A Chattanooga Tennessee Credit Shelter Marital Trust, also known as a bypass trust or an A-B trust, is a specialized legal framework used in estate planning to minimize estate taxes and provide financial security for spouses upon the death of one partner. This trust is designed to shelter a portion of the deceased individual's assets from estate taxation, while ensuring that the surviving spouse has access to income and assets during their lifetime. In simple terms, a credit shelter marital trust allows a married couple to take advantage of both of their estate tax exemptions, which effectively doubles the amount of assets that can be transferred to their heirs tax-free. This type of trust is particularly beneficial for couples with substantial assets, as it helps mitigate the potential tax burden on the surviving partner and preserves the couple's legacy. There are two main types of Chattanooga Tennessee Credit Shelter Marital Trusts: 1. A-B Trust: This trust is created upon the death of the first spouse. The deceased partner's assets, up to the federal estate tax exemption limit, get transferred into the credit shelter trust. The surviving spouse can use the income generated from the trust assets and access the principal if needed. Upon the passing of the surviving spouse, the remaining assets in the trust pass to the designated beneficiaries, typically the children or other heirs. 2. Disclaimer Trust: This type of trust offers flexibility in estate planning. When the first spouse dies, the surviving spouse has the option to disclaim or refuse a portion of the deceased's assets, allowing them to pass into the credit shelter trust. The disclaimer trust provides the same tax-saving benefits as the A-B trust, giving the surviving spouse access to the trust assets while still providing for the ultimate distribution to the beneficiaries designated by the couple. Chattanooga Tennessee Credit Shelter Marital Trusts require careful consideration and guidance from experienced estate planning attorneys or financial advisors. The specific rules and regulations surrounding these trusts may vary, and it is crucial to tailor the trust structure to fit individual circumstances and meet legal requirements. In conclusion, a Chattanooga Tennessee Credit Shelter Marital Trust is a valuable strategy for married couples to minimize estate taxes and secure the financial well-being of the surviving spouse and future generations. The A-B trust and disclaimer trust are two common variations of this trust, each offering unique benefits based on the couple's goals and preferences. Professional assistance is critical in establishing and managing these trusts to ensure the desired outcomes and maximum tax efficiency.

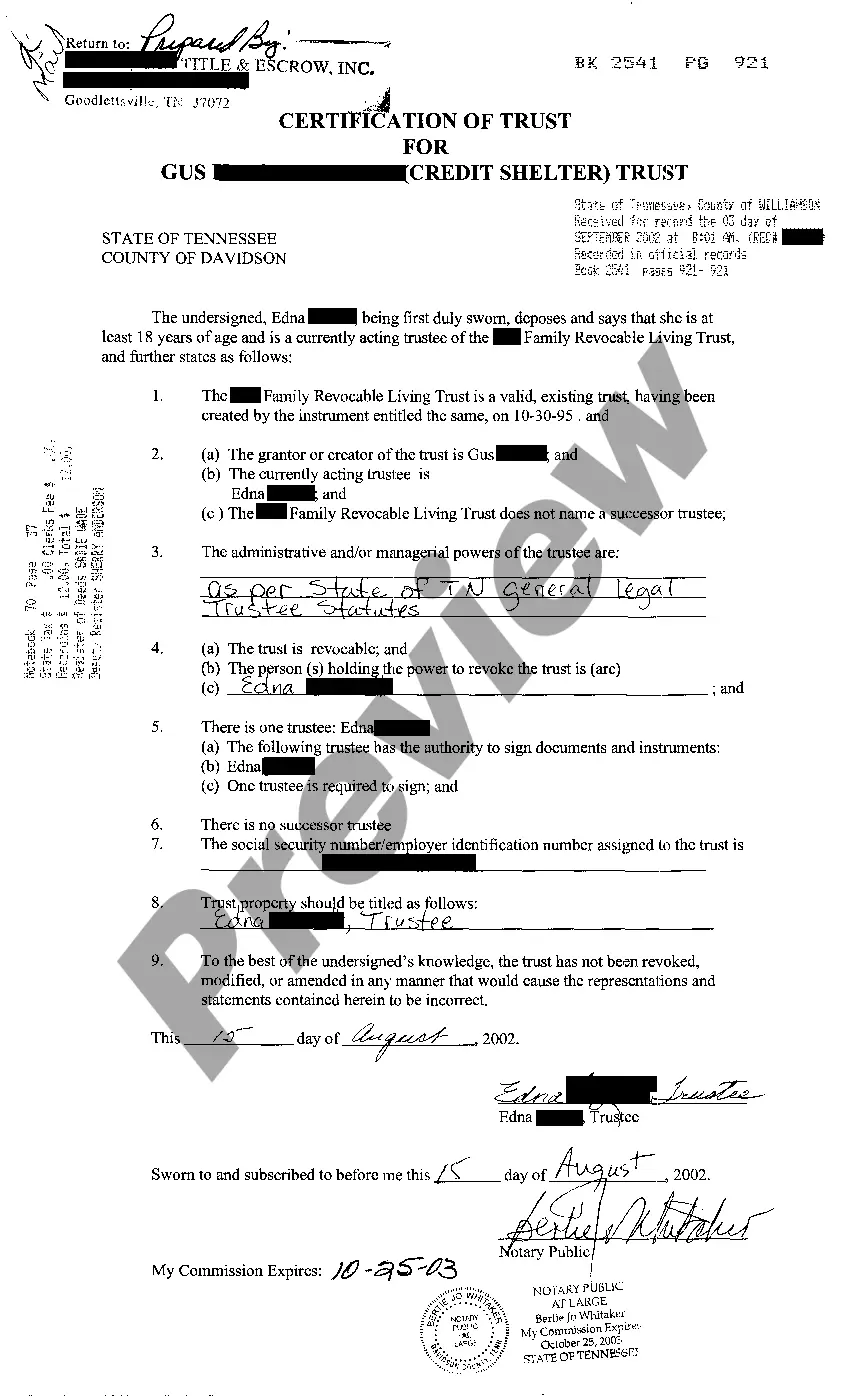

Chattanooga Tennessee Credit Shelter Marital Trust

Description

How to fill out Chattanooga Tennessee Credit Shelter Marital Trust?

We always want to minimize or prevent legal damage when dealing with nuanced legal or financial matters. To accomplish this, we sign up for attorney solutions that, usually, are very expensive. Nevertheless, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based catalog of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of turning to an attorney. We provide access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Chattanooga Tennessee Credit Shelter Marital Trust or any other document quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again in the My Forms tab.

The process is equally effortless if you’re new to the website! You can create your account within minutes.

- Make sure to check if the Chattanooga Tennessee Credit Shelter Marital Trust complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Chattanooga Tennessee Credit Shelter Marital Trust is proper for you, you can choose the subscription option and make a payment.

- Then you can download the form in any available file format.

For more than 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!