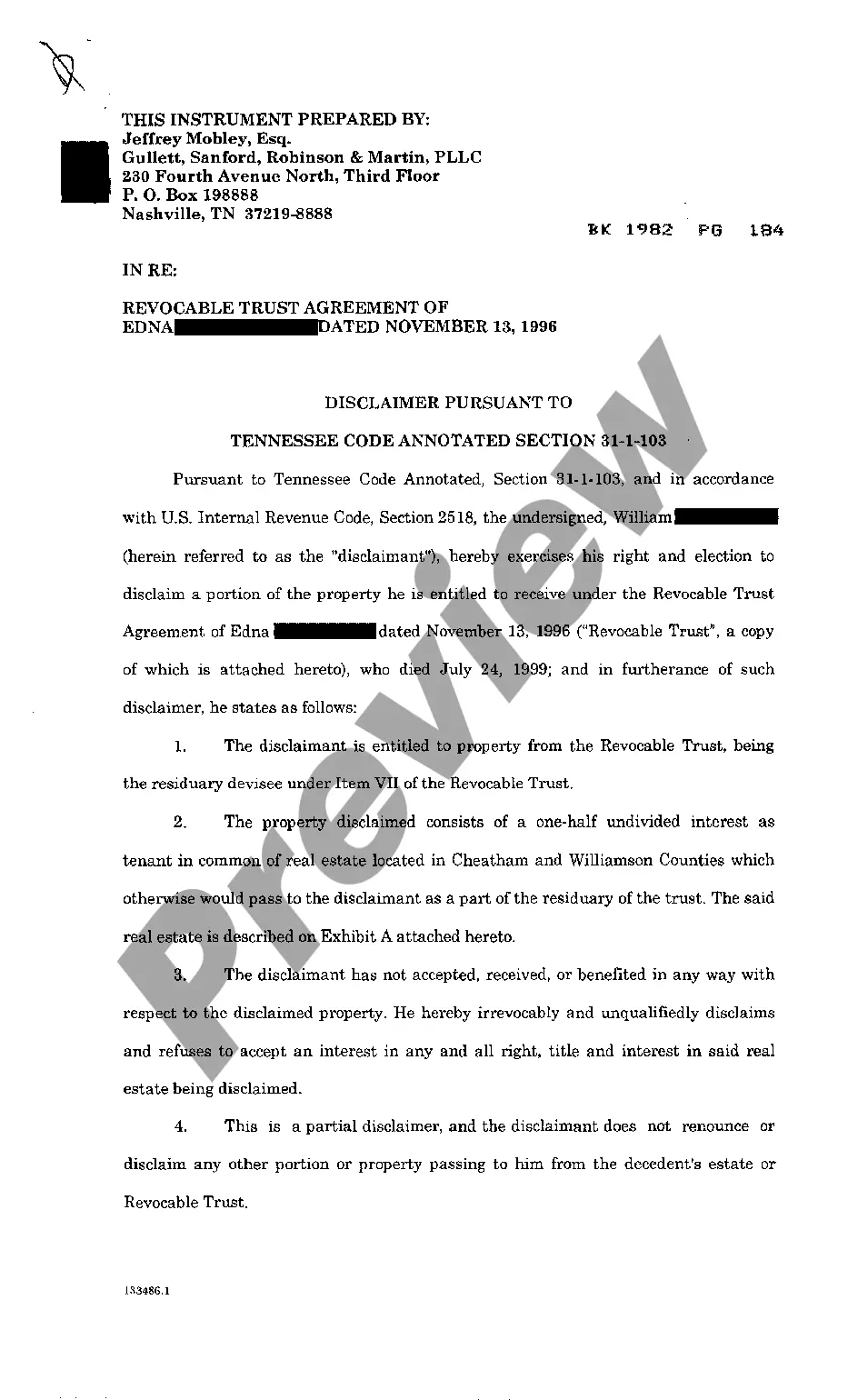

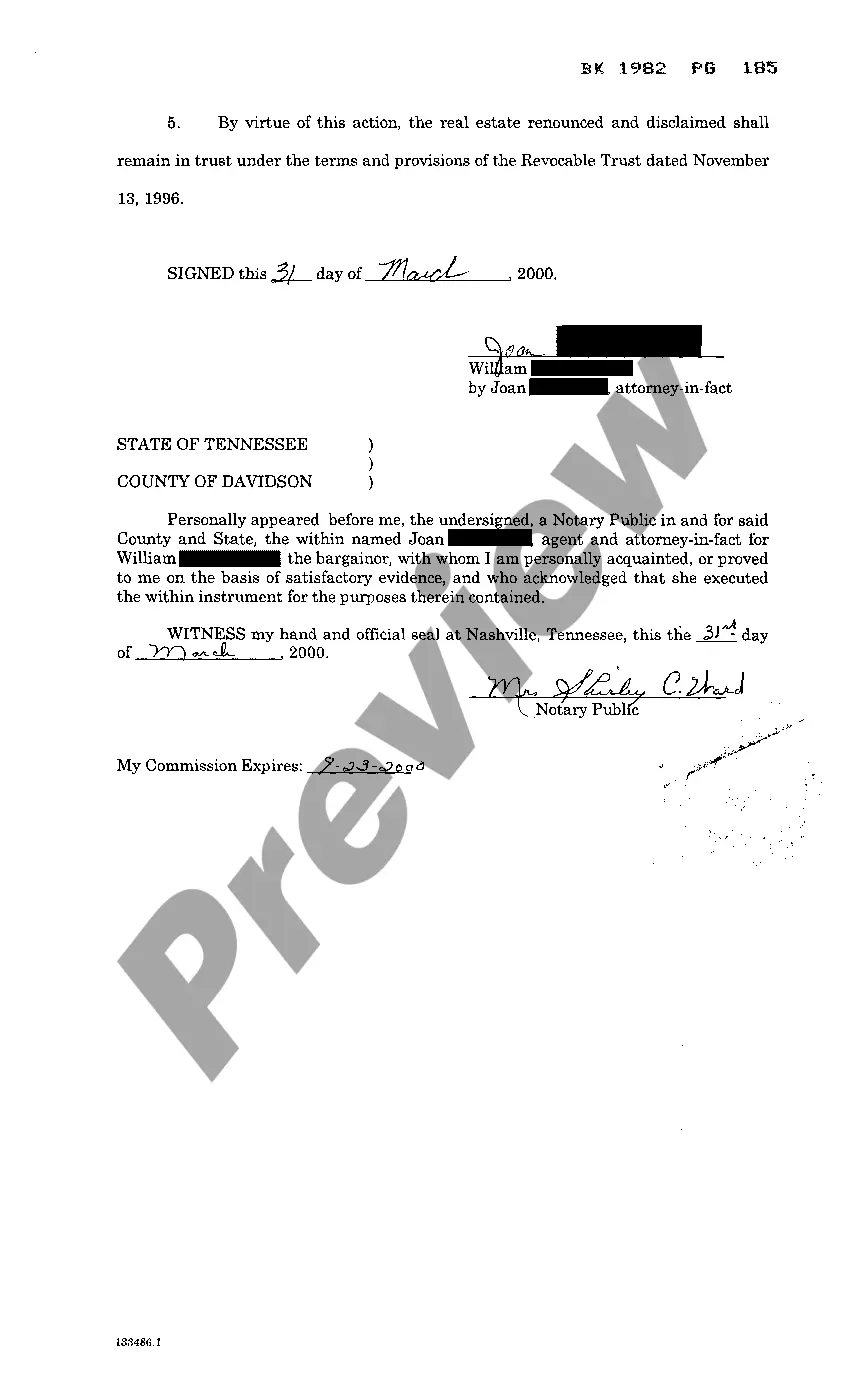

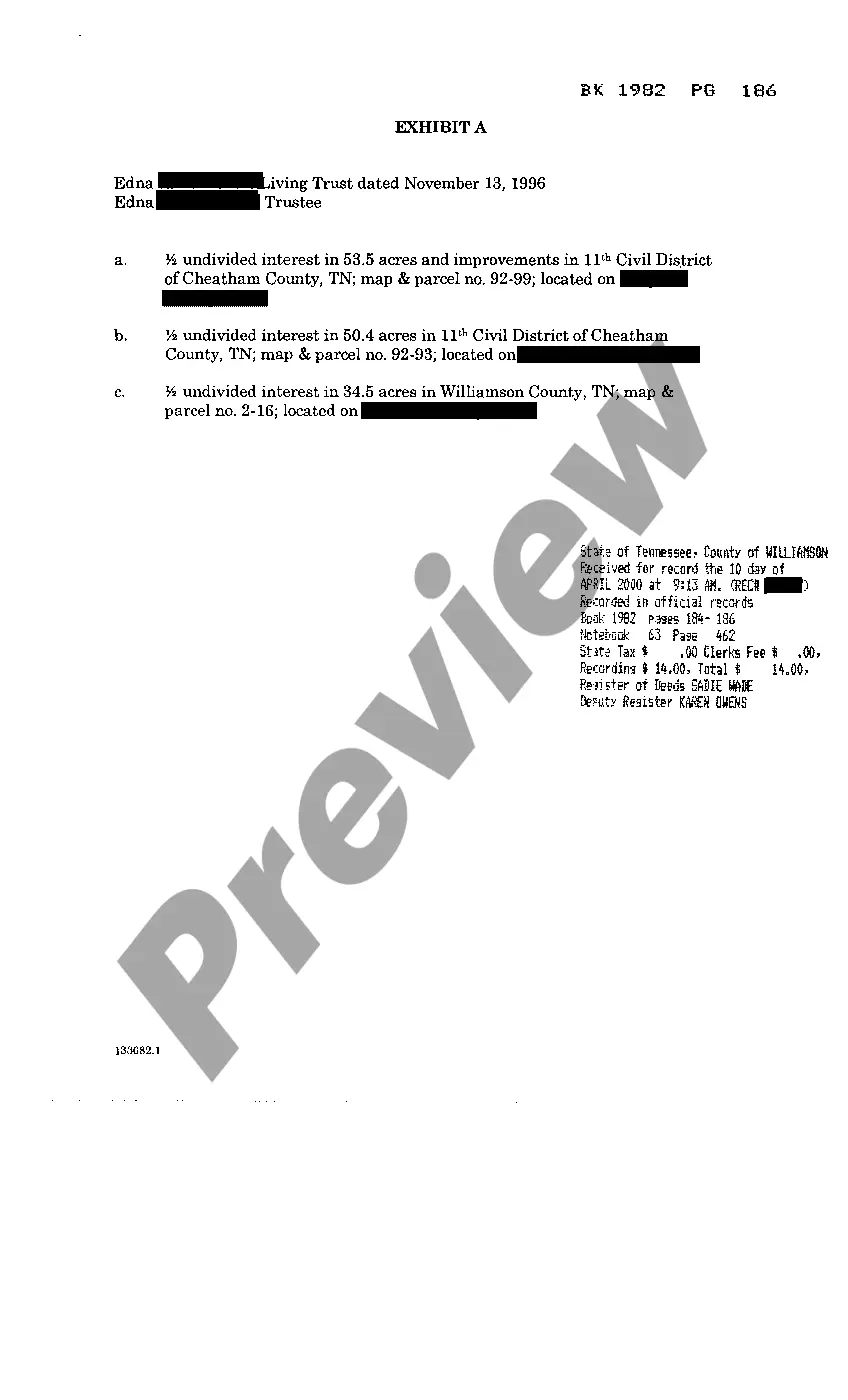

A Knoxville Tennessee Disclaimer of Interest in Real Property from a Beneficiary of Trust is a legal document that allows a beneficiary of a trust to renounce or disclaim their right to any interest they may have in a specific real property. When a beneficiary realizes they do not wish to accept or inherit the property included in the trust, they can execute a Disclaimer of Interest form. This disclaimer effectively removes their claim to any ownership or rights affiliated with the real property, allowing it to pass on to the next eligible beneficiary or follow the trust's predetermined distribution plan. There are several types of Knoxville Tennessee Disclaimer of Interest in Real Property from Beneficiary of Trust: 1. Full Disclaimer: This is the most common type, where the beneficiary completely renounces their right to the real property without any conditions or reservations. 2. Partial Disclaimer: In some cases, a beneficiary may choose to disclaim only a portion of their interest in the real property. This can occur when the property is expensive to maintain, or they may have personal reasons for not wanting to assume full ownership. 3. Qualified Disclaimer: A qualified disclaimer is used when a beneficiary wants to refuse their interest in the property in favor of someone else, such as their children or another family member. The disclaimer must meet specific IRS requirements to be considered a qualified disclaimer. 4. Time-Limited Disclaimer: This type of disclaimer allows a beneficiary to temporarily renounce their interest in the property for a specified period. This can be useful when the beneficiary is unsure about their long-term plans or wants to postpone making a permanent decision. 5. Disclaimer with Conditions: In some situations, a beneficiary may choose to disclaim their interest in the real property with certain conditions attached. For instance, the beneficiary might require that the property be sold within a specific timeframe or that certain debts be cleared before the property passes on to the next beneficiary. Executing a Disclaimer of Interest in Real Property from a Beneficiary of Trust must adhere to the applicable laws and regulations of Knoxville, Tennessee. It is advisable to consult with an experienced estate attorney to ensure that the disclaimer is properly drafted, executed, and recorded to avoid any future legal complications. In summary, a Knoxville Tennessee Disclaimer of Interest in Real Property from Beneficiary of Trust is a legal tool that enables a beneficiary to relinquish their right to inherit specific real property held within a trust. Various types of disclaimers exist, including full, partial, qualified, time-limited, and those with conditions. Seeking legal guidance is essential to navigate this process effectively.

Knoxville Tennessee Disclaimer of interest in real property from beneficiary of trust

State:

Tennessee

City:

Knoxville

Control #:

TN-E321

Format:

PDF

Instant download

This form is available by subscription

Description

Disclaimer of interest in real property from beneficiary of trust

A Knoxville Tennessee Disclaimer of Interest in Real Property from a Beneficiary of Trust is a legal document that allows a beneficiary of a trust to renounce or disclaim their right to any interest they may have in a specific real property. When a beneficiary realizes they do not wish to accept or inherit the property included in the trust, they can execute a Disclaimer of Interest form. This disclaimer effectively removes their claim to any ownership or rights affiliated with the real property, allowing it to pass on to the next eligible beneficiary or follow the trust's predetermined distribution plan. There are several types of Knoxville Tennessee Disclaimer of Interest in Real Property from Beneficiary of Trust: 1. Full Disclaimer: This is the most common type, where the beneficiary completely renounces their right to the real property without any conditions or reservations. 2. Partial Disclaimer: In some cases, a beneficiary may choose to disclaim only a portion of their interest in the real property. This can occur when the property is expensive to maintain, or they may have personal reasons for not wanting to assume full ownership. 3. Qualified Disclaimer: A qualified disclaimer is used when a beneficiary wants to refuse their interest in the property in favor of someone else, such as their children or another family member. The disclaimer must meet specific IRS requirements to be considered a qualified disclaimer. 4. Time-Limited Disclaimer: This type of disclaimer allows a beneficiary to temporarily renounce their interest in the property for a specified period. This can be useful when the beneficiary is unsure about their long-term plans or wants to postpone making a permanent decision. 5. Disclaimer with Conditions: In some situations, a beneficiary may choose to disclaim their interest in the real property with certain conditions attached. For instance, the beneficiary might require that the property be sold within a specific timeframe or that certain debts be cleared before the property passes on to the next beneficiary. Executing a Disclaimer of Interest in Real Property from a Beneficiary of Trust must adhere to the applicable laws and regulations of Knoxville, Tennessee. It is advisable to consult with an experienced estate attorney to ensure that the disclaimer is properly drafted, executed, and recorded to avoid any future legal complications. In summary, a Knoxville Tennessee Disclaimer of Interest in Real Property from Beneficiary of Trust is a legal tool that enables a beneficiary to relinquish their right to inherit specific real property held within a trust. Various types of disclaimers exist, including full, partial, qualified, time-limited, and those with conditions. Seeking legal guidance is essential to navigate this process effectively.

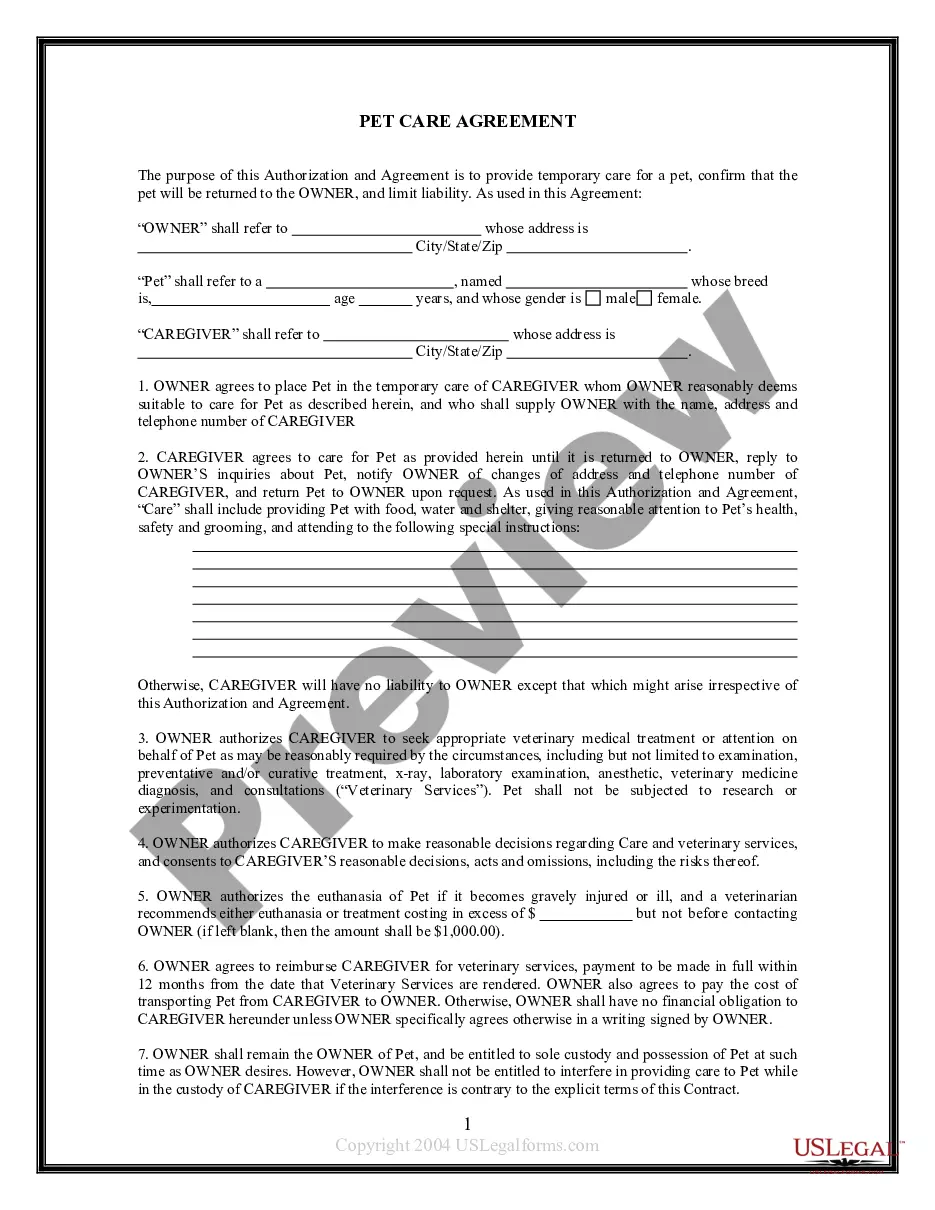

Free preview

How to fill out Knoxville Tennessee Disclaimer Of Interest In Real Property From Beneficiary Of Trust?

If you’ve already used our service before, log in to your account and save the Knoxville Tennessee Disclaimer of interest in real property from beneficiary of trust on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to get your file:

- Make sure you’ve found an appropriate document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Knoxville Tennessee Disclaimer of interest in real property from beneficiary of trust. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!