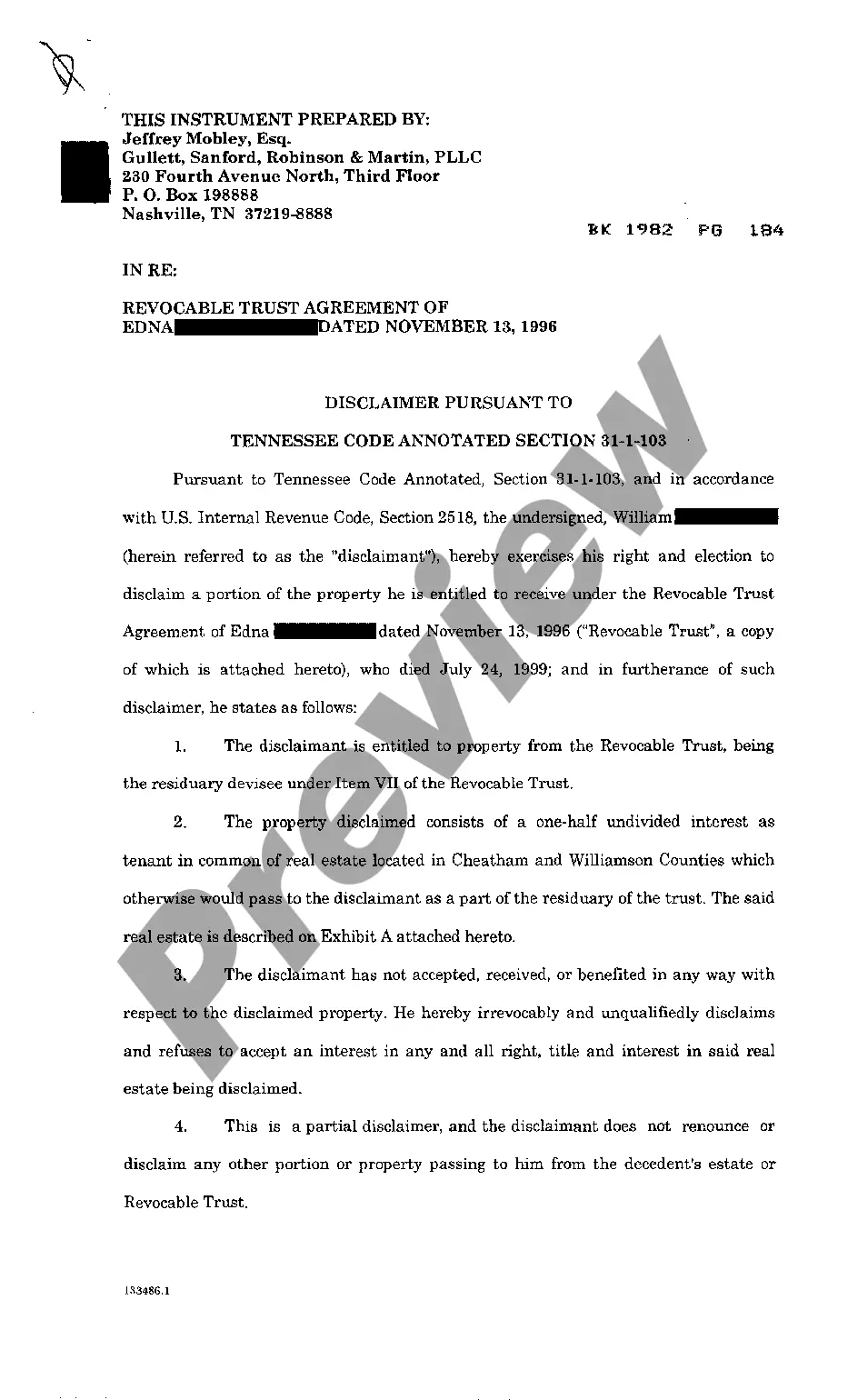

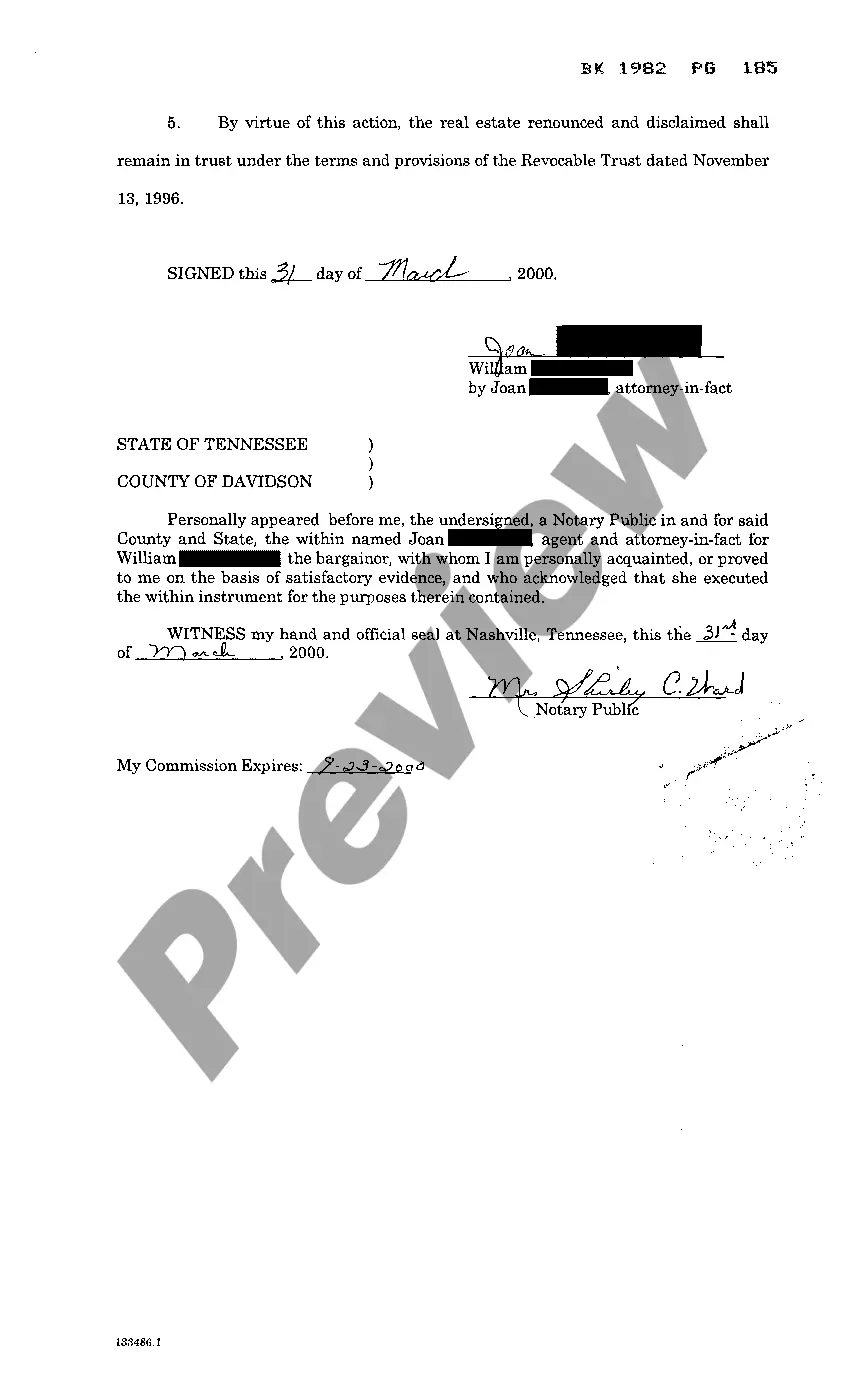

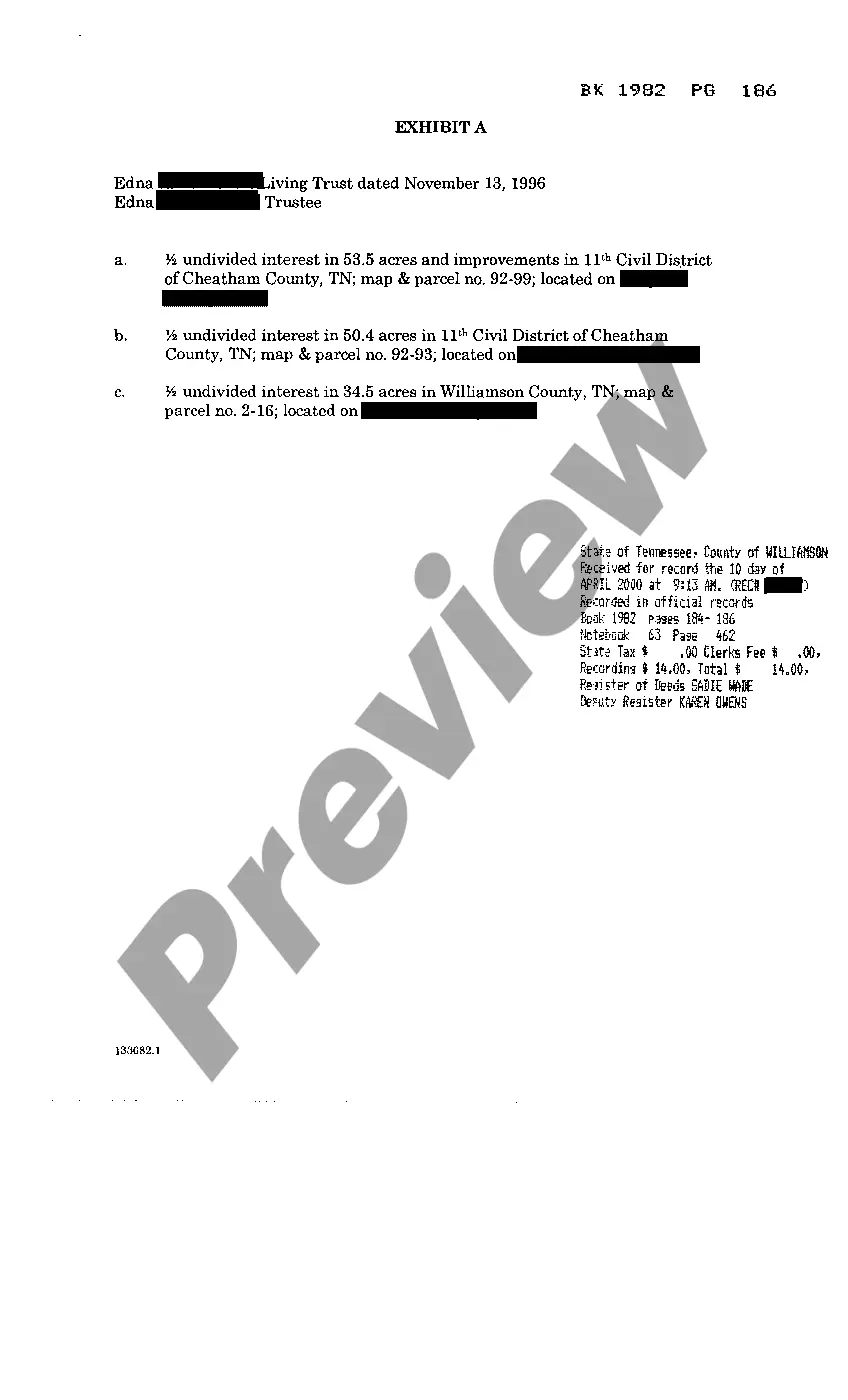

A Memphis Tennessee Disclaimer of interest in real property from a beneficiary of trust refers to a legal document or declaration made by a beneficiary of a trust to renounce or disclaim any rights or interests they may have in a specific property held within the trust. This disclaimer effectively allows the beneficiary to release their claim to the property, thereby preventing it from being included in their estate upon death or being subject to any taxation, debts, or liabilities they may incur. A Disclaimer of interest in real property from a beneficiary of trust is a crucial tool for estate planning purposes as it provides beneficiaries with the option to refuse ownership of a property they have been designated to receive through a trust. This disclaimer can take different forms and may incorporate specific language and terms depending on the circumstances. There are several types of Memphis Tennessee Disclaimer of interest in real property from beneficiary of trust, including: 1. General Disclaimer: This form of disclaimer releases the beneficiary from any and all interests in the real property within the trust. By signing this disclaimer, the beneficiary effectively waives their right to the property, stating that they have no intention to claim or receive any benefits from it. 2. Partial Disclaimer: In certain situations, a beneficiary may not want to disclaim their entire interest in the property. Instead, they may choose to disclaim a portion of their interest or specify certain conditions for their disclaimer. A partial disclaimer allows beneficiaries to retain some control over their involvement in the property while relinquishing the rest. 3. Marital Disclaimer: This disclaimer type typically occurs in the context of spousal trusts. A beneficiary who is a spouse may choose to disclaim their interest in the property to ensure that it passes directly to the next intended beneficiary, often the couple's children or other designated individuals. 4. Qualified Disclaimer: A qualified disclaimer refers to a disclaimer made by a beneficiary that meets specific requirements outlined by the Internal Revenue Service (IRS). By complying with these requirements, the beneficiary can avoid any tax implications that may arise as a result of the disclaimer. In conclusion, a Memphis Tennessee Disclaimer of interest in real property from a beneficiary of trust is a legal document that allows beneficiaries to renounce their rights or interests in a specific property held within the trust to avoid potential taxation, debts, or liabilities. Understanding the different variations and requirements for each type of disclaimer is crucial for effective estate planning and asset distribution.

Memphis Tennessee Disclaimer of interest in real property from beneficiary of trust

Description

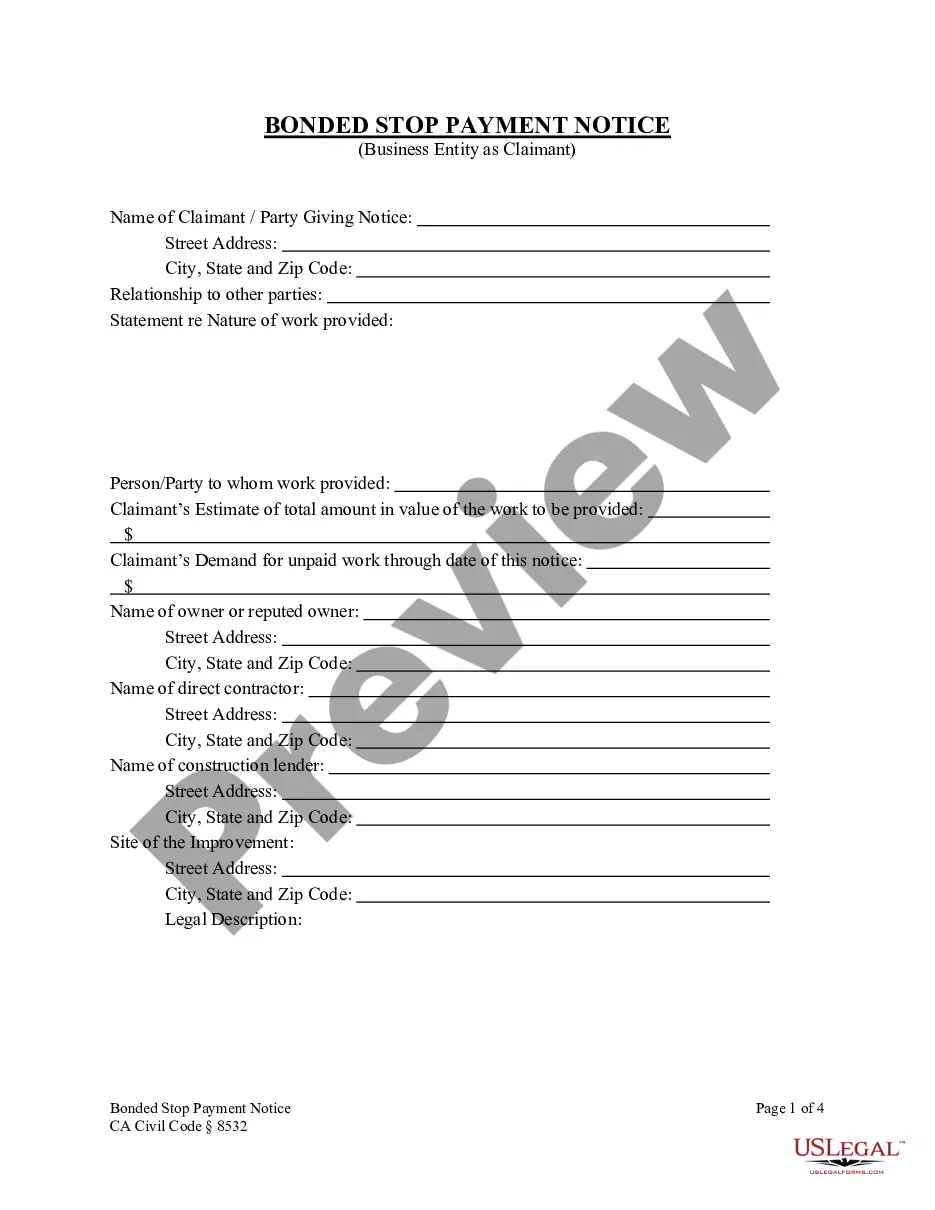

How to fill out Memphis Tennessee Disclaimer Of Interest In Real Property From Beneficiary Of Trust?

Take advantage of the US Legal Forms and have immediate access to any form template you need. Our useful website with a large number of templates makes it easy to find and get virtually any document sample you need. You can save, fill, and sign the Memphis Tennessee Disclaimer of interest in real property from beneficiary of trust in a couple of minutes instead of browsing the web for many hours searching for a proper template.

Using our collection is a wonderful strategy to improve the safety of your record submissions. Our professional attorneys regularly check all the documents to make sure that the forms are relevant for a particular state and compliant with new laws and regulations.

How do you get the Memphis Tennessee Disclaimer of interest in real property from beneficiary of trust? If you have a profile, just log in to the account. The Download button will be enabled on all the documents you view. In addition, you can get all the previously saved files in the My Forms menu.

If you don’t have a profile yet, follow the tips below:

- Find the template you require. Ensure that it is the template you were seeking: examine its title and description, and utilize the Preview feature if it is available. Otherwise, use the Search field to find the needed one.

- Start the downloading procedure. Select Buy Now and choose the pricing plan that suits you best. Then, create an account and process your order with a credit card or PayPal.

- Save the file. Indicate the format to get the Memphis Tennessee Disclaimer of interest in real property from beneficiary of trust and edit and fill, or sign it for your needs.

US Legal Forms is one of the most extensive and trustworthy document libraries on the internet. Our company is always ready to assist you in virtually any legal process, even if it is just downloading the Memphis Tennessee Disclaimer of interest in real property from beneficiary of trust.

Feel free to make the most of our form catalog and make your document experience as efficient as possible!