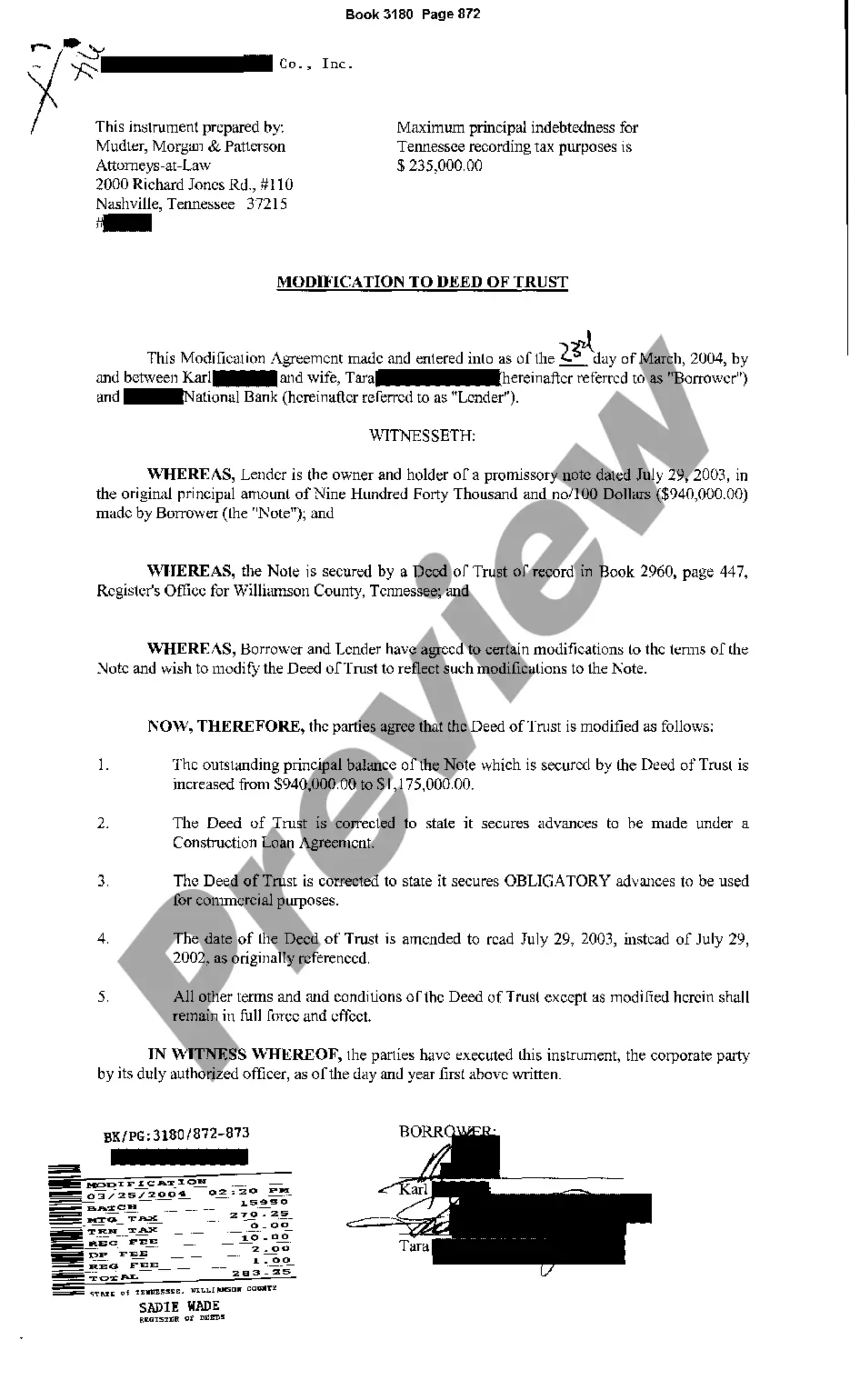

Clarksville Tennessee Change or Modification to Deed of Trust to Increase Principal Balance: Understanding the Process and Types In Clarksville, Tennessee, homeowners may find themselves in a situation where they need to make changes or modifications to their deed of trust to increase the principal balance. Whether it is due to financial constraints, refinancing options, or home improvements, understanding the process and different types of changes available can be beneficial. Here, we will delve into the details and provide essential information about Clarksville Tennessee's change or modification process for deed of trust. 1. Definition of Deed of Trust: A deed of trust is a legal document that outlines the terms and conditions of a loan secured by real estate property. It involves three key parties: the borrower (homeowner), the lender (usually a bank or mortgage company), and the trustee (an impartial third party). The deed of trust serves as security for the loan, allowing the lender to foreclose on the property in case of default. 2. Need for Change or Modification: Homeowners in Clarksville, Tennessee, might consider changing or modifying their deed of trust to increase the principal balance for various reasons. Some common scenarios include: — Home Improvement: Homeowners may choose to increase the principal balance to finance renovations, additions, or upgrades on their property. — Debt Consolidation: Consolidating high-interest debts into a mortgage may be a financially viable option, allowing homeowners to pay off their outstanding debts more comfortably. — Refinancing: Lower interest rates or improved credit scores may prompt homeowners to refinance their current mortgage, increasing the principal balance in the process. — Financial Hardship: In times of financial difficulty, some homeowners may opt for a modification to lower their monthly payments, extend the loan term, or obtain a temporary pause in payments. 3. Types of Changes or Modifications to Deed of Trust: When considering increasing the principal balance of a deed of trust in Clarksville, Tennessee, homeowners have a few options available: — Loan Modification: This type of change involves negotiating new terms with the lender to adjust the principal balance and potentially modify the interest rate, payment schedule, or loan term. Loan modifications typically aim to provide immediate relief in the form of more manageable payments. — Refinancing: Homeowners may choose to refinance their existing loan and obtain a new mortgage with an increased principal balance. This involves paying off the current mortgage and acquiring a new loan with different terms and interest rates. Refinancing often requires a credit check and appraisal of the property. — Line of Credit: A home equity line of credit (HELOT) allows homeowners to borrow against the increased equity of their property. This option provides flexibility in accessing funds by utilizing the accumulated equity to accommodate various financial needs. 4. The Process of Change or Modification: To initiate a change or modification to the deed of trust in Clarksville, Tennessee, homeowners should follow these general steps: — Contact the Lender: Discuss the desired changes and reasons with the lender, as they can guide homeowners through the available options and requirements. — Provide Documentation: Prepare and submit all necessary documentation, such as financial statements, proof of income, tax returns, and any other information required by the lender or loan service. — Review the Proposed Terms: Carefully examine the terms offered by the lender, including the new principal balance, interest rates, repayment schedule, and any associated costs or fees. — Legal Assistance: Seeking the help of a real estate attorney or a qualified professional can ensure that homeowners fully understand the legal implications of the changes and that the modification process aligns with local laws and regulations. — Signing and Recording: Once both parties agree upon the modified terms, homeowners will need to sign the new deed of trust and have it recorded with the county recorder's office to formalize the changes. In conclusion, Clarksville, Tennessee homeowners have options when it comes to changing or modifying their deed of trust to increase the principal balance. Whether seeking a loan modification, refinancing, or a home equity line of credit, understanding the process and working closely with the lender and legal professionals can help homeowners make informed decisions.

Clarksville Tennessee Change or Modification to Deed of Trust to Increase Principal Balance

Description

How to fill out Clarksville Tennessee Change Or Modification To Deed Of Trust To Increase Principal Balance?

Are you looking for a reliable and affordable legal forms supplier to buy the Clarksville Tennessee Change or Modification to Deed of Trust to Increase Principal Balance? US Legal Forms is your go-to option.

Whether you need a simple agreement to set regulations for cohabitating with your partner or a set of documents to advance your divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and framed based on the requirements of particular state and area.

To download the document, you need to log in account, locate the required form, and click the Download button next to it. Please remember that you can download your previously purchased document templates at any time from the My Forms tab.

Are you new to our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the Clarksville Tennessee Change or Modification to Deed of Trust to Increase Principal Balance conforms to the laws of your state and local area.

- Go through the form’s details (if provided) to learn who and what the document is intended for.

- Start the search over in case the form isn’t suitable for your specific scenario.

Now you can create your account. Then select the subscription option and proceed to payment. As soon as the payment is done, download the Clarksville Tennessee Change or Modification to Deed of Trust to Increase Principal Balance in any provided file format. You can return to the website when you need and redownload the document without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about spending your valuable time learning about legal papers online once and for all.