In Memphis, Tennessee, a Gift of Interest in Promissory Note refers to a legal document that represents the transfer of a promissory note as a gift from one individual to another. A promissory note is a written promise by a borrower to repay a specific amount of money, typically borrowed for a certain purpose, within a specified time frame. The Gift of Interest in Promissory Note allows the original note holder, also known as the donor, to gift their interest in the promissory note to another individual, known as the done or recipient. This transfer of interest is typically completed without any exchange of money or consideration. The purpose of this type of gift is to transfer the rights and obligations associated with the promissory note, including the right to receive payments from the borrower, to the done. This can be done as a gesture of goodwill, generosity, or to facilitate estate planning. Different types of Memphis Tennessee Gift of Interest in Promissory Note can include: 1. Irrevocable Gift of Interest in Promissory Note: This type of gift cannot be revoked or taken back by the donor once it has been transferred to the recipient. It provides a permanent transfer of the interest in the promissory note. 2. Revocable Gift of Interest in Promissory Note: In contrast to an irrevocable gift, a revocable gift allows the donor to revoke or cancel the transfer of the interest in the promissory note at any time before it becomes effective. 3. Partial Gift of Interest in Promissory Note: This type of gift involves transferring only a portion of the interest in the promissory note to the recipient, while the donor retains ownership of the remaining portion. 4. Absolute Gift of Interest in Promissory Note: An absolute gift represents the complete transfer of the donor's interest in the promissory note to the done, without any restrictions or conditions. It is important to note that the transfer of a gift of interest in a promissory note generally requires proper documentation and legal assistance to ensure its validity and enforceability. Consulting with an attorney who specializes in estate planning or contract law is advisable to navigate the legal process and ensure compliance with applicable Memphis, Tennessee laws.

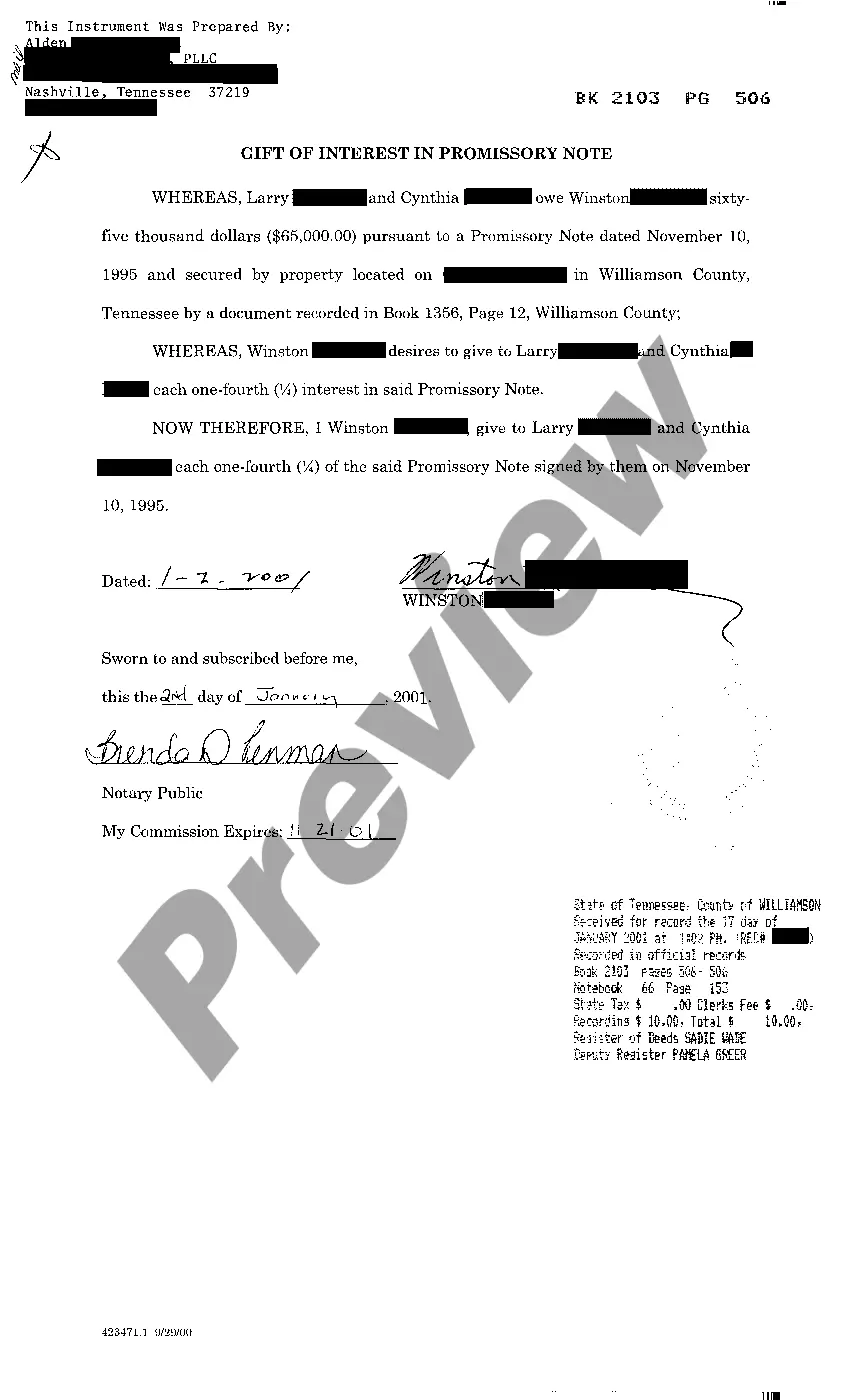

Memphis Tennessee Gift of Interest in Promissory Note

Description

How to fill out Memphis Tennessee Gift Of Interest In Promissory Note?

We consistently seek to minimize or avert legal harm when navigating intricate law-related or financial issues.

To achieve this, we engage attorney services that are typically very costly.

Nevertheless, not every legal matter is so complicated.

Many can be managed independently.

Utilize US Legal Forms whenever you need to acquire and download the Memphis Tennessee Gift of Interest in Promissory Note or any other form with ease and security.

- US Legal Forms is an online collection of current DIY legal documents covering everything from wills and power of attorney to articles of incorporation and petitions for dissolution.

- Our collection enables you to handle your issues independently without requiring an attorney.

- We provide access to legal form templates that are not always publicly accessible.

- Our templates are tailored to specific states and regions, which greatly simplifies the search process.

Form popularity

FAQ

A promissory note is like a written promise or IOU for everything from car loans to loans between family members. Even without a signature from a notary public, it can still be a valid promissory note.

Calculate interest for one year Next, calculate the interest charge for one year by multiplying the principal by the interest rate. In our example that math would yield $5,000 X 0.07 = $350. This is the annual interest charge for the note.

A valid promissory note only needs the signatures of the participating parties involved in the agreement, not necessitating acknowledgment or being witnessed by a notary public to be legitimate.

If interest on your loan is calculated as simple interest, the formula for calculating interest begins with the total principal balance multiplied by the interest rate. For example, if the principal is $5,000 and the interest rate is 15 percent, multiply 5,000 by 0.15 to equal 750.

Promissory Notes, Interest, and Usury A promissory note must specify the percentage interest charged on the loan. All loans should carry some interest, even if it is between family members.

A promissory note is a written promise to pay within a specific time period. This type of document enforces a borrower's promise to pay back a lender by a specified period of time, and both parties must sign the document.

In Tennessee, there is no legal requirement to have a promissory note notarized. To make the document into a legal document, a Tennessee promissory note must be signed and dated by the borrower.

In the case of a gift of a promissory note, the transfer will be respected as a completed gift for tax purposes as long as the gift is one which is enforceable under local law. This may require the gift either to be structured as an enforceable agreement (including offer, acceptance and consideration).

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.