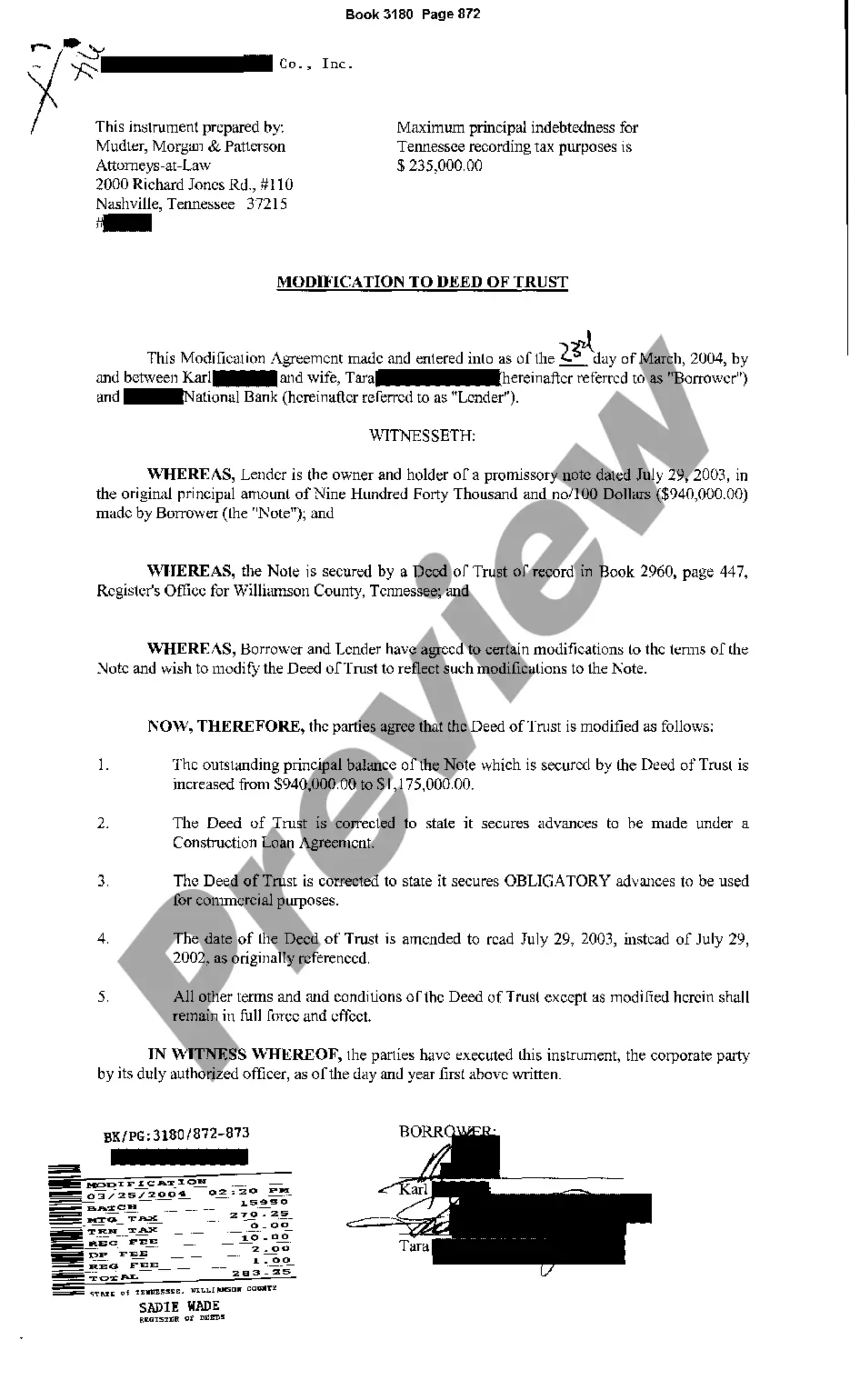

When it comes to making a change or modification to a deed of trust in Knoxville, Tennessee to increase the principal balance, there are several important aspects to consider. It is essential to understand the process, requirements, and potential outcomes associated with such changes. Here, we will provide a detailed description of Knoxville Tennessee Change or Modification to Deed of Trust to Increase Principal Balance, highlighting the procedure and different types of modifications available. 1. Knoxville Tennessee Deed of Trust: A deed of trust is a legal document used in Tennessee to secure a loan on real property. It involves three parties: the borrower (trust or), the lender (beneficiary), and a trustee. The trustee holds the legal title to the property on behalf of the lender until the loan is fully repaid. Deeds of trust are commonly used instead of mortgages in Tennessee. 2. Need for Change or Modification: A change or modification to a deed of trust in Knoxville, Tennessee, may be necessary when the borrower requires an increase in the principal balance. This could occur due to various reasons, such as the need for additional funding for property improvements, debt consolidation, or leveraging the existing equity. 3. Types of Changes or Modifications: a. Principal Balance Increase: This type of modification aims to increase the loan amount borrowed against the property. The borrower and lender negotiate new terms, which may include adjusting interest rates, extending the loan term, or changing the monthly payment structure. b. Interest Rate Adjustment: In some cases, instead of modifying the principal balance, the borrower may negotiate an adjustment to the interest rate. This can be done to align with current market rates or prevailing economic conditions, resulting in changes to the monthly payment amount. c. Loan Term Extension: Another modification option is extending the loan term, allowing the borrower to repay the increased principal balance over a longer period. This can help reduce the monthly payment burden and make it more affordable for the borrower. d. Combination of Changes: Depending on the borrower's financial situation and goals, a combination of principal balance increase, interest rate adjustment, and loan term extension can be negotiated to achieve the desired outcome. 4. Process and Requirements: a. Communication: The borrower needs to communicate with the lender to discuss the intention of modifying the deed of trust. Both parties must agree on the changes before proceeding. b. Documentation: Typically, the lender will require the borrower to complete a modification request form and provide supporting documentation, such as financial statements, income verification, and an explanation of the reason for the modification. c. Title Search and Legal Review: The lender will conduct a title search to ensure the property is free from liens or encumbrances that may affect the modification process. A legal review is also conducted to ensure the modification complies with Tennessee law. d. Agreement and Execution: Once the modification terms are agreed upon, all parties involved must sign and execute the modified deed of trust. This document becomes legally binding and replaces the original deed of trust. e. Filing and Recording: The modified deed of trust is then filed with the appropriate county office, such as the Knox County Register of Deeds, ensuring public record of the changes made. In conclusion, when considering a change or modification to a deed of trust in Knoxville, Tennessee, to increase the principal balance, an open and transparent communication between the borrower and the lender are crucial. Understanding the different types of modifications available, such as principal balance increase, interest rate adjustment, or loan term extension, enables borrowers to choose a suitable option that aligns with their financial goals. With proper documentation, legal review, and execution, the modification process can be successfully completed, leading to a revised deed of trust that reflects the new terms agreed upon by all parties involved.

Knoxville Tennessee Change or Modification to Deed of Trust to Increase Principal Balance

Description

How to fill out Knoxville Tennessee Change Or Modification To Deed Of Trust To Increase Principal Balance?

Benefit from the US Legal Forms and have immediate access to any form template you require. Our beneficial platform with a large number of documents simplifies the way to find and obtain virtually any document sample you will need. It is possible to export, complete, and certify the Knoxville Tennessee Change or Modification to Deed of Trust to Increase Principal Balance in just a couple of minutes instead of surfing the Net for several hours attempting to find the right template.

Utilizing our collection is a superb strategy to improve the safety of your record filing. Our experienced attorneys regularly check all the records to ensure that the forms are appropriate for a particular region and compliant with new acts and regulations.

How do you get the Knoxville Tennessee Change or Modification to Deed of Trust to Increase Principal Balance? If you have a profile, just log in to the account. The Download option will be enabled on all the samples you view. Furthermore, you can find all the previously saved documents in the My Forms menu.

If you don’t have a profile yet, follow the instructions listed below:

- Open the page with the template you require. Ensure that it is the form you were seeking: examine its name and description, and utilize the Preview function when it is available. Otherwise, use the Search field to look for the needed one.

- Start the saving process. Select Buy Now and select the pricing plan you prefer. Then, create an account and process your order using a credit card or PayPal.

- Save the document. Choose the format to get the Knoxville Tennessee Change or Modification to Deed of Trust to Increase Principal Balance and modify and complete, or sign it for your needs.

US Legal Forms is one of the most considerable and reliable template libraries on the internet. We are always ready to assist you in any legal case, even if it is just downloading the Knoxville Tennessee Change or Modification to Deed of Trust to Increase Principal Balance.

Feel free to take full advantage of our service and make your document experience as straightforward as possible!