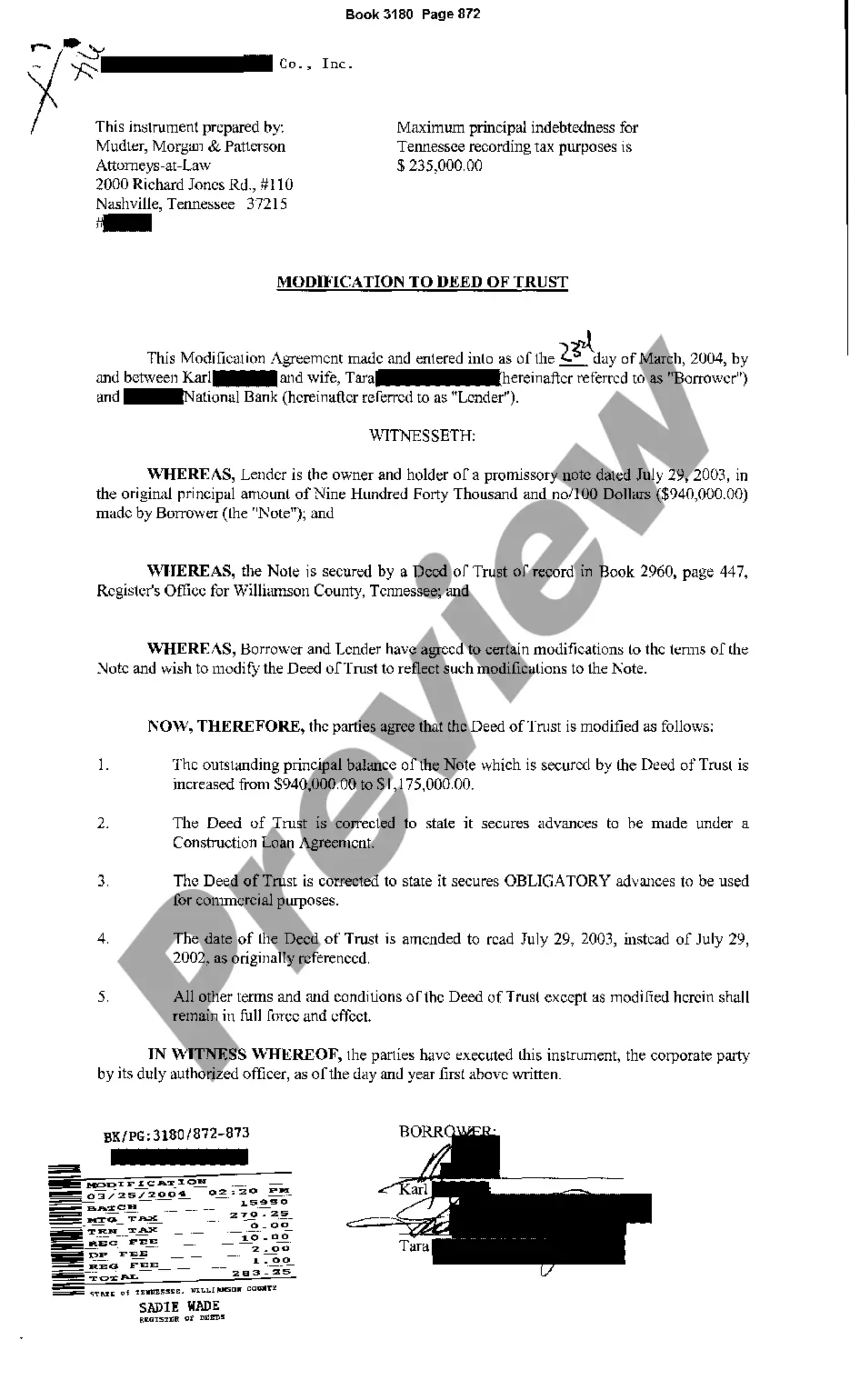

Memphis Tennessee Change or Modification to Deed of Trust to Increase Principal Balance refers to a legal procedure that allows property owners in Memphis, Tennessee to amend or alter their existing Deed of Trust to increase the principal balance of their loan. This modification is typically sought when borrowers require additional funds for various purposes, such as home improvements, debt consolidation, or real estate investment. The process of changing or modifying a Deed of Trust to increase the principal balance in Memphis, Tennessee involves several steps. Firstly, the borrower must communicate their intention to the lender, expressing their need for additional funds and outlining the purpose for which the funds will be utilized. It is essential to provide accurate and detailed information to the lender, including the desired increase in the principal balance and the reasons behind the request. Once the lender receives the borrower's request, they will evaluate it based on various factors such as the borrower's creditworthiness, the property's appraised value, and the overall financial stability of the borrower. The lender may also analyze the borrower's current income and employment status to assess their ability to repay the increased loan amount. If the lender approves the request, they will prepare a modification agreement that outlines the terms and conditions of the increased principal balance. This document will specify the new loan amount, the revised interest rate, and any modifications to the repayment schedule. Additionally, it may include clauses that protect the lender's interests and ensure timely repayment. There are different types of Memphis Tennessee Change or Modification to Deed of Trust to Increase Principal Balance, depending on the specific circumstances and needs of the borrower. Some common types include: 1. Rate and Term Modification: In this type of modification, the borrower seeks to increase the principal balance to take advantage of lower interest rates or to extend the loan term, thereby reducing monthly payments. 2. Cash-Out Refinance: This modification allows the borrower to increase the principal balance and receive a lump-sum payment based on the accumulated equity in the property. The additional funds can be utilized for various purposes, such as renovations, debt consolidation, or investments. 3. Home Equity Line of Credit (HELOT): This type of modification involves increasing the principal balance to establish a line of credit against the equity in the property. The borrower can then draw funds from this line of credit as needed, similar to a credit card. It is important for borrowers in Memphis, Tennessee seeking a change or modification to their Deed of Trust to increase the principal balance to carefully review the terms and conditions of the modification agreement before signing. Seeking legal advice or consulting with a real estate professional can help ensure that the modification is in their best interests and aligns with their financial goals.

Memphis Tennessee Change or Modification to Deed of Trust to Increase Principal Balance

Description

How to fill out Memphis Tennessee Change Or Modification To Deed Of Trust To Increase Principal Balance?

We always want to minimize or avoid legal damage when dealing with nuanced legal or financial affairs. To accomplish this, we apply for legal services that, usually, are extremely expensive. Nevertheless, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based catalog of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without turning to an attorney. We offer access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Memphis Tennessee Change or Modification to Deed of Trust to Increase Principal Balance or any other form quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again in the My Forms tab.

The process is just as effortless if you’re unfamiliar with the platform! You can create your account in a matter of minutes.

- Make sure to check if the Memphis Tennessee Change or Modification to Deed of Trust to Increase Principal Balance complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Memphis Tennessee Change or Modification to Deed of Trust to Increase Principal Balance is suitable for you, you can select the subscription plan and proceed to payment.

- Then you can download the document in any suitable file format.

For over 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!