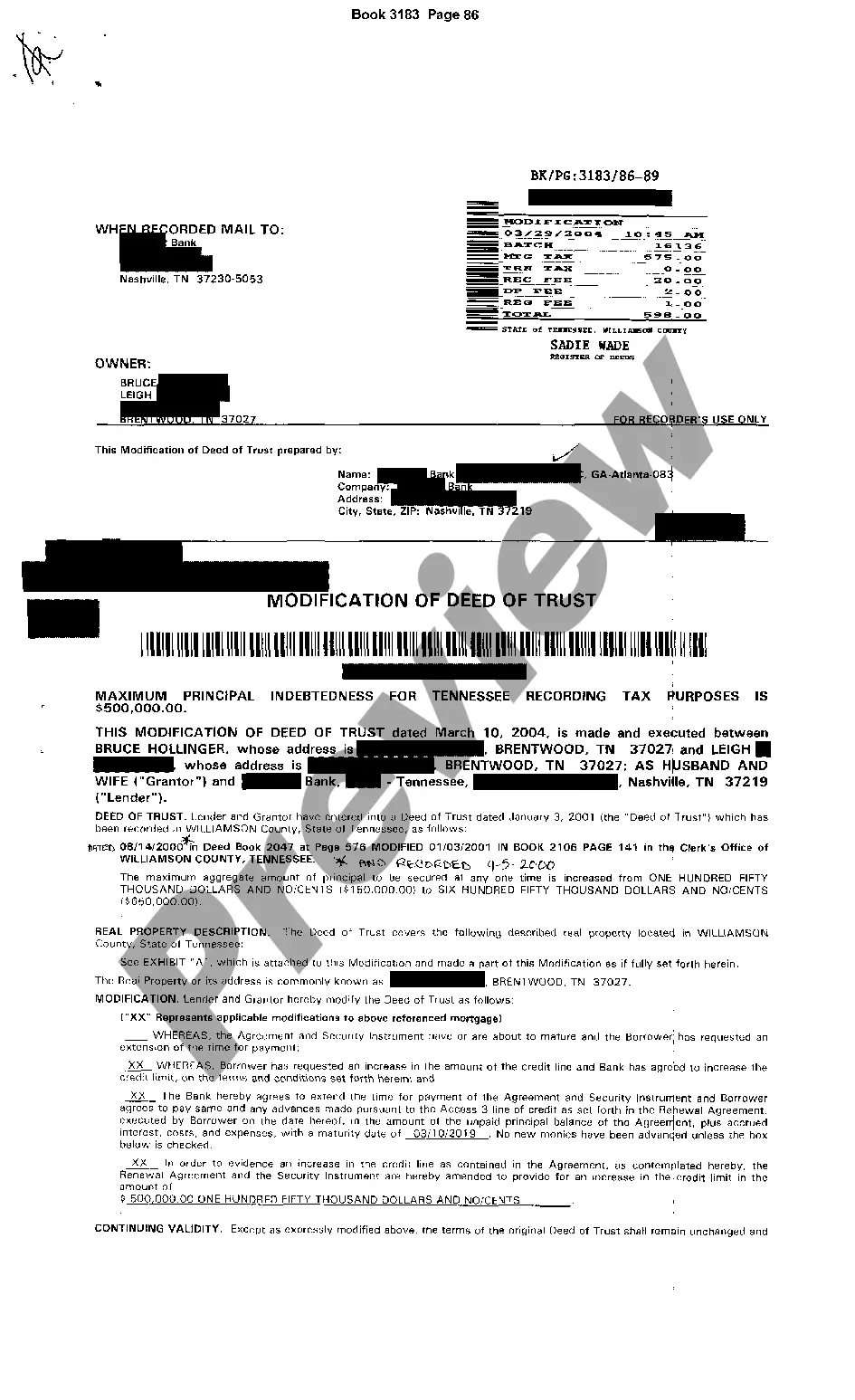

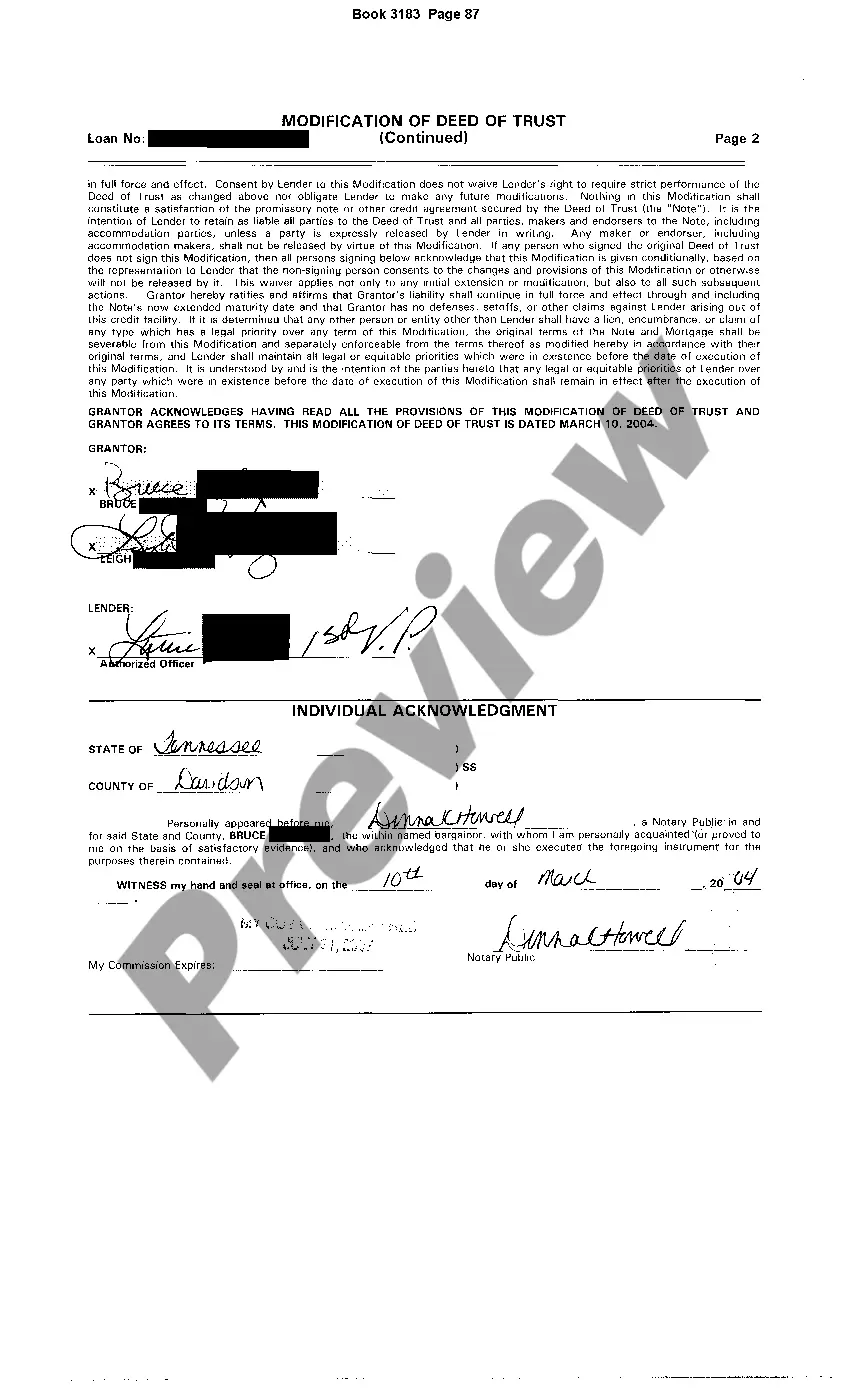

Clarksville Tennessee Change or Modification of Deed of Trust to Increase Credit Line is a process that allows homeowners in Clarksville, Tennessee to make adjustments to their existing deed of trust in order to increase their credit line. This modification can be helpful for homeowners who are in need of additional funds for home improvements, debt consolidation, or other financial needs. The Clarksville Tennessee Change or Modification of Deed of Trust to Increase Credit Line involves several key steps. First, the homeowner must contact their lender or mortgage service to express their interest in increasing their credit line. They will then need to provide the necessary documentation, such as proof of income, a current appraisal of the property, and any other documents required by the lender. Once the lender reviews the homeowner's application, they will assess the current value of the property and the homeowner's ability to repay the loan. If approved, the lender will then modify the existing deed of trust to reflect the increased credit line. This may involve amendments to the loan agreement, including changes to the principal amount, interest rate, and repayment terms. It's important to note that there may be different types of Clarksville Tennessee Change or Modification of Deed of Trust to Increase Credit Line, depending on the specific circumstances and objectives of the homeowner. Some common types may include: 1. Cash-out refinance: This involves refinancing the existing mortgage for an amount higher than the outstanding balance, allowing homeowners to access the additional equity in their property as cash. 2. Home equity line of credit (HELOT): This allows homeowners to access a revolving line of credit based on the equity they have built in their property. They can borrow funds as needed, up to a pre-approved credit limit. 3. Second mortgage: This involves obtaining a second mortgage loan on top of the existing first mortgage, providing additional funds based on the equity in the property. 4. Loan modification: This option is available for homeowners who are struggling to make their mortgage payments. It involves negotiating with the lender to modify the terms of the existing mortgage, including increasing the credit line if needed. The Clarksville Tennessee Change or Modification of Deed of Trust to Increase Credit Line can be a beneficial option for homeowners in need of additional funds. However, it's important to consult with a lender or mortgage professional to explore the available options and fully understand the implications of any modifications to the deed of trust.

Clarksville Tennessee Change or Modification of Deed of Trust to Increase Credit Line is a process that allows homeowners in Clarksville, Tennessee to make adjustments to their existing deed of trust in order to increase their credit line. This modification can be helpful for homeowners who are in need of additional funds for home improvements, debt consolidation, or other financial needs. The Clarksville Tennessee Change or Modification of Deed of Trust to Increase Credit Line involves several key steps. First, the homeowner must contact their lender or mortgage service to express their interest in increasing their credit line. They will then need to provide the necessary documentation, such as proof of income, a current appraisal of the property, and any other documents required by the lender. Once the lender reviews the homeowner's application, they will assess the current value of the property and the homeowner's ability to repay the loan. If approved, the lender will then modify the existing deed of trust to reflect the increased credit line. This may involve amendments to the loan agreement, including changes to the principal amount, interest rate, and repayment terms. It's important to note that there may be different types of Clarksville Tennessee Change or Modification of Deed of Trust to Increase Credit Line, depending on the specific circumstances and objectives of the homeowner. Some common types may include: 1. Cash-out refinance: This involves refinancing the existing mortgage for an amount higher than the outstanding balance, allowing homeowners to access the additional equity in their property as cash. 2. Home equity line of credit (HELOT): This allows homeowners to access a revolving line of credit based on the equity they have built in their property. They can borrow funds as needed, up to a pre-approved credit limit. 3. Second mortgage: This involves obtaining a second mortgage loan on top of the existing first mortgage, providing additional funds based on the equity in the property. 4. Loan modification: This option is available for homeowners who are struggling to make their mortgage payments. It involves negotiating with the lender to modify the terms of the existing mortgage, including increasing the credit line if needed. The Clarksville Tennessee Change or Modification of Deed of Trust to Increase Credit Line can be a beneficial option for homeowners in need of additional funds. However, it's important to consult with a lender or mortgage professional to explore the available options and fully understand the implications of any modifications to the deed of trust.