee Substitution of Collateral would work for your case, you can choose the subscription plan and proceed to payment.

- Then you can download the document in any suitable file format.

For over 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!