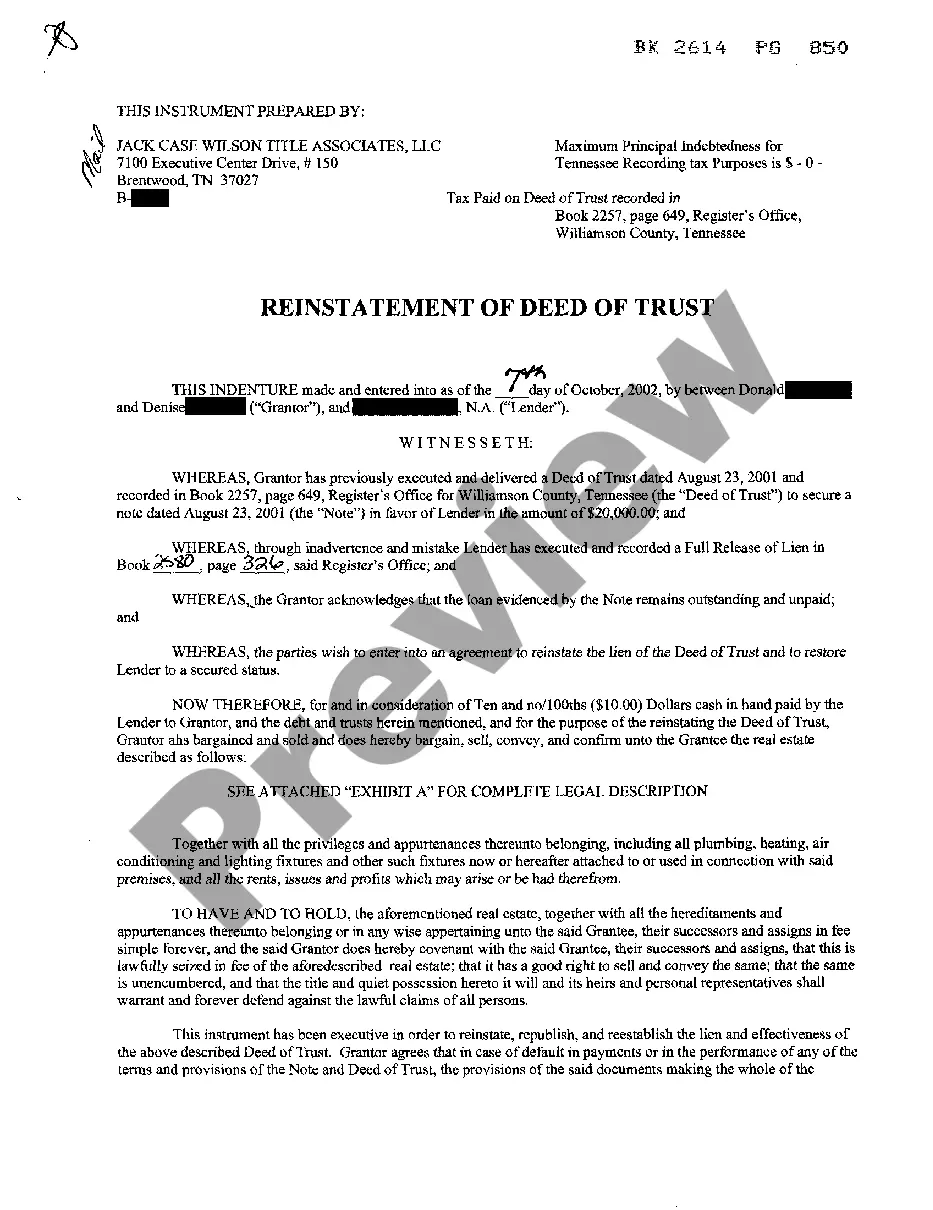

Title: Knoxville Tennessee Reinstatement of Deed of Trust: Understanding the Process and Key Types Introduction: When it comes to real estate transactions, understanding the intricacies of legal instruments such as deeds of trust is crucial. In Knoxville, Tennessee, homeowners may encounter situations where they need to reinstate a deed of trust. This article aims to provide a comprehensive overview of the Knoxville Tennessee reinstatement of deed of trust, including its definition, process, and the different types of reinstatement available. 1. Definition: Reinstatement of Deed of Trust refers to the act of restoring a legally binding agreement between a borrower and a lender after certain terms of the deed of trust, such as mortgage payments, have lapsed or fallen in default. It allows the borrower to make up missed payments and related expenses to reinstate the original terms of the loan. 2. Process: a. Identify default: The borrower should first ascertain if they have defaulted on their mortgage payments or violated any terms of the deed of trust. b. Notification: The lender typically initiates the reinstatement process by sending a Notice of Default (NOD) to the borrower, detailing the missed payments and providing a deadline for reinstatement. c. Reinstatement amount: The lender will calculate the total amount required to reinstate the loan, including missed payments, interest, late fees, and any additional costs incurred. d. Payment arrangements: The borrower has the option to pay the entire reinstatement amount in one lump sum or negotiate a payment plan with the lender. e. Completion: Once the borrower fulfills the reinstatement requirements, the lender will acknowledge the payment and reinstate the deed of trust, restoring the loan to its original terms. 3. Types of Reinstatement: a. Full Reinstatement: This type involves the borrower repaying the total amount owed and any associated fees or charges before the lender's set deadline. b. Partial Reinstatement: In some cases, the lender may allow the borrower to make a partial payment towards the defaulted amount, thereby preventing foreclosure while entering into a formal agreement to pay off the remaining balance over a set period. c. Forbearance Agreement: In situations where the borrower experiences financial hardship, the lender may provide a temporary period of reduced or suspended payments, allowing the borrower to catch up on missed payments gradually. d. Loan Modification: In certain cases, lenders might offer to modify the terms of the original loan, including interest rates, payment amounts, or extending the loan term, to make it more manageable for the borrower. Conclusion: Understanding the Knoxville Tennessee Reinstatement of Deed of Trust is crucial for homeowners facing a potential default on their mortgage payments. By working closely with their lender and knowing the various types of reinstatement available, borrowers can navigate this process effectively, potentially avoiding foreclosure and maintaining homeownership. Seeking legal or financial advice is recommended to ensure the best outcome in reinstating a deed of trust in Knoxville, Tennessee.

Knoxville Tennessee Reinstatement of Deed of Trust

Description

How to fill out Knoxville Tennessee Reinstatement Of Deed Of Trust?

We always strive to minimize or prevent legal issues when dealing with nuanced law-related or financial affairs. To do so, we apply for legal services that, usually, are very costly. However, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based library of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of using services of a lawyer. We provide access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Knoxville Tennessee Reinstatement of Deed of Trust or any other document quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it from within the My Forms tab.

The process is just as easy if you’re unfamiliar with the website! You can register your account in a matter of minutes.

- Make sure to check if the Knoxville Tennessee Reinstatement of Deed of Trust complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the Knoxville Tennessee Reinstatement of Deed of Trust would work for your case, you can choose the subscription plan and proceed to payment.

- Then you can download the document in any available file format.

For over 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!