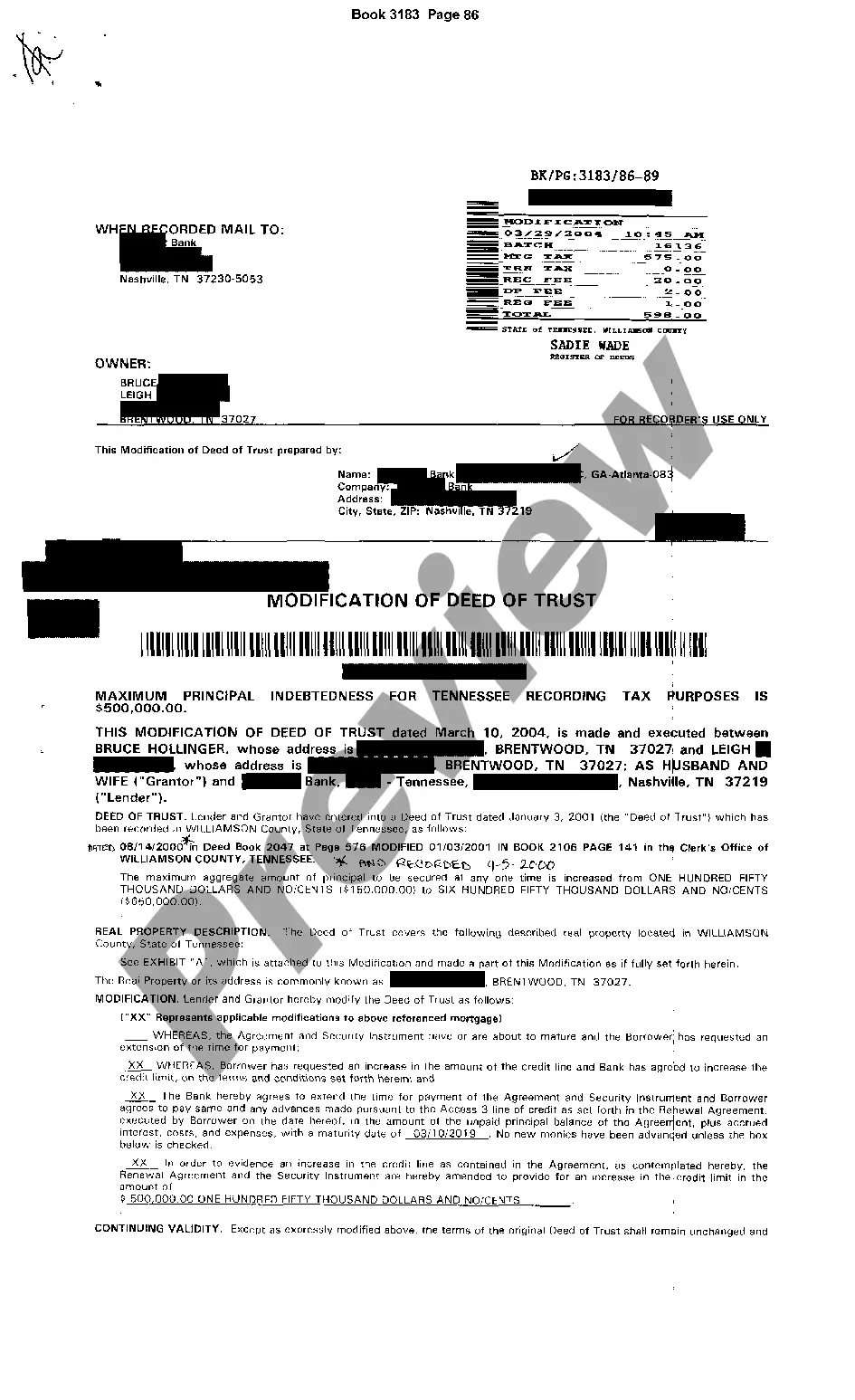

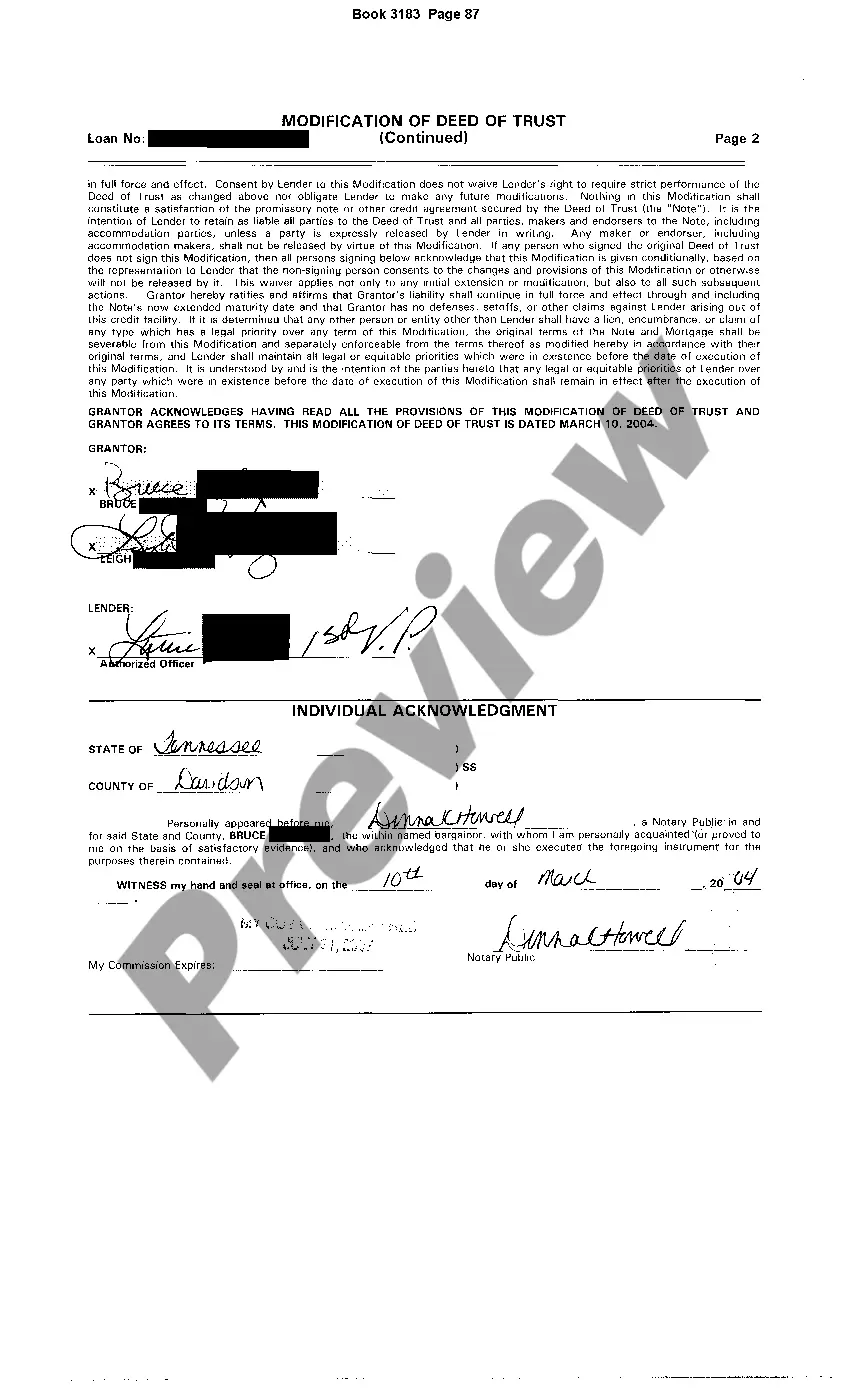

A Knoxville Tennessee Change or Modification of Deed of Trust to Increase Credit Line is a legal document that allows homeowners to make amendments to their existing deed of trust in order to obtain additional credit or increase their borrowing capacity. This process is particularly beneficial for homeowners who wish to access additional funds for various purposes such as home improvements, debt consolidation, or other financial needs. There are typically two types of Knoxville Tennessee Change or Modification of Deed of Trust to Increase Credit Line: 1. Change or Modification of Deed of Trust: This refers to the process of adjusting the terms and conditions of an existing deed of trust to accommodate the increase in credit line. The modification may involve extending the repayment term, altering the interest rate, adjusting the monthly payments, or making other changes to suit the borrower's requirements. This modification ensures that the lender recognizes the increased credit line and maintains accurate records. 2. Increase in Credit Line: This type of modification specifically aims at increasing the borrower's credit line without making any significant changes to the original deed of trust terms. It involves adding an addendum or amendment to the current deed of trust, stating the updated credit line and related terms. This type of modification allows homeowners to tap into the increased equity of their property and borrow additional funds, while keeping the existing interest rate and repayment term intact. Homeowners in Knoxville, Tennessee seeking a change or modification of their deed of trust to increase their credit line may need to provide certain documentation such as income verification, credit history, property appraisal, and other financial information to support their request. It's essential to consult with a qualified attorney or a trusted financial professional to ensure compliance with legal requirements and to navigate the modification process smoothly. By undertaking a Knoxville Tennessee Change or Modification of Deed of Trust to Increase Credit Line, homeowners can access the extra credit they need while utilizing the equity in their property. This option offers flexibility and can be a viable solution for those seeking additional financial resources without refinancing their entire mortgage. Remember to research and understand the specific terms and conditions related to this modification, and work closely with professionals to ensure that all legal aspects are addressed appropriately.

Knoxville Tennessee Change or Modification of Deed of Trust to Increase Credit Line

Description

How to fill out Knoxville Tennessee Change Or Modification Of Deed Of Trust To Increase Credit Line?

Benefit from the US Legal Forms and get instant access to any form sample you need. Our useful website with thousands of documents simplifies the way to find and get almost any document sample you require. You are able to download, fill, and certify the Knoxville Tennessee Change or Modification of Deed of Trust to Increase Credit Line in just a few minutes instead of surfing the Net for many hours trying to find the right template.

Utilizing our catalog is a great way to improve the safety of your form submissions. Our experienced lawyers regularly review all the documents to ensure that the templates are appropriate for a particular state and compliant with new acts and regulations.

How can you get the Knoxville Tennessee Change or Modification of Deed of Trust to Increase Credit Line? If you already have a subscription, just log in to the account. The Download button will appear on all the samples you view. In addition, you can get all the earlier saved files in the My Forms menu.

If you haven’t registered an account yet, stick to the tips below:

- Open the page with the template you need. Make sure that it is the form you were seeking: verify its headline and description, and utilize the Preview option if it is available. Otherwise, make use of the Search field to look for the appropriate one.

- Start the downloading process. Click Buy Now and choose the pricing plan that suits you best. Then, create an account and pay for your order using a credit card or PayPal.

- Export the document. Select the format to get the Knoxville Tennessee Change or Modification of Deed of Trust to Increase Credit Line and change and fill, or sign it according to your requirements.

US Legal Forms is one of the most significant and trustworthy template libraries on the internet. We are always happy to assist you in virtually any legal procedure, even if it is just downloading the Knoxville Tennessee Change or Modification of Deed of Trust to Increase Credit Line.

Feel free to take full advantage of our form catalog and make your document experience as efficient as possible!