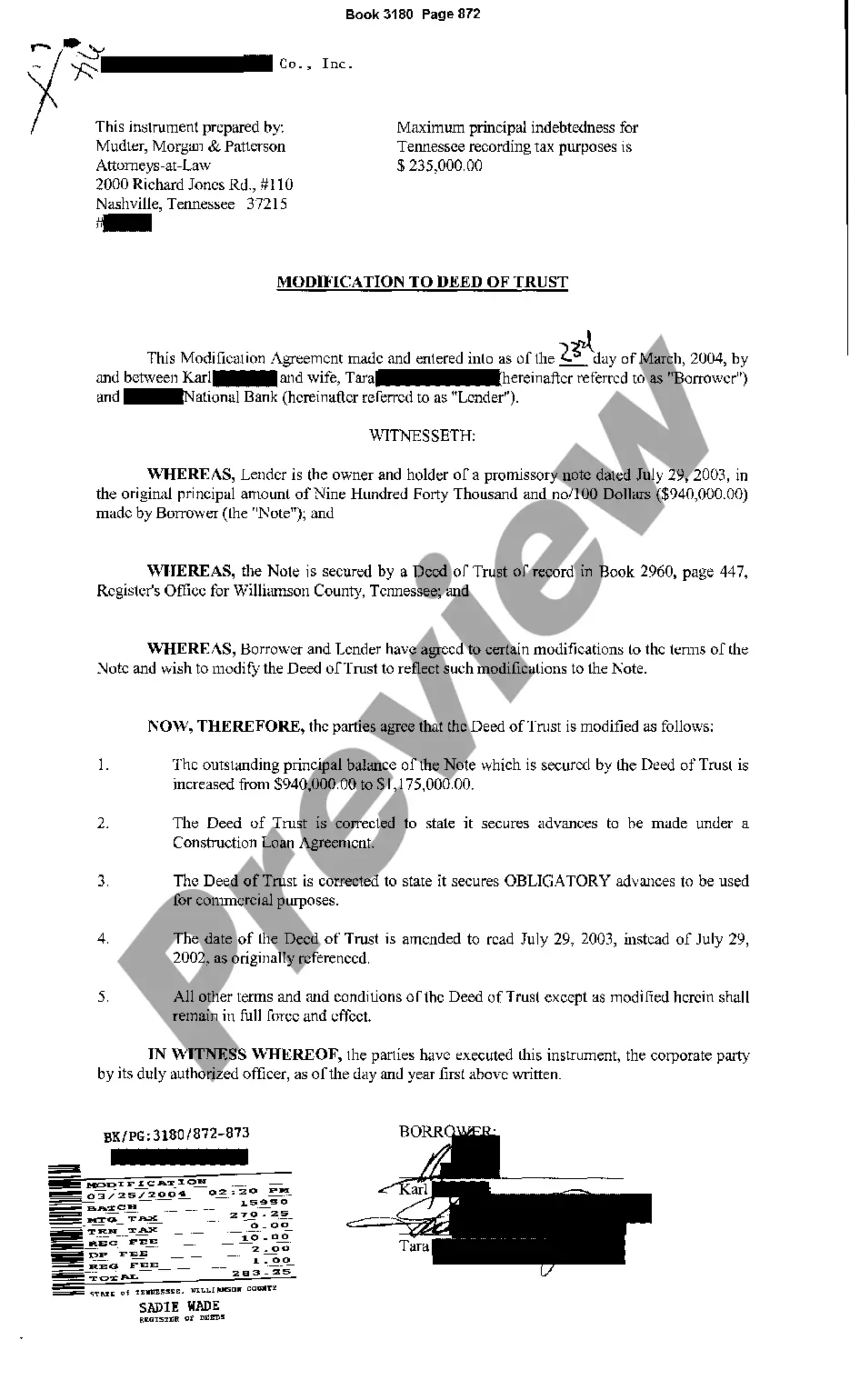

Chattanooga Tennessee Change or Modification to Deed of Trust to Increase Principal Balance involves altering the terms of a loan agreement secured by a property located in the Chattanooga area, with the purpose of increasing the original principal amount. This modification can be requested by borrowers who wish to borrow additional funds against the property or to consolidate other debts, among other reasons. The process of amending the Deed of Trust to increase the principal balance in Chattanooga, Tennessee typically requires formal documentation and is subject to certain legal procedures. The borrower must provide a written request to the lender, detailing the reasons for the modification and the desired new loan amount. The lender evaluates the borrower's financial situation, creditworthiness, and the property's current value to consider the feasibility of the modification. Different types of Chattanooga Tennessee Change or Modification to Deed of Trust to Increase Principal Balance may include: 1. Cash-out Refinancing: This type of modification allows borrowers to refinance their existing loan, obtaining a new loan for a higher amount than the outstanding balance. The excess funds are given to the borrower in cash, which can be used for various purposes such as home improvements, debt consolidation, or other financial needs. 2. Home Equity Line of Credit (HELOT) Increase: With a HELOT, borrowers can access a revolving line of credit based on the equity in their property. A modification may involve increasing the credit limit, enabling borrowers to withdraw additional funds as needed, while securing the loan against the property. 3. Loan Consolidation: This modification option allows borrowers to combine multiple loans or debts into a single loan with an increased principal balance. Consolidating debts can simplify monthly payments and potentially lower overall interest rates. 4. Construction Loan Expansion: If borrowers intend to undertake significant property improvements or construct an addition to the existing structure, they may seek a modification to their Deed of Trust to obtain additional funds required for the project. It is crucial for borrowers in Chattanooga, Tennessee considering a Change or Modification to Deed of Trust to Increase Principal Balance to consult with their lender or a legal professional to understand the specific terms, conditions, and implications of the modification. The lender will typically assess the borrower's eligibility, creditworthiness, and financial ability to repay the increased loan amount. Moreover, borrowers should carefully review the updated terms and evaluate the long-term financial impact before proceeding with the modification.

Chattanooga Tennessee Change or Modification to Deed of Trust to Increase Principal Balance

Description

How to fill out Chattanooga Tennessee Change Or Modification To Deed Of Trust To Increase Principal Balance?

Regardless of social or professional status, filling out law-related forms is an unfortunate necessity in today’s world. Too often, it’s almost impossible for a person with no law background to create this sort of paperwork cfrom the ground up, mainly because of the convoluted terminology and legal subtleties they come with. This is where US Legal Forms can save the day. Our platform provides a massive catalog with more than 85,000 ready-to-use state-specific forms that work for practically any legal scenario. US Legal Forms also serves as a great resource for associates or legal counsels who want to save time utilizing our DYI forms.

Whether you want the Chattanooga Tennessee Change or Modification to Deed of Trust to Increase Principal Balance or any other document that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Chattanooga Tennessee Change or Modification to Deed of Trust to Increase Principal Balance in minutes employing our trusted platform. If you are presently a subscriber, you can go on and log in to your account to download the appropriate form.

However, if you are unfamiliar with our library, ensure that you follow these steps before downloading the Chattanooga Tennessee Change or Modification to Deed of Trust to Increase Principal Balance:

- Ensure the form you have found is suitable for your area because the regulations of one state or county do not work for another state or county.

- Preview the document and read a brief description (if provided) of cases the document can be used for.

- In case the form you picked doesn’t meet your requirements, you can start over and search for the needed document.

- Click Buy now and pick the subscription plan you prefer the best.

- Log in to your account login information or register for one from scratch.

- Pick the payment method and proceed to download the Chattanooga Tennessee Change or Modification to Deed of Trust to Increase Principal Balance as soon as the payment is through.

You’re good to go! Now you can go on and print out the document or fill it out online. In case you have any issues getting your purchased forms, you can quickly access them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.