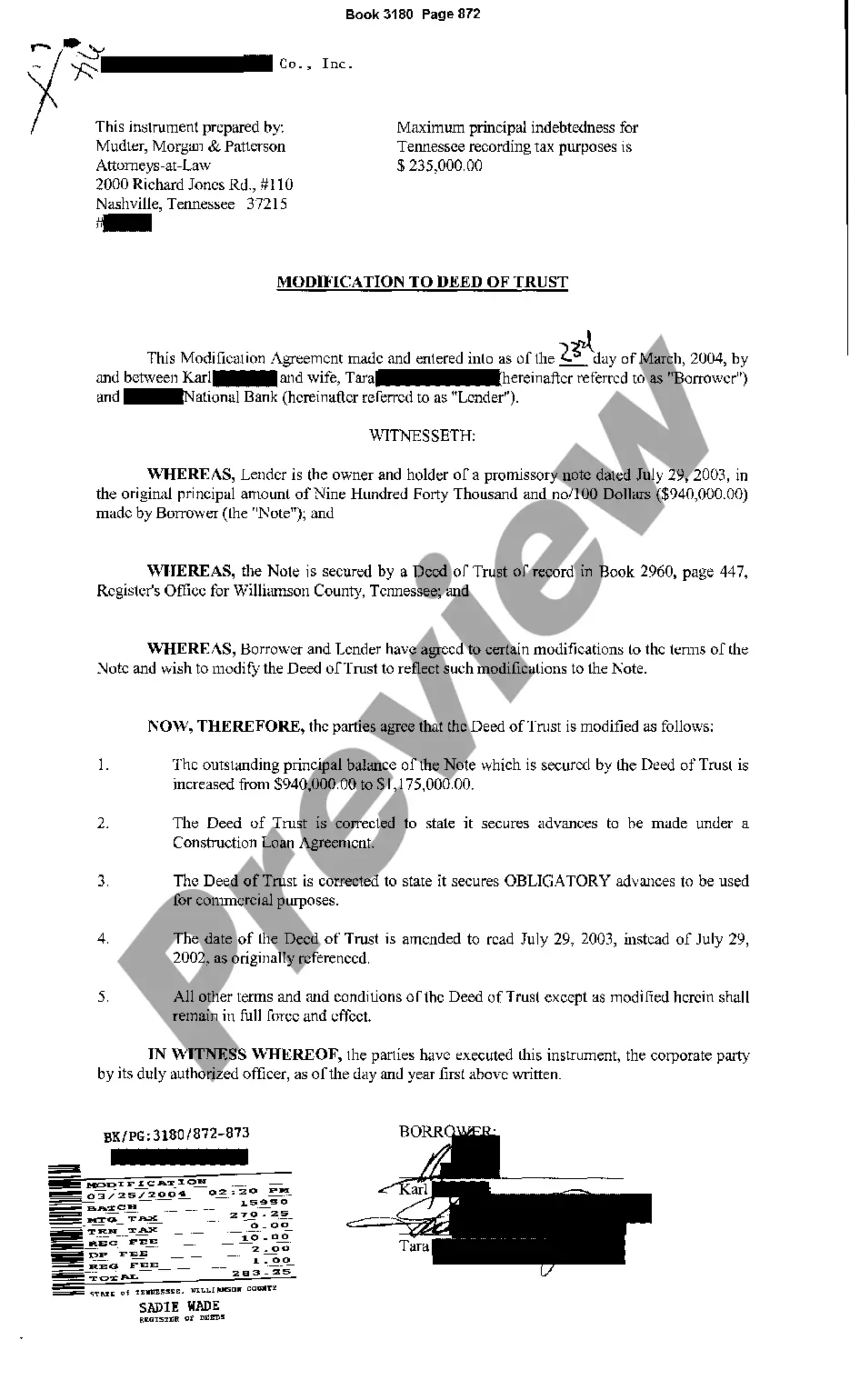

Title: Understanding Murfreesboro Tennessee Change or Modification to Deed of Trust to Increase Principal Balance Introduction: In Murfreesboro, Tennessee, homeowners may find themselves in a situation where they need to make changes or modifications to their deed of trust to increase the principal balance. This process is crucial for individuals seeking additional funds without refinancing their entire mortgage. This article aims to provide a detailed description of what this procedure entails, outlining its importance and its various types. 1. What is a Deed of Trust? A deed of trust is a legal document that secures a mortgage loan by using the property as collateral. It grants the lender specific rights in the event of default, such as initiating foreclosure proceedings. It outlines the terms, conditions, and borrower's obligations, including the principal amount borrowed. 2. Understanding Change or Modification to Deed of Trust: A change or modification to a deed of trust in Murfreesboro, Tennessee, refers to making alterations to the original terms agreed upon in the deed. This process can involve increasing the principal balance owed on the loan. It allows homeowners to access additional funds without refinancing the entire mortgage. 3. Importance of Increasing Principal Balance: a) Home Renovations and Remodeling: Increasing the principal balance through a modification enables homeowners to finance home improvements, renovations, or remodeling projects without seeking external financing options. b) Debt Consolidation: Homeowners may choose to increase the principal balance to consolidate debt, incorporating higher-interest debts into their mortgage at a more favorable interest rate. c) Emergency Situations: In times of financial emergency or unforeseen expenses, homeowners may need quick access to funds. By modifying the deed of trust, they can increase the principal balance and use these funds to address urgent needs. 4. Types of Murfreesboro Tennessee Change or Modification to Deed of Trust to Increase Principal Balance: a) Principal Increase with Same Interest Rate: Homeowners can negotiate with their lender to increase the principal balance while keeping the same interest rate, resulting in adjusted monthly payments. b) Principal Increase with Modified Interest Rate: Alternatively, homeowners may opt for a change in both the principal balance and the interest rate. This modification allows borrowers to take advantage of current market rates and potentially secure more favorable terms. c) Principal Increase with Extended Repayment Term: Another option involves increasing the principal balance and extending the repayment term, effectively reducing monthly payments. This approach can be beneficial for homeowners seeking improved cash flow or affordability. Conclusion: Modifying a deed of trust to increase the principal balance in Murfreesboro, Tennessee, offers homeowners a flexible means of accessing additional funds without refinancing. Whether for home improvements, debt consolidation, or unforeseen expenses, this process can provide financial relief. Understanding the different types of modifications available can help borrowers choose the best option based on their specific needs. As with any legal matter, it is advisable to consult with a professional, such as an attorney or mortgage advisor, to guide you through the process accurately and ensure compliance with the relevant regulations.

Murfreesboro Tennessee Change or Modification to Deed of Trust to Increase Principal Balance

Description

How to fill out Murfreesboro Tennessee Change Or Modification To Deed Of Trust To Increase Principal Balance?

No matter what social or professional status, completing law-related forms is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for a person with no legal education to draft this sort of paperwork from scratch, mostly because of the convoluted terminology and legal subtleties they entail. This is where US Legal Forms comes to the rescue. Our platform provides a massive collection with more than 85,000 ready-to-use state-specific forms that work for practically any legal situation. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

No matter if you want the Murfreesboro Tennessee Change or Modification to Deed of Trust to Increase Principal Balance or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Murfreesboro Tennessee Change or Modification to Deed of Trust to Increase Principal Balance quickly employing our reliable platform. In case you are already a subscriber, you can go ahead and log in to your account to get the appropriate form.

Nevertheless, if you are a novice to our platform, make sure to follow these steps before obtaining the Murfreesboro Tennessee Change or Modification to Deed of Trust to Increase Principal Balance:

- Be sure the template you have found is specific to your area because the regulations of one state or county do not work for another state or county.

- Review the form and read a brief outline (if provided) of cases the document can be used for.

- In case the form you chosen doesn’t meet your needs, you can start again and search for the necessary form.

- Click Buy now and choose the subscription plan that suits you the best.

- with your login information or create one from scratch.

- Pick the payment method and proceed to download the Murfreesboro Tennessee Change or Modification to Deed of Trust to Increase Principal Balance as soon as the payment is completed.

You’re all set! Now you can go ahead and print the form or complete it online. In case you have any problems getting your purchased forms, you can easily access them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.