A Knoxville Tennessee Credit Shelter Marital Trust, also known as a bypass trust or A-B trust, is a legal and financial instrument designed to minimize estate taxes for married couples residing in Knoxville, Tennessee. With the objective of maximizing the utilization of federal estate tax exemptions, this trust structure allows couples to utilize both spouses' exemptions while preserving assets for future generations. In a Credit Shelter Marital Trust, upon the death of one spouse, a portion of the deceased spouse's assets — typically up to the estate tax exemption amount — are transferred into the trust. This amount is often determined by the federal tax laws in effect at the time of the spouse's demise. These assets are sheltered from estate taxes, hence the name "Credit Shelter." The surviving spouse is then entitled to receive income generated by the trust and, in some cases, may also have access to the principal. However, the assets within the trust are not included in the surviving spouse's estate for estate tax purposes. There are a few specific types of Knoxville Tennessee Credit Shelter Marital Trusts: 1. Traditional Credit Shelter Marital Trust: This type of trust provides income to the surviving spouse while preserving the principal for the next generation. The principal is typically distributed to beneficiaries, such as children or grandchildren, upon the death of the surviving spouse. 2. Qualified Terminable Interest Property (TIP) Trust: A TIP trust ensures that the surviving spouse receives income from the trust throughout their lifetime. After the surviving spouse's death, the principal is distributed according to the deceased spouse's wishes. This type of trust offers greater flexibility in determining the distribution of assets. 3. Generation-Skipping Credit Shelter Marital Trust: This trust is designed to protect assets for multiple generations while still providing income to the surviving spouse. It allows for the skipping of estate taxes when transferring assets to grandchildren or other younger beneficiaries. It's important to note that the details, rules, and regulations surrounding Knoxville Tennessee Credit Shelter Marital Trusts may vary based on state laws and individual circumstances. Consulting with an experienced estate planning attorney or financial advisor is highly recommended ensuring compliance with specific Tennessee laws and optimize the benefits of this trust structure.

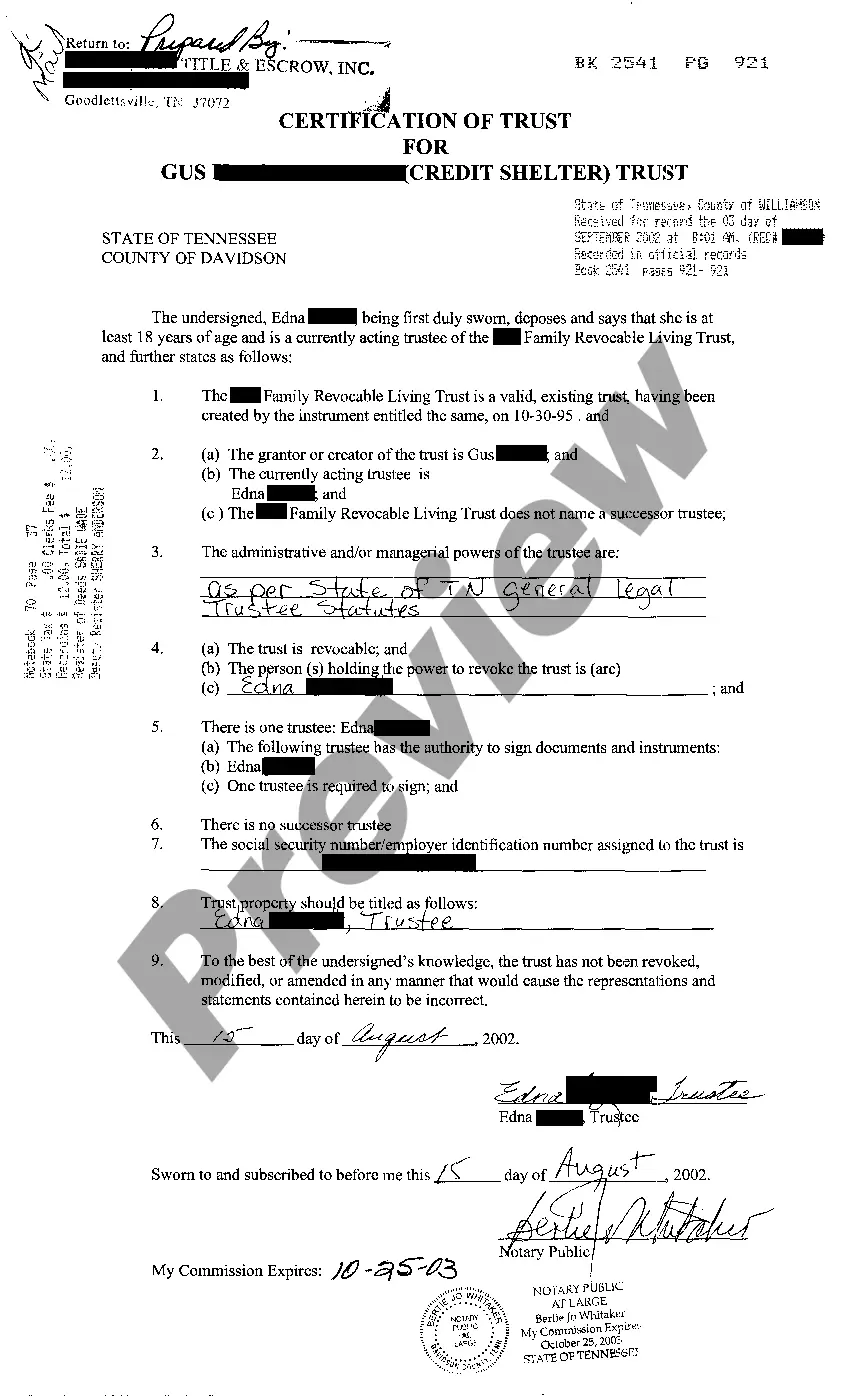

Knoxville Tennessee Credit Shelter Marital Trust

Description

How to fill out Knoxville Tennessee Credit Shelter Marital Trust?

Regardless of social or professional status, filling out law-related documents is an unfortunate necessity in today’s world. Very often, it’s practically impossible for a person without any law background to draft such paperwork from scratch, mainly due to the convoluted terminology and legal subtleties they involve. This is where US Legal Forms can save the day. Our platform provides a massive catalog with more than 85,000 ready-to-use state-specific documents that work for almost any legal situation. US Legal Forms also is a great resource for associates or legal counsels who want to save time using our DYI forms.

No matter if you want the Knoxville Tennessee Credit Shelter Marital Trust or any other document that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Knoxville Tennessee Credit Shelter Marital Trust quickly using our trustworthy platform. If you are presently a subscriber, you can proceed to log in to your account to get the needed form.

Nevertheless, if you are unfamiliar with our platform, make sure to follow these steps before obtaining the Knoxville Tennessee Credit Shelter Marital Trust :

- Be sure the template you have found is good for your location since the regulations of one state or area do not work for another state or area.

- Review the document and read a quick description (if provided) of scenarios the document can be used for.

- In case the one you selected doesn’t meet your requirements, you can start again and search for the suitable form.

- Click Buy now and choose the subscription option that suits you the best.

- Access an account {using your login information or register for one from scratch.

- Select the payment method and proceed to download the Knoxville Tennessee Credit Shelter Marital Trust once the payment is done.

You’re all set! Now you can proceed to print the document or fill it out online. Should you have any issues locating your purchased documents, you can quickly find them in the My Forms tab.

Regardless of what case you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.