Murfreesboro Tennessee Credit Shelter Marital Trust, also known as the Bypass Trust or Family Trust, is an estate planning tool used by married couples to maximize the use of their federal estate tax exemption. This type of trust allows a surviving spouse to utilize the exemption amount of the deceased spouse, thereby reducing potential estate taxes upon the death of the surviving spouse. The Murfreesboro Tennessee Credit Shelter Marital Trust works by having the deceased spouse's assets, up to the value of their estate tax exemption, placed in a trust upon their passing. These assets are then held and managed for the benefit of the surviving spouse during their lifetime. Upon the death of the surviving spouse, the assets held in the trust pass on to the designated beneficiaries, such as children or other family members, bypassing their estate and potentially reducing the overall estate tax liability. Some key features and benefits of Murfreesboro Tennessee Credit Shelter Marital Trust include: 1. Estate Tax Exemption Maximization: By using this trust, married couples can fully utilize both spouses' estate tax exemptions, effectively doubling the amount that can be passed on tax-free to their beneficiaries. 2. Asset Protection: Assets placed in the trust are protected from potential creditors, lawsuits, and future estate tax changes, ensuring their preservation and benefit for future generations. 3. Flexibility of Distribution: The trust document can be customized to specify how the trust assets should be distributed upon the surviving spouse's death, allowing for specific instructions regarding beneficiaries and ensuring the assets are distributed according to the couple's wishes. 4. Controlling Future Beneficiaries: In cases where blended families exist or specific considerations need to be made, this trust can provide an effective means of controlling the ultimate distribution of assets, ensuring they are protected and distributed in line with the couple's intentions. It's important to note that while the Murfreesboro Tennessee Credit Shelter Marital Trust can be highly beneficial in estate planning, it requires careful consideration and guidance from a professional attorney or financial advisor. Each individual's situation is unique, and the trust's creation must align with their specific goals and objectives. In summary, the Murfreesboro Tennessee Credit Shelter Marital Trust is a valuable estate planning tool that enables married couples to maximize their estate tax exemptions and ensure the preservation and efficient transfer of their assets to future generations.

Murfreesboro Tennessee Credit Shelter Marital Trust

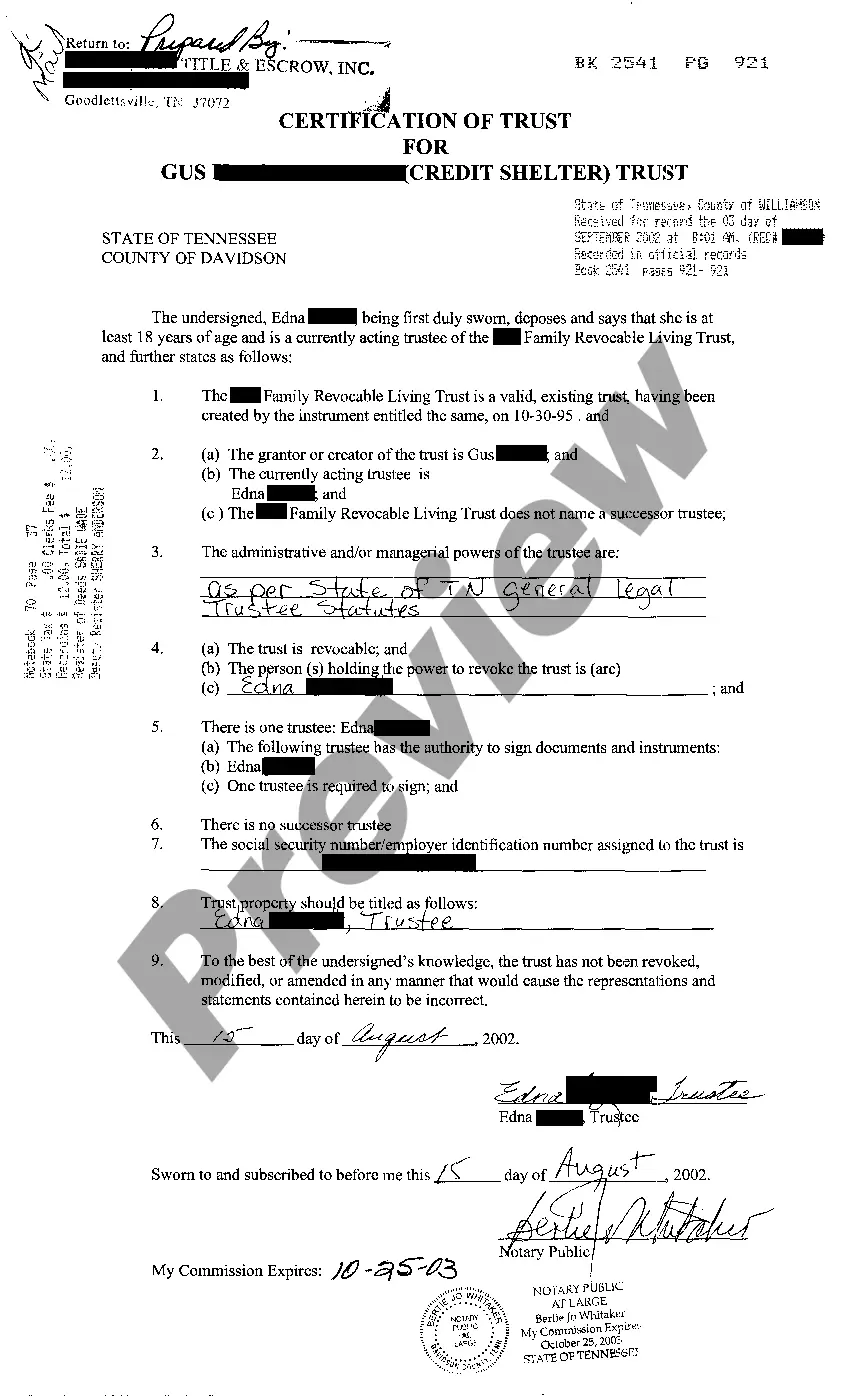

Description

How to fill out Murfreesboro Tennessee Credit Shelter Marital Trust?

If you are looking for a valid form, it’s impossible to find a more convenient service than the US Legal Forms website – probably the most comprehensive libraries on the internet. With this library, you can get a huge number of form samples for company and personal purposes by types and regions, or keywords. With the advanced search option, getting the most recent Murfreesboro Tennessee Credit Shelter Marital Trust is as easy as 1-2-3. Furthermore, the relevance of each document is confirmed by a team of professional attorneys that regularly review the templates on our website and revise them according to the most recent state and county demands.

If you already know about our system and have an account, all you should do to get the Murfreesboro Tennessee Credit Shelter Marital Trust is to log in to your account and click the Download button.

If you utilize US Legal Forms for the first time, just follow the guidelines below:

- Make sure you have discovered the sample you need. Check its description and utilize the Preview function to check its content. If it doesn’t meet your requirements, utilize the Search option at the top of the screen to discover the proper record.

- Affirm your decision. Click the Buy now button. After that, pick the preferred pricing plan and provide credentials to sign up for an account.

- Make the transaction. Make use of your bank card or PayPal account to finish the registration procedure.

- Receive the template. Select the format and save it to your system.

- Make modifications. Fill out, edit, print, and sign the acquired Murfreesboro Tennessee Credit Shelter Marital Trust .

Each template you save in your account does not have an expiry date and is yours forever. You always have the ability to access them using the My Forms menu, so if you need to have an additional copy for enhancing or printing, feel free to return and export it once again whenever you want.

Make use of the US Legal Forms extensive library to gain access to the Murfreesboro Tennessee Credit Shelter Marital Trust you were seeking and a huge number of other professional and state-specific templates on a single website!