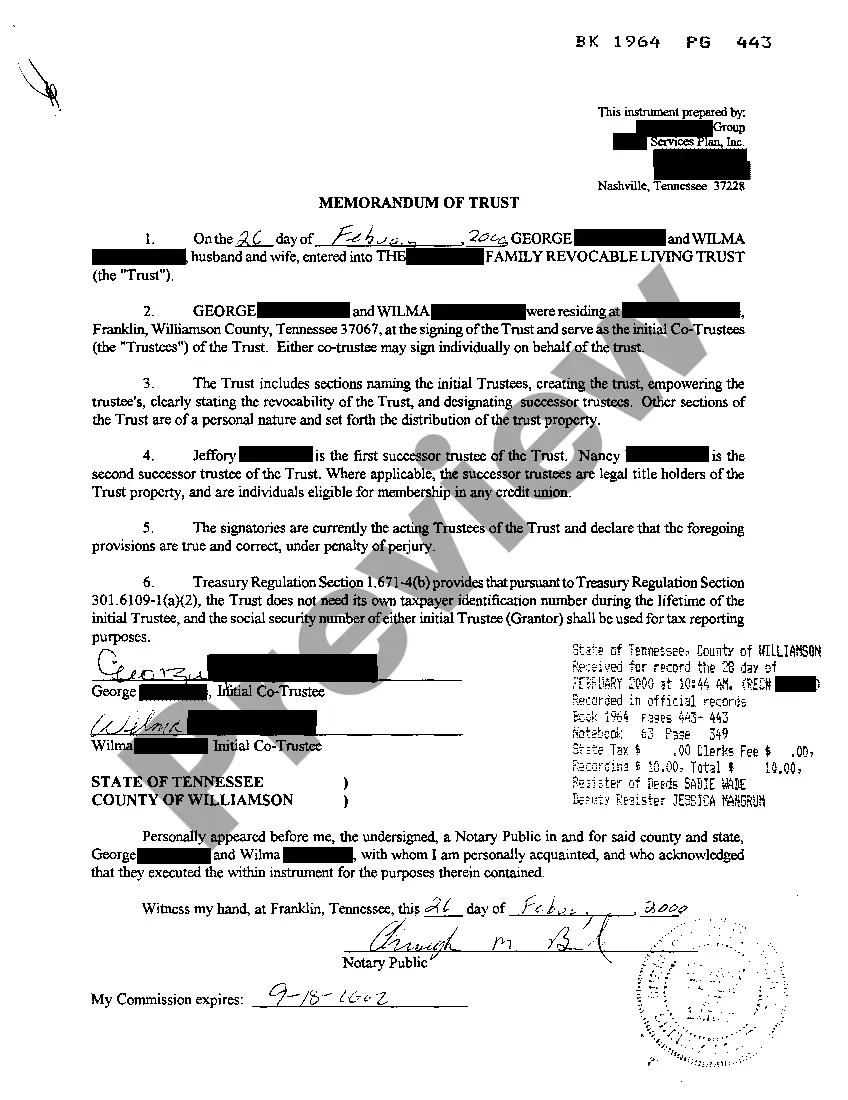

The Memphis Tennessee Memorandum of Trust is a legal document that outlines the establishment and function of a trust in Memphis, Tennessee. It serves as a written record of the essential elements and terms of the trust. A trust is typically created to manage and protect assets, ensuring their distribution according to the wishes of the settler (the person creating the trust). The Memorandum of Trust contains vital information such as the name of the trust, the date it was established, and the names of the beneficiaries who will benefit from the trust assets. It also details the powers and responsibilities of the trustees, who are appointed to manage the trust funds and ensure they are used for the benefit of the beneficiaries. Different types of Memphis Tennessee Memorandum of Trust can be created depending on the specific needs and objectives of the settler. Some common types include: 1. Revocable Trust: This type of trust allows the settler to make changes or revoke the trust during their lifetime. It provides flexibility and control, and assets held in a revocable trust are generally not subject to probate. 2. Irrevocable Trust: Once the assets are transferred into this type of trust, the settler typically cannot modify or revoke it without the consent of the beneficiaries. Irrevocable trusts often have tax advantages and can protect assets from creditors. 3. Charitable Trust: This trust is established to support charitable organizations or causes. It allows for the distribution of trust assets to designated charities while providing potential tax benefits to the settler. 4. Special Needs Trust: This type of trust is designed to provide support and resources to individuals with special needs or disabilities. It aims to protect the individual's eligibility for government programs while supplementing their care. 5. Testamentary Trust: Created through a person's will, this trust becomes effective upon their death. It allows for the distribution of assets according to the terms specified in the will, often used to provide for minor children or beneficiaries with specific needs. These are just a few examples of the various types of trusts that can have a corresponding Memphis Tennessee Memorandum of Trust. Each trust type has its own specific requirements, rules, and advantages, depending on the settler's objectives, asset types, and intended beneficiaries. It is crucial to consult with an attorney well-versed in estate planning and trust law to ensure compliance with applicable laws and to achieve the desired outcomes.

Memphis Tennessee Memorandum of Trust

Description

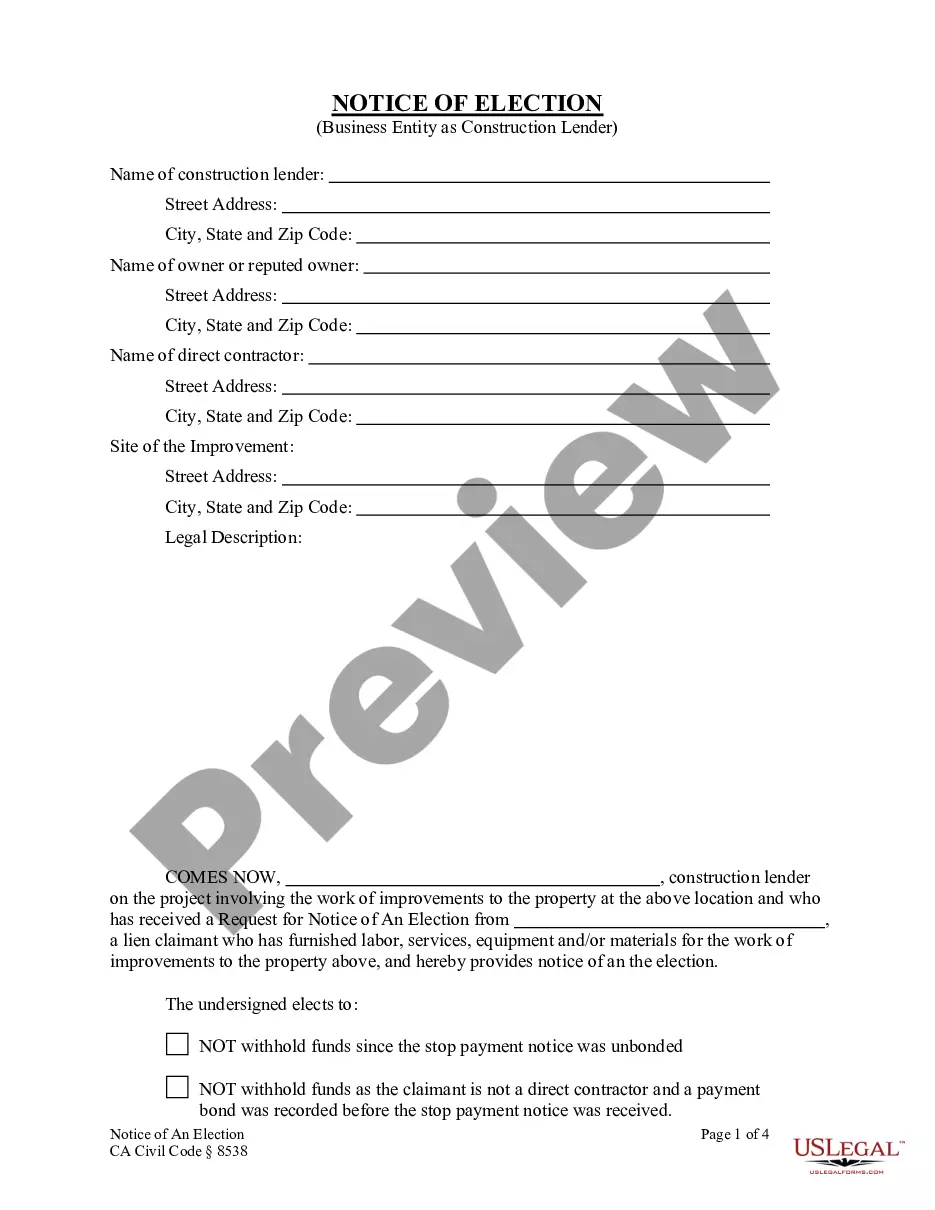

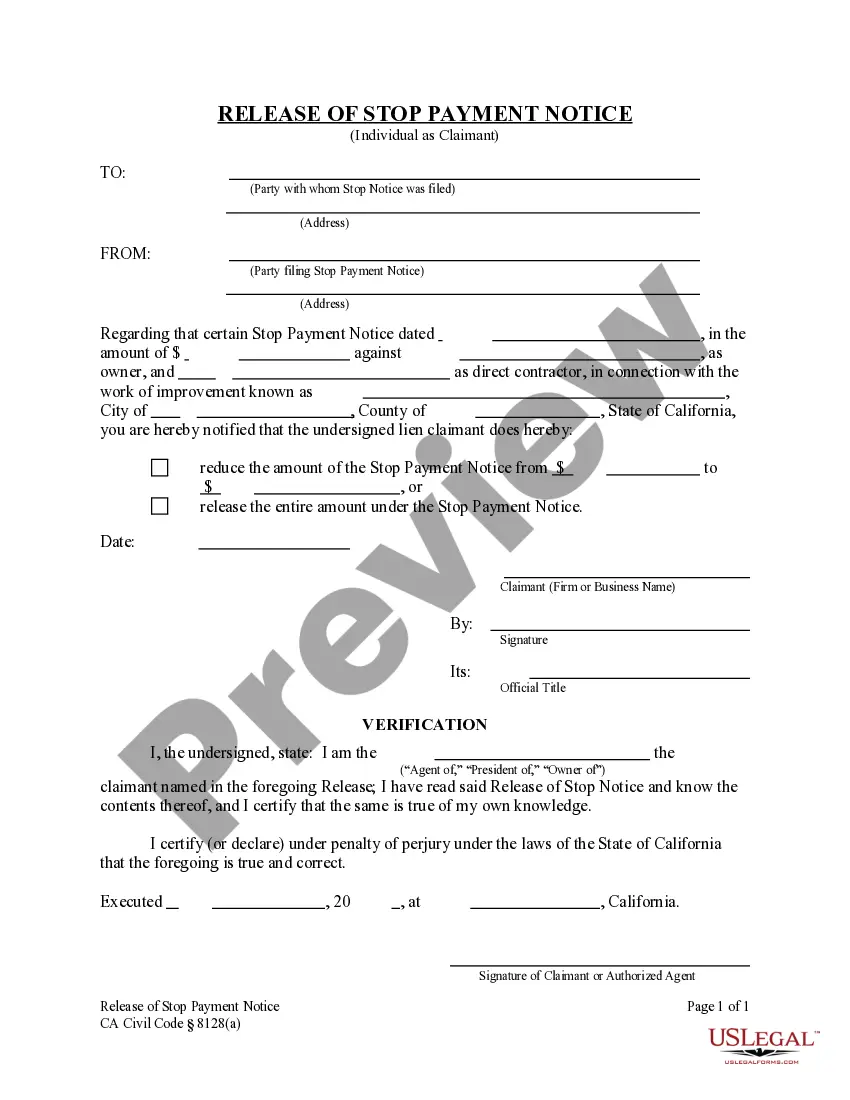

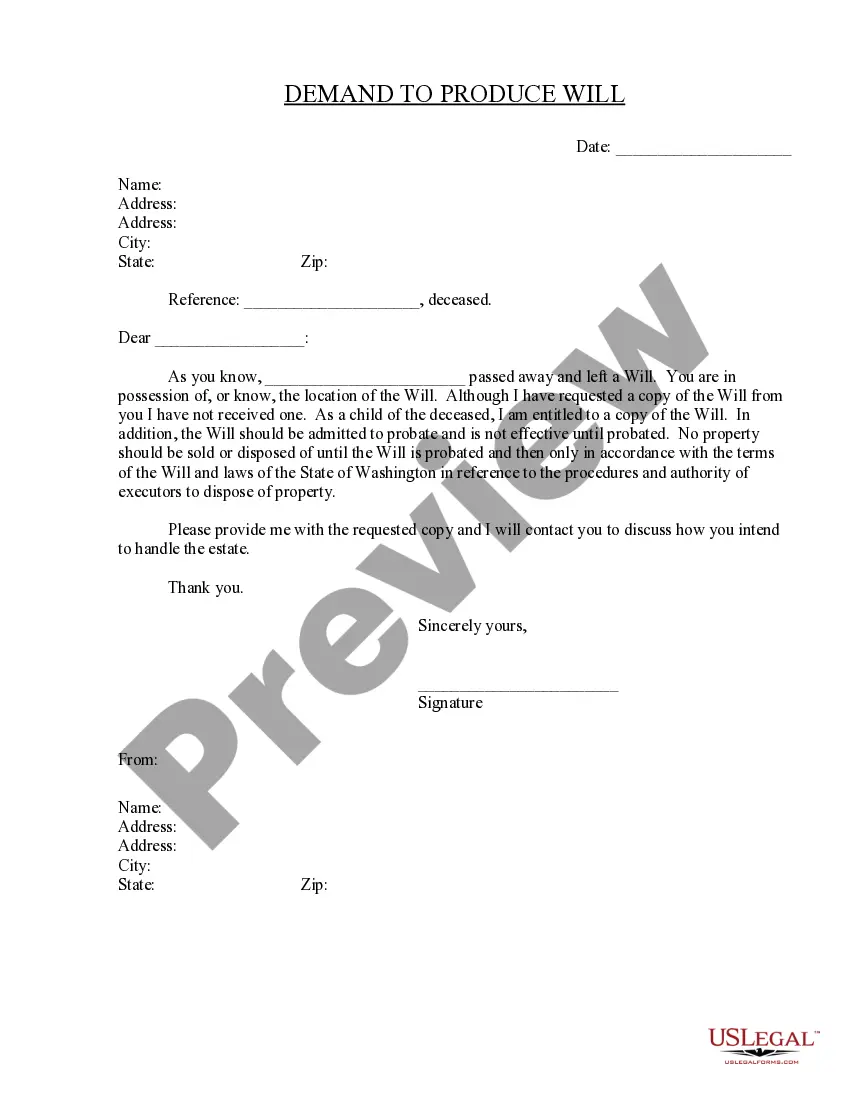

How to fill out Memphis Tennessee Memorandum Of Trust?

We consistently aim to reduce or avert legal harm when addressing intricate law-related or financial issues.

To achieve this, we seek attorney services that are typically quite expensive.

Nevertheless, not all legal issues are of the same complexity; many can be managed by ourselves.

US Legal Forms is an online repository of current DIY legal templates covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Just Log In to your account and click the Get button adjacent to it. If you misplace the form, you can always download it again from the My documents section. The procedure is just as simple if you're not familiar with the platform! You can set up your account in just a few minutes.

- Our platform empowers you to handle your issues independently without the need for an attorney's assistance.

- We offer access to legal form templates that are not always readily accessible.

- Our templates are tailored to specific states and regions, which greatly streamlines the search process.

- Utilize US Legal Forms whenever you need to quickly and securely obtain and download the Memphis Tennessee Memorandum of Trust or any other form.

Form popularity

FAQ

Does Tennessee Law Require Probate? Yes, probate is a requirement for estates in Tennessee. This is the method used to distribute the assets to the heirs and ensure the will is followed. In some cases, it is possible to avoid probate, especially if you utilize estate planning.

Real Estate: Muniment of Title is a legal action used to legally transfer clear title of one type of property (for assets such as real estate, a bank account, or a stock account) to a beneficiary. This procedure is appropriate only if the decedent executed a valid Will.

In terms of filing for probate, if the estate is small and has a value of $50,000 or less, a small estate affidavit can be filed 45 days after the death of the property owner.

Under Tennessee law, there are simplified rules for handling a small estate. A ?small estate? is one in which the total value of the personal property of the estate is $50,000 or less. Many county probate courts have forms online to help you handle a small estate.

A Tennessee small estate affidavit is a document that allows a petitioner, known as the affiant, to claim part or all of the estate of a deceased individual, known as the decedent.... Step 1 ? Wait Forty-Five (45) Days.Step 2 ? No Personal Representative.Step 3 ? Complete the Paperwork.Step 4 ? File with Probate Court.

Publication of probate must take place where the decedent lived. Creditors have from four to twelve months after the date of publication to make a claim.

There is no time limit in applying for Probate. Unlike some legal processes, such as applying for compensation, your application will not be disqualified because it is late.

The Seventh Circuit Court has exclusive jurisdiction in Davidson County for all matters related to the administration of deceased person's estates, including the probating of wills and is, thus, commonly referred to as the Davidson County Probate Court.

In Tennessee, claims against the estate of a deceased person must be filed with the probate court within four months from the date the probate court clerk first publishes what is referred to as a ?Notice to Creditors.? Such notices to creditors are required to be published for two consecutive weeks in a newspaper in

There is not any legal timeframe for applying for probate, however much of the estate administration will not be possible until this is received, so it is generally one of the first things that is done. In the case of some small estates, probate may not be necessary. This will depend on the amount of assets held.

More info

The award-winning print edition of Sunday's Advocate is available in all bookstores in the state through September 25. A free online edition is found at. Email your questions to For the entire July/August 2017 issue of the Advocate: click here; and for a full list of printed issues, search the Advocate archive at. What's a Ponzi Scheme? Ponzi schemes (unpersuaded buyers are misled into investing in investments that don't deliver a genuine profit for the promised investment of money) have become common in the United States and most countries across the world. They usually involve one person (who pretends to be an investor in a business, but actually is receiving funds for themselves) making many investments (purchasing shares of stock and issuing convertible debt), which are promised to investors in return for a set price.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.