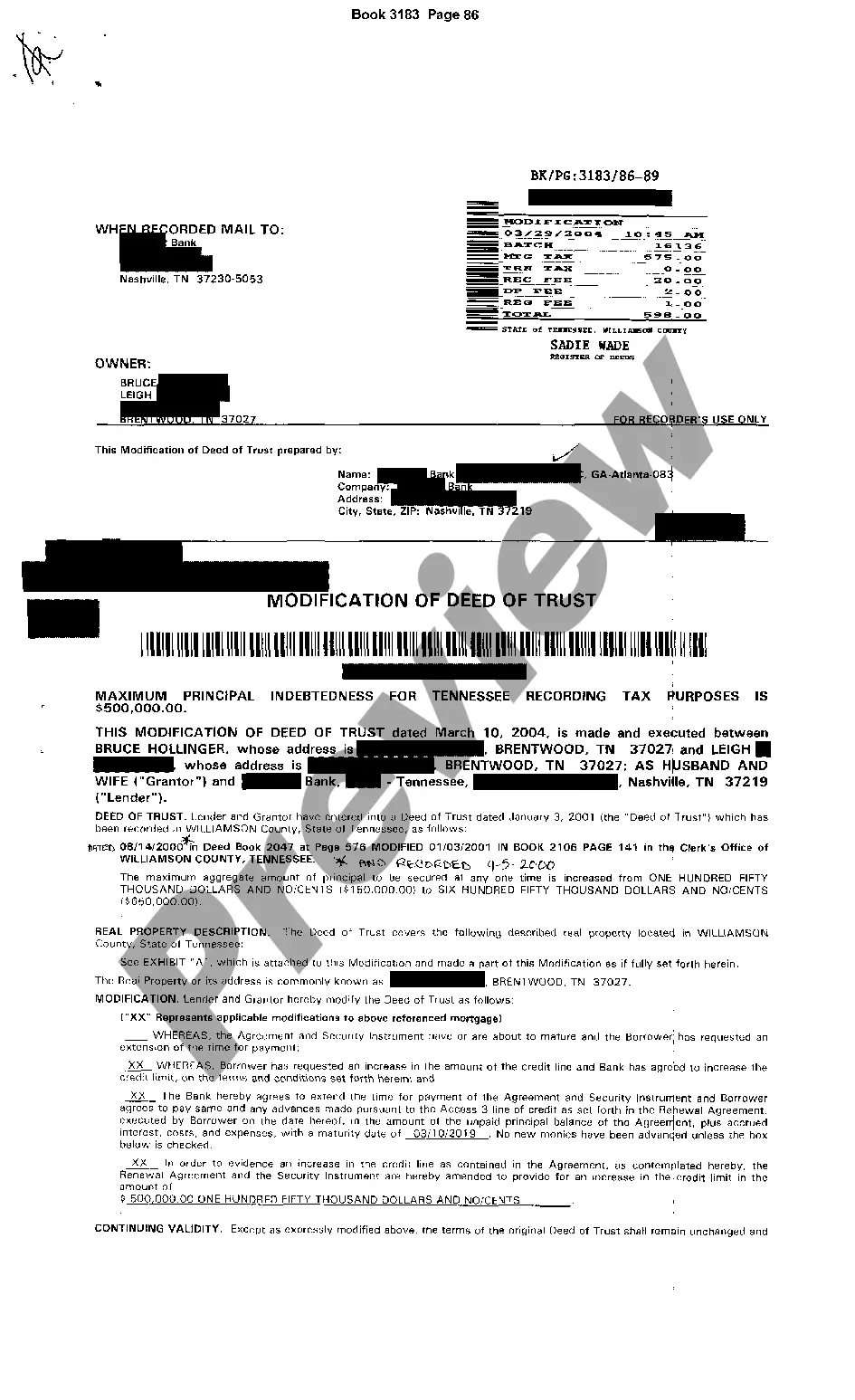

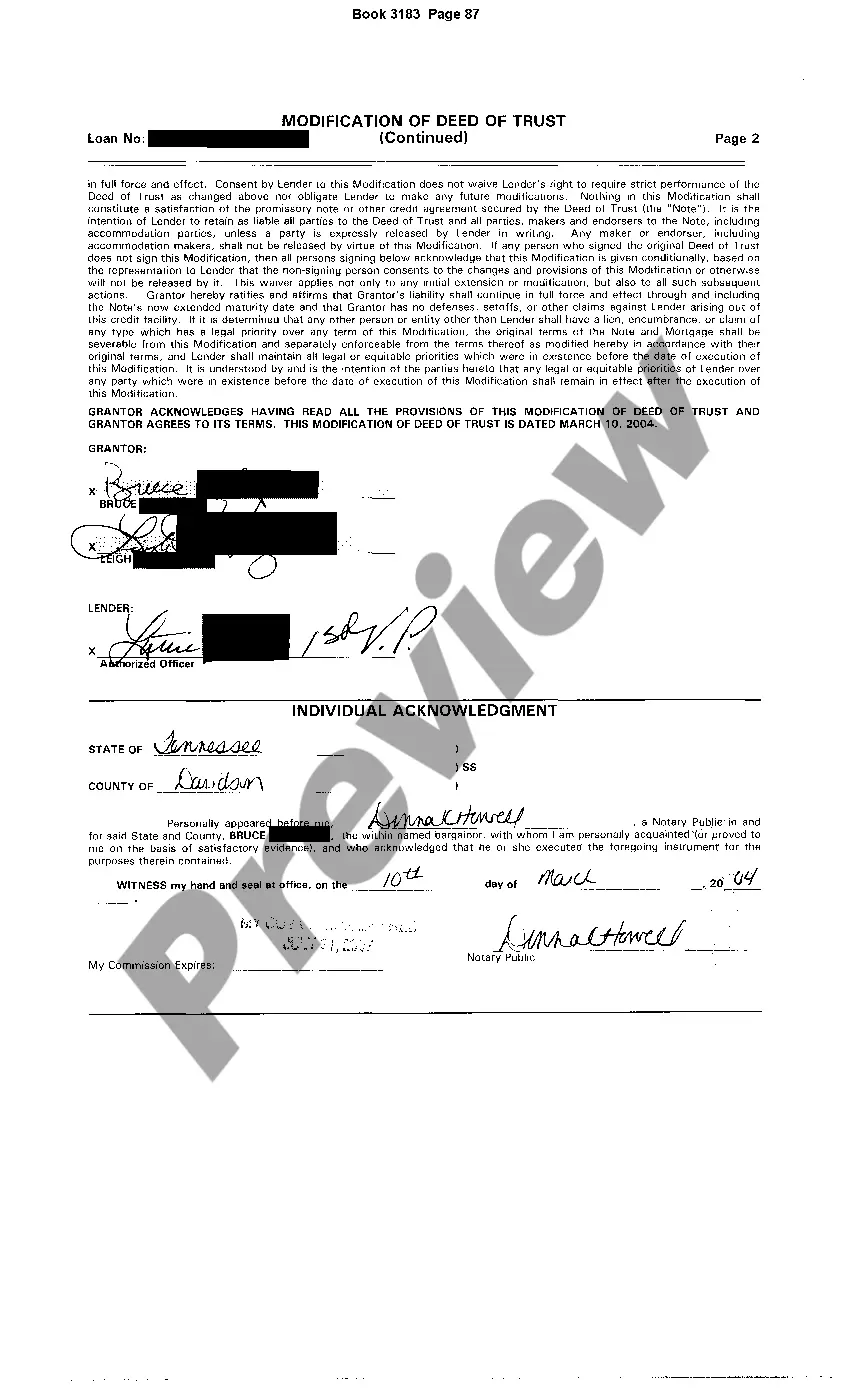

Chattanooga Tennessee Change or Modification of Deed of Trust to Increase Credit Line: A Comprehensive Guide Keywords: Chattanooga Tennessee, Change or Modification, Deed of Trust, Increase Credit Line Introduction: The Chattanooga Tennessee Change or Modification of Deed of Trust is a crucial legal process that allows property owners to increase their credit line by making adjustments to their existing deed of trust. This modification is a favorable solution for individuals who aim to access additional funds while leveraging the equity in their Chattanooga property. In this article, we will explore the different types of Change or Modification of Deed of Trust to Increase Credit Line available in Chattanooga Tennessee, providing you with a detailed understanding of each. 1. Chattanooga Tennessee Change or Modification of Deed of Trust — Traditional: The traditional method of modifying a deed of trust in Chattanooga Tennessee involves working closely with a reputable lender to assess and evaluate the existing terms and conditions of the loan. Through this process, property owners can negotiate an increase in their credit line, allowing them access to additional funds based on the property's current market value and equity. 2. Chattanooga Tennessee Change or Modification of Deed of Trust — Refinancing: Another common type of change or modification available in Chattanooga is refinancing. This process involves obtaining a new loan with modified terms and conditions in order to increase the credit line on the property. Refinancing can be an advantageous option for property owners seeking reduced interest rates, extended loan periods, or an overall improvement in their financial situation. 3. Chattanooga Tennessee Change or Modification of Deed of Trust — Home Equity Line of CreditHELOTOC): A home equity line of credit (HELOT) is a specialized type of modification that allows property owners to gain access to a credit line based solely on their property's equity. Chattanooga's residents with a substantial amount of equity in their property can apply for a HELOT to increase their credit line. This flexible form of credit provides convenience for individuals who anticipate accessing funds in a staggered manner, as it allows them to withdraw money as needed while only paying interest on the amount borrowed. 4. Chattanooga Tennessee Change or Modification of Deed of Trust — Cash-Out Refinance: The cash-out refinance option is suitable for property owners in Chattanooga who have built significant equity in their property and wish to access a lump sum of cash. By refinancing their existing loan, property owners can increase their credit line and receive the difference between the newly appraised value and the remaining mortgage balance in cash. This type of modification can be beneficial for consolidating debt, funding home improvements, or covering unexpected expenses. Conclusion: The Chattanooga Tennessee Change or Modification of Deed of Trust to Increase Credit Line provides property owners with a valuable opportunity to tap into their property's equity and access additional funds. Whether you opt for the traditional method, refinancing, a HELOT, or cash-out refinance, understanding the various options available can significantly empower you when it comes to financial decision-making. It is recommended to consult with a knowledgeable lender or financial advisor to determine the most appropriate modification option based on your specific needs and financial goals.

Chattanooga Tennessee Change or Modification of Deed of Trust to Increase Credit Line

Description

How to fill out Chattanooga Tennessee Change Or Modification Of Deed Of Trust To Increase Credit Line?

Do you need a reliable and inexpensive legal forms supplier to get the Chattanooga Tennessee Change or Modification of Deed of Trust to Increase Credit Line? US Legal Forms is your go-to option.

Whether you need a basic agreement to set regulations for cohabitating with your partner or a set of documents to advance your separation or divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and frameworked in accordance with the requirements of specific state and area.

To download the form, you need to log in account, locate the required form, and click the Download button next to it. Please remember that you can download your previously purchased form templates anytime from the My Forms tab.

Are you new to our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the Chattanooga Tennessee Change or Modification of Deed of Trust to Increase Credit Line conforms to the regulations of your state and local area.

- Go through the form’s description (if provided) to learn who and what the form is good for.

- Restart the search if the form isn’t suitable for your legal situation.

Now you can register your account. Then pick the subscription plan and proceed to payment. As soon as the payment is done, download the Chattanooga Tennessee Change or Modification of Deed of Trust to Increase Credit Line in any provided format. You can return to the website when you need and redownload the form free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about wasting your valuable time researching legal paperwork online once and for all.