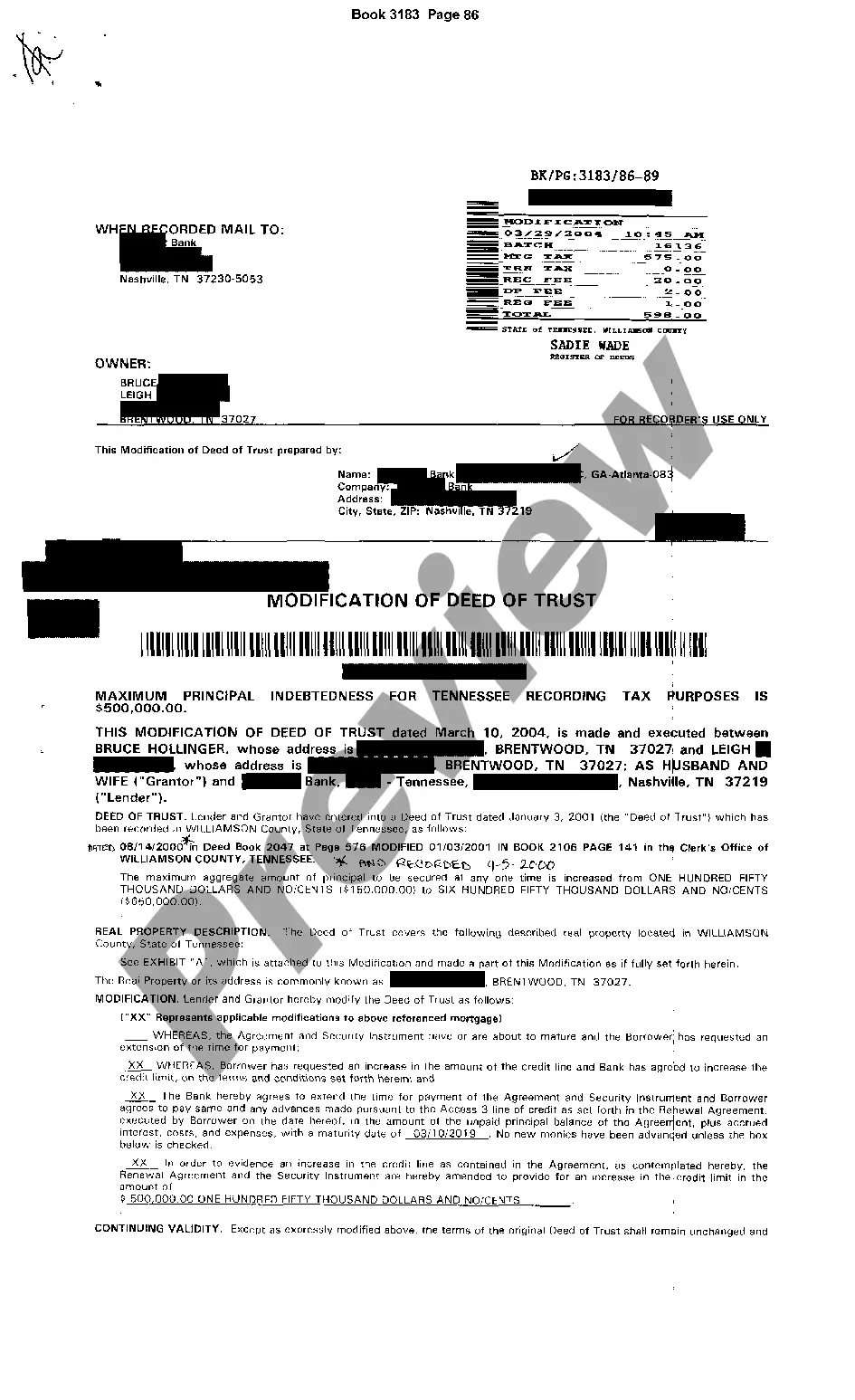

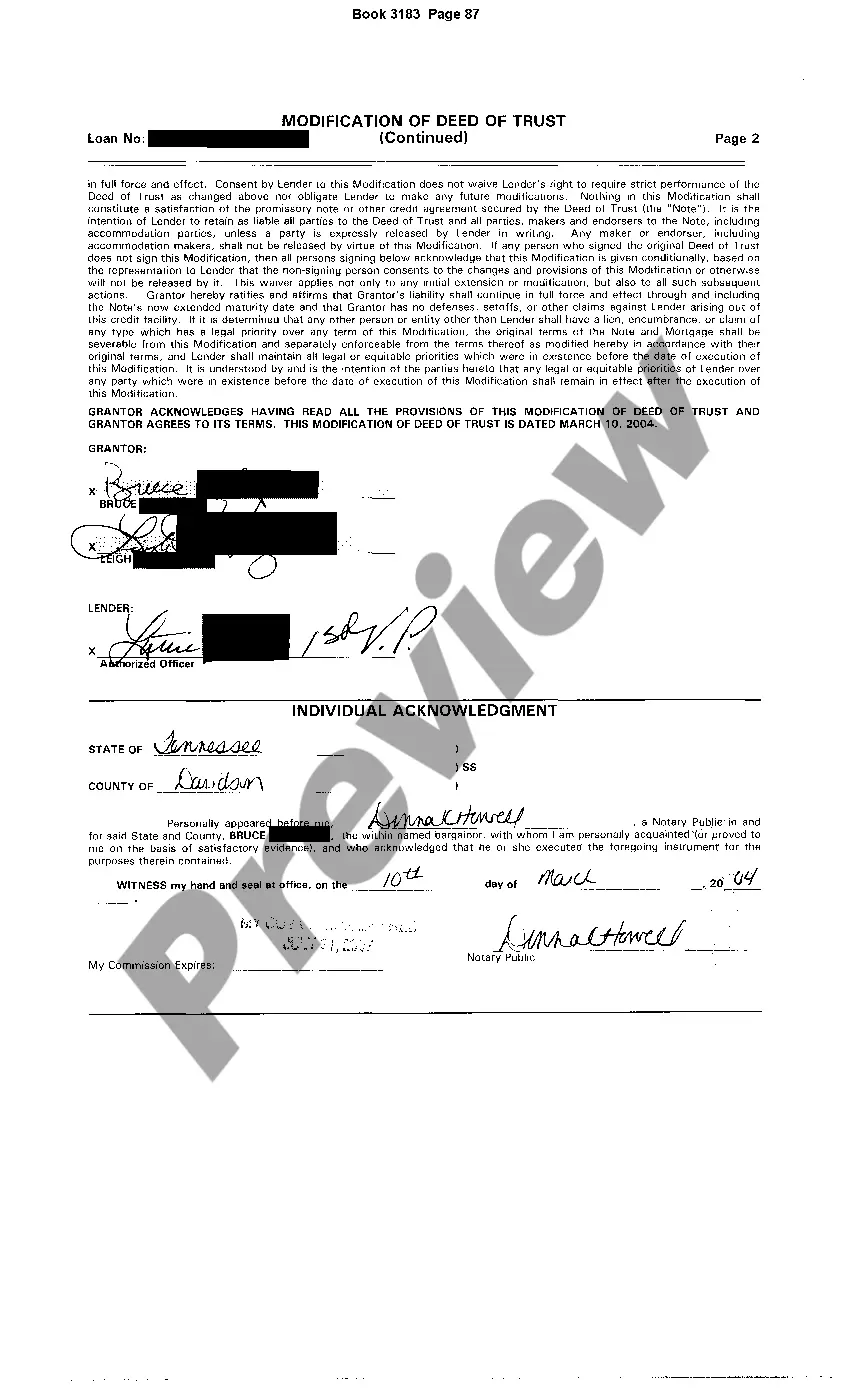

Memphis, Tennessee Change or Modification of Deed of Trust to Increase Credit Line refers to the legal process of altering the terms and conditions of a property's deed of trust to increase the available credit line. This change allows the property owner to borrow additional funds based on the increased value of the property or other specific factors. The purpose of this process is to provide property owners in Memphis, Tennessee with the opportunity to access more credit and potentially secure better financing options. The modification of the deed of trust is typically done in collaboration with the lender or financial institution holding the mortgage. It is important to note that this process is subject to the specific laws and regulations governing property transactions in Memphis, Tennessee. There may be multiple types of Change or Modification of Deed of Trust to Increase Credit Line in Memphis, Tennessee, which may include: 1. Equity Line of Credit Modification: This type of modification allows property owners to tap into the accrued equity in their property, increasing the credit line available. The equity in a property is the difference between its fair market value and the outstanding mortgage balance. 2. Construction Loan Modification: In certain cases, property owners may seek to increase the credit line to finance construction or renovation projects. This type of modification allows for an increase in the credit line based on the estimated value of the completed project. 3. Interest Rate Modification: Property owners may also seek to modify the deed of trust to increase the credit line by negotiating for lower interest rates on their existing mortgage. This modification allows for a more favorable lending arrangement and potentially reduces the overall cost of borrowing. To initiate the Memphis, Tennessee Change or Modification of Deed of Trust to Increase Credit Line, property owners typically need to provide relevant documentation such as proof of ownership, financial statements, and an appraisal of the property. The lender will evaluate the request and consider factors such as the property's current value, the borrower's creditworthiness, and their ability to repay the increased credit line. Once both parties agree to the modified terms, a legal document or amendment is prepared, known as a Modification of Deed of Trust. This document outlines the revised terms, including the increased credit line, new interest rates, and any other changes agreed upon. It is important to consult with a qualified attorney or real estate professional specializing in Memphis, Tennessee property law to ensure compliance with all legal requirements during this process.

Memphis Tennessee Change or Modification of Deed of Trust to Increase Credit Line

Description

How to fill out Memphis Tennessee Change Or Modification Of Deed Of Trust To Increase Credit Line?

Do you need a trustworthy and affordable legal forms supplier to buy the Memphis Tennessee Change or Modification of Deed of Trust to Increase Credit Line? US Legal Forms is your go-to option.

No matter if you need a basic arrangement to set rules for cohabitating with your partner or a set of documents to move your separation or divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and frameworked in accordance with the requirements of particular state and area.

To download the form, you need to log in account, find the required template, and click the Download button next to it. Please remember that you can download your previously purchased document templates at any time from the My Forms tab.

Are you new to our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the Memphis Tennessee Change or Modification of Deed of Trust to Increase Credit Line conforms to the regulations of your state and local area.

- Read the form’s details (if provided) to learn who and what the form is intended for.

- Start the search over in case the template isn’t good for your legal situation.

Now you can create your account. Then select the subscription plan and proceed to payment. Once the payment is done, download the Memphis Tennessee Change or Modification of Deed of Trust to Increase Credit Line in any provided format. You can return to the website when you need and redownload the form without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about spending hours learning about legal papers online for good.