The Memphis Tennessee Credit Shelter Marital Trust is a legal and financial arrangement that provides individuals with the opportunity to protect their assets for future generations while also ensuring financial security for their surviving spouse. This type of trust is commonly used in estate planning and allows individuals to minimize estate taxes upon their passing. The purpose of the Memphis Tennessee Credit Shelter Marital Trust is to maximize the use of both spouses' estate tax exemptions. The trust allows the first spouse to pass the assets into the trust upon their death, with the surviving spouse benefiting from the income generated by these assets. The surviving spouse is typically the primary beneficiary of this trust, ensuring their financial well-being and providing them with a source of income. The credit shelter aspect of the trust utilizes the federal estate tax exemption limit, which allows each individual to pass a certain amount of assets to their beneficiaries without incurring estate taxes. By utilizing this exemption, the Memphis Tennessee Credit Shelter Marital Trust can help protect a significant portion of the estate from taxation. There are different types of Memphis Tennessee Credit Shelter Marital Trusts that individuals may consider, depending on their specific needs and goals: 1. A-B trust: This is the most common type of Credit Shelter Marital Trust. It involves splitting the assets of both spouses into two separate trusts upon the death of the first spouse. The credit shelter trust holds the maximum amount that can pass tax-free, while the marital trust holds the remaining assets that can qualify for the unlimited marital deduction. 2. TIP trust: This stands for Qualified Terminable Interest Property trust. It allows the deceased spouse to control the distribution of their assets to the surviving spouse, even after their passing. This trust ensures that the assets eventually pass to the intended beneficiaries, such as the couple's children or other designated individuals. 3. Disclaimer trust: A disclaimer trust allows the surviving spouse to disclaim or refuse a portion of the assets they would otherwise inherit. By disclaiming part of the assets, these can pass into the credit shelter trust, maximizing the use of the estate tax exemption. Overall, the Memphis Tennessee Credit Shelter Marital Trust is an effective estate planning tool for individuals seeking to minimize estate taxes, protect their assets, and provide for their surviving spouse. It is crucial to consult with an experienced estate planning attorney to determine the specific type of trust that aligns with individual circumstances and goals.

Memphis Tennessee Credit Shelter Marital Trust

State:

Tennessee

City:

Memphis

Control #:

TN-E305

Format:

PDF

Instant download

This form is available by subscription

Description

Credit Shelter Marital Trust

The Memphis Tennessee Credit Shelter Marital Trust is a legal and financial arrangement that provides individuals with the opportunity to protect their assets for future generations while also ensuring financial security for their surviving spouse. This type of trust is commonly used in estate planning and allows individuals to minimize estate taxes upon their passing. The purpose of the Memphis Tennessee Credit Shelter Marital Trust is to maximize the use of both spouses' estate tax exemptions. The trust allows the first spouse to pass the assets into the trust upon their death, with the surviving spouse benefiting from the income generated by these assets. The surviving spouse is typically the primary beneficiary of this trust, ensuring their financial well-being and providing them with a source of income. The credit shelter aspect of the trust utilizes the federal estate tax exemption limit, which allows each individual to pass a certain amount of assets to their beneficiaries without incurring estate taxes. By utilizing this exemption, the Memphis Tennessee Credit Shelter Marital Trust can help protect a significant portion of the estate from taxation. There are different types of Memphis Tennessee Credit Shelter Marital Trusts that individuals may consider, depending on their specific needs and goals: 1. A-B trust: This is the most common type of Credit Shelter Marital Trust. It involves splitting the assets of both spouses into two separate trusts upon the death of the first spouse. The credit shelter trust holds the maximum amount that can pass tax-free, while the marital trust holds the remaining assets that can qualify for the unlimited marital deduction. 2. TIP trust: This stands for Qualified Terminable Interest Property trust. It allows the deceased spouse to control the distribution of their assets to the surviving spouse, even after their passing. This trust ensures that the assets eventually pass to the intended beneficiaries, such as the couple's children or other designated individuals. 3. Disclaimer trust: A disclaimer trust allows the surviving spouse to disclaim or refuse a portion of the assets they would otherwise inherit. By disclaiming part of the assets, these can pass into the credit shelter trust, maximizing the use of the estate tax exemption. Overall, the Memphis Tennessee Credit Shelter Marital Trust is an effective estate planning tool for individuals seeking to minimize estate taxes, protect their assets, and provide for their surviving spouse. It is crucial to consult with an experienced estate planning attorney to determine the specific type of trust that aligns with individual circumstances and goals.

How to fill out Memphis Tennessee Credit Shelter Marital Trust?

Finding authenticated templates related to your regional regulations can be challenging unless you access the US Legal Forms repository.

This is an online resource containing over 85,000 legal documents for both personal and professional requirements, as well as various real-life scenarios.

All the files are clearly organized by their area of application and jurisdiction, making the search for the Memphis Tennessee Credit Shelter Marital Trust as straightforward and simple as possible.

Maintaining documentation organized and compliant with legal standards is crucial. Take advantage of the US Legal Forms repository to always have vital document templates readily available for any requirements!

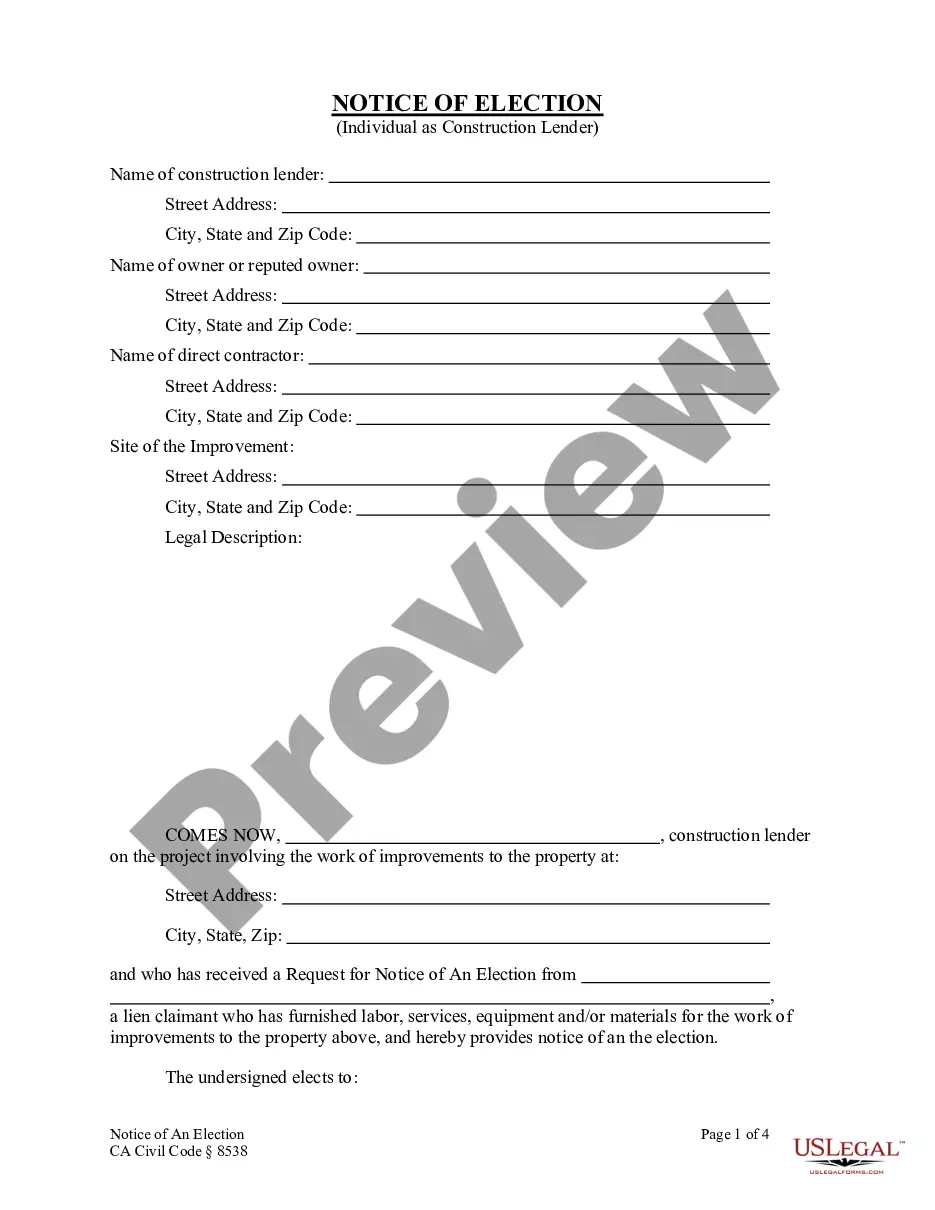

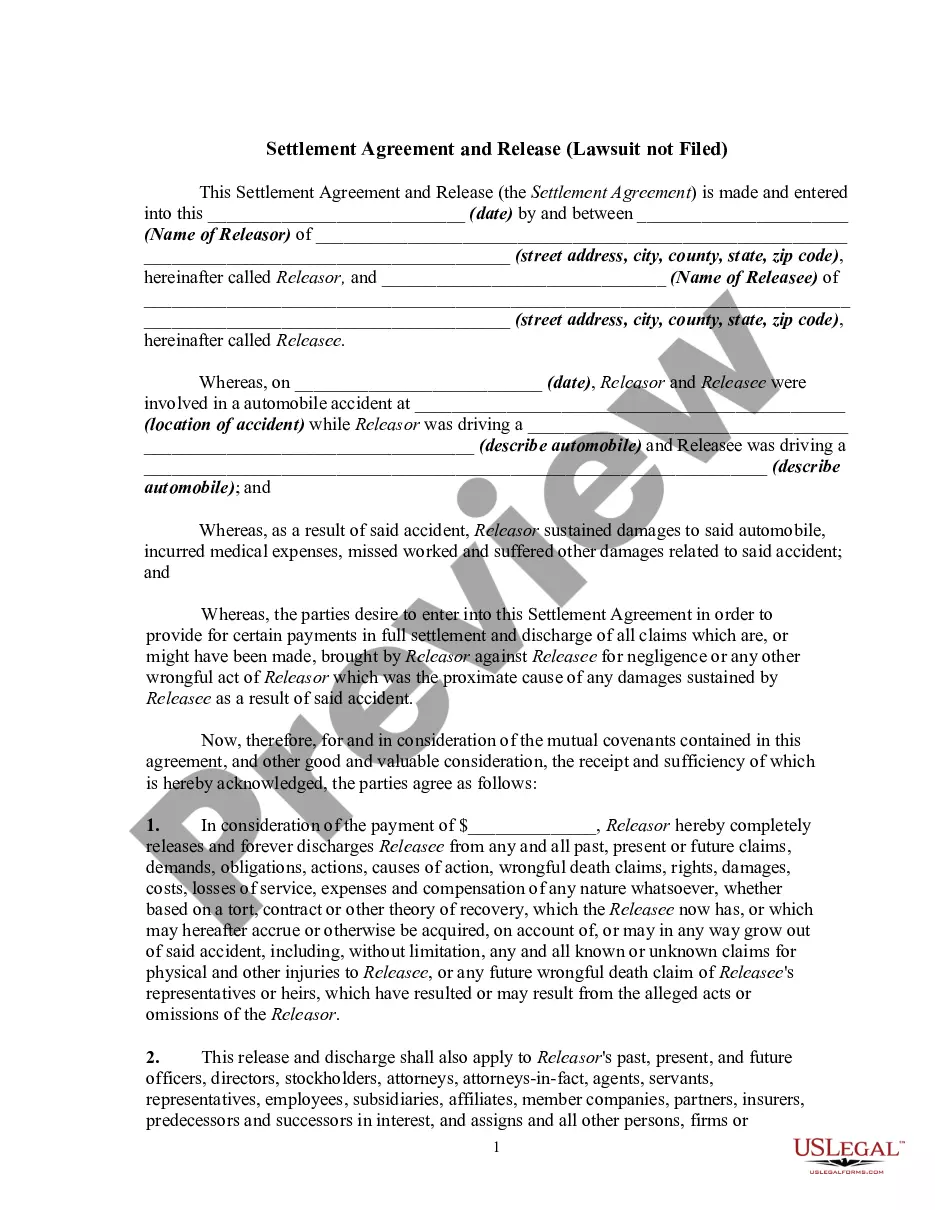

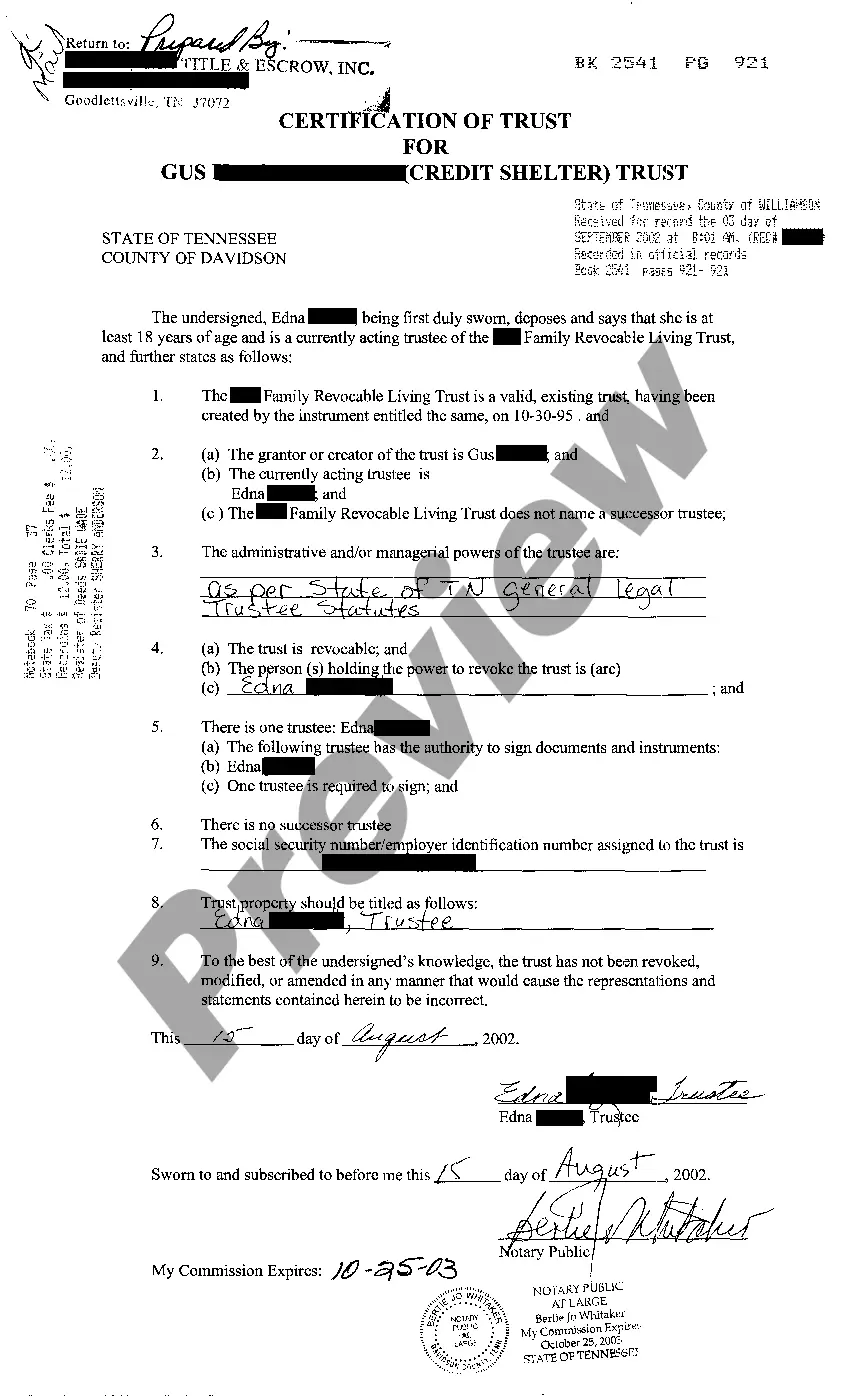

- Review the Preview mode and document description.

- Ensure you’ve selected the correct one that fulfills your needs and entirely aligns with your local jurisdiction standards.

- Seek additional templates, if necessary.

- If you discover any discrepancies, use the Search tab above to find the appropriate one.

- If it meets your criteria, proceed to the following step.