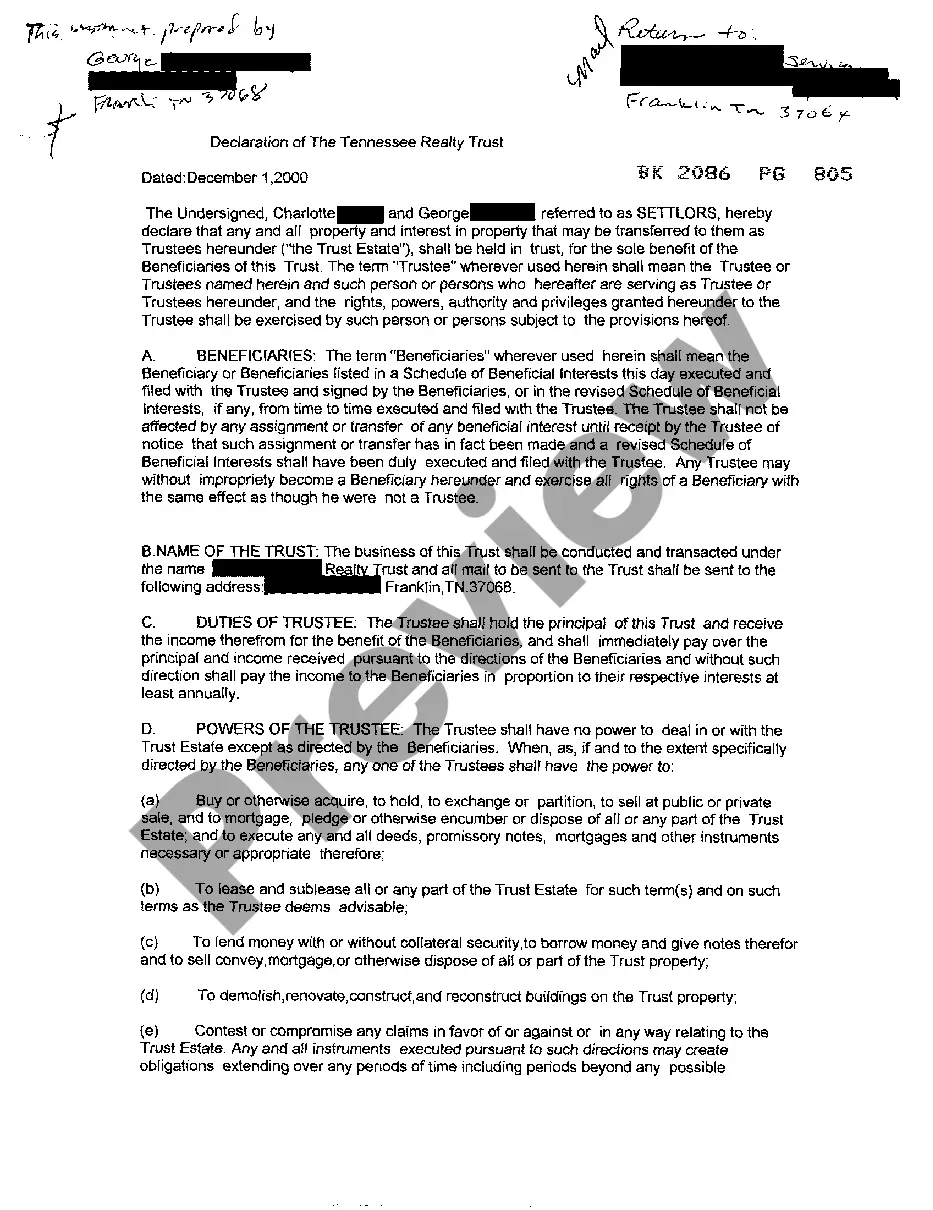

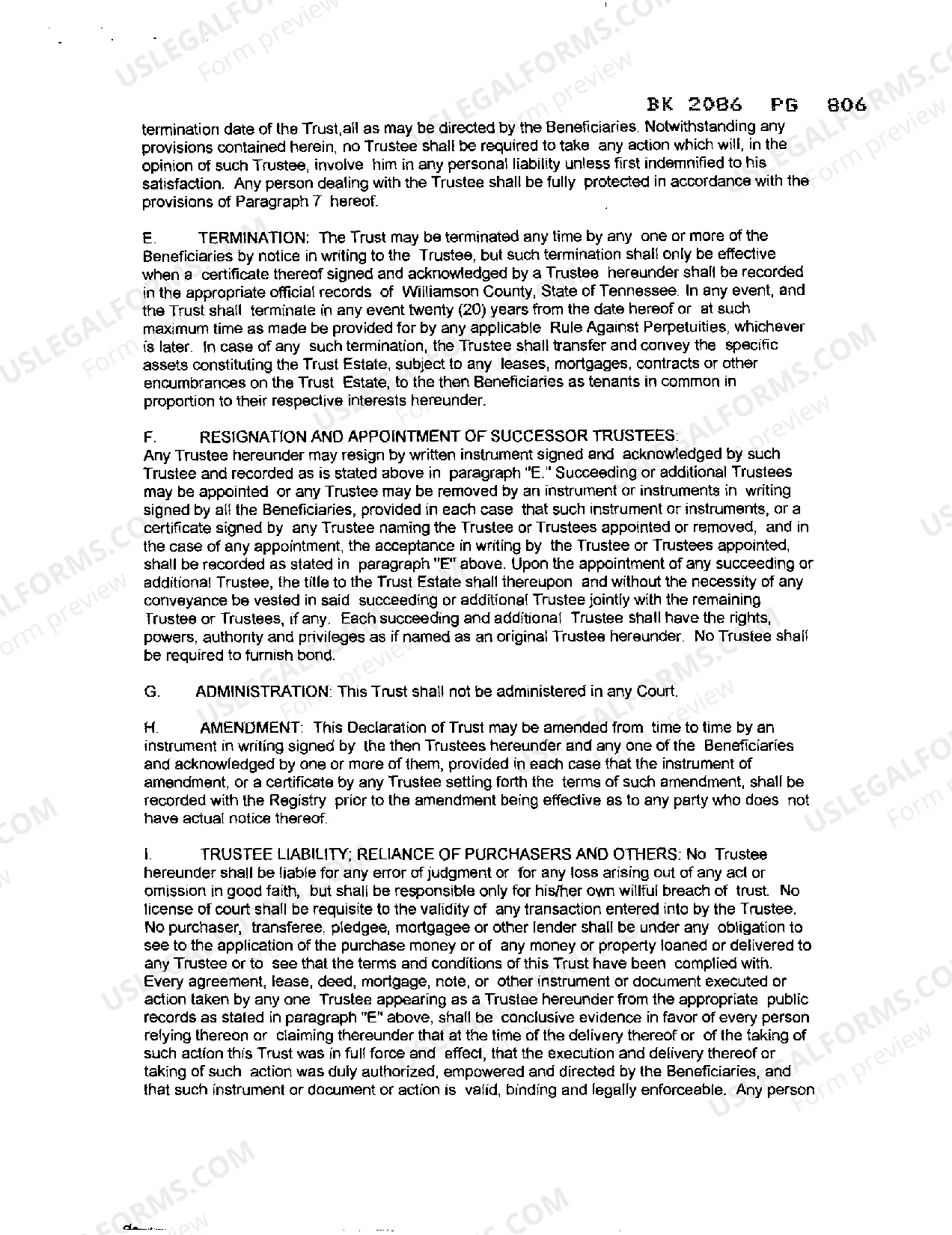

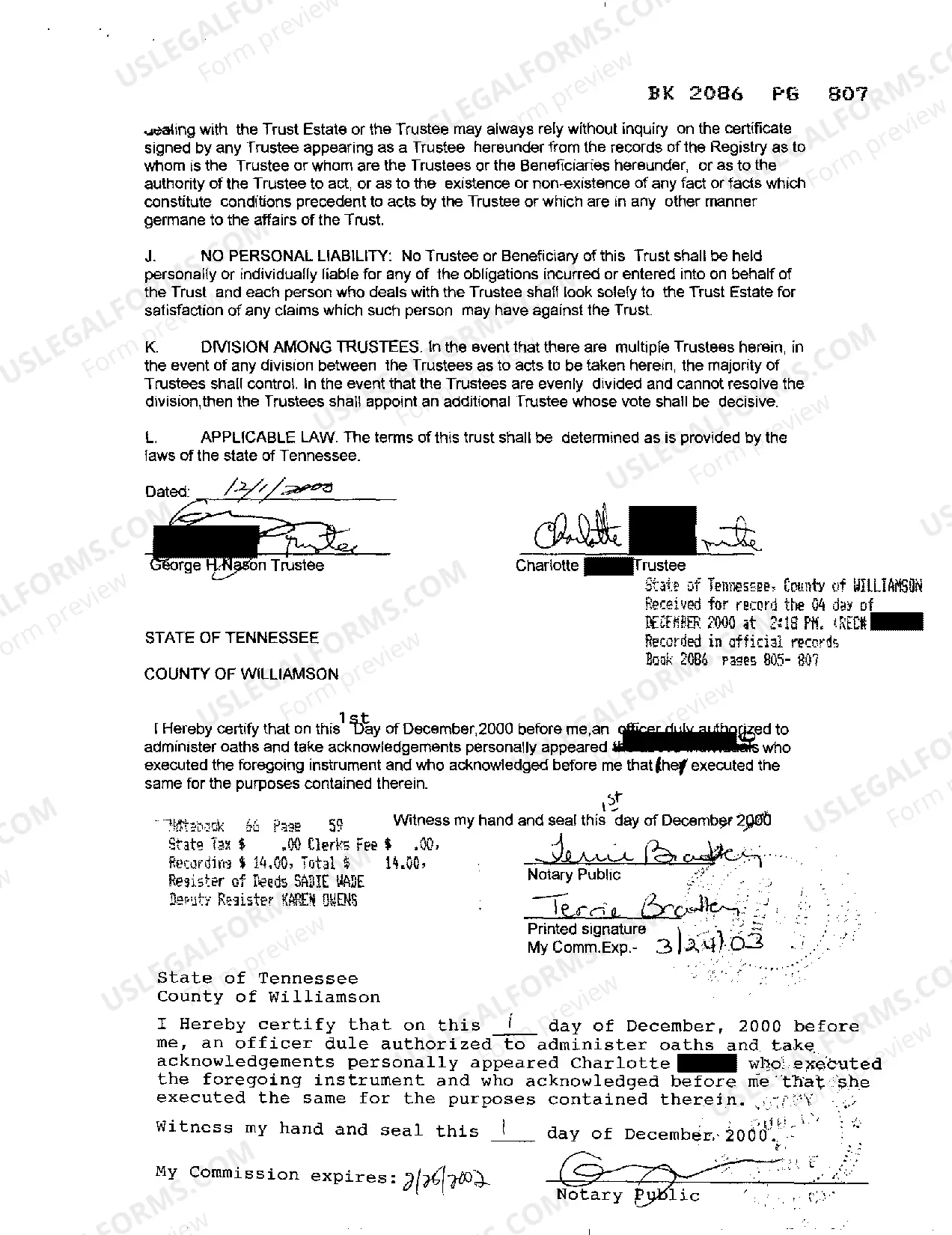

The Memphis Tennessee Declaration of Realty Trust is a legally binding document that establishes a trust agreement for real estate properties located in Memphis, Tennessee. This declaration creates a relationship between the trust or (property owner) and the trustee (the person or entity responsible for managing the trust). Keywords: Memphis, Tennessee, declaration, realty trust, trust agreement, property owner, trustee. The purpose of the Memphis Tennessee Declaration of Realty Trust is to protect the property owner's assets, provide for efficient management of the real estate, and facilitate the transfer of ownership rights in accordance with the trust or's wishes. By creating a trust, the property owner can ensure the smooth transition of their property to beneficiaries, avoid probate, and potentially reduce estate taxes. Different types of Memphis Tennessee Declaration of Realty Trust may include revocable living trusts and irrevocable trusts. 1. Revocable Living Trust: This type of trust allows the property owner to retain control over their assets during their lifetime. They can modify or revoke the trust at any time, making it a flexible estate planning tool. The property is held in the trust, and the trustee manages it according to the trust or's instructions. Upon the trust or's death, assets transfer to the designated beneficiaries without the need for probate. 2. Irrevocable Trust: Unlike the revocable living trust, an irrevocable trust cannot be modified or revoked once created. This type of trust is often used for estate planning and asset protection purposes. By transferring ownership of the property to the trust, the trust or effectively removes it from their estate, potentially reducing estate taxes. The trustee has full control and management over the property, and beneficiaries are entitled to the trust's assets as designated. Regardless of the type, the Memphis Tennessee Declaration of Realty Trust typically includes essential elements such as the identification of the trust or and trustee, a detailed description of the real estate property, the powers and responsibilities of the trustee, provisions for income distribution or reinvestment, provisions for the appointment of successor trustees, and the process for beneficiaries and heirs to receive the property. In conclusion, the Memphis Tennessee Declaration of Realty Trust is a legal document that establishes a trust agreement for real estate properties located in Memphis, Tennessee. It serves to protect the property owner's assets, facilitate efficient management of the property, and ensure the smooth transfer of ownership rights according to the trust or's wishes. Different types of trusts, such as revocable living trusts and irrevocable trusts, can be created through this declaration.

Memphis Tennessee Declaration of Realty Trust

Description

How to fill out Memphis Tennessee Declaration Of Realty Trust?

Are you seeking a reliable and affordable provider of legal documents to obtain the Memphis Tennessee Declaration of Realty Trust? US Legal Forms is your preferred choice.

Whether you require a straightforward arrangement to establish guidelines for living together with your partner or a collection of documents to facilitate your divorce proceedings, we've got you covered. Our platform features over 85,000 current legal document templates for personal and business use.

All templates we provide are not one-size-fits-all and are tailored to comply with the regulations of individual states and counties.

To download the document, you must Log In to your account, locate the desired template, and click the Download button adjacent to it. Please note that you can re-download your previously acquired document templates any time from the My documents section.

Now you can register your account. Then choose a subscription option and proceed to payment. Once the payment is successfully processed, download the Memphis Tennessee Declaration of Realty Trust in your preferred format. You can return to the site at any time and re-download the document at no expense.

Obtaining updated legal forms has never been more straightforward. Try US Legal Forms today, and say goodbye to exhausting hours researching legal paperwork online.

- Is it your first visit to our site? No need to worry.

- You can create an account with great ease, but first, ensure to do the following.

- Verify if the Memphis Tennessee Declaration of Realty Trust complies with your state and local regulations.

- Review the description of the form (if available) to understand what the document is suitable for.

- Initiate a new search if the template doesn't cater to your particular needs.

Form popularity

FAQ

A Declaration of Trust is a legal document confirming the terms on which an asset, such as a property, is held on trust. The document usually records the portion of the ownership of the property, as well as other terms agreed by the parties.

Key estate planning documents that might be impacted include trusts, wills, living wills, and durable or healthcare power of attorney. All of these legal documents require the signatory, witnesses, and notary to be physically present in order to execute the document.

Tennessee's probate period is considered long and it does not use the Uniform Probate Code. So a living trust is likely a good call if your estate is worth more than $50,000. At or below that amount, Tennessee allows for a simplified small estate process, which makes a living trust unnecessary.

Once you die, your living trust becomes irrevocable, which means that your wishes are now set in stone. The person you named to be the successor trustee now steps up to take an inventory of the trust assets and eventually hand over property to the beneficiaries named in the trust.

A deed of trust includes a declaration of trust within it, as above, however it goes on further to set out the intentions of the parties in the co-ownership of the property. It is a far more robust legal document and is signed by all parties and witnessed.

The Tennessee State Library and Archives has microfilmed copies of older deeds for every county in Tennessee. The deeds records are arranged by the name of the seller/buyer (grantor/grantee).

The Register of Deeds files certain legal documents mainly pertaining to or affecting real estate and provides public access to these records.

A trust is not public record. A will is always made public record when it is probated. No one need know what assets are in your trust, who your beneficiaries are, or when the assets are distributed.

In either case, you can contact your local county Assessor with questions about ownership. You can find the contact information for your local Assessor at this link.

Generally speaking, beneficiaries have a right to see trust documents which set out the terms of the trusts, the identity of the trustees and the assets within the trust as well as the trust deed, any deeds of appointment/retirement and trust accounts.

Interesting Questions

More info

We use it to encompass all real estate asset classes, not just those we deal with personally. For example, it could mean a REIT can hold a mortgage, but also a business, trust or limited liability company. If you are searching for the right structure to manage a small business, you may not want to use a REIT. If you want to build a business that involves selling real estate, a REIT may be the right option. See more on Rests. S2 Notice of Dividend. Send the notice with your final dividend to the Trustee or the Solicitor for the month of the dividends in which that notice was issued. See S11.d. S3 Tax Dividend Return (Form 940). If the property is included in the trust, we provide a tax return if you elect to include it in your gross estate. The trust automatically files one with IRS each year. See section 954 for information on how to file. See section 955 for information about filing. See section 956 for information about how to amend your return.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.