Nashville Tennessee Credit Shelter Marital Trust, also known as a bypass trust or an A-B trust, is a crucial estate planning tool used by married couples in order to minimize estate taxes and protect assets for future generations. This legal arrangement establishes a trust that allows individuals to utilize the maximum federal estate tax exemption available. The primary purpose of a Nashville Tennessee Credit Shelter Marital Trust is to make sure that both spouses can take full advantage of their estate tax exemptions by maximizing the amount of assets that can be transferred to their loved ones tax-free. In this type of trust, couples can leave an amount equal to the federal estate tax exemption in a trust for the benefit of their surviving spouse while still ensuring that the assets ultimately pass to other designated beneficiaries such as their children or grandchildren. There are different types of Nashville Tennessee Credit Shelter Marital Trusts, including: 1. Traditional A-B Trust: This trust is typically established for couples whose combined estates exceed the federal estate tax exemption. It separates the assets into two shares, with one share being placed in the credit shelter trust upon the death of the first spouse, and the other share passing directly to the surviving spouse. 2. Disclaimer A-B Trust: This type of trust allows the surviving spouse to "disclaim" a portion of the deceased spouse's assets, diverting them into the credit shelter trust. By disclaiming these assets, the surviving spouse can prevent them from being subject to estate taxes, benefitting from a higher exemption amount. 3. TIP Trust: The Qualified Terminable Interest Property Trust allows the spouse to receive income from the trust during their lifetime while ensuring that the remaining assets in the trust go to the beneficiaries chosen by the deceased spouse. 4. Portability Trust: With the introduction of the portability provision, couples have the option to transfer the unused estate tax exemption of the deceased spouse to the surviving spouse. This allows the surviving spouse to use both their own exemption and the deceased spouse's exemption, effectively doubling the tax-free transfer amount. Setting up a Nashville Tennessee Credit Shelter Marital Trust requires careful consideration of individual circumstances, estate size, and specific estate planning goals. Consulting with an experienced estate planning attorney familiar with Tennessee laws is crucial to determine the most suitable type of trust and ensure compliance with all legal requirements. This trust can provide peace of mind for couples looking to safeguard their assets and minimize estate tax burdens for future generations.

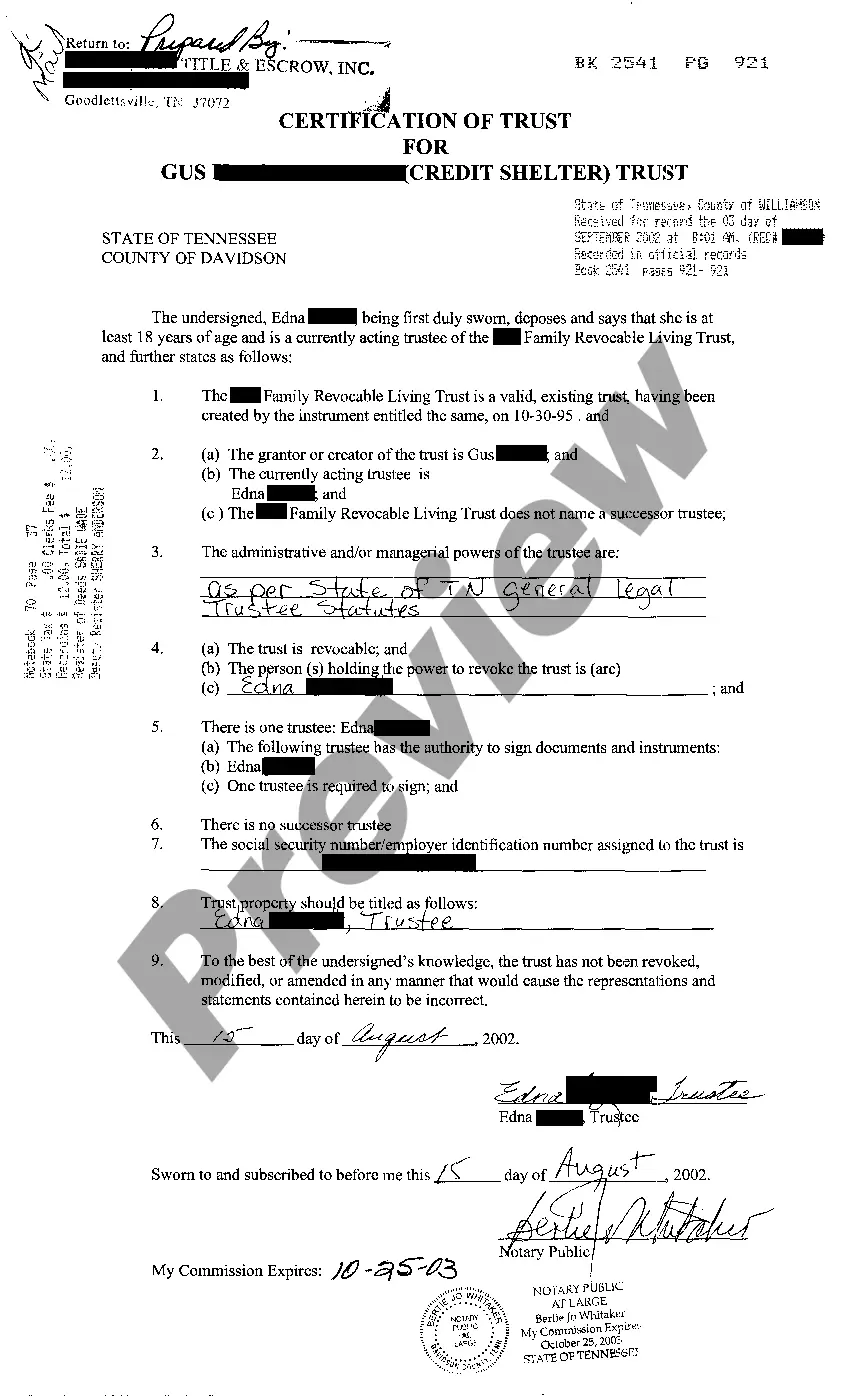

Nashville Tennessee Credit Shelter Marital Trust

Description

How to fill out Nashville Tennessee Credit Shelter Marital Trust?

Do you need a trustworthy and affordable legal forms provider to buy the Nashville Tennessee Credit Shelter Marital Trust ? US Legal Forms is your go-to choice.

Whether you need a simple arrangement to set regulations for cohabitating with your partner or a set of documents to advance your divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and frameworked based on the requirements of specific state and county.

To download the document, you need to log in account, find the required template, and click the Download button next to it. Please keep in mind that you can download your previously purchased document templates anytime from the My Forms tab.

Are you new to our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Nashville Tennessee Credit Shelter Marital Trust conforms to the laws of your state and local area.

- Read the form’s description (if provided) to find out who and what the document is good for.

- Start the search over in case the template isn’t good for your specific situation.

Now you can register your account. Then select the subscription plan and proceed to payment. As soon as the payment is done, download the Nashville Tennessee Credit Shelter Marital Trust in any provided file format. You can return to the website when you need and redownload the document free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about wasting hours researching legal paperwork online for good.