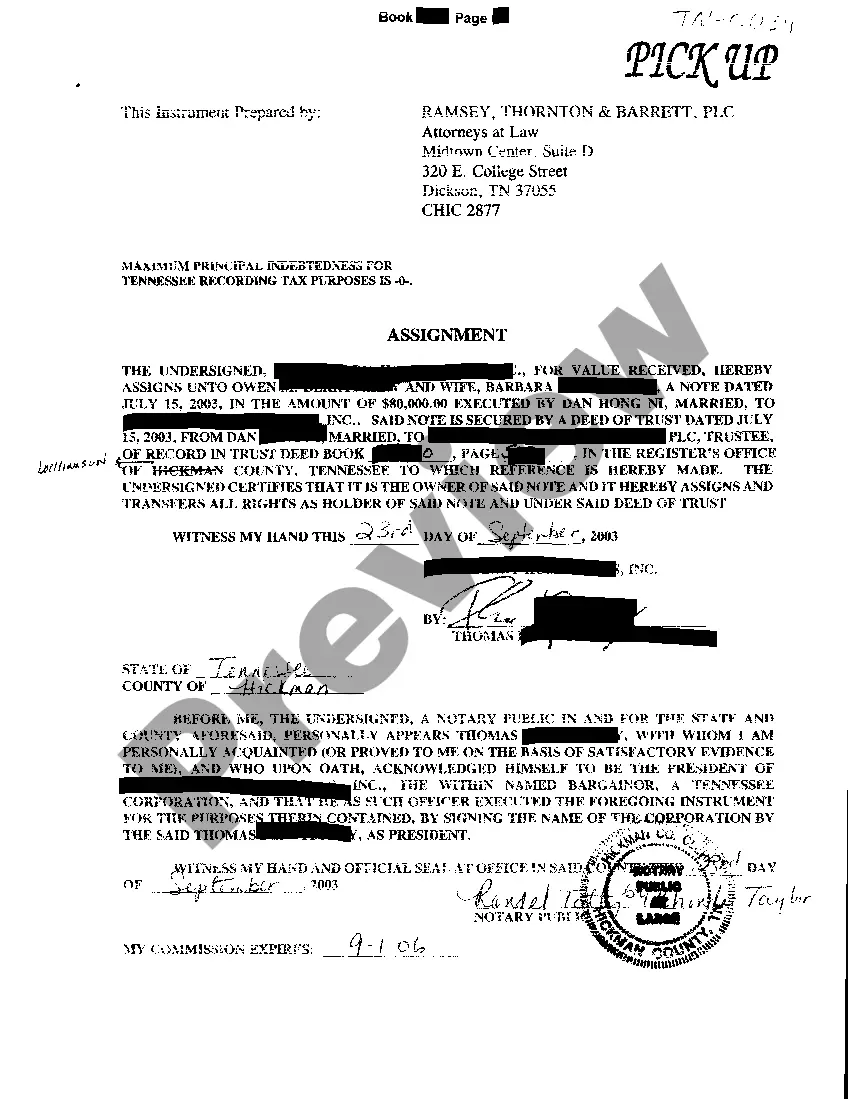

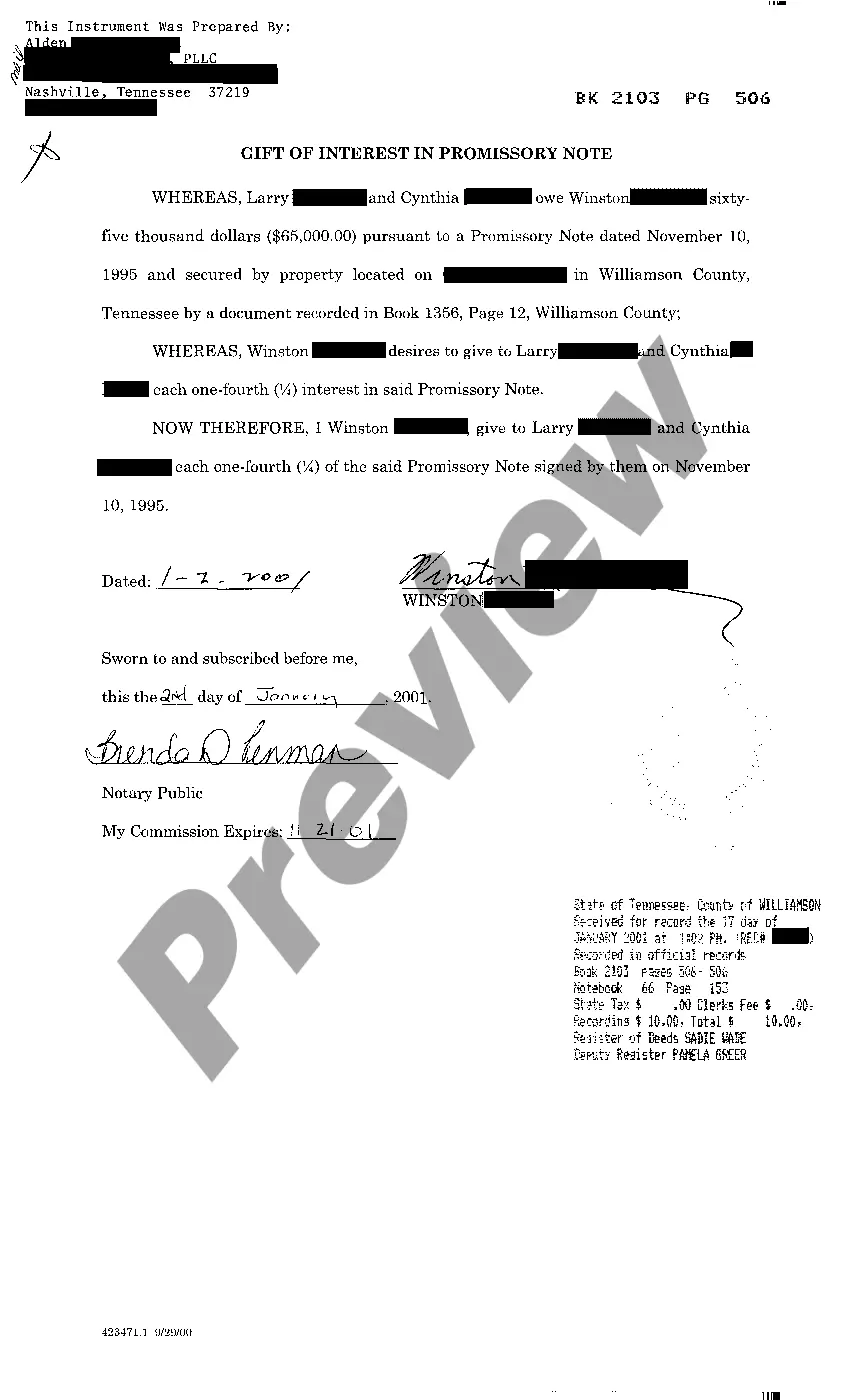

Chattanooga Tennessee Gift of Interest in Promissory Note

Description

How to fill out Tennessee Gift Of Interest In Promissory Note?

Regardless of one's social or professional standing, fulfilling law-related documentation is an unfortunate obligation in today's work environment.

Often, it’s nearly impossible for someone without a legal background to create this type of documentation from square one, largely due to the complex terminology and legal subtleties involved.

This is where US Legal Forms can be a lifesaver.

Confirm that the form you have selected is suitable for your location, as the regulations of one state or region do not apply to another.

Review the documentation and read a brief overview (if accessible) of the situations for which the paper can be utilized.

- Our platform boasts an extensive collection with over 85,000 state-specific forms that cater to nearly any legal situation.

- US Legal Forms is also a valuable resource for associates or legal advisers looking to save time with our DIY forms.

- Whether you need the Chattanooga Tennessee Gift of Interest in Promissory Note or any other documentation that will be recognized in your state or locality, everything is accessible with US Legal Forms.

- Here’s how to obtain the Chattanooga Tennessee Gift of Interest in Promissory Note in mere minutes using our reliable platform.

- If you're already a subscriber, you can go ahead and Log In to your account to download the needed form.

- However, if you’re not acquainted with our platform, make sure you follow these steps before downloading the Chattanooga Tennessee Gift of Interest in Promissory Note.

Form popularity

FAQ

An example of a simple promissory note could be a borrower promising to repay $500 to a friend within 6 months. The note would include the repayment date, any interest terms, and the signatures of both the friend and the borrower. Simple promissory notes are straightforward and offer clear terms to avoid misunderstandings. The Chattanooga Tennessee Gift of Interest in Promissory Note can be a valuable tool for crafting this document.

The format of a promissory note usually includes crucial elements: the title, date, parties' information, the amount, repayment terms, and signatures. It is helpful to structure the note clearly, ensuring each section is easy to read and understand. Including any other relevant clauses, such as default terms, can provide additional protection for both parties. The Chattanooga Tennessee Gift of Interest in Promissory Note template provides a reliable structure to follow.

Filling out a promissory note requires you to start with the date, followed by the principal amount being borrowed. Clearly name the parties involved, ensuring you have their correct contact information. Define the terms for repayment, as well as any interest that may apply, and finalize with signatures from both parties. Utilizing the Chattanooga Tennessee Gift of Interest in Promissory Note can offer clarity in this process.

To fill out a demand promissory note, begin by entering the date on which the note is created. Clearly state the amount being loaned and identify both the borrower and lender with legal names and addresses. Include terms for repayment and specify that it is a demand note, meaning the lender can request payment at any time. The Chattanooga Tennessee Gift of Interest in Promissory Note makes it simple to understand the components you'll need.

Promissory notes must adhere to specific rules to ensure they are legally enforceable. They should contain the names of the parties involved, the amount being borrowed, the interest rate, and the repayment terms. Furthermore, for the Chattanooga Tennessee Gift of Interest in Promissory Note, you may also want to include provisions for default and dispute resolution. Understanding these rules is vital, and USLegalForms offers resources to help you create a compliant and effective promissory note.

To present a promissory note effectively, start by ensuring it is clear, concise, and properly formatted. Include essential details such as the principal amount, interest rate, payment schedule, and maturity date. It's crucial to sign the note in front of a notary or two witnesses to give it legal standing, especially in regards to the Chattanooga Tennessee Gift of Interest in Promissory Note. Using a recognized platform like USLegalForms can also simplify the process, providing templates that meet local requirements.

The value of a promissory note varies based on several factors, including the principal amount, interest rate, and the borrower's creditworthiness. To determine the worth, consider both the outstanding balance and projected interest payments. Using tools from US Legal Forms can help you evaluate the note accurately, especially when dealing with a Chattanooga Tennessee Gift of Interest in Promissory Note.

To record interest on a promissory note, you generally set clear terms within the document regarding the interest rate and payment schedule. It's important to calculate interest accurately and keep records of any payments made. US Legal Forms can help you draft a comprehensive promissory note that ensures proper documentation of the interest. This way, you can manage the Chattanooga Tennessee Gift of Interest in Promissory Note smoothly.

In Chattanooga, Tennessee, a promissory note does not necessarily need to be notarized to be valid. However, notarization provides an extra layer of security and can help avoid disputes in the future. If you're concerned about the authenticity of the document, consider using US Legal Forms to create a notarized version of the promissory note. This ensures clarity and protection for both parties involved in the Chattanooga Tennessee Gift of Interest in Promissory Note.